Alex Wong/Getty Images News

Velodyne Lidar (NASDAQ:VLDR) has had a horrible couple of years or so since going public via a SPAC. The Lidar sensor company has changed the CEO and seen the founding shareholder unload his stock at prices below $1.50, yet the Lidar sensor business could still bloom. My investment thesis remains Bullish on the stock, but investors need high levels of risk tolerance to remain invested here.

Limited Projections

With Ted Tewksbury taking over the company at the end of last year, Velodyne Lidar quit providing financial projections of the business beyond the next quarter. The company regularly had high financial targets for a few years out and the current lack of details on customer agreements is a prime reason the stock is down to $1 with a market cap of only $250 million.

When the new CEO took over, Velodyne provided a list of 35 signed multi-year contracts and a pipeline with over 220 deals in the works. Mr. Tewksbury last said the company would start providing updated info by Q1’22 and the lack of such information is now hurting the stock despite clear progress with additional deals signed since the last disclosure for November 1. In addition, smaller industrial and robotic deals aren’t always multi-year agreements making an order book comparison to automotive less meaningful.

The founding CEO selling his shares hasn’t helped one bit. The market no longer has confidence in Velodyne Lidar despite the ongoing progression with additional business in the industrial and robotic segment along with under the radar work with autonomous vehicles and robotaxi providers.

For Q2, the company reported billings (adjusted revenues) of $12.5 million, up sequentially from $11.5 million in the prior quarter. Velodyne Lidar guided to Q3 revenues for $10 to $12 million with billings held back by ongoing supply chain issues.

On the Q2’22 earnings call, the CEO let this statement slip indicating a much stronger future than predicted by some mundane figures otherwise provided by the company:

Again, the strength is coming from industrial and robotics as well as the intelligent infrastructure with continuing contributions from AVs. And yes, let me just emphasize that we’re going into Q3 with enormous demand and enormous backlog. And the only thing that’s holding revenue growth back right now is supply. And as I explained earlier, we are well underway in redesigning our Pucks to use new FPGAs, which we expect to get us out of this company specific supply constrained by the end of the year.

While founder David Hall clearly isn’t happy with Velodyne Lidar, the company still has an important position in the Lidar market with a huge customer backlog mostly unaltered from prior large projections. The company no longer announces the backlog figures, but the Lidar sensor firm clearly has a deal with Amazon (AMZN) and signed contracts with Baidu (BIDU) in the past.

Velodyne Lidar doesn’t discuss the firms working with test Lidar sensors from the company, but half of the revenues from Q2 were related to the AV segment. The automotive segment is where companies such as Luminar Tech. (LAZR) and Innoviz Tech. (INVZ) report massive backlogs, yet Velodyne is selling vastly more amounts of sensors into those segments now.

After all, Innoviz Tech. only reported Q2 revenues of $1.8 million versus a backlog of $6+ billion. In essence, Velodyne Lidar reported over 3x the revenues of Innoviz from the automotive sector, yet Velodyne isn’t viewed as a leader in the sector.

Even more intriguing is the concept of Velodyne Lidar producing the necessary costing Lidar sensor to supply the AV market at a price point below $500. Per the CEO on the Q2’22 earnings call:

With respect to passenger vehicles, as we’ve talked about in past calls, our discussions with OEMs and Tier 1’s in the automotive industry and we’ve talked to all of them. The feedback has been loud and clear that prices have to come down below $500, preferably in the $300 to $400 range. And we have designs in progress right now that we expect to be ready for production when those markets materialize, which is probably still two or three years away.

A one million unit annual deal quickly becomes a $500 million sales opportunity and a backlog of $2+ billion based on typical deals over 4 to 5 years.

Big Market

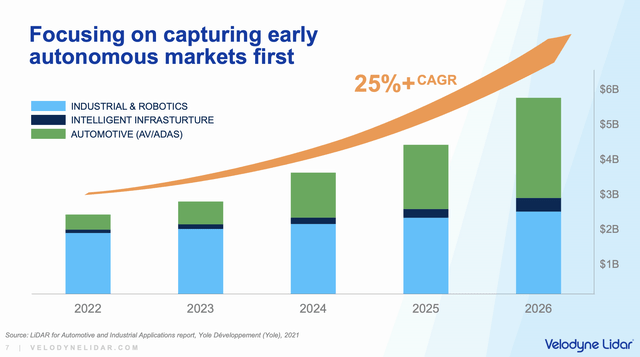

The company continues to promote large gains in Lidar markets with the market size reaching $5.7 billion by 2026. A lot of the existing market isn’t even controlled by the public Lidar companies where total revenues are only around $100 million while the total revenues are already approaching $3 billion now.

Source: Velodyne Lidar Q2’22 presentation

The stock has a minimal market cap now with the stock market completely giving up on Velodyne along with the founding family. The company definitely has a lot of problems, but deals announced this year with Boston Dynamics, Amazon and others summarize the opportunity hidden by limited projections.

Velodyne Lidar is basically priced as if the company is going out of business. Innoviz traded down to a low below $3 and rocketed up above $6 on news of the massive $4 billion deal with Volkswagen (OTCPK:VWAGY). A similar outcome could definitely occur on Velodyne Lidar just based on the company providing some updated estimates.

Clearly, the company is set to exceed the limited targets of analysts now at 2024 revenues of only $120 million. Not many investors would count such a revenue target as enormous when the original corporate estimates were for revenues in a couple of years to reach $684 million based on deals signed in 2020 delivering half those revenues.

Takeaway

The key investor takeaway is that Velodyne Lidar is hardly priced for a current business delivering $50 million of revenues in a supply constrained environment. The stock definitely isn’t correctly priced for the fast growth forecast for the next five years as the demand for Lidar sensors takes off.

Investors should continue to use this weakness to load up on Velodyne Lidar knowing the stock is definitely risky reporting large losses as the business ramps.

Be the first to comment