davidf/iStock via Getty Images

Welcome to the Vanadium miners news.

August saw mixed vanadium prices with China prices moving higher and Europe moving lower. The ferrovanadium outlook remains weak due to reduced steel demand in China; however the vanadium pentoxide for VRFBs outlook continues to brighten. See market news below regarding the boost from the U.S Inflation Reduction Act.

Vanadium uses

Vanadium is traditionally used to harden steel. Chinese rebar standards are requiring more vanadium. Also Vanadium Flow Batteries [VRFBs] are becoming increasingly popular especially for commercial energy storage, most notably in China. Vanadium Pentoxide [V2O5] is used in VRFBs and Ferrovanadium [FeV] is used in the steel industry.

Vanadium spot price history

Europe Vanadium Pentoxide [V2O5] Flake 98% 1 year chart – Price = USD 7.30/lb (China price not given)

Vanadiumprice.com![Europe Vanadium Pentoxide [V2O5] Flake 98% 1 year chart](https://static.seekingalpha.com/uploads/2022/8/28/37628986-16617377080769231.png)

China and Europe Ferrovanadium [FeV] 80% prices – China = USD 35.00/kg, Europe = USD 31.75/kg

Vanadium demand versus supply

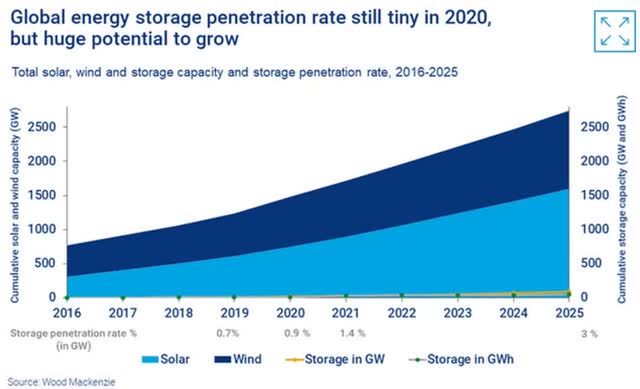

An April 2021 Wood Mackenzie report stated:

Global energy storage deployment surged a remarkable 62% in 2020, with 5 GW/9 GWh of new capacity added. This brought the total energy storage market to more than 27 GWh. Furthermore, we expect the global (energy storage) market to grow 27-fold by 2030.

Woodmac forecasts high growth ahead for solar, wind and energy storage

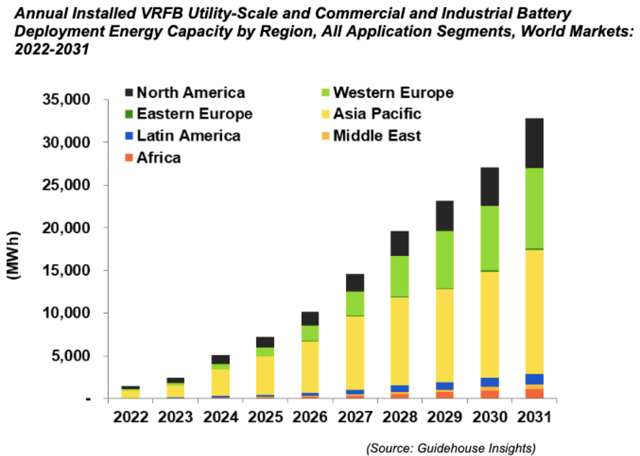

Global VRFB forecast growth by region 2022-2031

Energy Storage News, Courtesy: Guidehouse Insights

In 2017 Robert Friedland stated: “We think there’s a revolution coming in vanadium redox flow batteries…”

Vanadium market news

On July 27 Investing News reported:

Vanadium market update: H1 2022 in review… Looking at what could happen on the demand side entering the second half of the year, steel production for long products, a substantial driver of Chinese vanadium demand, will remain steady over the coming quarters… The battery segment has also been an exciting area in vanadium, as interest in energy storage continues to increase… “Vanadium battery demand expectations are notoriously difficult to meet, with issues of supply and for the battery projects themselves being common”… Prices are likely to remain under pressure until the fourth quarter as supply, especially in the US, currently outweighs demand, according to CRU.

On August 16 Invinity Energy Systems (OTCQX:IESVF) announced:

U.S. Vanadium and Invinity sign MoU to form U.S. Joint Venture. Plan to manufacture and sell vanadium flow batteries in the United States to meet growing demand.

On August 22 Energy Storage News reported:

Will the US Inflation Reduction Act boost demand for flow batteries?… With the introduction of an investment tax credit [ITC] incentive for standalone energy storage, the act will reduce the capital cost of equipment for such projects by roughly 30%. The Inflation Reduction Act (IRA) also incentivises domestic manufacturing of clean energy technologies.

Vanadium miner news

Vanadium producers

Glencore [LSX:GLEN] [HK:805] (OTCPK:GLCNF)

Glencore is a large vanadium producer, but vanadium production represents only a small portion of their revenue.

On July 29, Glencore announced: “Half-year production report 2022…” Vanadium was not mentioned.

On August 4, Glencore announced:

2022 half-year report… Group Adjusted EBITDA to $18.9 billion. Marketing Adjusted EBIT more than doubled to $3.7 billion, with energy products the standout, while Industrial Adjusted EBITDA increased $8.4 billion to $15.0 billion period-on-period…

On August 4, Glencore announced:

Share buy-back programme. Glencore plc (the “Company”) announces the commencement of a programme to make market purchases of its ordinary shares (the “Shares”) of an aggregate value of USD3 billion (the “Programme”), subject to market conditions, which may continue until the 2022 full year results are announced in February 2023.

AMG Advanced Metallurgical Group NV [NA:AMG] [GR:ADG] (OTCPK:AMVMF)

AMG Vanadium is a leading provider of products and services for the metals, manufacturing, refinery and petrochemical industries. AMG Vanadium produces ferrovanadium and related ferroalloys from spent refinery catalysts using a proprietary pyrometallurgical process.

On July 28, AMG Advanced Metallurgical Group NV announced: “AMG Advanced Metallurgical Group N.V. reports record earnings for second quarter 2022.” Highlights include:

Strategic Highlights

- “Construction and commissioning of the new vanadium spent catalyst recycling facility in Zanesville, Ohio is proceeding as planned. The roaster is fully operational, and the entire plant is expected to be at run-rate capacity by the end of the fourth quarter of 2022.

- The project to expand the spodumene production in AMG Brazil is on time and on budget. The objective is to be in full production in the second half of 2023 or earlier.”

Financial Highlights

- “Revenue increased by 42% to $424.1 million in the second quarter of 2022 from $298.4 million in the second quarter of 2021.

- EBITDA was $81.1 million in the second quarter of 2022, up 158% versus the second quarter 2021 EBITDA of $31.4 million, marking the highest six-month and quarterly EBITDA in AMG’s history and its eighth straight quarter of sequential improvement.

- Annualized return on capital employed was 25.5% for the first six months of 2022, more than double the 10.0% for the same period in 2021.

- Net income to shareholders for the second quarter of 2022 was $29.6 million, yielding 91 cents diluted earnings per share, compared to $3.6 million of net income to shareholders in the same period in the prior year and 11 cents diluted earnings per share.

- AMG’s liquidity as of June 30, 2022, was $476 million, with $301 million of unrestricted cash and $175 million of revolving credit availability.

- AMG declares an interim dividend of €0.30 per ordinary share, to be paid in the third quarter of 2022.”

You can view the latest investor presentation here.

Bushveld Minerals Limited [LN- AIM:BMN] (OTC:BSHVF)

Bushveld is a diversified AIM-listed resources company with a portfolio of vanadium, tin and coal assets in Southern Africa and Madagascar.

On July 28, Bushveld Minerals announced: “Q2 2022 and H1 2022 operational update.” Highlights include:

- “Group production for H1 2022 of 1,641 mtV, was 4% higher than H1 2021 (H1 2021: 1,574 mtV). Vametco showing continued operational performance and stability. Vanchem production adversely impacted by lower recoveries associated with end-of-life Kiln 1, electricity load shedding, and a slower than planned ramp-up post commissioning of Kiln 3.

- Group production for Q2 2022 was 668 mtV, 25% lower than Q2 2021 (Q2 2021: 886 mtV). Vametco completed a 26-day planned maintenance shutdown during the quarter, following which production volumes are back to Q1 2022 levels. Vanchem’s production impacted by the reasons mentioned above.

- Group H1 2022 weighted average production cash cost (C1) of US$28.32/kgV, was 6% higher than H1 2021 of US$26.71/kgV.

- Group Q2 2022 weighted average production cash cost (C1) of US$ 31.23/kgV, was 19% higher than Q2 2021 of US$26.33/kgV.

- Group H1 2022 sales of 1,644 mtV, in line with H1 2021 Group sales (H1 2021: 1,608 mtV).”

2022 Guidance

- “…Group is on target to meet the annualised steady state production run rate of between 5,000 mtVp.a. and 5,400 mtVp.a. by the end of 2022.”

You can view the latest investor presentation here.

Largo Inc. [TSX:LGO] [GR:LR81] (LGORF) (NASDAQ:LGO)

Largo Inc. is a pure-play vanadium pentoxide producer from their Maracás Menchen mine in Brazil as well as a producer of VRFBs.

On August 4, Largo Inc. announced:

Largo Clean Energy signs non-binding MOU with Ansaldo Green Tech to negotiate the formation of a Joint Venture for the manufacturing and commercial deployment of vanadium redox flow batteries (VRFBs) in the European, African, and Middle East Power…

On August 10, Largo Inc. announced: “Largo reports solid second quarter 2022 financial results highlighted by net income of $18 million; provides revised 2022 production, cost and CAPEX Guidance.” Highlights include:

- “Revenues of $84.8 million, a 56% increase over Q2 2021; Revenues per pound sold1 of $11.69, a 44% increase over Q2 2021 mainly due to stronger vanadium prices.

- Net income of $18.0 million, a 113% increase over Q2 2021; Basic earnings per share of $0.28 in Q2 2022.

- Cash provided before non-cash working capital items of $25.4 million, a 57% increase over Q2 2021; Cash provided by operating activities of $2.9 million vs. $19.1 million in Q2 2021.

- Cash and restricted cash balance of $52.9 million and $23.4 million, respectively, exiting Q2 2022; Net working capital2 surplus of $129.0 million following an increase in vanadium inventory and amounts receivable balances.

- Total V2O5 equivalent sales of 3,291 tonnes, a 9% increase over Q2 2021.

- V2O5 production 3,084 tonnes (6.8 million lbs3) vs. 3,070 tonnes in Q2 2021.

- Operating costs of $50.7 million vs. $35.0 million in Q2 2021 and cash operating costs excluding royalties per pound1 of V2O5 equivalent sold of $4.23 vs. $3.39 in Q2 2021.

- 2022 Production, Cost and Capital Expenditures Guidance Update: The Company has revised its V2O5 equivalent production guidance to 11,000 – 12,000 tonnes from 11,600 – 12,400 tonnes; Cash operating cost excluding royalties1 guidance increased to $4.10 – 4.50 per lb sold from $3.90 – 4.30; Ilmenite concentration plant capital expenditure guidance lowered to $19.0 – 21.0 million from $29.0 – 30.0 million; Titanium dioxide (“TiO2“) processing plant capital expenditures guidance lower to $2.0 – 3.0 million from $9.0 – 10.0 million.

- On May 30, 2022, the Company announced that the TSX had accepted its notice of intention to make a normal course issuer bid (“NCIB”) to purchase for cancellation its common shares (“Common Shares”); On July 14, 2022, the Company announced it had implemented an automatic securities purchase plan under its previously announced NCIB.

- Published 2021 Sustainability Report…”

Vanadium Market Update4

- “Demand in all of the Company’s key markets continued to remain strong in Q2 2022, which was reflected in a robust vanadium price during the period.

- The average benchmark price per lb of V2O in Europe was $11.08 in Q2 2022, an increase of 3% from the average of $10.72 seen in Q1 2022 and an increase of 35% from the average of $8.19 seen in Q2 2021; The average benchmark price per kg of ferrovanadium in Europe was $44.22, a decrease of 4% from the average of $46.17 seen in Q1 2022 and an increase of 24% from the average of $35.79 seen in Q2 2021.

- Vanadium prices have decreased since then and the average benchmark price per pound of V2O5 in Europe was $8.00 as of August 5, 2022.”

You can view the latest investor presentation here.

Energy Fuels Inc. [TSX:EFR] (UUUU)

Energy Fuels state they are “the No. 1 uranium producer in the U.S. with a market-leading portfolio”, as well as being a small vanadium producer.

On August 9, Energy Fuels Inc. announced: “Energy Fuels announces Q2-2022 results, including continued robust balance sheet and market-leading U.S. uranium & rare earth positions.”

- “…During the first half of 2022, the Company sold approximately 575,000 pounds of the Company’s existing inventory of vanadium (“V2O5“) (as ferrovanadium, “FeV”), for an average weighted net price of $13.44 per pound of V2O5. Vanadium markets have dropped in recent weeks. Therefore, the Company has halted sales of its inventory which currently stands at approximately 1.05 million pounds of V2O5. However, the Company expects to resume sales when markets improve again. The Company is evaluating the potential to resume vanadium recovery at the Mill in the future as market conditions may warrant for future sale and to replace sold inventory, where its tailings pond solutions contain an estimated additional 1.0 to 3.0 million recoverable pounds of V2O5…”

Ferro-Alloy Resources [LON:FAR]

FAR is developing the giant Balasausqandiq vanadium deposit in Kyzylordinskaya Oblast of southern Kazakhstan. FAR state: “The ore at this site has a significantly higher grade than all other primary vanadium extraction sites, which allows for much lower processing costs.”

No news for the month.

Western Uranium & Vanadium Corp. (OTCQX:WSTRF)

Western Uranium & Vanadium Corp. own the Sunday Mine Complex which is an advanced stage mine property consisting of five interconnected underground mines in Colorado, USA.

No news for the month.

Investors can read the latest company presentation here.

Vanadium developers

Neometals [ASX:NMT] (OTCPK:RDRUY) (OTCPK:RRSSF)

Neometals 100% own the Barrambie Titanium Vanadium Iron Project in Western Australia. Barrambie’s Eastern Band is one of the highest grade hard rock titanium deposits globally.

On July 29, Neometals announced: “Quarterly activities report for the quarter ended 30 June 2022.” Highlights include: Corporate

- “Cash balance A$60.4 million, receivables and investments of A$32.1 million and no debt.

- Multiple on-market share purchases by Company Directors and Officers during the quarter.”

Core Battery Materials Business Units

Vanadium Recovery Project (“VRP”) (earning into 50:50 JV with Critical Metals Ltd)

- “Potential for lowest quartile operating costs confirmed via AACE®1 Class 3 Engineering and Cost Study (“ECS”) announced post the quarter end.

- Feasibility study, including ECS findings, is being advanced in parallel with negotiations for additional slag volumes from Swedish Steel AB (“SSAB”).

- Offtake, financing and permitting activities advanced during the quarter with a decision on the environmental permit expected from Finnish regulators in September 2022.”

Upstream – Mineral Extraction

Barrambie Titanium and Vanadium Project (“Barrambie”) (100% NMT)

- “40 tonne sample of mixed gravity concentrate arrived at Jiuxing ahead of commercial smelting trials planned to commence in July 2022.

- AACE® Class 4 pre-feasibility study advanced with completion expected in Dec Q 2022.”

You can view the latest investor presentation here.

Australian Vanadium [ASX:AVL] [GR:JT71] (OTC:ATVVF)

Australian Vanadium is an emerging vanadium producer focused on their Australian Vanadium Project in Western Australia. VSUN Energy was launched by AVL in 2016 to target the energy storage market for vanadium redox flow batteries [VRFBs].

On August 23, Australian Vanadium announced:

Vanadium drill program commencement. New diamond drill program underway in southern ore blocks at the Australian Vanadium Project to support Mineral Resource classification upgrades and metallurgical confirmation of higher vanadium concentrate grades.

Catalysts include:

- 2022/23 – Possible further off-take and/or JV partner announcements.

You can view the latest investor presentation here, or read a Trend Investing CEO interview here.

Technology Metals Australia [ASX:TMT]

The Company’s primary exploration focus is on the 100% owned Gabanintha Vanadium Project located 40km southeast of Meekatharra in the mid-west region of Western Australia. Technology Metals Australia is studying (“Integration Study”) to combine the high grade, high quality Yarrabubba deposit with the Gabanintha Vanadium Deposit to form the Murchison Technology Metals Project (MTMP).

On August 5, Technology Metals Australia announced: “MTMP mine life increased to 25 years maiden ilmenite reserve and production profile.” Highlights include:

- “Integration Study delivers a global Murchison Technology Metals Project (MTMP) Ore Reserve of 44.48Mt at 0.89% V2O5.

- Yarrabubba Ore Reserve has increased by 69% to 15.88Mt at 0.87% V2O5 and 10.03% TiO2.

- Increased mine life to 25 years, targeting average production rate of ~12,500 tpa (27.5 Mlbs pa) V2O5.

- Maiden Yarrabubba ilmenite (TiO2) Ore Reserve generates 1.13Mt of ilmenite over the life of mine, delivering a material additional revenue stream.

- Dual revenue streams from Yarrabubba further de-risks the development of the MTMP.

- DCF analysis conducted by Orelogy shows the integrated MTMP meets the investment criteria for TMT to pursue the next stages of project development.

- TMT has moved to commercial competitive tendering to update MTMP economic parameters and support development of the financial model and a Development Decision expected by the end of 2022.”

You can view the latest investor presentation here.

TNG Ltd [ASX:TNG] [GR:HJI] (OTCPK:TNGZF)

TNG is an Australian resources company focused on the evaluation and development of its Mount Peake Vanadium-Titanium-Iron project. The Mount Peake Project is located 235km north-northwest of Alice Springs in the Northern Territory of Australia. TNG Ltd is well advanced with a massive $4.7b NPV8%, but relies on titanium and iron with a lower grade vanadium by-product.

On August 1, TNG Ltd. announced: “TNG receives further financial backing with Korean Export Credit Agency K-SURE issuing a letter of support for up to A$200m in debt funding for the Mount Peake Project. The conditional finance support from K-SURE is another cornerstone component of the multi-source, global funding package for TNG’S flagship Mount Peake Project.” Highlights include:

- “The Korean official Export Credit Agency Korea Trade Insurance Corporation (“K-SURE”) has issued a conditional Letter of Support for the provision of up to A$200 million in debt funding for TNG’s Mount Peake Vanadium-Titanium-Iron Project in the Northern Territory.

- TNG has now received a total of up to A$800 million in conditional Letters of Support/Interest for the Mount Peake Project from Australian, German and Korean Government backed funding sources.

- The Letter of Support from K-SURE builds on the December 2021 Memorandum of Understanding on Cooperation in Critical Minerals Supply Chains, signed between the Republic of Korea and Australia.

- KPMG Corporate Finance and Germany’s KfW IPEX-Bank GmbH continue to support TNG in achieving these landmark financing milestones.”

On August 16, TNG Ltd. announced:

TNG acquires strategic lithium exploration tenure near its flagship Mount Peake Project. Acquisition of large strategic exploration portfolio covering the Northern Arunta Pegmatite Province includes numerous highly prospective lithium targets…

You can view the latest investor presentations here.

Vanadium Resources Limited [ASX:VR8] [GR:TR3]

Vanadium Resources is a junior exploration company established with the purpose of exploring and developing gold zinc, lead, copper, and other mineral opportunities. Vanadium Resources owns 74% of a globally significant vanadium project, the Steelpoortdrift [SPD] Project, in Gauteng Province, South Africa.

On July 28, Vanadium Resources Limited announced: “Activities report – June quarter 2022.” Highlights include:

- “The Company successfully dual listed on the Frankfurt Stock exchange, under the ticker code TR3.

- Pilot plant metallurgical test work was completed which indicated elevated recoveries achievable compared to inputs used during PFS.

- The DFS continues to remain on target and within budget for completion end Q3 2022.”

On August 19, Vanadium Resources Limited announced: “Acquisition of property to locate salt roast facility.”

You can view the latest investor presentation here.

King River Resources [ASX:KRR] (formerly King River Copper)

King River holds 785 square kilometres of mineral leases covering a unique geological feature in the Eastern Kimberley of Western Australia, called the Speewah Dome. The company state on their website: “The focus of King River Copper Limited is the exploration for Gold, Silver and Copper.” However their deposits also contain vanadium.

No news for the month.

You can view the latest investor presentation here.

Vanadiumcorp Resource Inc. [TSXV:VRB][GR:NWN] (OTCPK:VRBFF)

Vanadiumcorp Resources Inc. 100% owns the Lac Dore Vanadium-Iron-Titanium project in Quebec Canada. The Company also has royalties on the Raglan Nickel-PGM mine. The Company is looking to take a vertically integrated approach and is also developing leading process technologies ‘VanadiumCorp-Electrochem Processing Technology’ and “Electrochem globally patented Electrowinning” technology.

No news for the month.

You can view the latest investor presentation here.

Richmond Vanadium Technologies Pty Ltd (“RVT”) ASX IPO planned for Sept./ Oct 2022 – Spin-off from Horizon Mining [ASX:HRZ]

RVT now owns 100% of the Richmond Vanadium Project. It has a global Mineral Resource of 1.8Bt @ 0.36% Vanadium Pentoxide (V2O5).

On August 9, Richmond Vanadium Technologies Pty Ltd announced:

Miner throws in cash for battery IPO. Miner Horizon Minerals will invest in battery manufacturer Ultra Power Systems, which manufactures vanadium batteries, via its partially owned subsidiary Richmond Vanadium Technology. It holds 25%. Richmond Vanadium Technology will invest up to $5 million in the company prior to its planned initial public offering on the ASX, giving it first dibs to supply all vanadium to Ultra and giving it a seat at the board.

On August 10, The North West Star reported:

Richmond Vanadium signs deal with battery module maker Ultra. Richmond Vanadium Technology has signed a Binding Term Sheet to invest up to five million dollars into battery company Ultra Power Systems as part of its ASX initial public offering. Under the deal RVT will have the right to supply all vanadium offtake to UPS and will appoint a representative director to the UPS board… Under the term sheet RVT will subscribe for up to 20,000,000 shares valued at 25 cents per share in Western Australian energy technology company, Ultra Power Systems subject to a successful listing of RVT on the Australian Securities Exchange, in which the company intends to raise between $25-35 million.

Phenom Resources Corp. [TSXV:PHNM] (OTCQX:PHNMF) (formerly First Vanadium Corp.)

The Carlin Gold-Vanadium Property hosts one of North America’s largest richest primary vanadium deposits, located in Nevada. Its West Jerome project targets a large-scale high-grade copper and zinc deposit in Arizona. Carlin has a Historic Inferred Resource 28Mt at 0.525% V2O5 (2010 SRK).

No news for the month.

Investors can read the latest company presentation here.

Graphite miners with potential vanadium projects

- Syrah Resources [ASX:SYR] (OTCPK:SYAAF) (OTC:SRHYY)

- NextSource Materials [TSX:NEXT]

- DNI Metals [TSXV:DNI] [GR:DG7N](OTC:DMNKF)

Other listed vanadium juniors

- BlackRock Metals (Private)

- Gladiator Resources [ASX:GLA]

- Golden Deeps [ASX:GED]

- Intermin Resources [ASX:IRC]

- Maxtech Ventures [CSE:MVT]

- New Energy Minerals [ASX: NXE] (formerly Mustang Resources)

- Pursuit Minerals [ASX:PUR]

- QEM Limited [ASX:QEM]

- Sabre Resources [ASX:SBR]

- Strategic Resources [TSXV:SR] (OTCPK:SCCFF)

- Trigon Metals Inc. [TSXV:TM] (OTC:PNTZF)

- Voyager Metals Inc. [TSXV:VONE][GR:9VR1] (OTC:VDMRF) (formerly Vanadium One Iron Corp.)

- Venus Metals [ASX:VMC]

- Victory Metals [TSXV:VMX]

VRFB Companies

- Protean Energy [ASX:POW] [GR:SHE1]

- Enerox GmbH (90% Bushveld/10% Cellcube Energy Storage Systems)

- Invinity Energy Systems (LSE:IES) (IVVGF) (OTCQX:IESVF)

Conclusion

August saw mixed vanadium prices with China prices moving higher and Europe moving lower.

Highlights for the month include:

- Ferrovandium prices are likely to remain under pressure until the fourth quarter of 2022 due to weakness in the steel sector. Vanadium pentoxide prices may do better due to limited supply and rising demand for VRFBs.

- U.S. Vanadium and Invinity MoU plan to manufacture and sell vanadium flow batteries in the United States.

- The US Inflation Reduction Act should boost demand for VRFBs, due to the introduction of an investment tax credit [ITC] incentive for standalone energy storage, the act will reduce the capital cost of equipment for such projects by roughly 30%.

- AMG reports record earnings for Q2, 2022. AMG’s new vanadium spent catalyst recycling facility in Zanesville, Ohio is expected to be at run-rate capacity by the end of Q4, 2022.

- Bushveld’s group production for Q2 2022 was 668 mtV, 25% lower than Q2 2021 (Q2 2021: 886 mtV).

- Largo Inc. reports Q2, 2022 net income of $18.0 million, a 113% increase over Q2 2021.

- Technology Metals Australia Integration Study delivers a global Murchison Technology Metals Project (MTMP) Ore Reserve of 44.48Mt at 0.89% V2O5.

- TNG receives further financial backing with Korean Export Credit Agency K-SURE issuing a letter of support for up to A$200m in debt funding for the Mount Peake Project.

- Richmond Vanadium signs deal with battery module maker Ultra.

As usual all comments are welcome.

![China and Europe Ferrovanadium [FeV] 80% prices](https://static.seekingalpha.com/uploads/2022/8/28/37628986-16617378515299008.png)

Be the first to comment