YelenaYemchuk/iStock via Getty Images

Although it may be typical to view the market as an ecosystem that steadily climbs over time, the fact of the matter is that the many components that make it up can experience extreme volatility over short windows of time. This is true even during a typical year. But in a volatile and uncertain year like 2022, it is especially the case. One example of this can be seen by looking at US Foods Holding Corp. (NYSE:USFD), an enterprise that’s dedicated to distributing food and related products to roughly 250,000 customers across the US. Even as the broader market has fallen, shares of the company have risen nicely, with the increase backed by impressive top line and bottom line performance. Given the company’s continued strength and how shares are priced today, it’s almost tempting to increase my rating on it from a ‘hold’ to a ‘buy’, but I’m not there quite yet.

Improvements continue

Back in September of this year, I wrote an article following up on US Foods. In that article, I talked about how the recent financial figures provided by management had been encouraging, especially noting that cash flow figures were doing quite well. But given how shares were priced, I concluded that there were likely better players on the market that investors could consider. So, despite the quality of the operation and the continued improvements that management had demonstrated, I ended up keeping my rating as a ‘hold’ to reflect my opinion that the stock should generate returns that would more or less match the broader market for the foreseeable future. Since then, the company has defied my own expectations. While the S&P 500 is down by 2.1%, shares of US Foods have generated a return for investors of 12.4%.

This increase in market value has not been without cause. To see what I mean, we need only look at financial results covering the third quarter of the company’s 2022 fiscal year. This is the only quarter for which new data is available that was not available when I last wrote about the enterprise. For that quarter, sales came in at $8.92 billion. That’s 13% higher than the $7.89 billion the company generated the same time last year. A small contributor to this increase involved a 0.7% rise in total case volume and a 2.9% increase in independent restaurant case volume as demand for more food increased. But most of the growth can be attributed by food cost inflation of 12% that management pushed onto its customers.

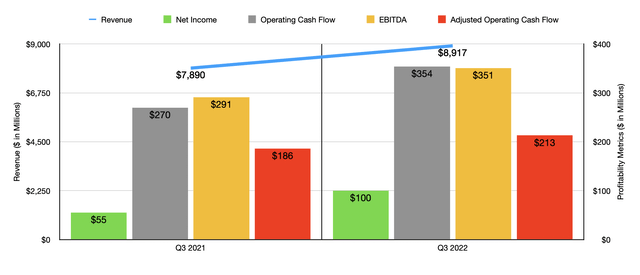

In this kind of business, you wouldn’t expect a company like this to be able to push all or more than all of its food cost inflation onto its customers. But in a sense, that is exactly what happened. This can be seen by looking at the company’s profitability figures. During the latest quarter, net income totaled $100 million. That’s almost double the $55 million the company reported the same time last year. This was driven in large part by the increase in sales, combined with the rise in the company’s gross profit margin from 15.7% to 16.4%. Though this margin improvement may not seem significant, when applied across the company’s revenue for that quarter, it would translate to $62.4 million in additional pre-tax profits. Investing in low-margin enterprises can be very profitable when margins improve modestly. Other profitability metrics followed suit. Operating cash flow jumped from $270 million to $354 million. If we adjust for changes in working capital, it would have risen from $186 million to $213 million. Meanwhile, EBITDA for the company also increased, climbing from $291 million to $351 million.

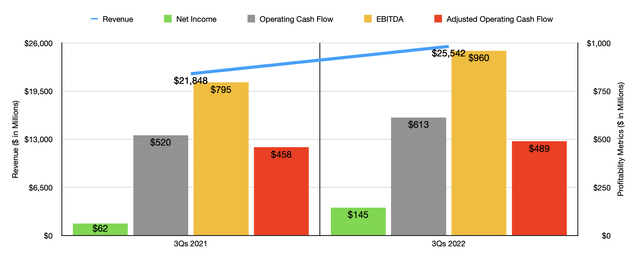

Thanks to this strong performance in the third quarter, results for the company remain on track to be better than they could have been for the 2022 fiscal year. Revenue in the first three quarters of the year totaled $25.54 billion. This compares favorably to the $21.85 billion generated the same time last year. Net income has more than doubled from $62 million to $145 million. We also saw a nice increase in operating cash flow from $520 million to $613 million, while the adjusted figure for this grew from $458 million to $489 million. Similarly, EBITDA for the company also increased, rising from $795 million to $960 million.

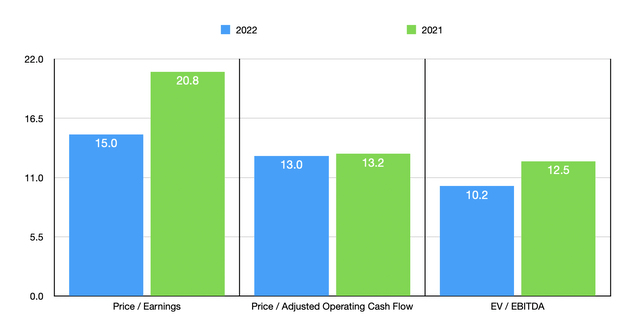

Thanks to the strong performance, management expects earnings per share this year to come in at between $2.10 and $2.20. At the midpoint, that would translate to net profits of $539.7 million. That stacks up against the $388 million reported last year. Meanwhile, EBITDA should come in at between $1.28 billion and $1.30 billion. If we use the midpoint figure there, that should translate to adjusted operating cash flow of roughly $658.5 million. Based on these figures, the company is trading at a forward price to earnings multiple of 15, at a forward price to adjusted operating cash flow multiple of 13, and at a forward EV to EBITDA multiple of 10.2. As you can see in the chart above, these prices are all lower than what we get if we were to rely on the data from the 2021 fiscal year. As part of my analysis, I also compared the company to five similar firms. On a price-to-earnings basis, these companies ranged from a low of 8.5 to a high of 44.5. In this case, two of the five companies were cheaper than US Foods. Using the price to operating cash flow approach, the range was from 8.5 to 47.1. In this scenario, only one of the four that had positive results ended up being cheaper than our target. And finally, using the EV to EBITDA approach, the range was from 6.1 to 16.8, with three of the five companies cheaper than our prospect.

| Company | Price / Earnings | Price / Operating Cash Flow | EV / EBITDA |

| US Foods Holding Corp | 15.0 | 13.0 | 10.2 |

| Performance Food Group Company (PFGC) | 44.5 | 16.1 | 13.4 |

| United Natural Foods (UNFI) | 11.4 | 8.5 | 6.5 |

| The Chefs’ Warehouse (CHEF) | 42.6 | 39.3 | 16.8 |

| The Andersons (ANDE) | 8.5 | N/A | 6.1 |

| SpartanNash Company (SPTN) | 20.9 | 47.1 | 8.8 |

Takeaway

Based on what data we have today, it seems to me that US Foods continues to perform quite well. I remain impressed by recent fundamental performance, and I do believe that the long-term trajectory for the company is positive. It’s not a bad prospect by any means, but I do not think it is the type of value prospect that I like to look for. It would be different if shares were cheaper or if growth was more impressive. But for now, especially when considering other opportunities out there, I do think that it makes for a more solid ‘hold’ than as a ‘buy’ at this time.

Be the first to comment