Justin Sullivan

Introduction

It’s time to talk about Valero Energy (NYSE:VLO). The company is one of my largest dividend growth investments and one of the most dominant refinery companies in the United States. In this article, I will make the case for a return of aggressive dividend growth in 2023 as the company is showing tremendous progress when it comes to improving its balance sheet. That’s no surprise as industry fundamentals continue to be fantastic. Hence, we start this article by taking a closer look into the health of an industry that benefits from subdued supply as a result of underinvestments, shutdowns, and the war in Ukraine. While we will eventually run into a situation of oversupply, we’re a long way from such a scenario, allowing Valero to improve its business beyond anything we thought would be possible before we entered this volatile year.

So, let’s get to it!

Shortages Fuel The Bull Market

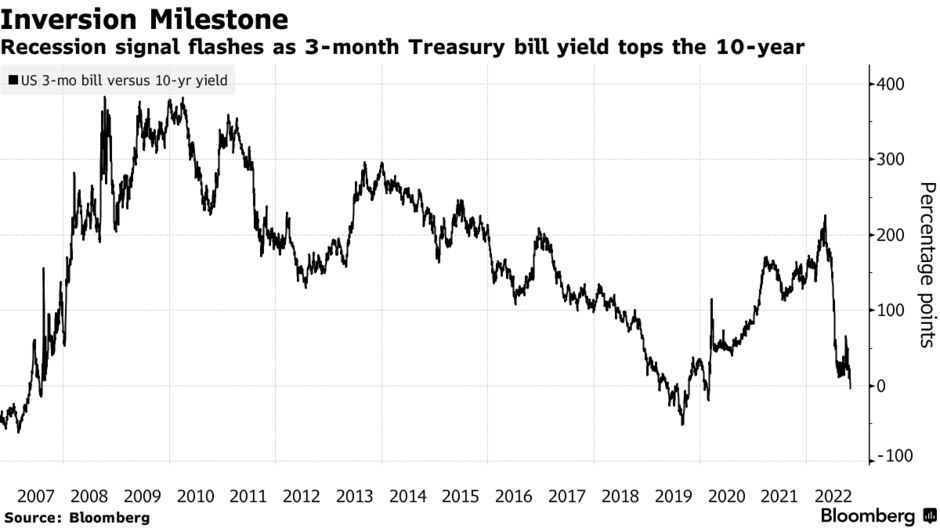

The US economy is about to enter a recession. Last week, the Fed’s favorite yield curve (10-year minus 3-month bond yields) went negative, indicating an almost 100% chance of a recession.

Bloomberg

On top of that, we see quickly deteriorating economic expectations, very low consumer sentiment, and a hawkish Fed looking to combat persistently high inflation with rate hikes and quantitative tightening. That’s a toxic mix, resulting in stocks entering a bear market this year.

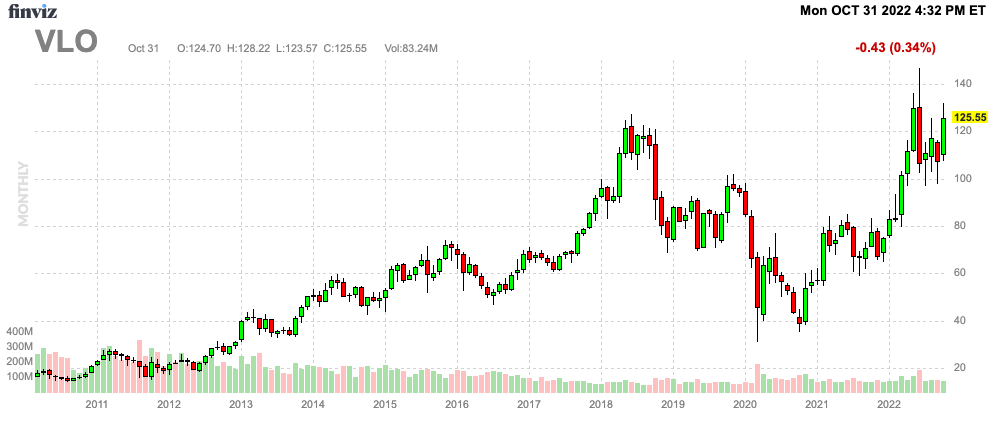

Based on this context, it’s interesting to mention that Valero shares are up 68% year-to-date.

I have to admit that I haven’t been through a lot of recessions after starting trading in 2011, but this is one of the most unique. Global economic sentiment is imploding and the best stocks in my portfolio are energy companies.

FINVIZ

What we are dealing with here is a deep-rooted supply problem, making sure that lower demand is not allowing prices to collapse.

So, how bad are things?

Well, it’s getting pretty bad. To quote a recent article in American Military News:

Waco economist Ray Perryman says there are only a few weeks’ supply left with the nation’s 130 refineries going full blast and the truck fleets, trains, ships, farmers and military potentially facing big challenges.

“Much of our logistics system relies on diesel and if we get to zero inventory, there will be disruptions,” Perryman said. “There’s not a good way to deal with a shortage.

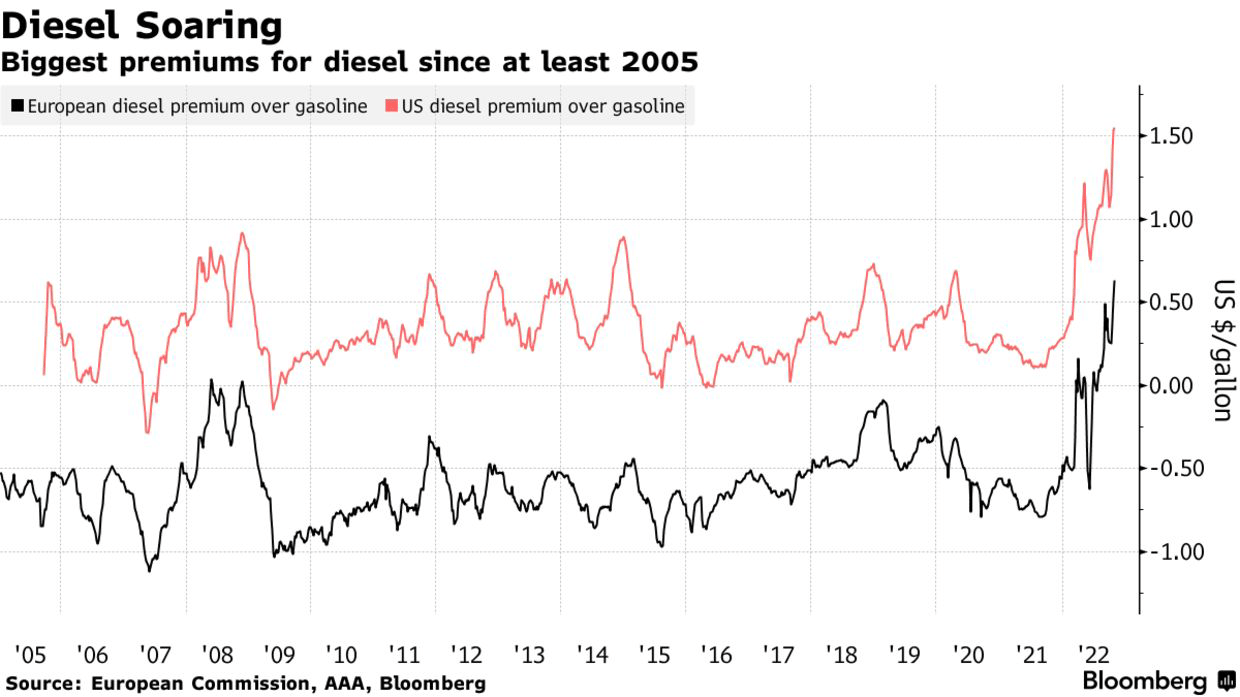

Right now, diesel premiums over gasoline are skyrocketing in major markets. In the US, premiums are now at $1.50, with European diesel trading more than $0.50 above gasoline prices. Prior to the war, diesel was trading at a discount in Europe.

Bloomberg

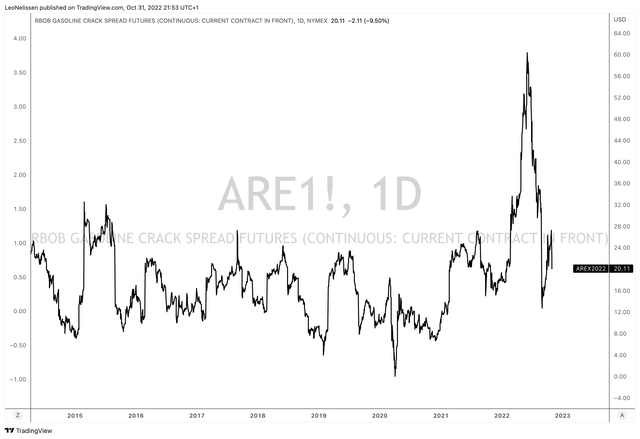

Moreover, gasoline crack spread futures in the US are still elevated, trading roughly 40% above the longer-term median as the chart below shows. In other words, the problem goes well-beyond diesel. Note that the crack spread indicates how much money refinery companies make on a barrel of oil turned into finished products like gasoline.

TradingView (ARE Gasoline Crack Spread Futures)

The problem is that there’s no easy fix as these problems are deep-rooted.

One factor is the strong increase in demand as a result of the economic upswing after the 2020 lockdowns. Economies reopened, causing the demand for fossil fuels to accelerate.

Unfortunately, the supply did not bounce back.

According to the EIA:

In the United States, refining capacity has decreased by about 1.1 million b/d since the start of 2020, contributing 184,000 b/d to the global decline in 2021. Global demand for refined products dropped substantially in 2020 as a result of the COVID-19 pandemic. Less petroleum demand and the associated lower petroleum product prices encouraged refinery closures, reducing global refining capacity, particularly in the United States, Europe, and Japan.

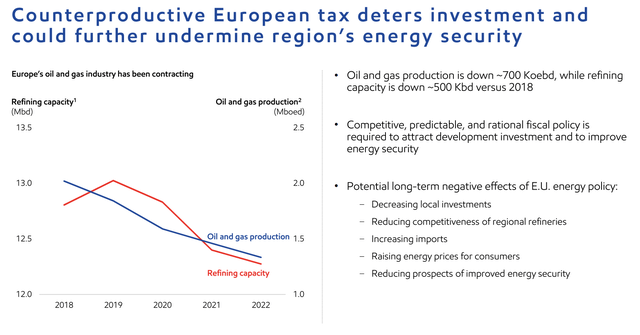

In Europe, the situation is even worse. Exxon Mobil (XOM) mentioned this in its 3Q22 earnings call, and it didn’t pull any punches.

Refining capacity in Europe is down 500 thousand barrels per day since 2018. Both crude oil and gas production and refining capacity have been in a steady decline as “progressive” policies simply didn’t focus on fossil fuels, which turned out to be a huge mistake.

Exxon Mobil

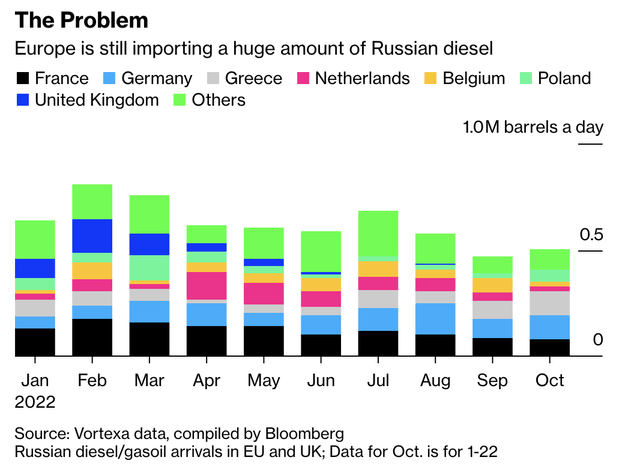

The war in Ukraine made these factors even worse. The European Union buys roughly 200 million barrels of diesel per year from Russia. That’s now poised to come to a halt. As Bloomberg reports, from early February, EU sanctions will ban the delivery of almost all seaborne refined petroleum products, including diesel.

This is still coming as a shock as European nations are still buying a lot of Russian diesel – even eight months after the start of the war.

Bloomberg

According to Bloomberg:

Getting rid of Russian supply won’t be easy. France, one of Europe’s biggest importers, recently had its own diesel production slashed by strikes at its oil refineries, forcing it to source more. Domestic output in Germany, where the continent’s diesel demand is strongest, is also at risk because the Schwedt refinery is set to lose access to crude oil via the Druzhba pipeline.

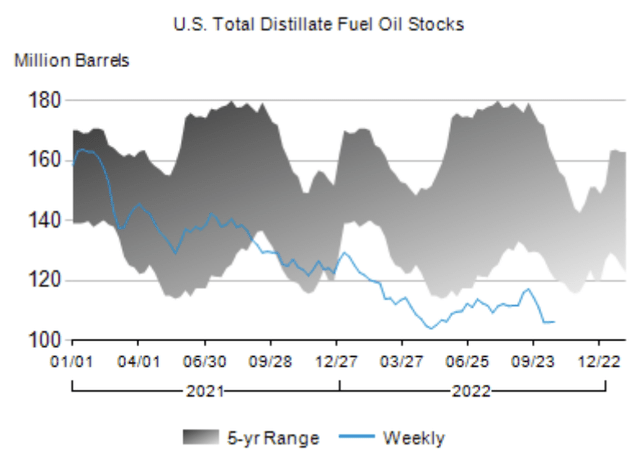

What this means is that all eyes are on the United States again. However, as the chart showing diesel margins in the US already explained, the US isn’t in the best position itself.

US total distillate fuel stocks are extremely low. Inventories are now more than 40% below the longer-term median, falling roughly 15 million barrels below last year’s lows.

EIA

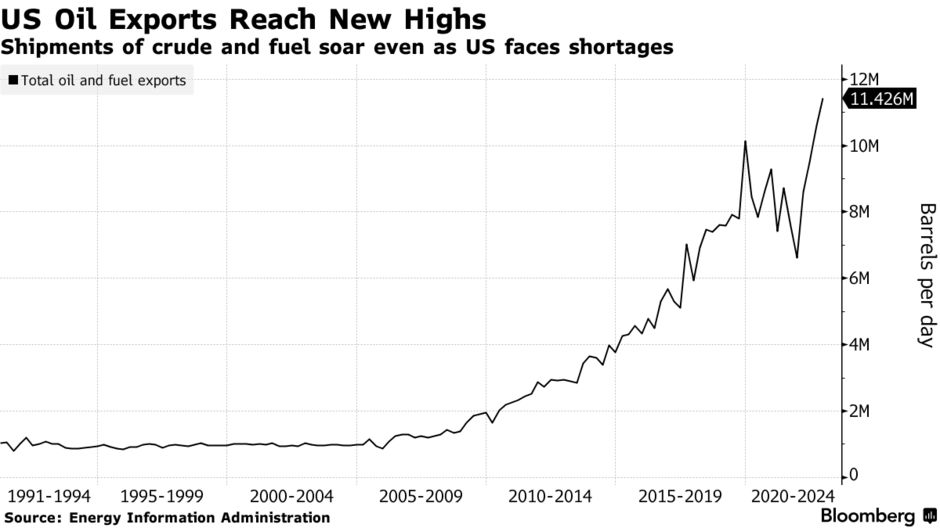

On the East Coast, some stats are discussing rationing supplies as total petroleum shipments reached 11.4 million barrels per day in October.

Bloomberg

The situation is so tricky that the government will have to pick what’s worse. Lowering exports will support domestic demand but hurt Europe in an already disastrous situation. Maintaining high exports will somewhat ease the pain overseas (not only in Europe), but it may not be the message Democrats want to send to voters ahead of important Midterm elections.

Now, this may not come as a surprise given what we just discussed, but all of this explains why an extremely cyclical company like Valero is doing so well. Despite a recession.

What All Of This Means For Valero

On October 25, Valero reported its 3Q22 earnings. The company generated $44.45 billion in revenue, that’s an increase of 50.6% versus the prior-year quarter. It was also $3.29 billion higher than expected.

This paved the way for an adjusted EPS result of $7.14 That’s $0.19 higher than expected and 536% higher compared to the prior-year quarter.

During the earnings call, CEO Joe Gorder immediately pointed out why Valero is in such a good spot, which is basically what we discussed in the first half of this article and Valero’s own ability to benefit from this:

Refining margins remain supported by strong product demand, low product inventories and continued energy cost advantages for US refineries compared to global competitors. Despite high refinery utilization rates, global product supply remains constrained due to roughly four million barrels per day of global refining capacity being taken permanently off-line since 2020 for a variety of reasons, including unfavorable economics or as part of planned conversions to produce low carbon fuels.

To give you a few numbers, the company’s refineries were 95% utilized in the third quarter to maximize throughput. Note that 95% is pretty much as high as it gets. Everything above that would prevent the company from performing sufficient maintenance. Hence, it’s highly unlikely that utilization rates go much higher than this – even in a high-demand scenario.

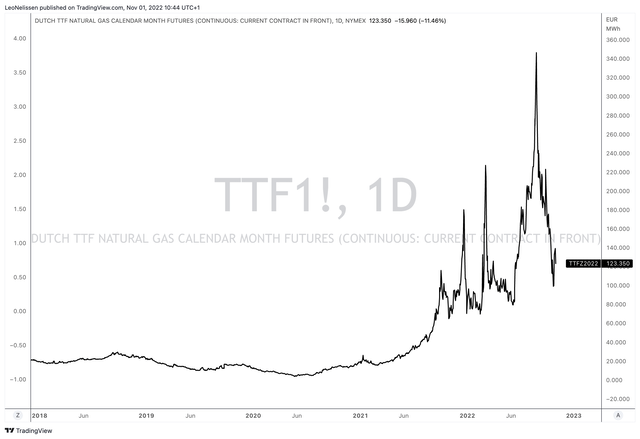

Moreover, the refineries benefited from wider sour crude oil differentials to the Brent light sweet crude oil benchmark. This is caused by the increase in sour crude oil supply, the impact of the IMO 2020 regulations for low-sulfur marine fuels, and high natural gas prices in Europe that incentivize European refiners to process sweet crude oils instead of sour crude oils.

TradingView (Dutch TTF Natural Gas Futures)

In the third quarter, the company’s refineries produced three million barrels per day, which was up 141,000 barrels per day compared to 3Q21.

Refining cash operating expenses were $5.48 per barrel, up $0.95 versus 3Q21 as a result of higher natural gas prices. However, due to strong selling prices, margins more than doubled from $10.07 per barrel in 3Q21 to $21.34 in 3Q22.

In the renewable segment, the company produced 2.2 million gallons of renewable diesel per day. Up 1.6 million gallons per day versus 3Q21. This huge increase paved the way for $212 million in operating income, an increase of almost 100% versus 3Q21 ($108 million). This is the result of Diamond Green Diesel (“DGD”) Unit 1 being down in 3Q21 due to Hurricane Ida and the impact of additional volumes in DGD 2, which started production in 4Q21.

In its ethanol segment, the company reported $1 million in operating income. Up from a $44 million loss in 3Q21. Production of ethanol averaged 3.5 million gallons per day, slightly down from 3.6 million gallons in the prior-year quarter.

Ethanol margins per gallon were $0.57, up from $0.46.

Going forward, the company expects full-year CapEx to be close to $2 billion. 60% of that will go towards sustaining its business while 40% will support growth. Half of that growth capital will be allocated to expanding its low-carbon fuels business.

In November, the company will start DGD 3, boosting annual renewable diesel volumes to roughly 750 million gallons. In the first half of 2023, the company is set to start the Port Arthur Coker project. According to the company:

The 55,000-barrel-per-day delayed coker and sulfur recovery unit creates two independent coker trains which should improve turnaround efficiency, reduce maintenance-related lost margin opportunity and increase heavy-sour crude oil and residual processing capacity and light products yield.

Now, we’re finally ready to discuss the reason why you either own or consider owning VLO shares.

The Valero Dividend

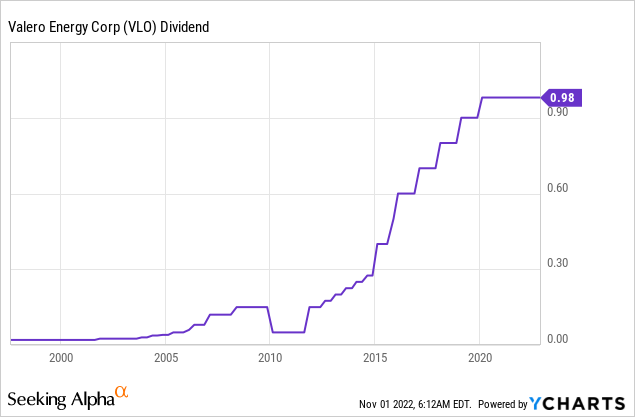

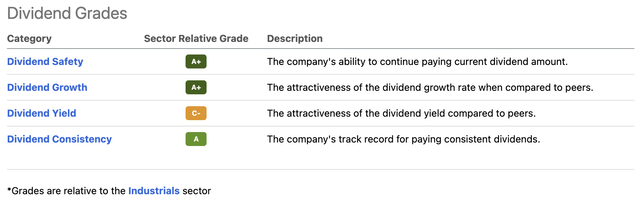

Valero is one of two companies in my portfolio that hasn’t hiked its dividend since the pandemic. Valero currently pays a $0.98 quarterly dividend per share. This translates to a 3.1% yield. The most recent hike dates back to January 2020 when management announced an 8.9% hike. That was just a few weeks before a city named Wuhan made headlines for unpleasant reasons.

A lot of people have vented some frustration to me in the past few quarters. They want Valero to hike. After all, it has been more than two years.

However, we need to consider a few things. First of all, Valero did not cut its dividend in 2020. It protected the dividend using its balance sheet.

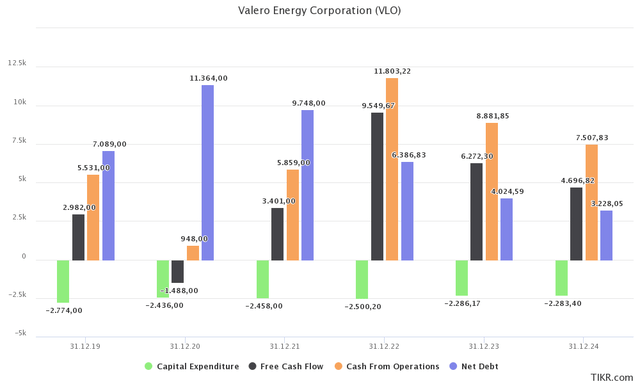

What happened in 2020 is well-known. Economies shut down as soon as COVID started to spread. Demand for energy imploded. Hence, in 2020, the company did only $950 million in operating cash flow. this was not even enough to cover CapEx of $2.4 billion. The company had to borrow money to maintain its operations. Hence, a dividend cut would not have been unexpected. However, the company maintained its dividend. This resulted in a net debt surge of more than $4 billion to $11.4 billion.

TIKR.com

The surge in net debt is the only reason why the dividend is still unchanged.

Unfortunately, because of the strong stock price, the company is now yielding only 3.1%, which isn’t that much – it also explains the C- score in the otherwise attractive dividend scorecard below.

Seeking Alpha

Now, the good news is that Valero is making progress.

Year-to-date, Valero has returned 40% of its adjusted net operating cash flow to its shareholders through buybacks and dividends. Total dividends were $1.2 billion. Gross buybacks were $2.8 billion.

These numbers push the company to the lower range of its 40% to 50% payout range. The company is aware of room to hike but decided to focus on its balance sheet.

Balance sheet debt is falling quickly. This year, net debt is expected to fall to less than $7 billion. That’s below pre-pandemic levels.

In the third quarter, debt was reduced by $1.25 billion. Since the second half of 2021, debt has been reduced by $3.6 billion. The debt-to-capitalization ratio is now 24%, down from 40% at the end of 1Q21.

With regard to debt reduction and higher dividends, this is what Valero said during its earnings call:

The debt is getting to a good level at 24.5%. We still like to do a little bit more. We have $430 left just to have paid-off the COVID and prefer to be at the lower end of that 20% to 30% range. But, yes, we’re getting in a good shape, but I would say we’re not declaring victory yet.

I believe that 2023 will see a return to aggressive dividend growth. Bear in mind, the 10-year average annual dividend growth rate is still 24%. That’s how high dividend growth was prior to the pandemic.

Next year, free cash flow is still expected to be $6.3 billion. That’s 13% of the company’s $48.4 billion market cap. This 13% yield implies that the company can distribute double-digit dividends and buybacks. As net debt is about to fall to $4.0 billion, there is no reason to prioritize balance sheet health over distributions.

Last month, I said the same about VLO’s peer Marathon Petroleum (MPC), which just hiked its dividend by 29.3%(!).

I’m not saying VLO will hike by 30% as well, but I’m making the case for a return to strong double-digit hikes as long as it runs into significant weakness again. At that point, it can use its balance sheet again to protect the dividend.

Needless to say, while we haven’t seen a hike since 2020, we have plenty of reasons to be extremely happy with the current situation.

The same goes for the valuation, which isn’t as unattractive as the stock price surge this year may suggest.

Valuation

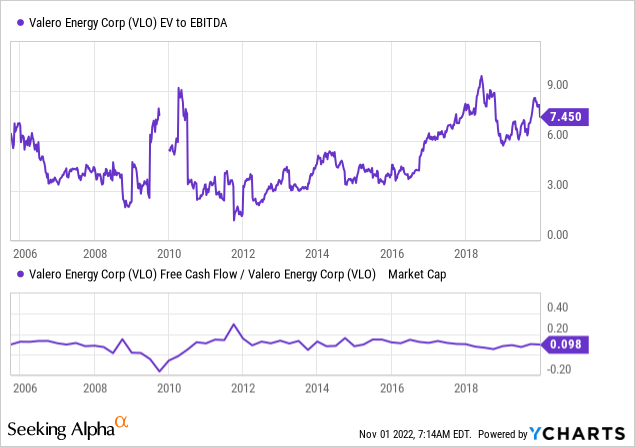

VLO shares are trading at 5.2x 2023E EBITDA of $10.6 billion. That’s based on its $54.8 billion enterprise value, consisting of a $48.4 billion market cap, $4.0 billion in 2023E net debt, $600 million in pensions, and $1.8 billion in minority interest tied to DGD (Green Diesel).

This valuation is still extremely fair. The same goes for the implied free cash flow yield of 13%, which we calculated earlier. It’s right in the middle, where we want it to be (higher is obviously even better).

Hence, my view remains unchanged. VLO is a buy whenever the market presents us with a dip of 10-15%, which happens rather often as VLO is very volatile. Please bear that in mind before adding any VLO exposure. Owning VLO is fun now, but on a long-term basis, dividend growth investors will experience that VLO is extremely volatile, including violent downtrends and sudden rallies.

Once investors take that into account, there really isn’t much to it besides enjoying what should be a continuation of an aggressive series of dividend hikes in the years ahead.

Takeaway

In this somewhat lengthy article, we started by discussing refinery margins. Despite global recession risks, refinery companies continue to do extremely well. This has everything to do with significant supply constraints. Underinvestments, pandemic-related shutdowns, and sanctions are creating a lasting situation of high margins and high throughput.

Valero is in a fantastic position to benefit from these developments. The company enjoys a large footprint in North America and high export demand for its traditional refinery products and specialty products like low-carbon renewable diesel.

Its balance sheet is rapidly improving, paving the way for aggressive dividend hikes after 2022.

The valuation remains attractive, allowing new investors to add VLO shares to their long-term portfolios.

(Dis)agree? Let me know in the comments!

Be the first to comment