AzmanJaka/E+ via Getty Images

urban-gro (NASDAQ:UGRO), business is architectural design, engineering, and cultivation design services focused on the sustainable commercial indoor horticulture market, especially cannabis.

The company’s revenue comes mostly (85%-90%) from CEA (Controlled Environment Agriculture), more especially the cannabis market. The company reports in two segments:

- Service Solutions, consisting of:

1) Architecture, Engineering Design Services

2) gro-care managed service offering generating recurring revenue from training, on-site remote troubleshooting, remote monitoring and ongoing maintenance programs.

3) Integrated equipment solutions (which they don’t manufacture themselves, but this is more like system design). These still generate almost 90% of revenue and increase with the client base.

The company prides itself on being able to offer turnkey solutions, including architecture, engineering, and cultivation design. With the latest acquisitions, it can now offer everything in-house, from the Q4CC:

We take a planned focus, end-to-end approach and provide our clients with a single point of responsibility across all aspects of their operations

urban-gro produced better than expected results in Q1 and maintained its guidance for the year despite a tough market.

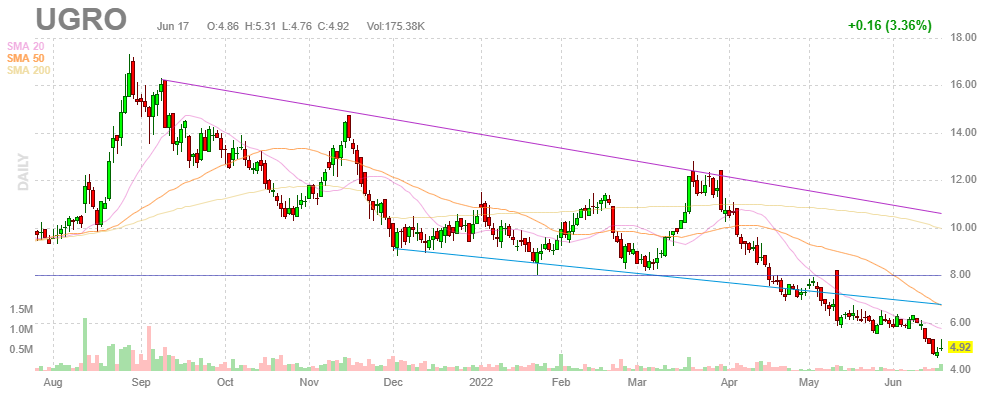

FinViz

However, we think there are some gives and takes, here is what we like:

- The company is very well diversified

- The company has several expansion paths

- No supply chain issues

The increasing range of segments the company sells into offers protection from the vagaries of any one segment and/or location and enables the company to utilize its resources (mainly specialist employees), maximizing billable hours.

But there is also some stuff we didn’t like:

- OpEx is growing faster than revenues

- Q1 backlog slumped quite a bit

To start with the latter, this is much less serious than might appear at first hand. Backlog is a pretty volatile figure quarter-to-quarter (depending on the composition of high lead-time products, for instance) and services backlog actually increased (from $5M at the end of Q4 to $6M at the end of Q1).

Further, the backlog didn’t contain the backlog from Emerald, the acquisition of which closed after Q1.

Growth

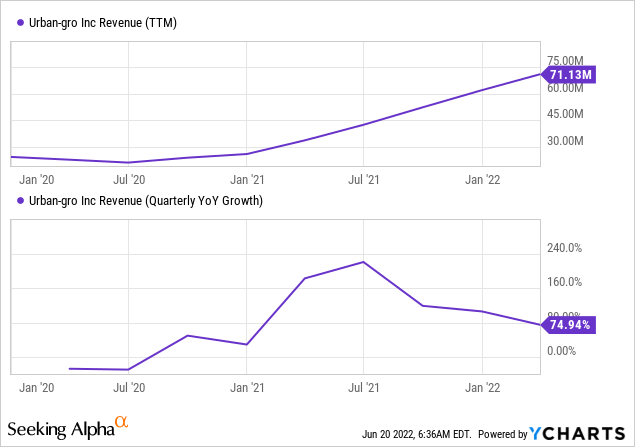

The growth has been pretty spectacular, but in part driven by acquisitions:

There are a number of growth vectors:

- Market growth

- Acquisitions

- New contracts

- Geographic expansions

- Service diversification

- Commercial horticulture market

Market growth

The company’s TAM is pretty large mostly serving two rapidly growing markets:

The cannabis market is booming but the company is operating in the wider CEA or Controlled Environment Agriculture market, from KD Market Insights:

A report from KD Market Insights said that Global controlled environment agriculture market is projected to grow from USD 74,499.7 Million in 2020 and is estimated to reach USD 172,164.64 Million in 2025, registering a compound annual growth rate (CAGR) of 18.7% between 2020 and 2025.

This includes the cannabis market where the company draws most of its revenues, but the cannabis market is growing considerably faster, from Research and Markets:

The global cannabis market in the COVID-19 period has been estimated to value USD 25,650.4 million in 2021, and is projected to reach USD 176,005.5 million by 2030 at a CAGR of 23.9%, 2021-2030.

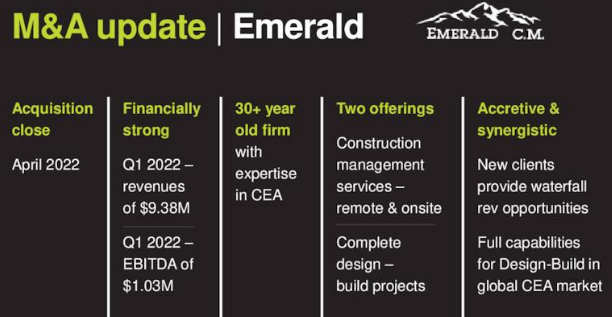

Acquisitions

The company has made some recent acquisitions

- Spent $9.1M on 2WR and MJ12 (June 2021)

- Spent $5M (+$2M in earnouts) on Emerald Construction Management (April 2022)

UGRO IR presentation

These acquisitions enable the company to expand into the wider CEA market and even beyond that in industrial and healthcare segments, becoming an EPC (Engineering, Procurement and Construction) company.

Then there are substantial cost and especially revenue synergies, from the MJ12 acquisition PR (linked above):

the integration of our services and equipment offering into MJ12 pipeline proved to be highly advantageous, and has driven strong waterfall revenues for the company.

Management is looking for further acquisitions in services, they’re not a manufacturer; geographic expansion, greenhouse in CEA.

Diversification

While the company’s revenues are mostly coming from clients that operate in the cannabis market the company is also making an effort to service adjacent segments in the CEA market, like vertical farming, and making considerable progress here (Q4CC):

In addition to signing 20 project contracts with 10 vertical farming operators in the North American market since the start of 2021, our marquee projects with Urban Health Farms in Europe is poised to launch in the coming months as they complete their site selection process… We are aggressively growing in the food sector with 20 projects with 10 vertical farm operators, but until the Urban Health Farms contracts come into play, none of those have been signed as of today. We are close and expect that in the coming months

And the recent acquisitions take them beyond the CEA market with the architect firms MJ12 and 2WR having about a third of their revenue from non-CEA, although management stressed that they will remain a CEA-focused company. The company could also expand into the greenhouse sector but isn’t contemplating this today.

New contracts

The company amassed a host of new contracts in Q4:

- 50 new service contracts for architecture, engineering, or cultivation design services

- 60 new cultivation equipment contracts

- 5 new project contracts so far in Georgia and Mississippi.

- 5 new supplier agreements

And of course, the acquisitions also bring in new clients. They were less specific for Q1 though (Q1CC):

since the start of 2022, our team has signed seven project contracts with five indoor vertical farming operators in North America… So the indication is we did ship good, strong equipment in Q1, and we’ll ship the remainder of that in Q2, but there wasn’t the contracts on the equipment side — on the equipment side, sorry, signed in Q1 that we would have expected. But again, equipment is all timing.

Indeed, the backlog declined from $30M at the end of Q4 to $22M at the end of Q1, but as management says, this might just be a matter of timing, there is a certain amount of lumpiness Q to Q.

Overseas expansion

The company is in the first innings to reproduce its turn-key project capabilities in EMEA, establishing an office in Amsterdam. But management did admit that their Urban Health Farm contract signed last December is progressing slower than planned. On the other hand, from the Q1CC:

In terms of our progress to-date so far in 2022 in EMEA, we signed contracts in Israel, Portugal, the UK, and North Macedonia.

Services

Services revenue is a leading indicator, producing equipment sales 8M+ down the road (Q1CC):

As our services backlog increases, it’s a good indication that our business is — we’re adding new clients, it’s trending in the right direction… And we continue to sign service contracts, which eventually, if we’re doing our job right turns into the equipment contracts eight months plus down the road.

Then there is of course their managed service solution gro-care, which brings in recurring revenue, but this is still very small in terms of the overall company.

Finances

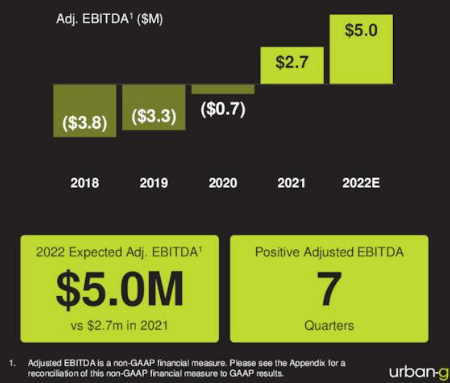

- Maintain FY22 guidance $110M revs $5M+ AEBITDA

- But Q2 revenue below Q1 on changing environment

- Gross margin at 23% +100bp

- OpEx $5.8M up from $2.5M in Q1/21

- Net loss of $0.7M (versus -$1.6M in Q1/21)

- AEBITDA $0.4M versus $0.5M Q1/21

- Backlog $22M down from $30M Q4/21 but doesn’t contain anything from Emerald. Service backlog $6M up from $5M in Q4/21

- Service contracts turn into equipment contracts 8M+ down the road

- $27.1M in cash, no debt

- $3.8M buyback in Q1

Operational leverage

There is some operational leverage, but it’s fairly tame:

UGRO IR presentation

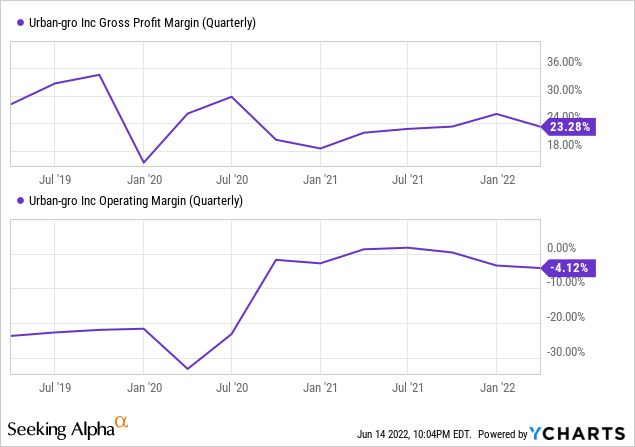

And we are a bit concerned by the steep rise in OpEx in Q1 which increased 132% to $5.8M well above the growth of revenue. For all the talk of services there hasn’t been much of an upward trend in gross margin either:

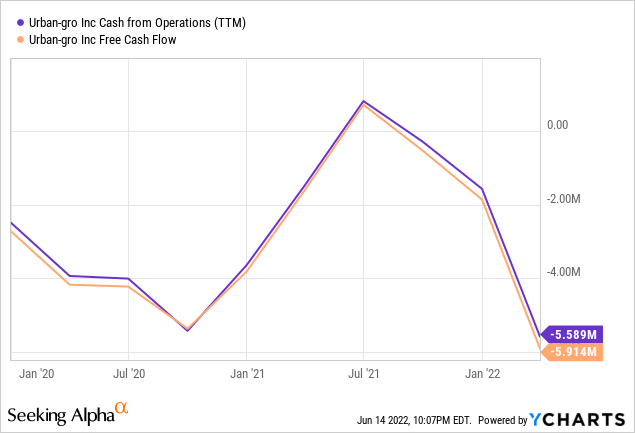

And cash flow has moved south as well:

Management is obviously not concerned as they spend $3.8M in Q1 for buybacks, not to mention the acquisition of Emerald. And indeed, there is no imminent cash crunch as the company still has $27.1M left which will last them years.

So one could argue this is a wise use of cash, prioritizing growth over margins and cash flow, and given their cash kitty there is a lot to be said for that.

Valuation

UGRO IR presentation

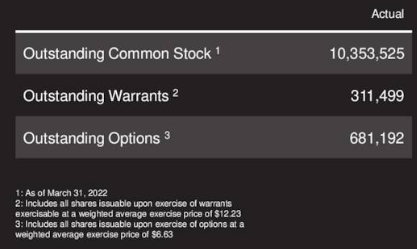

With 11M shares at $5 the company has a market cap of $55M and an EV of just $28M while revenues are guided to be $110M giving the company an EV/S of just 0.25x, which is a very low multiple.

Analysts expect an EPS of $0.07 this year rising to $0.35 next year, the latter would make the shares cheap on an earnings multiple as well.

Conclusion

We see multiple reasons to be bullish on the shares:

- Selling into rapidly growing markets, which legalization momentum and international expansion opportunities could expand still further.

- Turn-key offering with innovative gro-care producing recurring revenues.

- Rapidly growing organic revenue boosted by acquisitions.

- Expanding gross margin and opportunity for operational leverage.

- Very solid balance sheet offering opportunity for further acquisitions.

- Modest valuation.

While there are some aspects we didn’t like, more especially the cash bleed and the steep rise in OpEx, the company has plenty of cash to keep the growth going and growth has indeed been very strong.

The company is well placed to survive in a tough market due to its full-service orientation and diversity of markets it services. Its European expansion has run into some delays but nothing too substantial and there is still a huge opportunity for the company there.

While we would like to see some upward trend in gross margin and some operational leverage before we wholeheartedly recommend the shares. These might still arrive and meanwhile, the shares are undeniably cheap at 0.25x EV/S.

Be the first to comment