DebraMillet/iStock via Getty Images

Last month, I wrote a cautious article warning that a weak November retail sales report combined with rising credit card delinquencies suggest the U.S. consumer was tapped out.

One of the upside risks I pointed out was that the November retail sales figure could be an anomaly, and the underlying trend could still be strong.

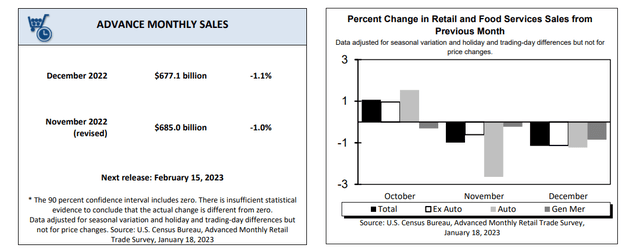

Unfortunately, the recently released December retail sales not only revised lower the November figures, it also showed an acceleration to the downside with a -1.1% MoM decline in retail sales. Consecutive declines in November/December retail sales have only occurred in 2008 and 2020.

Combined with weakening consumer credit metrics, it appears the future is bleak for retail-focused ETFs like the VanEck Retail ETF (NASDAQ:RTH). Until retail sales and consumer credit improves, I would recommend investors avoid the RTH ETF.

Fund Overview

The VanEck Retail ETF is a retail-focused ETF that tracks the MVIS US Listed Retail 25 Index (“Index”), an index designed to measure the performance of companies involved in retail distribution, wholesalers, on-line and direct retailers, multi-line retailers, specialty retailers and food and other staples retailers.

The index is a float-adjusted modified capitalization weighted index. To be eligible for inclusion, companies must have market cap greater than $150 million and derive at least 50% of their revenues from retail.

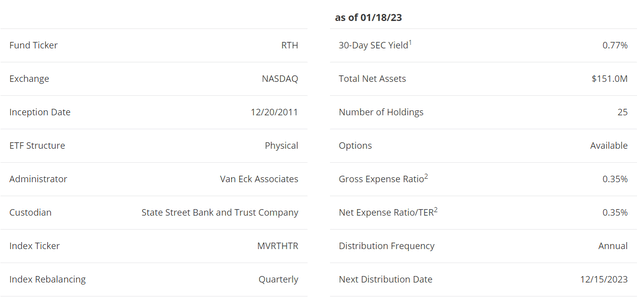

The RTH ETF has approximately $150 million in assets and charges a 0.35% net expense ratio (Figure 1). The RTH ETF pays a trailing 12 month 1.1% distribution that is paid quarterly.

Figure 1 – RTH fund details (vaneck.com)

Portfolio Holdings

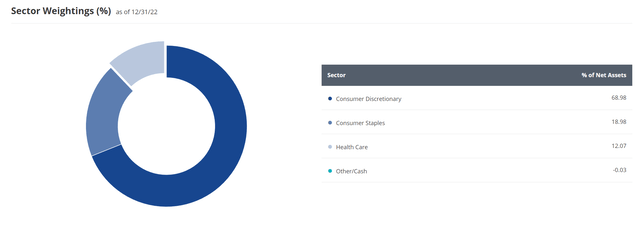

Figure 2 shows RTH’s sector allocations. Interestingly, RTH appears to hold healthcare companies within its portfolio. However, upon closer examination, these are really drugstores like CVS (CVS) and Walgreens (WBA), and drug distributors like McKesson (MCK) and AmerisourceBergen (ABC).

Figure 2 – RTH sector allocation (vaneck.com)

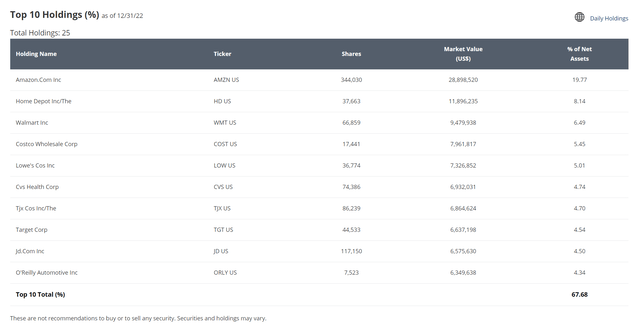

Overall, the RTH ETF only has 25 holdings and is very concentrated, with the top 10 holdings accounting for 68% of the fund’s assets (Figure 3). In fact, the top two holdings, Amazon and Home Depot, account for 28% of the fund.

Figure 3 – RTH top 10 holdings (vaneck.com)

Returns

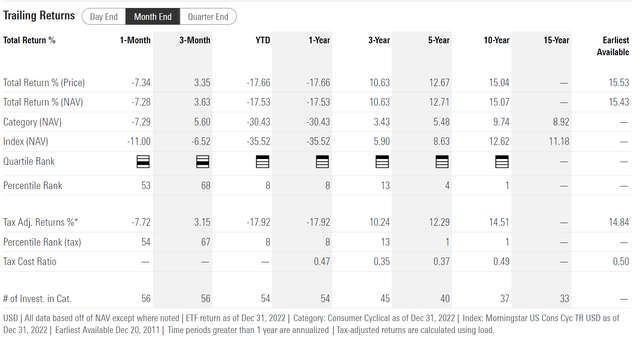

Historically, the RTH ETF has done very well, with 3/5/10Yr average annual total returns of 10.6%/12.7%/15.1% to December 31, 2022. 2022 was a sub-par year for RTH, with a -17.5% return (Figure 4).

Figure 4 – RTH historical returns (morningstar.com)

Back To Back Weak Retail Sales Is Rare

Last month, I highlighted a surprisingly weak November retail sales report, with U.S. retail sales declining 0.6% MoM to $689.4 billion, missing Wall Street consensus estimates of 0.1% MoM decline.

While a 1-month decline could be a statistical anomaly, the recently released December retail sales report not only confirmed November’s weakness, it also showed accelerating declines. First, November retail sales was revised even lower to only $685.0 billion, a -1.0% MoM decline from October. Furthermore, the December retail sales figure showed a continuation of declines to $677.1 billion, another -1.1% MoM decline, missing consensus estimates for a -0.8% decline (Figure 5).

Figure 5 – December retail sales (U.S. Census Bureau)

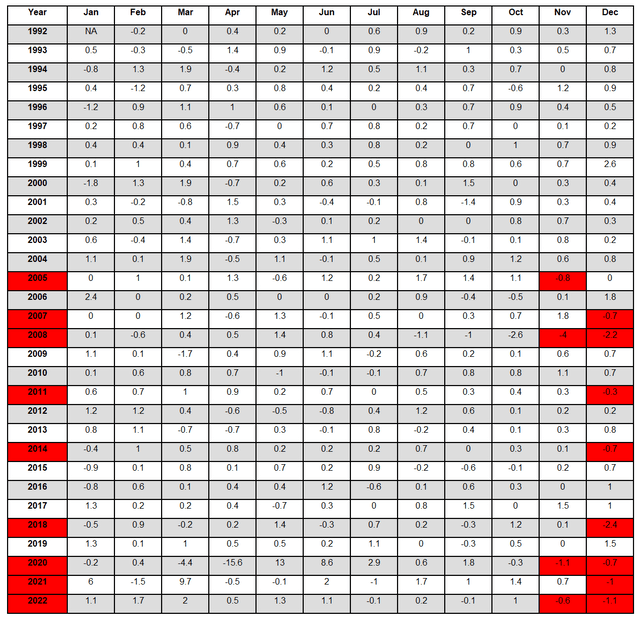

As I mentioned in my prior article, historically, MoM retail sales ex-Auto rarely decline in November and December as consumers are busy shopping for the holiday season. All the prior instances of weak holiday sales were associated with economic slowdowns and recessions (Figure 6).

Figure 6 – November/December declines in retail sales are rare (Author created with data from U.S. Census Bureau)

In fact, back-to-back declines in November/December are even more rare, and was only observed in 2008, during the Great Financial Crisis (“GFC”) and in 2020, during the COVID-19 pandemic.

Weak Retail Sales Consistent With Recessionary Data

In the past few months, I have written many articles highlighting weakness in the macro-economic data. For example, the recent S&P Global Flash US Composite PMI survey is consistent with “GDP contracting in the fourth quarter at an annualised rate of around 1.5%”. This latest weakness in U.S. consumer retail sales adds further fuel to my recession worries.

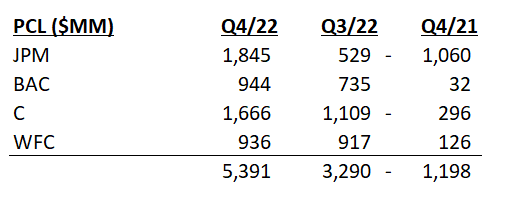

Banks And Credit Card Companies Are Preparing For The Worst

During their recent Q4 earnings report, we saw the big 4 American money-center banks (JPM, BAC, C, WFC) collectively set aside $5.4 billion in provisions for credit losses in their consumer divisions, up 64% QoQ (Figure 7).

Figure 7 – Q4/22 Consumer Provision for Credit Losses at JPM, BAC, C, and WFC (Author created with data from the companies’ respective Q4/22 earnings releases)

Similarly, Discover Financial Services (DFS) commented in its Q4 earnings that they expect credit to deteriorate materially in 2023, with net charge-off rates to rise to 3.5-3.9% vs. 1.82% in 2022.

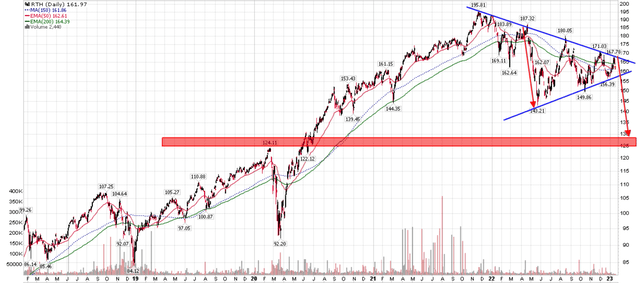

Technicals Point To Weakness Ahead

Technically, the RTH ETF is shaping a large triangle pattern, meaning the price is closing in on a key decision point. If the triangle pattern triggers negatively, I can see downside to $125-130 on RTH, or ~20% downside to current prices (Figure 8)

Figure 8 – RTH downside to $125 (Author created with price chart from stockcharts.com)

Risk To My Call

Currently, many market participants are betting that the Fed has solved the inflation problem with its series of rate hikes in 2022. If they are correct and the Fed is able to thread a ‘soft landing’, then perhaps retail sales can reaccelerate in the coming months and the retail-focused RTH ETF will break out to the upside from its triangle chart pattern.

Conclusion

The RTH ETF is a concentrated retail-focused ETF that provides exposure to the largest retailers in the U.S. Consecutive months of negative retail sales point to a weak consumer and confirms my fears of an impending recession. I would avoid the RTH ETF until the fundamental picture improves.

Be the first to comment