sharply_done

Thesis

In reference to the title of this article, just like the Hollywood movie of the same name, finding the right entry point in the Liberty All-Star Equity Fund (NYSE:USA) is a bit of a journey. The CEF is a mint equity fund, that has historically managed the rare feat of outperforming the S&P 500 Index. That comes down to individual stock selection, and an active management. A retail investor that purchases USA purely takes a long position in the broad equity market, with dividends extracted quarterly from a positive market performance. A down equity market equates to a negative performance, meaning there are no ‘real’ dividends to be paid, only return of capital (i.e., your own money). USA represents a view on the S&P 500, with potential for slight outperformance.

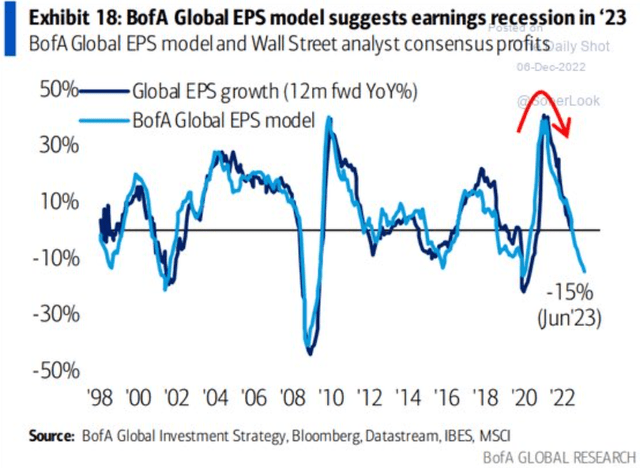

To that end, we can see how the fund liquidated two holdings and purchased ‘Aon PLC’ in its latest portfolio update. However, the fund’s correlation to the wider market is close to 1, meaning the two march in lockstep. So the right question to ask ourselves now is where is the S&P 500 headed? With the U.S. poised to enter a recession soon, the earnings component of the S&P 500 is set to follow suit. While 2022 has been heavily impacted by rising rates, we have yet to see a significant downwards revision in earnings forecasts. It is likely coming:

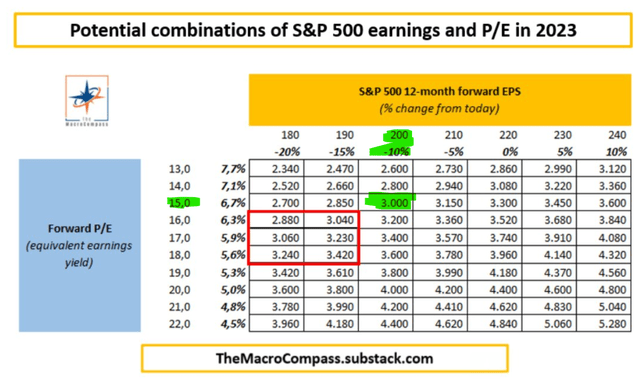

Many investment banks, including BofA as per the above graph, are predicting severe contractions in EPS figures. Lower EPS numbers should translate into lower figures for the equity indices. A lot of analysists are predicting a mean reversion to a 15x P/E ratio, which coupled with lower EPS figures should translate into much lower levels for the S&P 500:

P/E Matrix (The Macro Compass)

Choose your poison they say. We are going for the view that EPS is going to contract to 200, and the P/E multiple is going to go to 15x, which will bring the S&P 500 closer to a 3,000 level. That should translate into the price for the USA CEF to something close to $4.5/share. A lot to digest here!

Holdings

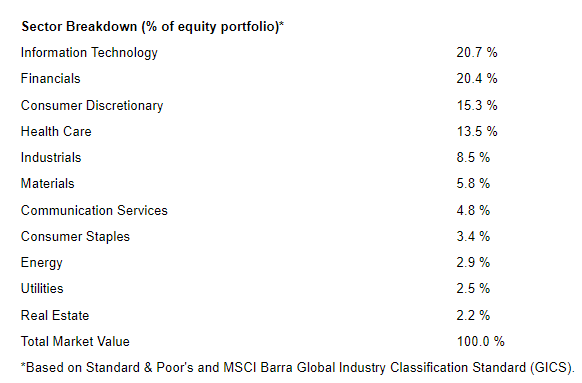

The fund contains equities, and mirrors to a large extent the S&P 500 index:

Sectors (Fund Fact Sheet)

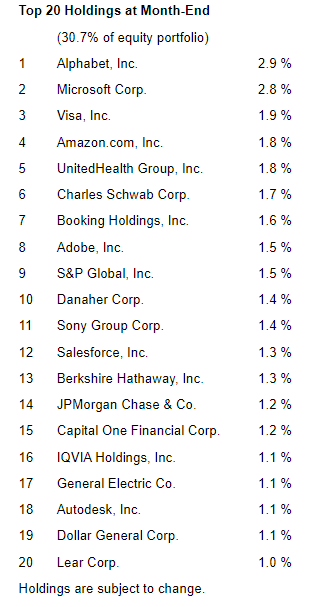

The largest holdings in the fund are to be found in the top-10 S&P 500 holdings, with tweaked weightings however:

Top Holdings (Fund Fact Sheet)

Certain names in the famous FAANG cohort are at the top of the table, with Apple (AAPL) surreptitiously missing. The fund takes a very active approach in managing its portfolio, and we have highlighted that above via its latest portfolio tweak. There are only positives to be said about the management team here, with the CEF achieving the rare feat of outperforming the S&P 500 during certain historic time-frames.

Macro View & Conclusion

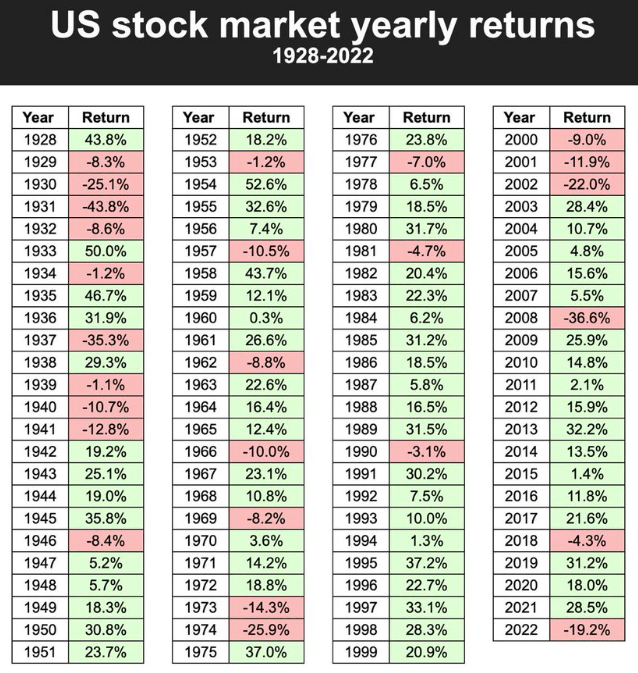

USA is not going to miraculously outperform if the broader equity market is going to collapse. USA is composed of stocks, and closely mirrors the S&P 500 composition. A savvy investor needs to take a view on the broader index and then set themselves up for an entry point that is within the realm of that view. In our overall take we see the broad index hitting the 3,000 level at some point next year. After consecutive years of substantial gains in equities, we think it is time for a healthy purge:

Yearly Returns (Aisha)

We can see 9 years of gains between 2009-2017 in the equities markets, followed by a small bump down in 2018. 2019 was saved by a Fed pivot, which helped the stock market post a positive performance in 2019. The Fed is probably not going to pivot anytime soon, and more pain is coming.

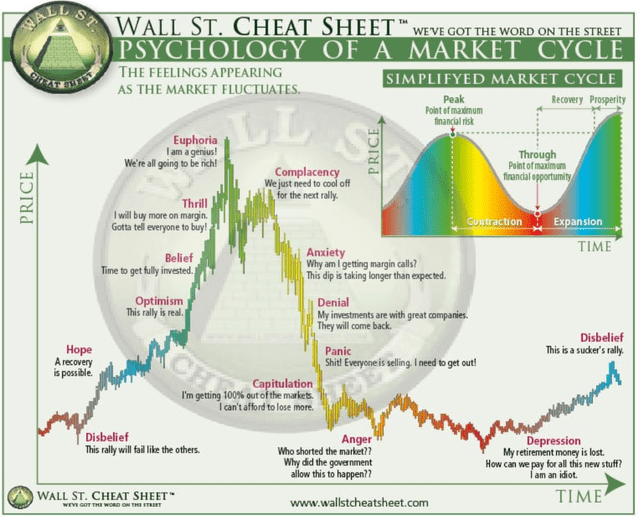

Furthermore, we have not seen a true capitulation which is the sign of the bottom in equity markets:

Panic and capitulations are those moments when even your uncle that works in a dental office will call you and tell you that he is all out of the markets because he can’t take it anymore. We need to see sustained, violent losses across the spectrum in order for people to abandon stocks. We have yet to see that, with dysfunctionalities persisting. ARK Invest is still seeing inflows, despite being down over -65% year to date! That is symptomatic of people chasing a pivot, a tradable “v” shaped rebound. They need to abandon all hope and ‘puke’ stocks in order for a true bottom to be established for this bear market. Are we there yet? Not quite

Be the first to comment