RHJ/iStock via Getty Images

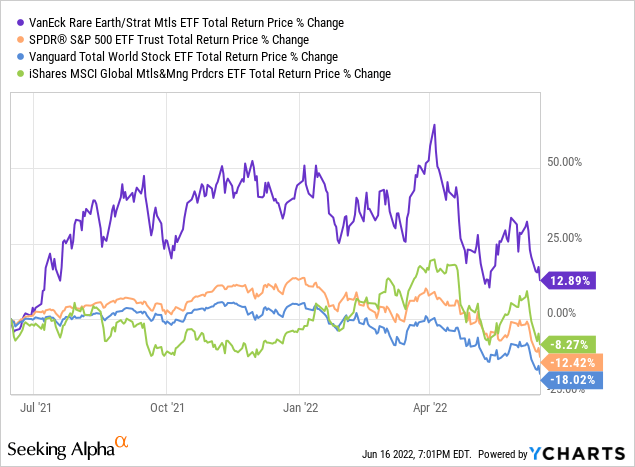

The VanEck Rare Earth/Strategic Metals ETF (REMX) is an equity index ETF investing in global rare earth and strategic metals producers, focusing on lithium miners, but including more specialized producers as well. REMX’s holdings are seeing skyrocketing revenues and earnings, due to booming demand and prices. These have resulted in strong, market-beating returns these past few months, a trend which is set to continue, in my opinion at least. REMX’s strong growth prospects, strong recent performance, and potential market-beating returns, make the fund a buy. REMX is a relatively risky, undiversified fund, and so only appropriate for more aggressive investors.

REMX – Index Analysis

REMX is an equity index ETF investing in global rare earth and strategic metals producers. It tracks the MVIS Global Rare Earth/Strategic Metals Index, an index of these same securities. Rare earths are a series of metals used in the manufacturing of many electronic devices and batteries, and particularly important for portable electronic devices like smartphones, and electric vehicle batteries. There are over a dozen rare earths, but most companies focus on lithium, as does REMX and its underlying index.

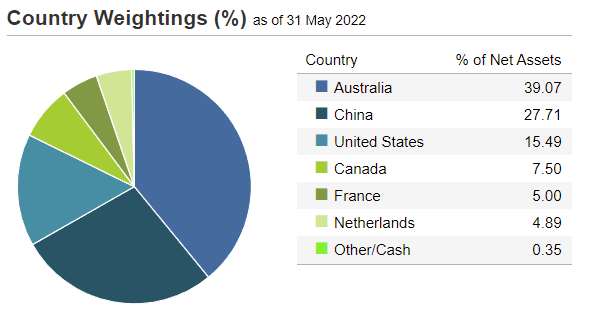

REMX’s underlying index includes most relevant global rare earth producers, subject to a basic set of liquidity, size, trading, and industry classification criteria. REMX is a global fund, but strongly focuses on Australia, China, and on the U.S., as these three countries have the largest reserves of rare earths. Country allocations are as follows.

REMX Corporate Website

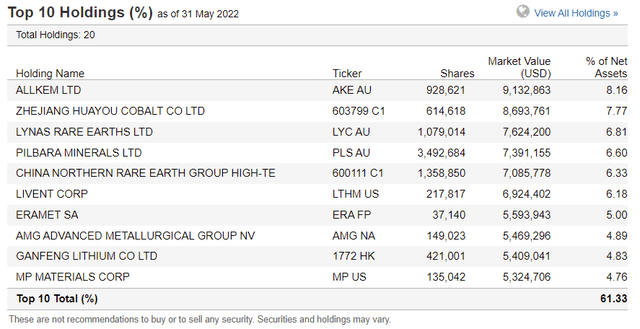

As REMX targets a very small, niche industry, the fund is quite concentrated, with investments in just twenty companies, all in the same niche industry. Holdings are as follows.

REMX Corporate Website

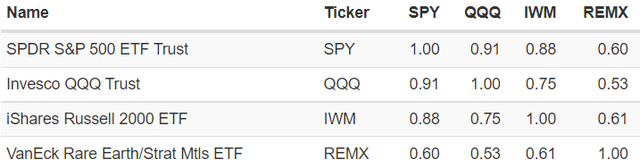

Concentration increases portfolio risk and volatility, and means returns could materially differ from those of broader equity indexes like the S&P 500, Nasdaq-100, or Russell 2000. As an example, a quick table showing the correlations between REMX and these three equity indexes.

Portfolio Visualizer

As can be seen above, REMX is much less correlated to equity indexes than equity indexes are to themselves. As mentioned previously, this means that returns could materially differ from that of said indexes. As such, and considering REMX’s concentrated holdings, the fund’s weight should be kept to relatively small levels, with large allocations being unwise.

Besides the above, nothing much stands out about the fund’s index or holdings. Let’s now have a look at the fund’s investment thesis.

REMX – Investment Thesis

REMX’s investment thesis is quite simple, and centers on the fund’s strong growth prospects.

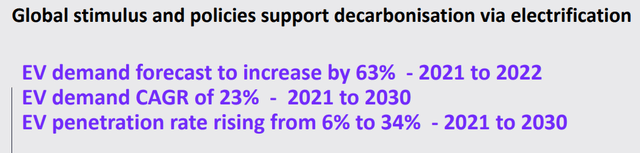

REMX’s underlying holdings focus on lithium, a key component of electronic devices, smartphones and, most importantly, electric vehicle batteries. Electric vehicles are a booming product / industry, due to environmental concerns, rising gasoline prices, and technological advancements improving their overall efficacy and benefits. Analysts forecast double-digit electric vehicle demand growth for the next decade or so, significant growth.

Allkem Investor Presentation

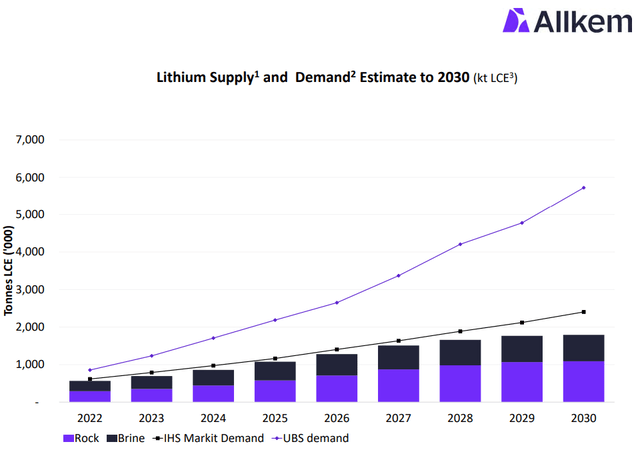

Increased electric vehicle manufacturing and sales leads to increased demand for lithium.

Allkem Investor Presentation

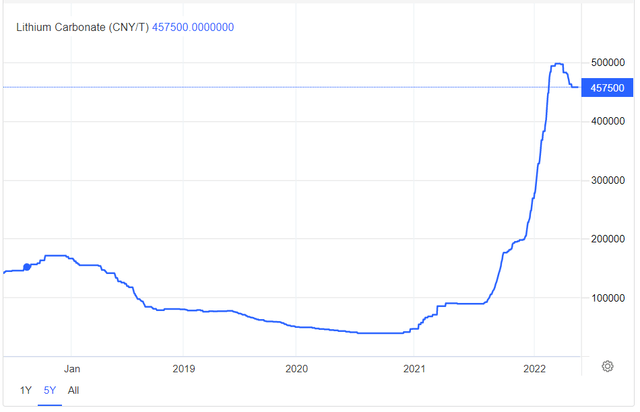

Increased demand for lithium ultimately results in significant revenue and earnings growth for companies focusing on said commodity. Growth comes from higher prices, with lithium prices increasing by a factor of 5x these past few months, and increased sales, with most major lithium producers investing heavily in new mines to boost production.

Tradingeconomics

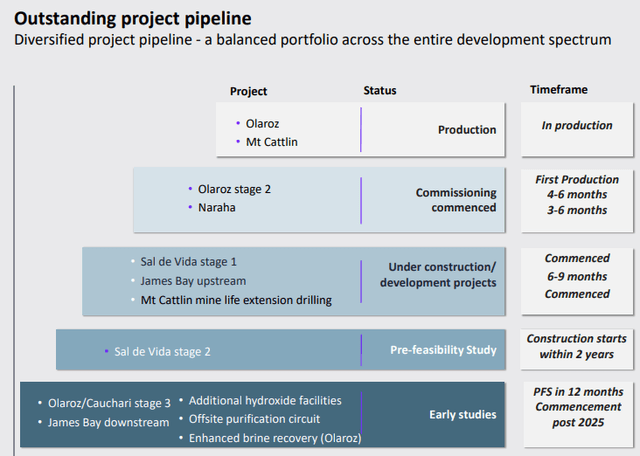

Allkem Corporate Presentation

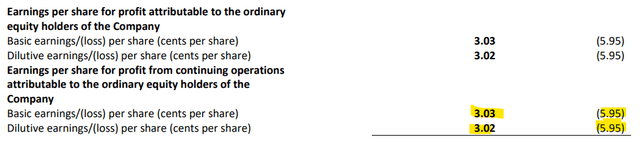

Higher prices and sales leads to significantly improved revenues and earnings. Allkem (OTCPK:OROCF), the fund’s largest holding, has seen triple-digit revenue growth this past year, although a recent acquisition makes these figures not all that material. Earnings per share increased by $9, a significant amount considering the company’s share trade with a $6.80 price. Allkem’s income grew by more than its entire market-capitalization last year, an incredible achievement.

Allkem Corporate Presentation

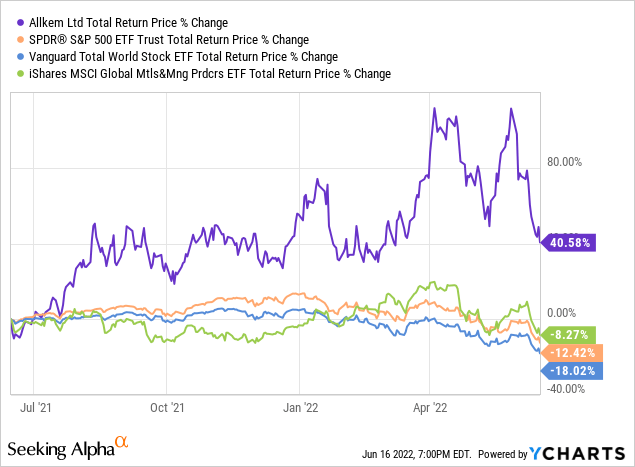

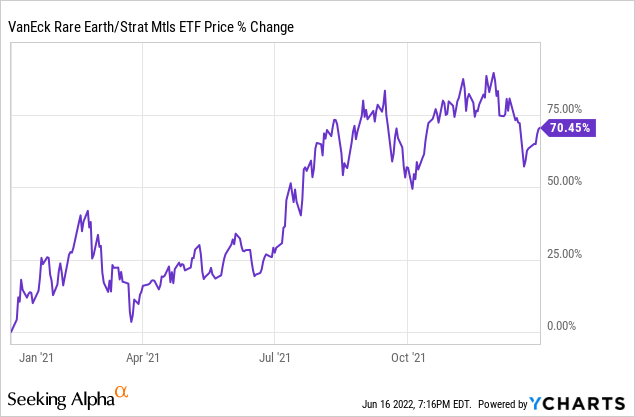

Increased revenues and earnings should ultimately result in higher share prices for these companies, and capital gains for their shareholders. Significant growth, as with Allkem, should result in significant, market-beating returns, as has been the case for said company for the past twelve months or so.

REMX’s underlying holdings are generally quite similar to Allkem, and have also seen increased revenues and earnings these past twelve months. REMX should have outperformed under these conditions, as has been the case.

As an aside, some of REMX’s holdings focus on different earth metals, like cobalt. These other metals are also generally used in electronic devices and batteries, and so have similar characteristics / expected performance as lithium.

REMX’s underlying holdings are seeing strong revenue and earnings growth from increased electric vehicle adoption. Growth should lead to strong, market-beating returns, as has been the case these past twelve months. Insofar as the trend continues, as most analysts forecast, returns should continue to be quite strong. I think the logic and investment thesis here is quite simple, and potent.

REMX – Risks and Drawbacks

REMX is a strong fund and investment opportunity, but it is not one without risks or drawbacks. Three stand out.

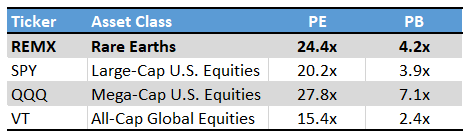

First, is the fact that the fund’s underlying holdings are trading with relatively expensive valuations. REMX itself sports a P/E ratio of 31.8x and a PB ratio of 5.1x, both moderately higher figures than the equity market average. On a more positive note, the fund’s valuation is slightly cheaper than that of the tech-heavy Nasdaq-100 index.

Fund Filings – Chart by author

Expensive valuations expose the fund and its shareholders to the possibility of losses if valuations were to normalize, as would likely occur if industry conditions were to worsen. Strong growth and high commodity prices have blunted the impact from the current bear market on the fund, but that will not necessarily be the case if conditions were to significantly worsen.

Second, is the fact that the fund has quite a bit of commodity risk. Expect significant losses and underperformance if rare earth prices were to decline, which is bound to happen, sooner or later, as commodities are cyclical businesses. Secular growth trends reduce these risks, but commodity cycles remain real.

Third, is the fact that the fund is significantly more concentrated than broad-based equity indexes, like the S&P 500 or Nasdaq-100. Concentration increases portfolio risk and volatility, and means the fund’s performance could materially differ from that of the index.

In my opinion, although REMX is a strong fund and investment opportunity, risks are quite significant, and higher than average. As such, and in my opinion, REMX is only appropriate for more aggressive investors, and position sizes should be kept small regardless.

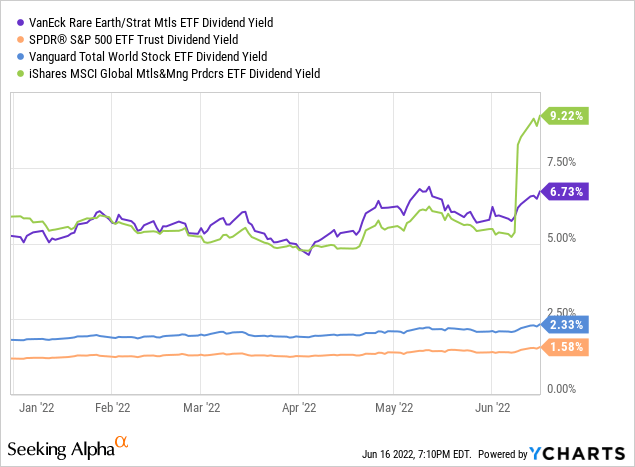

REMX – Dividend Analysis

REMX’s underlying holdings have seen strong revenue and earnings growth these past few months. Said growth could lead to significant dividends and dividend growth, subject to management decisions, CAPEX needs, and other such factors. REMX itself has seen significant dividend growth in the recent past, with the fund’s dividend increasing by a factor of 10x in 2022 alone. Said growth has boosted the fund’s yield to 6.5%, a reasonably strong amount, quite a bit higher than the equity average, although lower than comparable metals and mining producers.

Although REMX’s dividend yield is something of a benefit for shareholders, the situation is a bit complex. REMX pays an annual dividend to shareholders at the end of every year, and the dividend for 2021 looks abnormally high. International and mining equities tend to have volatile dividends, as does REMX. Dividends are sometimes higher / lower than expected, so past dividends or yields are not necessarily reflective or indicative of future dividends or yields. REMX yielded 6.5% in the past, but this does not necessarily mean the fund will yield 6.5% in the future, perhaps the fund simply had an abnormally high dividend in 2021 due to volatility, above-average earnings and the like.

At the same time, due to regulatory and accounting issues surrounding international equities, international equity funds are sometimes forced to distribute capital to shareholders when capital gains are high, and REMX’s capital gains were very high in 2021.

It is possible that REMX’s 6.5% yield is the result of significant capital gains in 2021, which might fail to materialize in 2022. Capital gains have been lower YTD, so a significant dividend cut for 2022 seems possible.

Although REMX does currently yield 6.5%, considering the issues above, I do not consider the fund’s dividend yield to be a significant benefit for shareholders, nor a core component of the fund’s investment thesis. This is not a safe, dependable, reliable dividend, and investors should assume that a cut is possible, even likely.

Conclusion – Buy

REMX is an equity index ETF investing in global rare earth and strategic metals producers. REMX’s strong growth prospects, strong recent performance, and potential market-beating returns, make the fund a buy.

Be the first to comment