ipopba

Many of you must have seen phrases like “Powered by VeriSign” or “VeriSign Secured” appearing when accessing websites. These basically show that these are secured or that the data which is being transferred to your laptop is encrypted. One of the companies which provide this service is VeriSign (NASDAQ:VRSN) a $21.6 billion company based in the U.S.

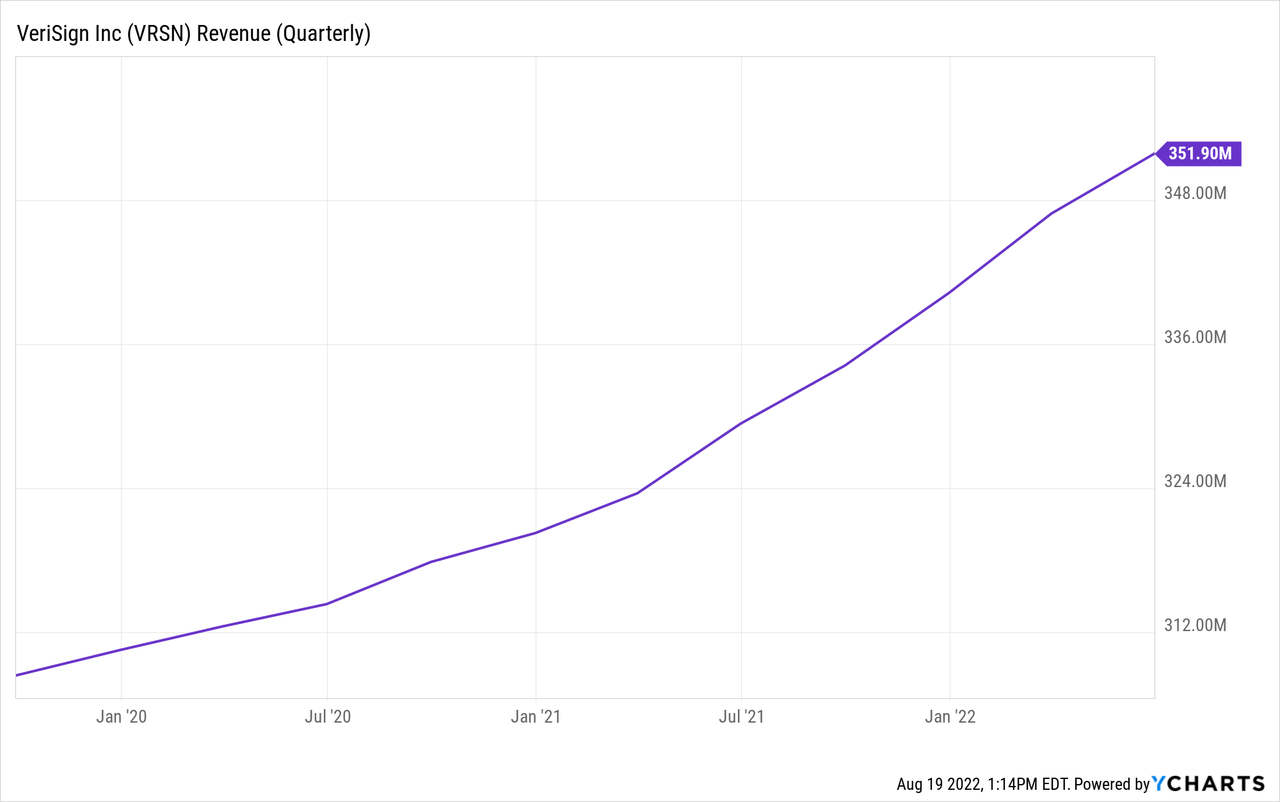

Now, with the internet being so huge composed of millions of websites and reliance on online services continuing to increase, it is no wonder that revenues have been increasing steadily to reach $352 million in the second quarter of 2022 (Q2).

However, a closer look at the above chart’s gradient shows that revenue growth has slowed in the last reported quarter and it is essential to understand the reason for this. Additionally, this thesis also aims to evaluate profitability and explore the dividend rationale after President Biden’s Inflation Reduction Act was recently signed into law.

Revenues and Profitability

First, the company has seen accelerated demand for its product since the second quarter of 2020 as evidenced by the above chart moving steeply up since July 2020. This was thanks to Covid-led digital transformation which motivated more businesses to go online.

As a result, not only demand for security services went up but also for domain name service or DNS provided by VeriSign. Now, without going into too many details, in the same way as fiber cables or modems, DNS is one of the key components for the internet to function. In this respect, the company functions like a registry for web addresses containing records of website names and their owners, namely for those ending with .com, .name, .cc, .tv, .net, and others. To provide investors with a sense of its scale of operations, the .com domain extension comes with over 160 million records, and alongside the likes of Cogent Communications (CCOI), VeriSign administers the root servers which are at the heart of the internet ecosystem.

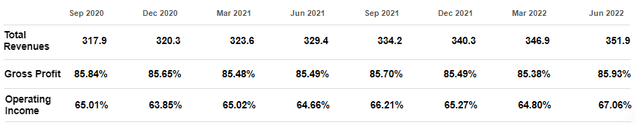

Coming back to the reason for the slight fall in the growth rate, this was due to “normalization” in demand after the pandemic peak, and VeriSign has other levers to increase revenues and profitability. Here, its operating income margins increased by 10.8% in Q2 on a year-on-year basis, compared only to 6.8% for the revenue growth. To this end, as seen in the table below, it has delivered 63%-65% of quarterly operating margins which is very good in view of higher wage inflation and higher supply chain costs making IT equipment more expensive.

Quarterly income statement (Seeking Alpha)

Noteworthily, Q2 saw record margins at 67%, but this was primarily due to staff costs (benefit and performance-based compensation accruals) having been significantly lowered and was more a result of “timing” than a long-term strategy to reduce expenses.

Still, to offset the costs associated with its huge internet network and sustain its high operating margins, the company can increase the amount it charges for its products. For this purpose, the management announced a price hike of $0.90 to the annual wholesale price for .net domain names, to be effective from February 1, 2023. In this case, I specifically mentioned “wholesale” as the company sells to DNS providers like GoDaddy (GDDY) or hyperscalers like Google (NASDAQ:GOOG) who in turn sell to the public.

This does not mean that it does not face competition though.

The Competition

The .net domain extension also called a TLD (top-level domain) remains a highly competitive market and the timing of the price hike has more to do with the fact that charges have not been raised in five years. As per the executive, prices had been frozen in 2020 in the footsteps of Covid becoming a pandemic. For investors, most businesses tend to choose .com where VeriSign has a monopoly, but, this is not necessarily the case for .net, where there are many other alternatives like .network or even .biz.

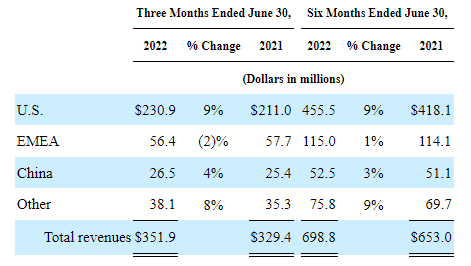

Exploring further, people now increasingly opt for businesses with country extensions like .cn for China. Now, with rapidly growing internet penetration, this country is a key market for VeriSign after the latter’s $20 billion acquisition of Network Solutions in June 2000. Subsequently, the U.S. company is one of the top web registration companies in China. As such, the world’s second-largest economy accounted for $52.5 million of VeriSign’s overall revenues in the first half of the year compared to $75.8 million for other countries, including Japan, Canada, and Australia.

Country-based revenues (Seeking Alpha)

The above table also shows that VeriSign obtains roughly 65% of sales from its largest market, the U.S., where it benefits from substantial government contracts. One of the reasons for this is its record-breaking resilience (consisting of 25 years of uninterrupted uptime) for .com and .net. In comparison, Cloudflare (NET) which is only a DNS provider and not a root server administrator had downtime in June 2022. This means that VeriSign is more successful in protecting its infrastructure from technical glitches or cyberattacks and that the company should be valued accordingly.

Valuations and the Dividend Rationale

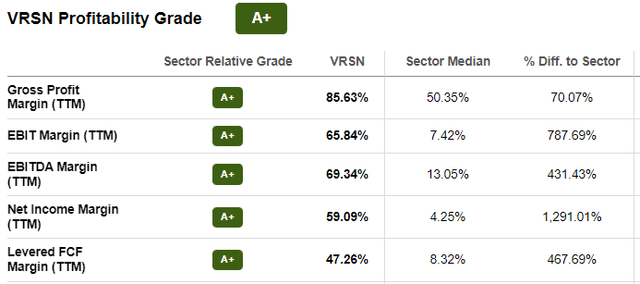

First, referring to guidance, revenue for the whole of 2022 is expected at $1.415 billion to $1.430 billion, with an operating margin of 65.25%-66.25%. Putting the profitability into perspective, the mid-point of 65.75% would constitute a 0.46% increase over 2021’s 65.29% and a sector comparison reveals that this is an exceptionally high level and dwarfs the IT median of 7.42% by nearly 788%.

Profitability metrics (Seeking Alpha)

As for valuations, this 0.46% increase in margins is not sufficient to lower the forward price-to-EBIT multiple of 24.78x in such a way that it will go below the 16.53x for the sector median. Thus, the stock remains overvalued and this is the reason I am not bullish.

As for the price-to-earnings, VeriSign’s P/E also remains on the high side, but the stock buybacks it performs indirectly return cash to investors by increasing the price of a share. Thus the company had 107.28 million outstanding shares as of July 22 with an amount of $543 million earmarked for repurchasing purposes at the end of Q2. This can fetch about 3.1 million shares based on the 2 million repurchased shares for $349 million in Q2. Now, 3.1 million repurchases would reduce total outstanding shares by 3% (3.1/107.28). This should have the opposite effect on the share price, increasing the value to $202 (196 x 1.03) based on the current unit price of $196. This remains a rough estimate and assumes the P/E to remain constant and also ignores the fact that this is a highly volatile market. However, it has the merit of showing that buybacks have a positive effect on the share price.

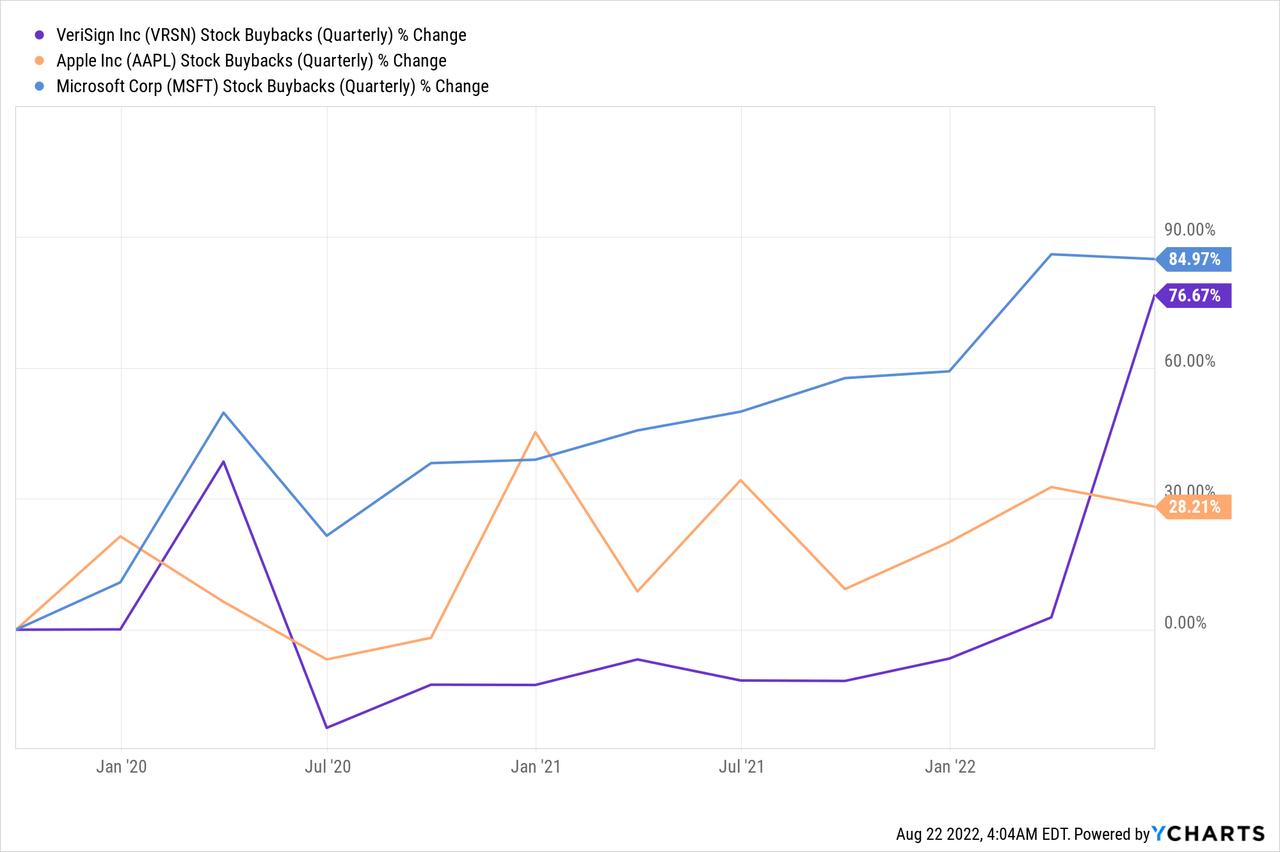

To this end, equipped with $997 million in cash and equivalents at the end of Q2 and with relatively more predictable operating margins compared to other IT peers, VeriSign has been boosting shares buybacks by 76.67% during the last three years as shown in the chart below, or at a more frantic pace than Apple (NASDAQ:AAPL) or Microsoft (NASDAQ:MSFT) which are famous for buybacks.

Now with the new excise tax rate of 1% on stock repurchases in 2023, companies like VeriSign may be motivated to instead use some of the buyback money to pay dividends to shareholders. In case this was to happen the company could pay a yield of 2.19% at a 60% payout ratio.

Conclusion

My rationale for dividends also stems from the high levered free cash flow margin of 47.26% as shown in the above table, higher than the sector median by over 460%. Moreover, only part of VeriSign’s buybacks goes towards complementing equity-based compensation to staff, which is dilutive in nature. This said it is better to wait for related corporate announcements.

Looking into risks, some will remember that there were issues around Chinese-language internet address some twenty years back, involving VeriSign and other foreign address-registration firms. At that time, there was competition with Chinese firms resulting in a lot of confusion about where companies should register their domains. Things have now cooled off, but renewal rates for domain names registered in China remain lower when compared to the U.S. Also, while having one of the best networks, VeriSign is not completely immune to the risks of a cyberattack as was the case in 2010 when there was a data breach. However, there was no downtime (or outage) or revenue loss which signifies that its infrastructure remains resilient, but such events can induce volatility in the stock.

Finally, with highly profitable growth, and a solid liquidity position, this is one of the few companies you want to own during an economic slowdown. The reason is simply that at less than $10 per year despite two recent price hikes, a .com domain extension is much cheaper to maintain for a company wanting to keep up its online presence rather than paying $5,000 per month for a brick-and-mortar shop. Thus, the current market volatility provides an opportunity to buy and momentum factors indicate a potential fall to the $180 level.

Be the first to comment