Pom669/iStock via Getty Images

(This article was co-produced with Hoya Capital Real Estate.)

Roughly a month ago, I published an article right here on Seeking Alpha, entitled “We’re In The 5th Inning – That’s Why I Hold 25% Cash.” In the article, I briefly discussed 5 factors which I believe will cause the market, at the very least, to briefly revisit the lows put in earlier in 2022.

The day that article was published, the S&P 500 index closed at 3,958.79. In the weeks that followed, the market rallied fairly strongly from those values, with the S&P crossing the 4,100 mark at least temporarily both on December 1 and December 13.

As a recent retiree, I took advantage of that rally to move enough cash to my online savings accounts (currently yielding roughly 3%) to fund my spending requirements for the upcoming year. But I did even more. Primarily on December 12, I sold sufficient amounts of both U.S. and foreign stock exchange-traded funds (“ETFs”) to bring the cash level of the remaining funds in my investment accounts all the way to roughly 28%.

Needless to say, I am happy I did. Just last week, the Fed followed through with its much-anticipated 50 basis point increase in the fed funds rate. Further, in both his formal comments and in the Q&A session that followed, Fed Chairman Powell didn’t stray at all from the themes he had earlier featured in comments to the Brookings Institution back on November 30. In fact, if anything, the “higher for longer” mantra came through even more clearly.

As I write this article the morning of December 19, the market has made a complete round-trip since my November article, with the S&P sitting at 3,802 approximately midway through the trading session.

Playing The Remaining Innings – The Case For Global Equities

At the conclusion of my “5th inning” article, I once again beat the drum for diversification. Here’s a brief quote from the article that will tie nicely into what I will write about next.

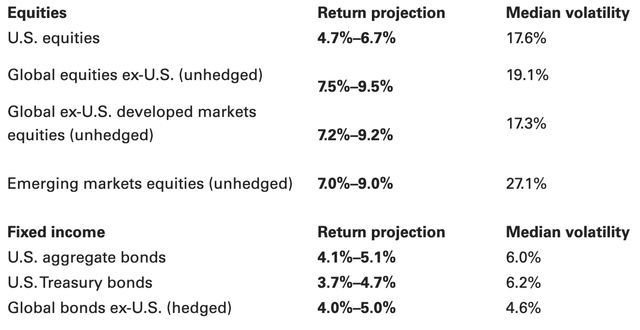

As can be seen, Vanguard suggests that global equities, both developed and emerging, may offer greater potential for return than U.S. equities, with only slightly higher volatility.

That comment was based on a November, 2022 market perspectives update from Vanguard.

Asset Class Return Outlooks – As of November, 2022 (Vanguard Research)

For purposes of this article, please focus on the 3rd asset class in the above chart; Global ex-U.S. developed markets equities (unhedged). As you are likely aware, the broader global equities asset class includes both developed and emerging markets.

In general, a country is considered developed if it has a highly-developed capital market, competent and serious regulatory agencies, and high levels of per-capita income. Countries such as Japan, France, Germany and Australia, to name just a few, are considered to be developed markets.

Emerging economies, on the other hand, tend to be characterized by higher levels of economic, political, or social instability, lower per-capita income, and still-developing infrastructure. Countries such as India, South Africa, Brazil and Mexico, to name just a few, are considered to be emerging markets.

You may have noticed that, while Vanguard projects that both developed and emerging foreign markets may outperform the U.S. market, the median volatility is less for developed markets.

Vanguard VEA – A Winning Choice

And that leads us nicely to today’s featured ETF: Vanguard FTSE Developed Markets ETF (NYSEARCA:VEA). Simply put, for an investor interested in either opening, or adding to, an allocation to developed-market foreign equities, VEA is a winning choice. With an inception date of 07/20/2007 and assets under management (“AUM”) of $102.8 billion, VEA has the most solid of track records. As with many of its ETFs, over the years Vanguard has lowered the expense ratio it charges for VEA all the way down to .05%. Finally, the fund carries a trading spread of .02%, extremely low for a fund trading in foreign securities.

Briefly, let’s look at why Vanguard may project outperformance for this asset class moving forward. Take a look with me at the following two graphics.

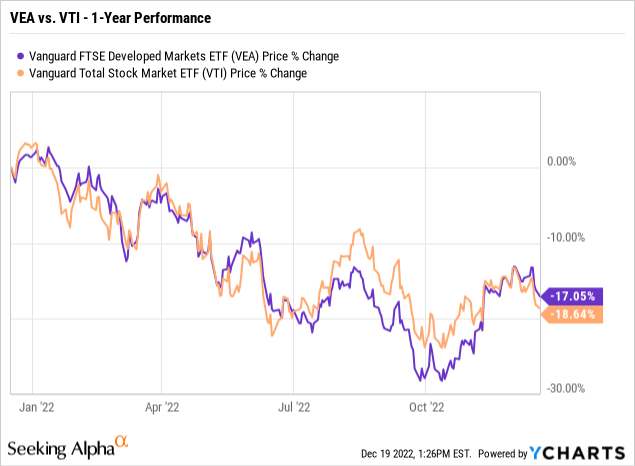

First of all, let’s look at a snapshot of the past year, comparing VEA’s performance with that of an ETF that could be considered a reasonable counterpart for the U.S. market, Vanguard Total Stock Market ETF (VTI).

As can be seen in this recent snapshot, both ETFs have performed somewhat similarly over the past year, a year where both the U.S. and foreign markets have experienced significant turmoil.

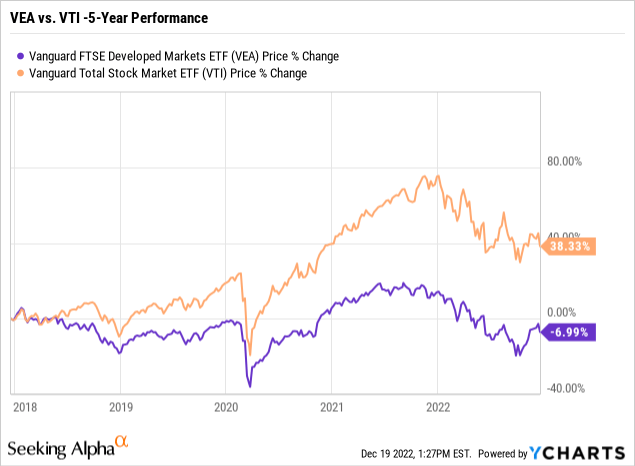

But now, let’s expand that snapshot over a much longer timeline, in this case 5 years.

That second graphic offers an easy-to-grasp intuition that, while U.S. and foreign stocks had a fairly similar performance during 2022, the starting point for foreign stocks was much lower. Put slightly differently, foreign stocks were cheaper than their U.S. counterparts as we entered 2022, and they remain so.

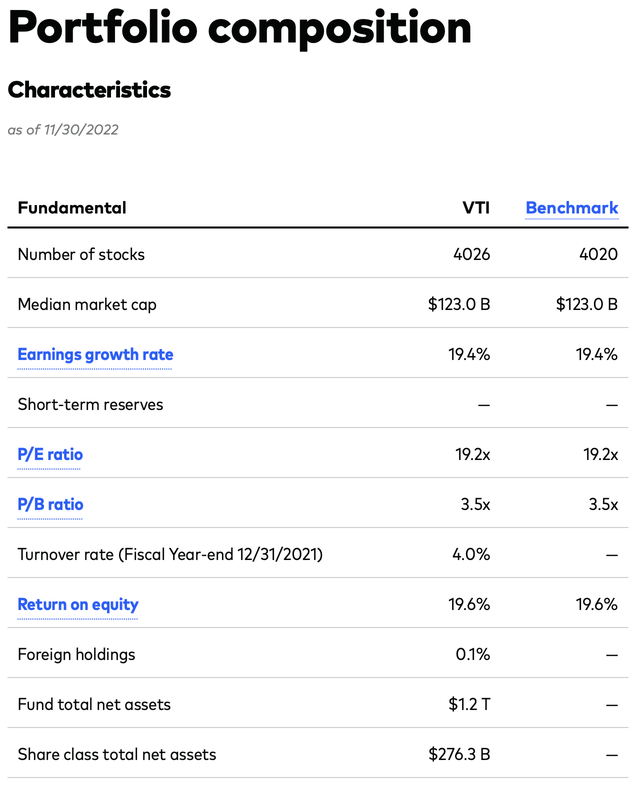

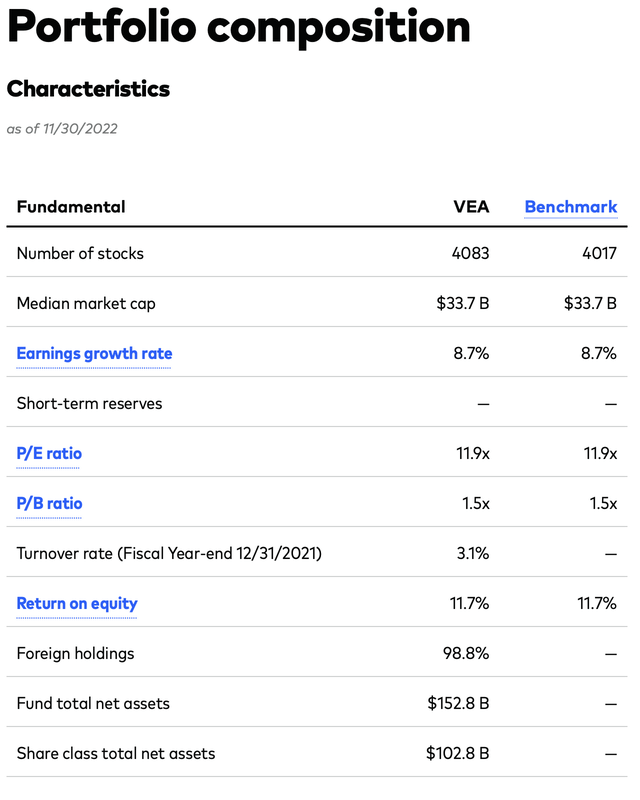

As a confirmation of this, here are the portfolio composition characteristics straight from the Vanguard websites for both VTI, representing U.S. stocks, and VEA, representing foreign developed-market stocks.

First, VTI.

VTI – Portfolio Composition (Vanguard Advisors)

And next, VEA.

VEA – Portfolio Composition (Vanguard Advisors)

As can quickly be seen, VEA’s overall P/E ratio is roughly 60% that of VTI, and its P/B ratio is less than 50% that of VTI.

Now, that is not completely surprising, as there are far more pricey technology and similar growth stocks present in the U.S. market. But, at this particular point in time, in an environment of “higher for longer” interest rates, that is not necessarily a strong point.

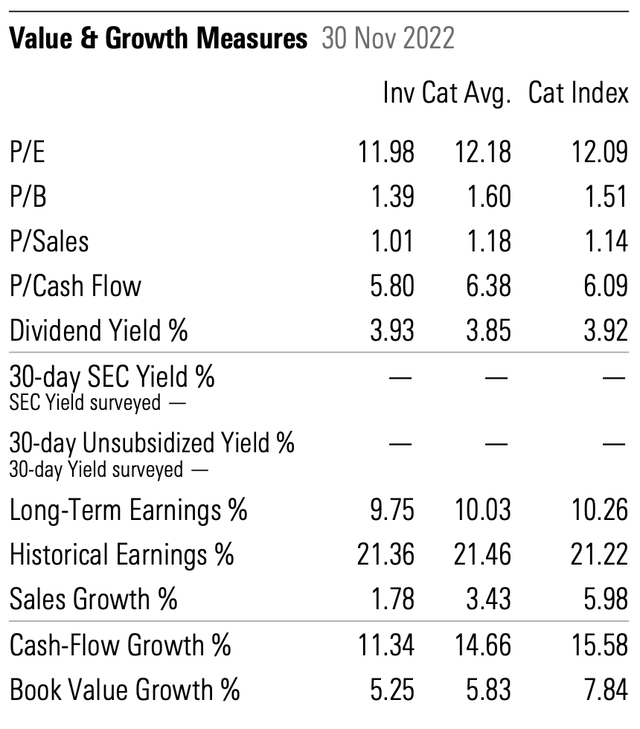

Finally, for one last benefit of global developed-market equities, take a look at one last comprehensive graphic on VEA, from Morningstar.

VEA – Valuation & Growth Measures (Morningstar)

This graphic effectively dives a little deeper into VEA’s metrics than the graphic from Vanguard. In addition to the P/E and P/B ratios, Morningstar shares the P/Sales and P/Cash Flow values. Finally, please notice that dividend yield value of 3.93%.

To give you some small sense of the sorts of companies that constitute the largest portions of the fund, here are extremely brief synopses of two of VEA’s top-10 holdings.

Nestle SA (OTCPK:NSRGY) – Nestle is the largest food company in the world, measured by revenues. Encompassing baby food, bottled water, coffee & tea, dairy products, frozen food, pet food, snacks, and more. The list of brands is made up of legendary names that you will instantly recognize, and Wikipedia states that 29 of these brands each have annual sales of over $1 billion. Nestlé has 447 factories, operates in 189 countries, and employs around 339,000 people.

Novartis AG (NVS) – Novartis is the largest pharmaceutical company in the world, measured by revenues. According to its latest Novartis In Society report, some 766 million patients were reached with Novartis medicines. The company won 21 major approvals (U.S., EU, Japan, China). As of the date of the report, some 40 million doses of the Pfizer-BioNTech vaccine for COVID-19 had been produced, and no doubt that number has grown since that time.

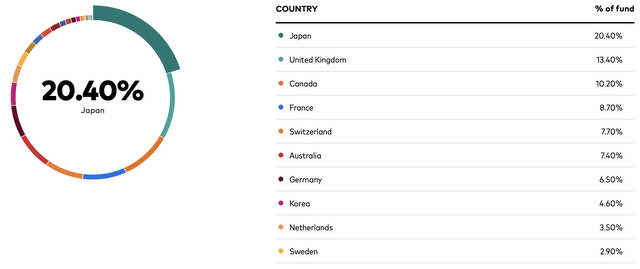

One last thing before we wrap up this section. Captured from the Vanguard Advisors website, here are the Top-10 countries represented in VEA.

VEA: Top-10 Countries (Vanguard Advisors)

Per Morningstar, one uniqueness of VEA is that its allocations favor the developed Asian and North American markets relative to the category average. For example, Japanese stocks occupy more than one fifth of the portfolio, 3 percentage points greater than the category average. Additionally, South Korea and Canada together represent about 15% of the portfolio, as opposed to being largely ignored in competing products.

Summary And Conclusion

It is my belief that investors are well-served to pay particular attention to maintaining a high-quality, diversified portfolio as we meet the challenges of 2023.

In this article, I hope to have made the case that an allocation to global equities becomes part of that strategy. Further, that according to Vanguard’s investment outlook, the developed-markets subset of such global equities may offer the best opportunities, in terms of strong returns with reasonable volatility.

If you agree with this assessment, I submit that VEA is deserving of a place in your portfolio.

Be the first to comment