jimmcdowall

Note: Valaris (NYSE:VAL) has been covered by me previously, so investors should view this as an update to my earlier articles on the company.

Following better-than-expected Q3 results, shares of leading offshore driller Valaris advanced to new 52-week highs early in Tuesday’s session but started to reverse course following weaker-than-expected fourth quarter guidance and somewhat guarded management commentary on the subsequent conference call.

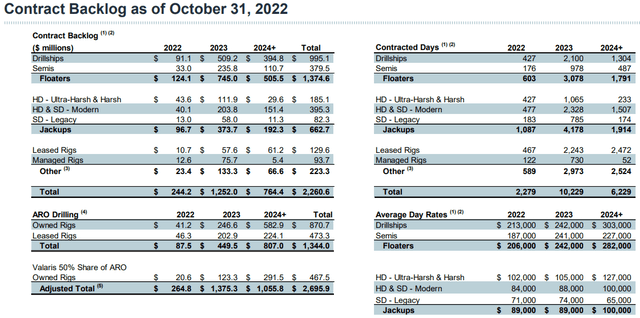

The company also released a less-than-stellar quarterly fleet status report with no major long-term contract awards and total backlog down slightly on a sequential basis to approximately $2.7 billion:

Company Presentation

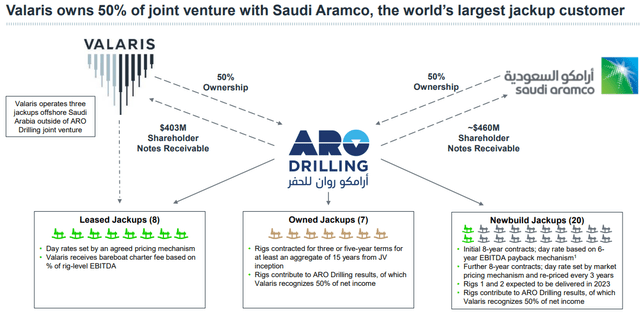

That said, total liquidity of $644 million increased by $67 million sequentially, mostly due to lower working capital requirements and particularly a $40 million debt prepayment received from ARO Drilling, the company’s unconsolidated joint venture with Saudi Aramco (ARMCO):

Company Presentation

As a result, Valaris’ net cash balance has increased to almost $100 million which should move up even further in the current quarter as the company received a $55 million tax refund in October with another $64 million expected at a later date.

In addition, the company expects to receive another $28.5 million in Q1 from the sale of the vintage jackup rig Valaris 54, following the completion of its existing contract.

On the conference call, management affirmed its positive industry outlook:

The fundamental outlook for our industry remains highly constructive. The lack of investment in new sources of production over the past several years has contributed to a tight supply picture that has been exacerbated by geopolitical instability and an increased focus on energy security.

A significant increase in investment will be required to rebuild global supplies, irrespective of near-term demand volatility and offshore production is expected to continue to play an important role in meeting the world’s need for secure and affordable energy. We believe that these factors and the significant reduction in the rig fleet, especially floaters over the past several years, lay the foundation for sustained industry up cycle.

Despite recent downward pressure on oil prices due to fears of a global economic recession and a strong U.S. dollar, commodity prices remain at levels that are highly supportive of continued investment in offshore oil and gas projects.

That said, management was cautious on the North Sea jackup market going into 2023 with near-term weakness in the U.K. and very little prospects offshore Norway for the entire year:

Our harsh environment jackup fleet includes three Keppel FELS N-Class rigs capable of operating in Norway. We already have one of these rigs operating in the UK North Sea and expect to relocate a second rig outside Norway following completion of its current contract in the fourth quarter. Our third rig operating offshore Norway is expected to end its existing contract in the first quarter of next year and prospects to follow on work in Norway Limited.

We expect some rigs work in the North Sea outside of Norway to go idle later this year, as we enter the seasonally weaker winter months, and rigs complete their current programs. While utilization during the first half of 2023 may be somewhat challenging, we see an improving pipeline of activity in the UK, North Sea for work commencing in the second half of the year. This coupled with an expected improvement in demand offshore Norway in 2024 leaves us hopeful for a more balanced harsh environment jackup market in future years.

For the fourth quarter, management guided revenues in line with analyst expectations but Adjusted EBITDA is now expected to come in slightly below the low end of the recently reduced $130 million to $150 million guidance range mostly due to some additional reactivation costs for the drillship Valaris DS-17 being incurred in Q4 rather than in Q1/2023 as originally planned.

During the question-and-answer session, Clarksons Platou Securities analyst Frederik Stene asked about recent Brazil tender offer results in which the cold-stacked drillships Valaris DS-7 and Valaris DS-8 finished way behind competitors as the company apparently demanded dayrates around $500,000+ despite Petrobras (PBR) offering long-term contracts of up to four years.

Management pointed to very meaningful upgrades being required by Petrobras in addition to an estimated $65 million to $75 million in reactivation costs.

Add some mobilization expense and it might take an upfront investment of well above $100 million for a cold-stacked Valaris drillship to get ready for work offshore Brazil.

With most IOCs still reluctant to award sufficient long-term contracts, Valaris expects limited floater reactivation activity for the time being.

Apparently, this assessment doesn’t bode well for competitor Transocean’s (RIG) massive fleet of cold-stacked drillships, particularly given the fact that most of these rigs have been idle for more than half a decade already.

Bottom Line

After reducing full-year profitability expectations for the second time in a row and some cautious commentary regarding near-term prospects for the North Sea jackup market and additional floater reactivations, Valaris’ shares might be ripe for a breather.

That said, I remain constructive on the offshore drilling industry as a whole with strong tailwinds likely to persist for the time being.

While I continue to prefer companies with rather sound financials like Valaris, Noble Corp. (NE) and Seadrill (SDRL) over debt-laden players Transocean and Borr Drilling (BORR), the rising tide is likely to lift all rigs.

Investors should consider adding industry shares on pullbacks.

Be the first to comment