Iana Surman/iStock via Getty Images

Floating rate notes have been a refuge for investors in a storm of rising rates through 2022. Investors hoping to get a reprieve from this week’s FOMC meeting instead found disappointment. During the opening statement of the FOMC Press Conference on Wednesday, Chairman Jerome Powell said:

We will stay the course, until the job is done.

The job is squelching inflation. The course; higher rates.

This means that more pain is likely ahead for risk assets and bonds with convexity. This is why bonds with low convexity are an attractive place to be. The WisdomTree Floating Rate Treasury ETF (NYSEARCA:USFR) is a fund with holdings in low convexity bonds as its holdings include floating rate notes (FRNs). My portfolio holds a sizable position in USFR and floating rate notes and will continue to do so as the Fed continues it rate hikes.

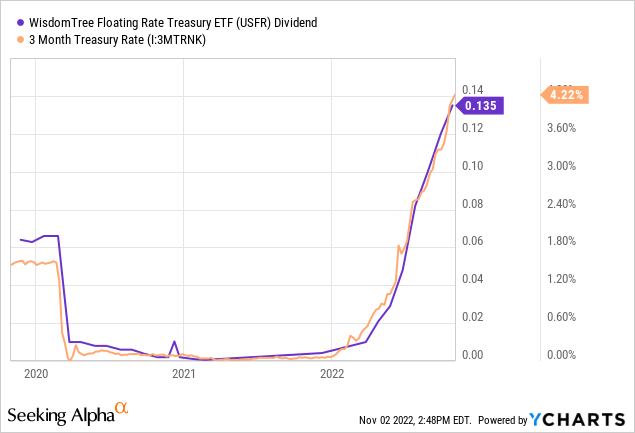

Floating Rate Yield Keeps Floating Higher

USFR distributes interest earned to its shareholders with a monthly dividend. That dividend has been increasing as the rate on the 3 month Treasury bill has risen. The yield on FRNs is indexed to the 13-week Treasury Bill rate. Last month’s dividend payment was $0.135 per share equal to 3.2% annualized. That rate is due to continue higher over the next few months or quarters as the rate on the 3 month T-bill continues to follow the Fed Funds Rate.

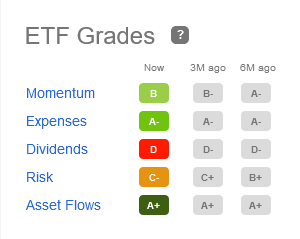

While the dividend grade by Seeking Alpha for the fund is low, this is because the fund has spent most of the year at lower rates, as you can see from the chart above. That is water under the bridge. Looking forward, USFR has an Average Yield to Maturity of 4.15% and a SEC 30-day Yield of 3.52%. Until the rate on the 3 month Treasury Bill begins to decline shareholders should expect an equivalent yield or higher. The ETF posts strong momentum and asset flows grades because the market has correctly identified the advantages of this fund and is rushing in for yield.

USFR Grades (Seeking Alpha)

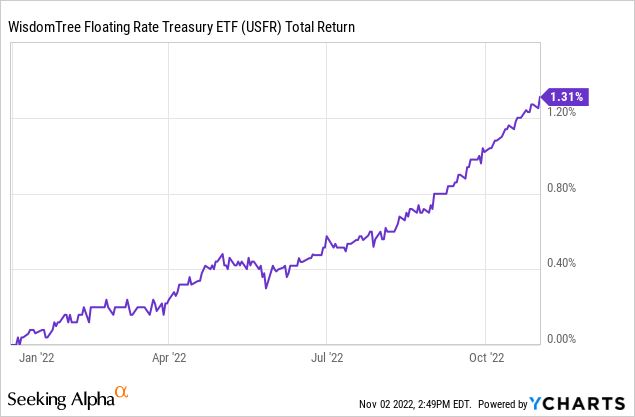

While the YTD total return of the fund is a meager 1.31%, investors have preserved capital which has outperformed the majority of the market. Going forward, the yield is substantive and rate risk is limited.

The Course of Rates and the Job of the Fed

The Federal Reserve had strong things to say at this month’s FOMC meeting. In the meeting statement they wrote:

The Committee seeks to achieve maximum employment and inflation at the rate of 2 percent over the longer run.

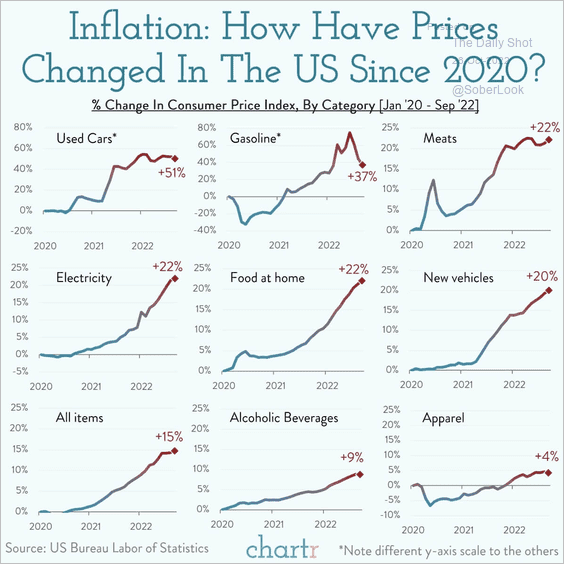

In contrast to near maximum employment with the unemployment rate at 3.5% and the non-farm job openings at 10.7 million, inflation is still nowhere near 2%. For the month of September, PCE was 6.2% YoY and Core PCE was 5.1% YoY, exceeding expectations of 4.9%. Likewise, CPI was 8.2% YoY and Core CPI was 6.6% YoY, beating expectations of 6.3%. I tend to pay more attention to PPI numbers which came in at 8.5% YoY for September. Inflation as a whole is being pushed higher by the cost of housing which experienced an 11.9% increase YoY in August.

Fortunately, home prices in August fell -0.7% MoM. It is exhibiting a change in momentum, as is other categories of goods and services including used cars, gasoline, meats, and apparel. While this improvement to the pace of price inflation is promising, it is not enough to walk the Fed back.

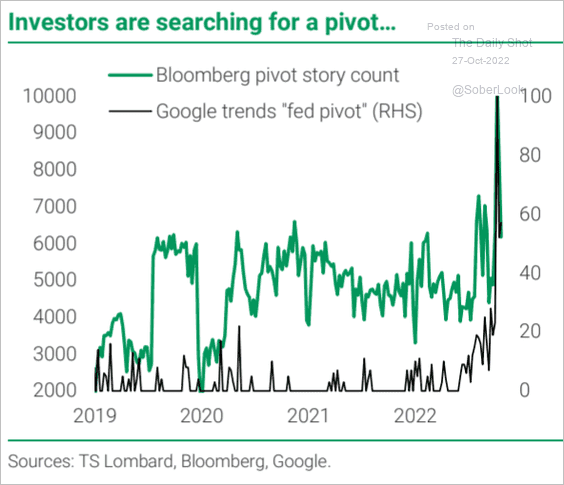

The Daily Shot (used with permission)

Also included in the FOMC statement was this:

In determining the pace of future increases in the target range, the Committee will take into account the cumulative tightening of monetary policy, the lags with which monetary policy affects economic activity and inflation, and economic and financial developments.

Markets responded favorably, interpreting the statement as dovish. Until the Chairman began his press conference. The first paragraph of Powell’s opening statement is critical (bold added for emphasis):

My colleagues and I are strongly committed to bringing inflation back down to our 2 percent goal. We have both the tools that we need and the resolve it will take to restore price stability on behalf of American families and businesses.

Nothing about this says “pivot.” And yet, leading up to this meeting, the expectations of a Fed pivot were high:

The Daily Shot (used with permission)

Just last month I explored the possibility in my article Is The Fed About To Pivot? This was my conclusion:

While the Fed may be laying groundwork for an eventual (and inevitable) pivot in policy stance, it is wedged in a tight spot that hinders their ability to do so.

Therefore, the Chairman’s remarks do not surprise me.

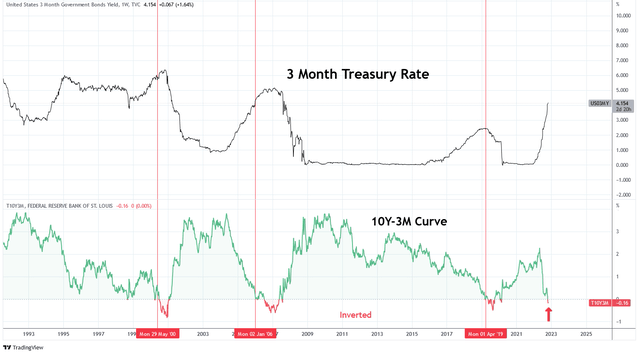

The job is not done but the clock is ticking. Yield curves have been inverting including the 10 year minus 3 month which inverted only days ago. The inversion of this curve tends to precede a pause in rate hikes. This suggests that the time is nigh for rate hikes to cease over the coming months or quarters. But rates will continue to rise in the meantime. The CME FedWatch Tool has increased the probability of a Fed Funds Rate of at least 4.75% by February 2023 from 55.7% last week to 74.6% today. That bodes well for FRNs.

Charts by TradingView (adapted by author)

Summary

The Fed’s job is not done. The Fed is still hawkish. Rates are still rising and the market expects higher rates over the next 6 months at least. Those expectations may not come to fruition but what we know now is that inflation is not under control and monetary tightening is set to continue.

Floating rate notes are now yielding over 4% and have a high probability of increasing in the near term. I continue to maintain a large position in FRNs to earn a very attractive risk-adjusted yield while the data comes in and changes to monetary policy unfold.

Be the first to comment