AnthonyRosenberg

The apparel sector has been a horrible place to invest during 2022 due to bloated inventories and a more promotional environment. V.F. Corp. (NYSE:VFC) has been no exception, with another earnings warning reducing expectations for the next year. My investment thesis is Bullish on the apparel retailer, as the yields surge to recent highs and cash flows remain solid.

Another Warning

Only back in July, V.F. cut FY23 EPS targets from $3.30 to $3.40 per share to $3.05 to $3.15. The market was already expecting a cut, with consensus EPS targets at only $3.08.

The July warning wasn’t actually much of a warning, with the market expecting V.F. to not reach lofty growth goals. The warning at the 2022 Investor Day is more surprising, with V.F. again lowering FY23 EPS targets by a large amount to $2.60 to $2.70.

The company made the following statement regarding the reasoning for again slashing financial targets:

VF is revising its FY23 outlook due to lower-than-expected Q2’FY23 results, coupled with ongoing uncertainty in the current environment, weaker than anticipated back-to-school performance at Vans and increasing inventories leading to a more promotional environment in North America in the fall.

V.F. is maintaining solid revenue growth of 5% to 6% for the year ending in March 2023 based on strong growth of The North Face brand. Apparently, Vans aren’t as popular this back-to-school season.

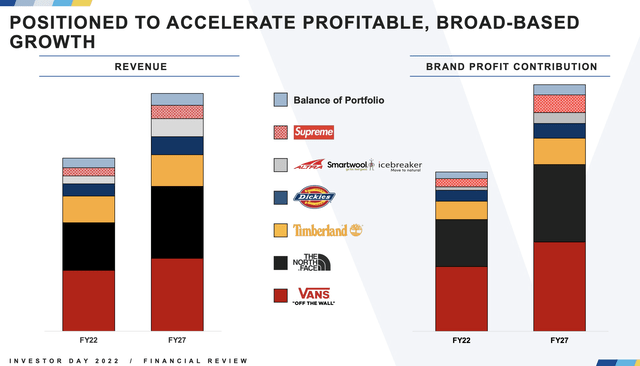

The footwear line is the largest revenue contributor now. The FY27 targets have The North Face catching up with Vans and other brands producing substantial growth in the 5 years ahead.

V.F. Investor Day Presentation

The apparel retailer forecasts still generating $1.0 billion in free cash flow this fiscal year. The promising part is the ability of the apparel retailer to still produce strong profits and cash flows in a tough climate, despite multiple cuts to targets.

Long Run

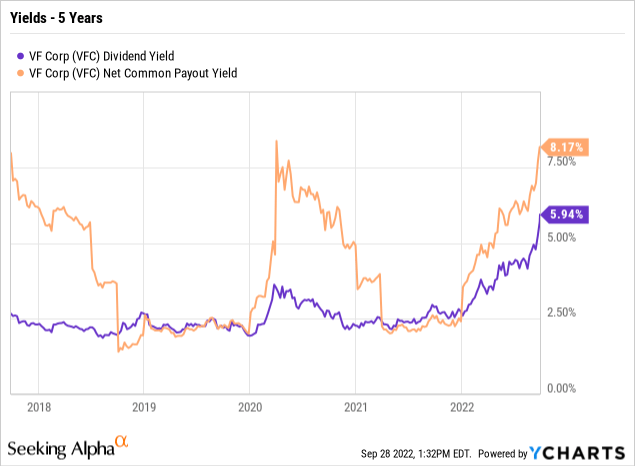

V.F. Corp. does a great job of getting investors to look at the long term, despite just cutting FY23 EPS estimates by $0.45 due to back-to-school sales weakness. The stock has fallen only 5% to $33 on the news, but the big dip in the stock this year has sent the dividend yield surging.

The company has a goal of a 50% dividend payout and currently pays a $2.00 annual dividend, sending the dividend yield to nearly 6.0%. The net payout yield has surged to 8.2%, with stock buybacks in prior periods boosting the capital returns to shareholders beyond just the dividend yield alone.

While V.F. has slashed FY23 EPS estimates, investors need to remember the company earned $3+ only last year. Due to Covid pull forwards and supply chain disruptions, the current results aren’t reflective of the long-term growth trends.

At the Investor Day, management set out a goal of returning $7.0 billion to shareholders over the next 5 years through the end of FY27. The company expects to generate $5.5 billion in free cash flow during this period. V.F. will have to find another $1.5 billion to reach the $7.0 billion target, and the balance sheet already has a net debt balance of $4.5 billion.

The annual dividend payout is ~$776 million now for a 5-year payout of $3.9 billion. V.F. is promoting a scenario of returning an additional $3.1 billion to shareholders over this period either via dividend hikes or share buybacks such as the $350 million spent last year to repurchase shares.

The stock has a market cap below $14 billion, so V.F. intends to return at least 50% of the current stock valuation to shareholders over just a 5-year period. Any share buybacks here will go a long way to reducing share counts after reducing the share count by 6 million shares YoY in FQ1’23.

Takeaway

The key investor takeaway is that another warning by V.F. is troubling. Under normal times, investors should think twice about investing in such a company with multiple warnings. With most of the issues now related to macro problems, investors should use the weakness to own a large dividend yielder with solid growth at a discount.

Be the first to comment