USD, GBP/USD, USD/JPY Analysis & News

QUICK TAKE: US Dollar Rally Halts, Gold Bounces Back

Equities: A turnaround in tech has dominated the pre-Wall Street open price action in the equity space with Nasdaq futures up 2% amid a pullback in US yields. However, equity markets remain choppy and with US yields biased to the upside, tech stocks are likely

Euro Stoxx 50 Sector Breakdown

Outperformers:Utilities (2.2%), Technology (1.6%),Consumer Staples (0.8%)

Laggards: Basic Materials (-1.2%), Financials (-0.9%), Industrials (-0.2%)

US Futures: S&P 500 (0.9%), DJIA (0.3%), Nasdaq 100 (2.3%)

Intra-day FX Performance

USD: A modest pullback in the US Dollar following the abovementioned slide in US yields. However, while this has lifted the greenback’s counterparts, trading conditions remain choppy and short-term in nature for now. Alongside this, markets appear to be gauging what side of the USD smile are we at, given that the notable upgrades in US growth relative to the rest of the world suggests that that we are on the right side, underpinning the greenback. That said, on the tech front, resistance resides at 92.50, with the 200DMA above at 92.87.

US Dollar Chart: Daily Time

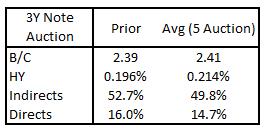

Elsewhere, Treasury auctions will be in focus, beginning with the 3Y today. Should the auction highlight weak demand, expect yields to march higher once again.

US 3YAuction Details:

Source: Refinitiv

Commodities: A much need reprieve for gold, up over 2% for the session as softer yields and USD underpins, which also coincided with strong support from 1670. However, as I said in the weekly gold report the technical landscape is unlikely to change until there is a close above 1760.

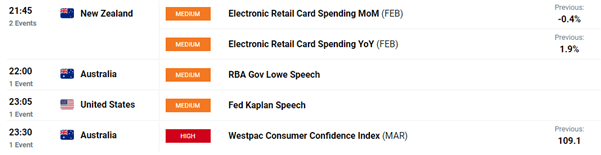

Looking ahead: DailyFX Calendar

Source: DailyFX

Be the first to comment