Production in the US should average 11.7 MMbo/d in 2020, based on Covid-19 related demand destruction and Saudi’s decision to flood the market for the second time in five years.

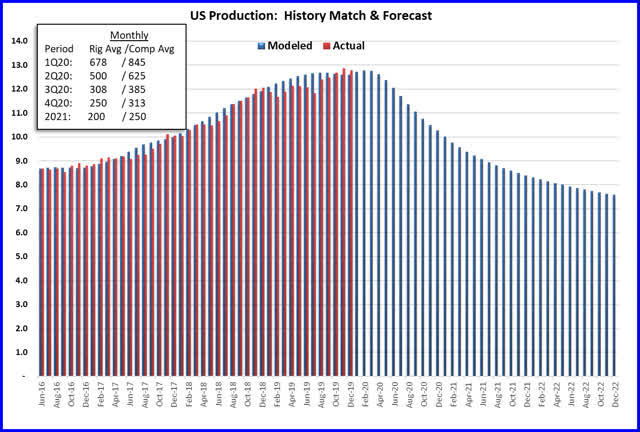

I forecast back in November 2019 that US production would average 12.8 MMbo/d in 2020 and would not eclipse 13MMbo/d until December 2020. This forecast was based on an average rig count of 640 rigs and ~10,000 completions. With the global outbreak of Covid-19 crippling major world economies and Saudi’s decision to open the taps and flood the market again, it’s time for a revision.

Covid-19: Inelastic Oil Demand Curve Left Shift

Covid-19 has effectively idled the economic engines of the world’s largest economies with an uncertain timeline of when they may restart. Planes are grounded, highways are empty, and restaurants, bars, and other places of social gathering have shut down or are sparsely attended. Crude demand will likely be 10% to 20% less in 2Q20 than we were expecting a month ago. This is a demand shock that has effectively shifted the steep inelastic demand curve to the left.

Saudi Flooding the Market in Response to a Failing Russian Alliance

As if one black swan event were not enough, Saudi has decided to pump an additional 2 – 3 MMbo/d into the market on the heels of a deteriorating oil alliance with Russia. The implied global oversupply is mind boggling. Again, oil demand curves are steep and inelastic in the short term even without a left shift, so I’m concerned that if Saudi follows though with its threat, the crude oil market will be overwhelmed with excess supply to the extent there will be no bid on the margin regardless of price. This outcome, if it were to occur, would likely see oil prices flirt with single digits for a few days and possibly weeks. Perhaps, one way to think about it is it would be similar to the same market forces that recently created $0 to negative natural gas prices in the Permian related to pipeline bottlenecks.

It’s Not All Bad News

With the impact from both Covid-19 and Saudi ramping up production in 2Q20, continued pressure on oil prices should lead to a collapse in the rig and frack spread counts through the end of the year. US production growth had already stalled, so it will not take long for rapid declines to kick in. Admittedly, it is an early guess, but let’s assume the rig count falls to 200 rigs by year end 2020 and remains at this level through 2022. In this instance, US production would fall to roughly 10.3 MMbo/d in December 2020, 8.4 MMbo/d in December 2021, and 7.6 MMbo/d in December 2022, easily offsetting additional Saudi production. I actually believe we will see a rebound in the rig count in early 2021, as our understanding and treatments of Covid-10 improve and Saudi has a change of heart after burning through $100+ billion of its currency reserves. That said, I am trying to paint a worst-case scenario for US production in case the economic slowdown and current Saudi production policy are prolonged longer than anticipated.

Below is my revised forecast:

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Be the first to comment