DNY59

Introduction

Here were the headlines of one of my recent Weather Wealth newsletters a week ago in which we were lucky enough to catch the huge move-up in cotton (BAL) for clients on U.S. droughts. In addition, using option strangles has been potentially for those who took my advice in natural gas (UNG), coffee (JO), soybeans (SOYB), and many other markets.

This report talks more about what option strangles are in commodities and how weather and geopolitics are creating incredible volatility in the natural gas (BOIL) (KOLD) market.

Weather Wealth Newsletter August 8th (www.bestweatherinc.com)

Volatile natural gas trading and the bullish vs bearish factors

In one of the most volatile natural gas markets in history, we are receiving questions from every corner of the world about how to play this market, based on the weather.

Never before, even during 2005 (Hurricanes Katrina, Rita, and Wilma) have we seen the price of natural gas make a $1 move in just a couple of days.

There is a plethora of news affecting energy markets right now. Thank goodness, at least for now that crude oil (CL1:COM) sold off enough to help the stock market rally back a bit on ideas maybe recessionary fears and inflation will not be as bad as earlier anticipated.

Here are the bullish vs bearish factors in natural gas and why we implemented profitable trading strategies using something that we call “selling option strangles.” I will get to that in a minute.

Bullish:

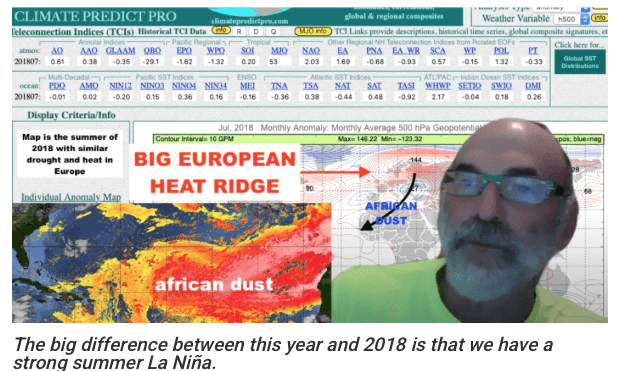

*One of the hottest summers in both Europe and the U.S. on record continues to deplete natural gas supplies

*The potential that the shut-down LNG export facility in the Gulf will come back online soon

*Russia is cutting off gas exports to parts of Europe, in the face of their record hot summer

*Pre-winter buying by commercials in anticipation of a cold winter.

*U.S. natural gas stocks are still below the 5-year average (-12%)

Bearish:

* A cooling trend for the Midwest and deep south soon

* A heavy long position in the market by speculators

* The hurricane season may be more inactive than others feel due to African dust.

Why the hurricane season has been weak so far (www.bestweatherinc.com)

* My in-house research that a warm fall could potentially weaken demand heading into October and November

What are option strangles and how to use them?

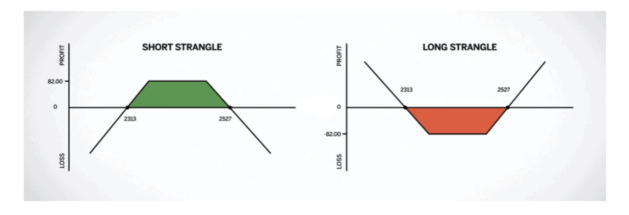

A strangle is a popular options strategy that involves holding both a call and a put on the same underlying asset. A long (purchased) strangle covers investors who think an asset will move dramatically but are unsure of the direction. In the case of natural gas, selling option strangles has worked well in the last few weeks or so.

Watch this video for more about strangles. Though it refers more to the S&P 500, as an investor, you can use these strategies in stocks, exchange-traded funds (“ETFs”), or commodities with Fidelity, Charles Schwab, Ameritrade, etc. Right now, from a global weather perspective in commodities, I like soybeans, natural gas, and coffee strangles given various fundamentals, increased volatility, and mixed weather signals.

Selling Option Strangles: What are they? (Weather Wealth newsletter)

Traders sell (go short) a strangle when they expect the market is going to stagnate. Because the traders are short the strangle, they profit as the option premiums exhibit “time decay” provided the market does not move too far beyond either strike.

Traders should not be afraid of rising implied volatility following the initiation of a strangle position. An increase in implied volatility lifts the value of the purchased options, allowing the trader to collect a higher return by selling (to close) the position. At the time of the trade, implied volatility for the UNG ETF was the highest in history.

Option strangles (Weather Wealth newsletter)

Conclusion:

There are so many fundamental factors affecting natural gas prices, that it is easy to get whip-sawed and blindsided in this market. Any piece of changing weather-related or political news can result in a furious, sudden dramatic price rise or fall in natural gas prices in a matter of minutes. That is where we come in and our Weather Wealth newsletter.

I was thinking for weeks that natural gas prices would surpass $10 based on my forecasts for a hot U.S. summer both here and in Europe. Clients may have profited a few weeks ago being long UNG or KOLD on our advice, but given a slow hurricane season and some areas of the country cooling off a bit, my confidence is not nearly as high being long natural gas.

I am often too early with my predictions, but a warm late fall and early winter could send natural gas prices collapsing, a few months from now. Presently my advice is to continue to sell way out of the money call and put options to capture market volatility. This can also be done, not just with a futures account but with Fidelity, Ameritrade, Vanguard, etc. with natural gas ETFs.

It will be important to follow my weather forecasts in the months ahead, as I have in-house weather forecast models that continue to improve and very often (not always) shine above the typical GFS and European global weather models. Please feel free to see my track record here

Be the first to comment