USD/JPY, FOMC, BoJ News and Analysis

- FOMC and Bank of Japan central bank preview

- Federal Reserve Bank due to hike tomorrow but by how much?

- USD/JPY technical analysis ahead of central bank meetings

FOMC Preview: Inflation and Geopolitical Uncertainty to Influence Rate Hike

Tomorrow marks a rather significant day in financial markets as the Federal Reserve Bank is scheduled to announce its first rate hike since the pandemic. Prior to the invasion of Ukraine, prominent FOMC members, particularly James Bullard, advocated for a rather aggressive approach to rate hikes, supporting a 50 basis point hike in March. Since then, market expectations seem to have settled on a more conservative 25 basis point hike (91% likelihood according to rates markets).

Implied Probabilities Derived from Fed Funds Futures

Source: Refinitiv, prepared by Richard Snow

In addition to the interest rate hike, quarterly economic projections will be released. One thing to note is that the projections are likely to have been finalized before the invasion of Ukraine and may already be out of date. Keep an eye on the press conference for clarification on the dates the projections – all the information is on the DailyFX economic calendar.

Bank of Japan Preview (BoJ): Yen Depreciation Tolerated for Now

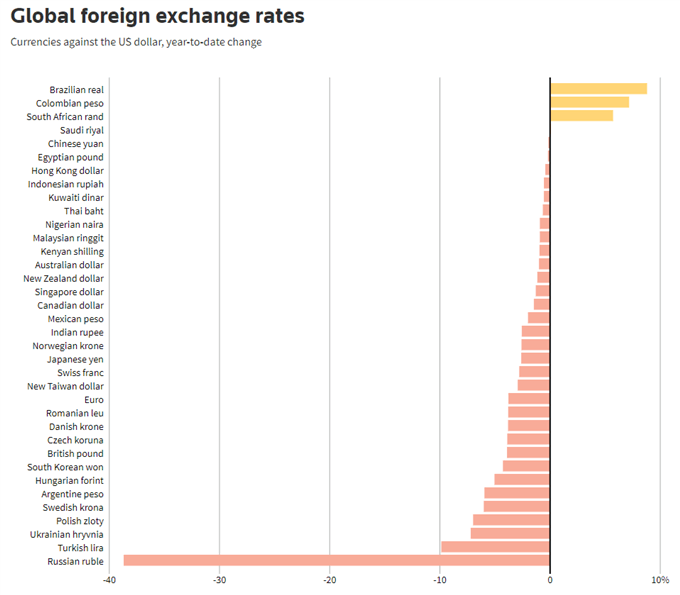

The Yen has depreciated since the Ukraine invasion which came as quite a surprise considering its status as a safe haven. However, upon closer inspectionJapan imports around 80% of its oil consumption, rising oil costs will further elevate import costs, placing downward pressure on the Yen. Japan joins a whole host of currencies that trade lower to the US dollar year-to-date.

A Reuters report citing someone close to the BoJ’s thinking mentioned that Japan is willing to tolerate a slow Yen depreciation but faster rates of depreciation are likely to demand closer attention to the issue.

Source: Refinitiv, prepared by Richard Snow

The US dollar has actually received a safe-haven bid and has remained elevated ever since the FOMC started talking up the probability of a March 2022 rate hike in response to multi-decade levels of inflation.

USD/JPY Key Technical Levels

The USD/JPY has gained momentum since its topside breakout but has now reached the first level of resistance at the longer-term trendline resistance. The RSI rose to overbought levels, a possible signal of short-term exhaustion however, the dollar shows little sign of weakness.

A 25 basis point hike would come as no surprise and could see sustained support for the greenback. A 50 basis point hike would elevate the attractiveness of the dollar and could result in a move in USD/JPY towards 120.00.

Should we see a sizeable USD/JPY retracement, 116.30 would be the nearest level of support where bulls may be tempted to enter the bullish trend.

USD/JPY Daily Chart

Source: IG, prepared by Richard Snow

— Written by Richard Snow for DailyFX.com

Contact and follow Richard on Twitter: @RichardSnowFX

Be the first to comment