Welcome to Vanadium miners news. March saw vanadium prices move lower and an interesting month of vanadium market news where we meet the inventor of the Vanadium Redox Flow Battery [VRFB].

Vanadium uses

Vanadium is traditionally used to harden steel. New Chinese rebar standards are requiring more vanadium. Also Vanadium Flow Batteries [VRFBs] are becoming increasingly popular, especially for commercial energy storage, most notably in China. Vanadium Pentoxide [V2O5] is used in VRFBs and Ferrovanadium [FeV] is used in the steel industry.

Vanadium spot price history

China Vanadium Pentoxide [V2O5] Flake 98% 1 year chart – Price = USD 6.20/lb

China Ferrovanadium [FeV] 80% Price = USD 27.50

Source: Vanadiumprice.com

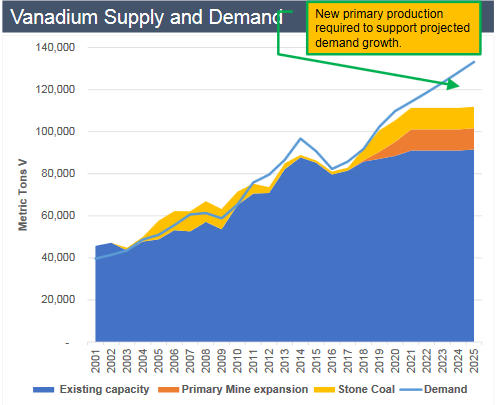

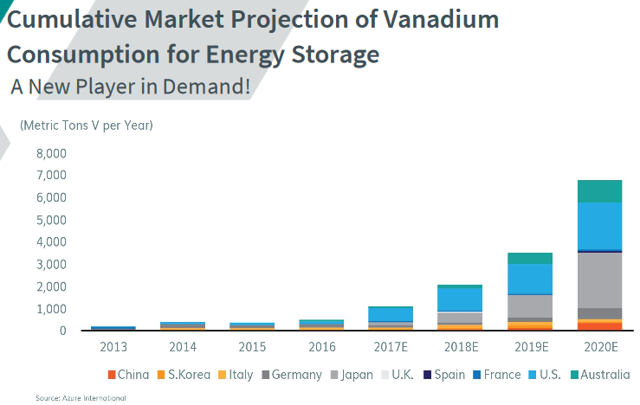

Vanadium demand versus supply

The charts below show energy storage to be a new source of vanadium demand, and overall demand looks likely to grow very strongly to 2025.

Vanadium total demand forecast to outstrip supply 2020-2025

Source: Technology Metals Australia investor presentation & TTP Squared

Roskill estimates that vanadium demand “for VRFB markets” could rise to 31,000 tons by 2025, amounting to a rise of 3,100% in a decade.

Source: Australian Vanadium presentation

Vanadium market news

In 2017, Robert Friedland stated:

We think there’s a revolution coming in vanadium redox flow batteries,” he says. “You’ll have to get into the mining business and produce ultra-pure vanadium electrolyte for those batteries on a massive scale. We’re very deeply interested in how you store electrical energy in the grid. The beauty of the vanadium redox battery is that you can charge and discharge it at the same time, something that can’t be done with a lithium battery. With a vanadium redox flow battery, you can put solar power and wind power into the battery, and you can put excess grid power into the battery at night, and at the same time you can have a stable output into the grid.

The world’s largest battery in Dalian, China to be completed in 2020: 200MW/800MWh vanadium flow battery (requires ~8,000 tonnes of V2O5)

On February 12, ET News reported: “South Korean Government allows flow battery to be used for ESS.”

On March 2, Power Mag reported:

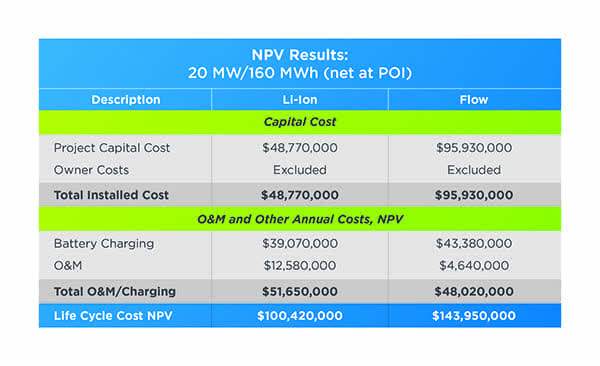

Flow Batteries: Energy storage option for a variety of uses. Energy storage is becoming increasingly important to the power industry. Lithium-ion battery technology has been implemented in many locations, but flow batteries offer significant benefits in long-duration usage applications and situations that require regular cycling throughout the day. With life spans reaching up to 30 years, depending on the electrolyte chemistry, flow batteries may provide unrivaled cost certainty versus other emerging storage technologies on the market. Though flow batteries currently represent a higher upfront capital investment than a similar-sized lithium-ion configuration, they become more competitive when evaluated on a total cost of ownership over a 20- to the 30-year lifecycle. Moreover, costs are dropping for flow batteries as technology advances and manufacturing efficiencies are implemented……The primary barrier to full market penetration of flow battery technologies today is simply the lack of commercialization compared to the heavy installation base of competing lithium-ion technology.

Costs of lithium-ion versus vanadium flow large scale energy storage

Note: The above example “shows the results of a lifecycle cost analysis comparing 20-MW, 8-hour (160-MWh) lithium-ion and flow battery systems. The model includes capital, O&M, and charging costs for 20-year project life. The net present value (NPV) totals are calculated and compared.”

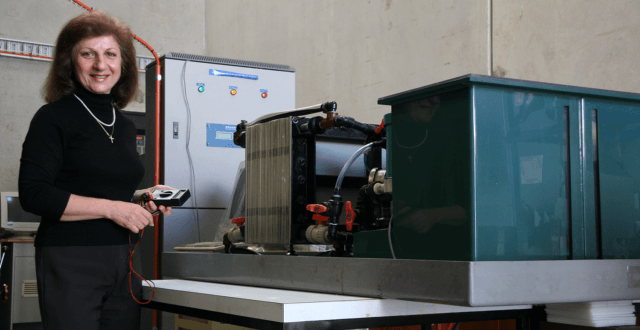

On March 20, ATSE reported: “The accidental engineer who invented the sustainable vanadium battery.”

Note: I find the story most interesting, particularly as I was also at the UNSW in 1984-86 studying my BSc degree.

Academy Fellow Emeritus Professor of Chemical Engineering Maria Skyllas-Kazacos led a team that invented the VRFB at Australia’s UNSW around 1984-85

Vanadium miner news

Vanadium producers

Glencore [LSX:GLEN] [HK:805] (OTC:OTCPK:GLCNF)

Glencore is a large vanadium producer, but vanadium production represents only a small portion of their revenue.

On February 27, Glencore announced: “Glencore donates medical equipment to Wuhan hospitals.”

On March 5 Glencore announced: “2019 annual report of Glencore plc.”

On March 20, Glencore announced:

Update on COVID-19. Ivan Glasenberg, CEO, Glencore, commented: “We continue to closely monitor and respond to events surrounding the COVID-19 pandemic. Our first priority is the health and wellbeing of all of our people and the broader community. “We have formulated our response in partnership with our expert medical advisors, taking into account advice from governments across the countries where we operate, and global bodies such as the World Health Organisation. “Through our business continuity planning, we aim to minimise disruption so we can continue to source and deliver the products that our customers need.”

AMG Advanced Metallurgical Group NV [NA:AMG] [GR:ADG] (OTCPK:AMVMF)

AMG Vanadium is a leading provider of products and services for the metals, manufacturing, refinery and petrochemical industries. AMG Vanadium produces ferrovanadium and related ferroalloys from spent refinery catalysts using a proprietary pyrometallurgical process.

On March 11, AMG announced: “AMG Advanced Metallurgical Group N.V. publishes 2019 annual report.”

On March 19, AMG announced:

AMG Advanced Metallurgical Group N.V. and Shell Catalysts & Technologies receive all regulatory consents necessary for the formation of Shell & AMG Recycling B.V. joint venture.

You can view the latest investor presentation here.

Bushveld Minerals Limited [LN- AIM:BMN] (OTC:BSHVF)

Bushveld is a diversified AIM-listed resources company with a portfolio of vanadium, tin and coal assets in Southern Africa and Madagascar.

On March 9, Bushveld Minerals Limited announced: “Joint Venture agreement with redT to form a Vanadium Financing Partnership to supply vanadium electrolyte.” Highlight include:

- “A key part of Bushveld’s strategy is to encourage the growth of the market for VRFBs, an attractive commercial opportunity in itself, which will also help strengthen vanadium demand profile.

- The simple architecture of a VRFB, combined with the re-usability and consequent positive residual value of the vanadium electrolyte after a long lifecycle create an opportunity for vanadium rental strategies that will reduce the upfront cost of purchasing and installing VRFBs to end users, by separating the cost of the mechanical and chemical elements of the VRFBs.

- The Partnership will take the form of a special-purpose vehicle structured to hold physical vanadium. It will supply vanadium electrolyte, an important element of VRFBs, to a series of VRFB projects in Europe (the “Projects”) to be deployed over an initial period of 2 years, which will help demonstrate proof of concept for this financial model at a larger scale. It builds on the smaller contract executed in 2019 in the USA with Avalon Battery Corporation.

- The Partnership’s initial target will be to deliver approximately 15 MWh of VRFBs to market, this will require approximately 80 mtV to be supplied by Bushveld.

- The vanadium electrolyte will be supplied to the Projects via long-term lease or rental arrangements, with financing from external funders that the Partnership are currently in discussions with.

- The vanadium electrolyte will be processed from feedstock from Bushveld’s primary assets in South Africa, by an industrial partner in the United Kingdom.”

On March 24, Bushveld Minerals Limited announced:

Covid-19 update and operation halt… directives issued by South Africa’s Government on 23 March 2020 to deal with the global Covid-19 outbreak. The measures include a 21-day National lockdown for all residents, to minimise movement of non-essential businesses and activities. A requirement is to put mining operations on care and maintenance with effect from midnight 26 March through to 16 April 2020.

You can view the latest investor presentation here.

Largo Resources [TSX:LGO] [GR:LR81] (OTCQX:LGORF)

Largo Resources is a pure-play vanadium pentoxide producer from their Maracás Menchen mine in Brazil.

On March 20, Largo Resources announced: “Largo Resources reports record production and lowest annual cash costs at the Maracás Menchen Mine with 2019 financial results.” Highlights include:

Q4 2019 Highlights

- “Production of 3,011 (6.6 million lbs) tonnes of V2O5 in Q4 2019, a 16% increase over Q4 2018.

- Record monthly V2O5 production of 1,162 tonnes in December 2019.

- Cash operating costs excluding royalties of US$2.48 ($3.28) per lb V2O5, a decrease of 29% over Q4 2018.

- Revenues of $34.1 million in Q4 2019 (net of the re-measurement of trade receivables/payables of $13.5 million on vanadium sales from a contract with a customer of $47.6 million).”

Full Year 2019 Highlights

- “Record FY 2019 production, achieving midpoint production guidance: 10,577 tonnes (23.3 million lbs1) of V2O5 produced in 2019, an increase of 8% over FY 2018.

- Cash operating costs excluding royalties of US$2.95 ($3.92) per lb V2O5, 12% lower than 2019 cost guidance; 13% lower than 2018.

- Revenues of $140.0 million in FY 2019 (net of the re-measurement of trade receivables/payables of $137.3 million on vanadium sales from a contract with a customer of $277.3 million).

- Net loss of $36.2 million and a loss per share of $0.07.

- Cash balance of $166.1 million exiting 2019…..”

Other Significant Updates

- “Strategic sales and marketing transition proven successful: 90% committed on guided annual sales for 2020.

- New 2020 total cash cost8 guidance of US$3.45 – 3.65/lb V2O5.

- 2020 total cash cost8, cash operating costs excluding royalties2, sales and production guidance maintained on a “business as usual” basis.

- Board approval for the construction of a vanadium trioxide (“V2O3“) processing plant in Maracás, Brazil.

- Ilmenite flotation pilot plant proven successful; TiO2 chemical pilot plant tests and study expected to commence in April 2020.”

You can view the latest investor presentation here.

Energy Fuels Inc. [TSX:EFR] (UUUU)

Energy Fuels state they are “the No. 1 uranium producer in the U.S. with a market-leading portfolio”, as well as being a recent vanadium producer.

On March 16, Energy Fuels announced: “Energy Fuels announces 2019 results.” Highlights include:

- “At December 31, 2019, the Company had $17.7 million in cash and marketable securities plus $22.8 million of inventory, including 515,000 pounds of uranium and 1,600,000 pounds of vanadium in the form of immediately marketable product.

- On February 20, 2020, the Company strengthened its balance sheet by completing a bought-deal financing for net proceeds of $15.1 million and has raised approximately $4.0 million on the Company’s At the Market (“ATM”) program in 2020. These amounts are in addition to the Company’s cash, marketable securities and marketable inventories balances, which totaled $40.5 million at December 31, 2019.

- Vanadium production totaled 1,800,000 pounds of high-purity V2O5 for the year. Production ceased during Q4-2019 due to weakened vanadium market conditions and lowered recoveries resulting from normal seasonal variances; however, substantial quantities of dissolved vanadium remain in the Company’s tailings management system to be recovered at a later date.

- The Company completed 200,000 pounds of vanadium sales during the year at an average price of $11.06 per pound. At this time, the Company is selling only small quantities of vanadium, instead focusing on maintaining its strong V2O5 inventory for sale in the future to capitalize on potential future price increases in vanadium markets that are often volatile.

- The Company had an operating loss of $40.6 million during 2019, due in part to an impairment of inventories of $14.4 million as a result of low uranium prices and a decrease in vanadium prices during the latter half of 2019.”

Ferro Alloy Resources [LON:FAR]

FAR is developing the giant Balasausqandiq vanadium deposit in Kyzylordinskaya Oblast of southern Kazakhstan. FAR states: “The ore at this site has a significantly higher grade than all other primary vanadium extraction sites, which allows for much lower processing costs.”

No significant news for the month.

Vanadium developers

Western Uranium & Vanadium Corp. (OTCQX:WSTRF)

Western Uranium & Vanadium Corp. own the Sunday Mine Complex which is an advanced stage mine property consisting of five interconnected underground mines in Colorado, USA.

On February 26, Western Uranium & Vanadium Corp. announced:

Western Uranium & Vanadium Corp. provides company updates. Western has completed all surface infrastructure project requirements of the Colorado Division of Reclamation Mining and Safety (DRMS)…

Investors can read the latest company presentation here.

Neometals [ASX:NMT] (OTCPK:RDRUY) (OTCPK:RRSSF)

Neometals 100% own the Barrambie Titanium Vanadium Iron Project in Western Australia. Barrambie’s Eastern Band is one of the highest grade hard rock titanium deposits globally.

On March 11, Neometals announced: “Half-year report for the 6 months ended 31 December 2019.”

On March 20, Neometals announced:

Letter to shareholders re dividend. Consistent with the Company’s commitment to deliver shareholder value and returns, Neometals Ltd is pleased to advise that it has announced the declaration of a partially franked dividend of 2 cents per share (approximately A$10.9 million dividend distribution in total) with a Record Date of 27 March 2020 and with payment anticipated to be made on 3 April 2020.

You can view the latest investor presentation here, or “An Update On Neometals”, or my article – “Neometals Managing Director Chris Reed Gives A Brief Update With Matt Bohlsen Of Trend Investing.”

Australian Vanadium [ASX:AVL] [GR:JT71] (OTC:ATVVF)

Australian Vanadium is an emerging vanadium producer focused on their Australian Vanadium Project in Western Australia.

On March 4, Australian Vanadium announced: “Total vanadium resource at the Australian Vanadium Project rises to 208 million tonnes.” Highlights include:

- “Indicated Resource of the distinct high-grade magnetite zone increased by 115% to 25.1Mt at 1.10% vanadium pentoxide [V2O5].

- Total Mineral Resource increased by 9.5% to 208.2Mt at 0.74% V2O5 consisting of: Measured: 10.1Mt at 1.14% V2O5. Indicated: 69.6Mt at 0.72% V2O5. Inferred: 128.5Mt at 0.73% V2O5.

- Updated high-grade portion now 87.9Mt at 1.06% V2O5 comprising: Measured: 10.1Mt at 1.14% V2O5. Indicated: 25.1Mt at 1.10% V2O5,. Inferred: 52.7Mt at 1.04% V2O5…

- Prospective project financiers and joint venture partners seeking a de-risked and large resource base.”

On March 16, Australian Vanadium announced: “Pilot study programme confirms high vanadium recoveries and concentrate quality.” Highlights include:

- “…Findings confirm the Project’s high vanadium recoveries and consistent excellent concentrate qualities. Concentrate generated from life-of-mine average feed blend achieved 76% vanadium recovery, at a grade of 1.37% V2O5 and 1.68% SiO2. Year 0-5 pilot testing achieved 69% vanadium recovery to concentrate at 1.39% V2O5 and 1.83% SiO2…”

Catalysts include:

- Early 2020 – Possible off-take and/or JV partner announcements.

- 2020 – DFS due.

You can view the latest investor presentation here, or read “Australian Vanadium Managing Director Vincent Algar Talks With Matt Bohlsen Of Trend Investing.”

Technology Metals Australia [ASX:TMT]

The company’s primary exploration focus is on the 100% owned Gabanintha Vanadium Project located 40km south east of Meekatharra in the mid-west region of Western Australia.

No significant news for the month.

Catalysts include:

- 2020 – Possible further off-take announcements. Possible funding or equity partner announcements.

You can view the latest investor presentation here, or read “Technology Metals Australia Execetive Director Ian Prentice Talks With Matt Bohlsen Of Trend Investing.”

TNG Ltd. [ASX:TNG] [GR:HJI] (TNGZF)

TNG is an Australian resources company focused on the evaluation and development of its Mount Peake Vanadium-Titanium-Iron project. The Mount Peake Project is located 235km north-northwest of Alice Springs in the Northern Territory of Australia. TNG Ltd is well advanced with a massive $4.7b NPV8%, but relies on titanium and iron with a lower grade vanadium by-product.

On March 11, TNG Ltd. announced: “Half-year financial report 31 December 2019.”

You can view the latest investor video presentations here.

Aura Energy [ASX:AEE] [GR:VU1] (OTC:AUEEF)

Aura Energy is an Australian-based minerals company that 100% owns polymetallic and uranium projects with large resources in Sweden (Häggån Project) and Mauritania (Tiris project). Aura’s focus is on the Häggån Project, located in Sweden’s Alum Shale Province, one of the largest depositories of vanadium in the world.

On March 16, Aura Energy announced: “Half-year report December 2019.”

On March 26, Aura Energy announced: “Extraordinary general meeting [EGM] postponed.”

You can view the latest investor presentation here.

Silver Elephant Mining Corp. [TSX:ELEF] (SILEF) (Formerly Prophecy Development Corp. TSX:PCY, (OTCQX:PRPCF))

Silver Elephant Mining Corp. is a Canadian public company listed on the Toronto Stock Exchange. The company’s objective is to advance the Gibellini Black Shale primary vanadium project in the Battle Mountain region in northeastern Nevada to production. Gibellini aims to be the first active primary vanadium mine in North America. They also have a huge silver asset in Bolivia.

On March 17, Silver Elephant Mining Corp. announced:

Prophecy shareholders pass all resolutions at 2020 special meeting Prophecy to be renamed Silver Elephant Mining Corp..

On March 18, Silver Elephant Mining Corp. announced:

Silver Elephant Mining Corp.: Name change complete from Prophecy. “ELEF”commences trading on TSX on March 19, 2020…..The Company has made application with FINRA in the US for a symbol change (from “PRPCF”) on the OTCQX and will provide an update as soon as the Company receives approval.

You can view the latest investor presentation here.

Vanadium Resources Limited [ASX:VR8] (formerly Tando Resources [ASX:TNO])

Vanadium Resources is a junior exploration company established with the purpose of exploring and developing gold zinc, lead, copper and other mineral opportunities. Vanadium Resources owns 74% of a globally significant vanadium project, the Steelpoortdrift [SPD] Project, in Gauteng Province, South Africa.

On March 13, Vanadium Resources Limited announced: “Financial report for the half-year ended 31 December 2019.”

You can view the latest investor presentation here.

King River Resources [ASX:KRR] (formerly King River Copper)

King River holds 785 square kilometres of mineral leases covering a unique geological feature in the Eastern Kimberley of Western Australia, called the Speewah Dome. The company state on their website: “The focus of King River Copper Limited is the exploration for Gold, Silver and Copper.” However their deposits also contain vanadium.

On March 6, King River Resources announced: “Half year financial report 31 December 2019.”

On March 24, King River Resources announced: “Speewah project PFS and coronavirus update.” Highlights include:

“Our current focus with the PFS is on four areas, each of which is progressing well:

- Metallurgy and Process Flowsheet Development… Hydrometallurgical refining testwork by TSW Analytical in Perth is focussing on producing a >99.99% high purity alumina (>4N HPA) product and increasing the final purification efficiencies…

- Process Plant Design and Costings…

- Mining Study and Reserve Estimate…

- Environmental, Social and Permitting Study…”

You can view the latest investor presentation here.

VanadiumCorp Resource Inc. [TSXV:VRB][GR:NWN] (OTCPK:APAFF)

VanadiumCorp Resources Inc. 100% owns the Lac Dore Vanadium-Iron-Titanium project in Quebec Canada. The company also has royalties on the Raglan Nickel-PGM mine. The company is looking to take a vertically integrated approach and is also developing leading process technologies ‘VanadiumCorp-Electrochem Processing Technology’ and “Electrochem globally patented Electrowinning” technology.

On March 12, VanadiumCorp Resources Inc. announced:

Iron-T Vanadium Project transaction closed and AGM. VanadiumCorp Resource Inc. is pleased to announce further to the news release titled “Definitive agreement signed for acquisition & secured offtake for VanadiumCorp’s Iron-T Project” dated October 30th, 2019, the transaction has been closed…

On March 16, VanadiumCorp Resources Inc. announced: “VanadiumCorp intercepts 0.66% V2O5 over 29.4 metres at Lac Doré, Québec.”

On March 17, VanadiumCorp Resources Inc. announced:

VanadiumCorp GmbH completes first battery order, contract and Memorandum of Understanding with Ecosource NV. VanadiumCorp has recently contract manufactured and deployed a 12.5 kilowatt / 40 kilowatt hour VRFB system for delivery to Ecosource in Temse, Belgium… Round one investment into VanadiumCorp GmbH through the purchase of securities of VanadiumCorp Resource Inc, the price of which is determined at the time of signing, timed with success of the first VRFB commissioning. Funding the CAPEX for commercial VRFB production…

You can view the latest investor presentation here.

First Vanadium Corp. [TSXV:FVAN] (FVANF) (OTCQB:CCCCF) (formerly Cornerstone Metals Inc.)

Cornerstone’s Carlin Vanadium project hosts one of North America’s largest richest primary vanadium deposits, located in Nevada. Its West Jerome project targets a large scale high grade copper and zinc deposit in Arizona. Carlin has a historic Inferred Resource 28Mt at 0.525% V2O5 (2010 SRK).

No news for the month.

Investors can read the latest company presentation here.

Graphite miners with potential vanadium projects

- Syrah Resources [ASX:SYR] (OTCPK:SYAAF) (OTC:SRHYY)

- Triton Minerals [ASX:TON] [GR:1TG]

- Battery Minerals [ASX:BAT]

- NextSource Materials [TSX:NEXT]

- DNI Metals [TSXV:DNI] [GR:DG7N] (OTCPK:DMNKF)

Other vanadium juniors

- Golden Deeps [ASX:GED]

- Sabre Resources [ASX:SBR]

- Trigon Metals Inc. [TSXV:TM] (OTC:PNTZF)

- Venus Metals [ASX:VMC]

- Intermin Resources [ASX:IRC]

- Vanadium One Energy Corp. [TSXV:VONE] [GR:9VR1] (OTC:VDMRF)

- New Energy Minerals [ASX: NXE] (formerly Mustang Resources)

- Maxtech Ventures [CSE:MVT]

- Pursuit Minerals [ASX:PUR]

- Victory Metals [TSXV:VMX]

- BlackRock Metals (Private)

- Gladiator Resources [ASX:GLA]

- Sabre Resources [ASX:SBR]

- Vanadium Resources [ASX:VR8]

VRFB Companies

- Protean Energy [ASX:POW] [GR:SHE1]

- CellCube Energy Storage [TSXV:CUBE] (STNUF)

Conclusion

Vanadium spot prices were lower in March.

Highlights for the month include:

- VRFBs have some advantages over lithium-ion for large scale energy storage, especially for very long term projects.

- The history of the VRFB invention – “The Accidental engineer who invented the sustainable vanadium battery”.

- Bushveld Minerals – Joint Venture agreement with redT to form a Vanadium Financing Partnership to supply vanadium electrolyte. Bushveld’s South African project shutdown until 16 April 2020 due to COVID-19.

- Australian Vanadium – Total Mineral Resource increased by 9.5% to 208.2Mt at 0.74% V2O5 consisting of: Measured: 10.1Mt at 1.14% V2O5. Indicated: 69.6Mt at 0.72% V2O5. Inferred: 128.5Mt at 0.73% V2O5.

- Silver Elephant Mining Corp. name change complete from Prophecy Development Corp..

- VanadiumCorp GmbH completes first battery order, contract and Memorandum of Understanding with Ecosource NV.

As usual, all comments are welcome.

Trend Investing

Thanks for reading the article. If you want to sign up for Trend Investing for my best investing ideas, latest trends, exclusive CEO interviews, chat room access to me, and to other sophisticated investors. You can benefit from the work I’ve done, especially in the electric vehicle and EV metals sector. You can learn more by reading “The Trend Investing Difference“, “Subscriber Feedback On Trend Investing”, or sign up here.

Latest Trend Investing articles:

Disclosure: I am/we are long GLENCORE [LSX:GLEN], AMG ADVANCED METALLURGICAL GROUP NV [AMS:AMG], LARGO RESOURCES [TSX:LGO], NEOMETALS [ASX:NMT], AUSTRALIAN VANADIUM [ASX:AVL], SYRAH RESOURCES [ASX:SYR], TRITON MINERALS [ASX:TON]. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: The information in this article is general in nature and should not be relied upon as personal financial advice.

Be the first to comment