buzbuzzer/E+ via Getty Images

Urstadt Biddle Properties (NYSE:UBA) operates as a REIT (real estate investment trust) which owns or has equity interest in 77 properties with a total of about 5.3 million square feet. The properties are shopping centers anchored by grocery stores, drug stores/pharmacies, and wholesale clubs. The locations of these shopping centers are in affluent suburbs of the New York City metro area.

Urstadt Biddle focuses on acquiring properties with a minimum of 10,000 square feet with a worth of at least $5 million. The REIT’s focus is on commuter markets surrounding Manhattan. The strategy includes properties typically anchored by regularly needed businesses such as grocery stores. This focus ensures that the tenants have large number of potential customers who are likely to frequent these types of businesses.

If you are considering owning a REIT, UBA is one to look at since the tenants of its properties tend to sell basic needs products such as groceries, drugs, clothing, pet supplies, etc. These are items that are always in demand in this region regardless of what the economy is doing. This is probably a better option than office space REITs which might be left with many vacancies due to the new trend and ability of businesses to operate remotely with employees working from home.

The Dividend Safety

Urstadt Biddle has dividend safety due to the nature of its business. The types of tenants and their locations provides this REIT with business stability which leads to stable revenue and FFO & AFFO growth and ultimately – dividend safety. The REIT focuses on great locations in the affluent suburbs of New York City including in New York state, New Jersey, and Connecticut. UBA also has a portfolio of successful tenants which helps to ensure that sustainable revenue can be maintained.

The properties tend to be anchored by stable businesses such as various grocery stores and drug stores. Tenants also include various leading retailers such as Starbucks (SBUX), TJX Companies (TJX) (Marshalls, TJ Maxx, Home Goods), Petco (WOOF), Old Navy (GPS), etc. Many of these are businesses that consumers need or want on a regular basis, giving the properties rental income stability.

Most of the businesses occupying UBA’s properties have staying power especially the anchor stores. That gives UBA protection from the downside even in the event of an economic downturn. I’m not saying that every business occupying the properties won’t have to pull out, but the majority are likely to keep UBA thriving over the long-term.

The following financials demonstrate UBA’s ability to grow. UBA has a great track record of growing rental revenue every year. The REIT increased rental revenue from $67.5 million in 2012 to $130.4 million in 2021. UBA increased operating income from $35.5 million to $51.9 million and FFO from $30.6 million to $52.3 million over the same period.

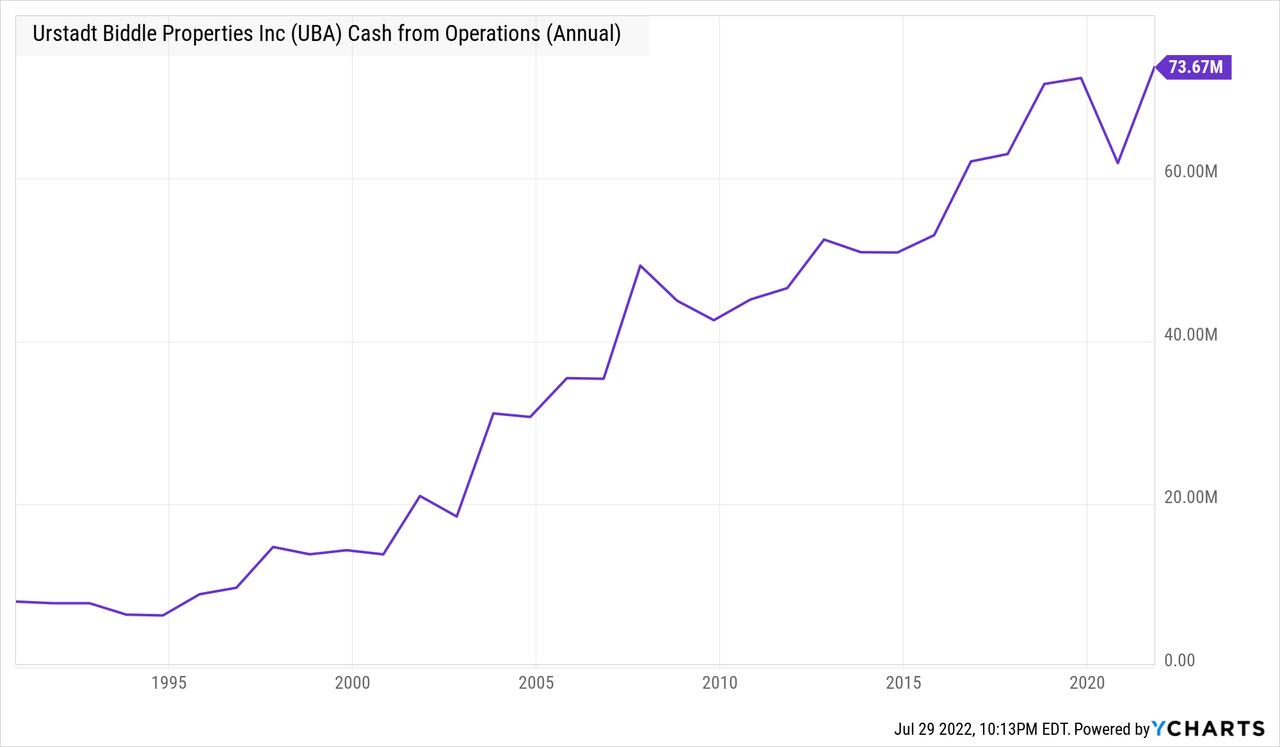

Strong Balance Sheet/Cash Flow

Urstadt Biddle has a strong balance sheet and cash flow which gives the company the ability to maintain existing properties, to acquire new properties, to pay down debt, and to pay dividends. UBA’s balance sheet shows 2.9x more total assets than total liabilities for total equity of $652 million.

UBA had $74 million in operating cash flow over the past 12 months. The REIT spent about $43 million on new property acquisitions while selling $17 million worth of property. One of the acquisitions was Shelton Square shopping center in Shelton, CT. This property comprises 186,000 square feet of one building and three pad sites. This was acquired for $33.6 million. This site is anchored by a 67,000 square foot Stop & Shop grocery store.

The cash flow and balance sheet show that UBA is on solid financial footing. This will allow the REIT to maintain existing properties and to expand its footprint over the long-term. The REIT is also likely to have the ability to pay and increase dividends over the long-term.

Valuation

Since UBA operates as a REIT, I will use the price/AFFO to evaluate the valuation which takes the adjusted funds from operations into account. UBA is trading with a trailing price/AFFO of 13.3 and forward price/AFFO of 14.7. This is below the sector median trailing price/AFFO of 17.9 and forward price/AFFO of 16.7. This low valuation for UBA gives the REIT plenty of upside price potential.

Urstadt Biddle is expected to grow AFFO at an annual pace of about 26% per year for the next two years. That strong growth is likely to lead to price appreciation from this low valuation. It should also allow UBA to increase the dividend payments on an annual basis.

Technical Perspective

The weekly chart above shows the UBA price recovering from a previously oversold condition. The RSI increased from the oversold level to above 50 which shows price strength. The green MACD line recently crossed above the red signal line, indicating that the price trend/momentum has changed back to positive. Overall, UBA’s price should trend higher over the long-term given the low valuation and expected strong AFFO growth for the next two years.

Urstadt Biddle’s Long-Term Outlook

Urstadt Biddle Properties is in a great position from a valuation and growth perspective. The low valuation leaves plenty of room to the upside for the underlying REIT price. The REIT’s strong double-digit expected annual AFFO growth is likely to drive the price higher over the next two years.

UBA’s strong growth and solid balance sheet/cash flow is likely to help support future dividend payment increases over the next couple of years. This should also support future acquisitions for add-on growth.

The threat of a deeper recession does remain a risk for UBA. The properties could experience some loss of tenants during a significant economic slowdown. However, this risk is mitigated by the properties being located in affluent suburbs and anchored by strong grocery store and drug store businesses. Many of the supporting tenants provide needed goods/services regardless of the economic situation.

Analysts have a one-year price target of $20.67 for the REIT, which represents a 12% potential gain. This looks conservative given the low valuation and high expected AFFO growth.

Be the first to comment