Morsa Images/DigitalVision via Getty Images

Investment Thesis

Upwork is a third-party marketplace that connects clients to freelancers, and it aims to deliver a better customer experience by disrupting the traditional way of hiring freelancers, such as through recruiting agencies. As the largest work marketplace, it serves as a critical intermediary for clients that are looking for skilled freelancers, and today, it has over 800,000 clients (and growing) on the platform.

I went through its most recent 2Q22 results, and I find it to be a decent quarter in terms of execution and top-line growth, although, there continue to be no clear signs of operating efficiency despite its heavy reinvestments. As a result, this puts pressure on its operating margin in the near term. While the valuation seems to imply a premium today, if Upwork shows it can achieve an operating margin of roughly 20% as those of mature marketplaces such as eBay (EBAY), the valuation can be reasonable in the long run.

GSV, Marketplace Revenue, and Growing Active Client Base

Upwork 10-Q Upwork 10-Q

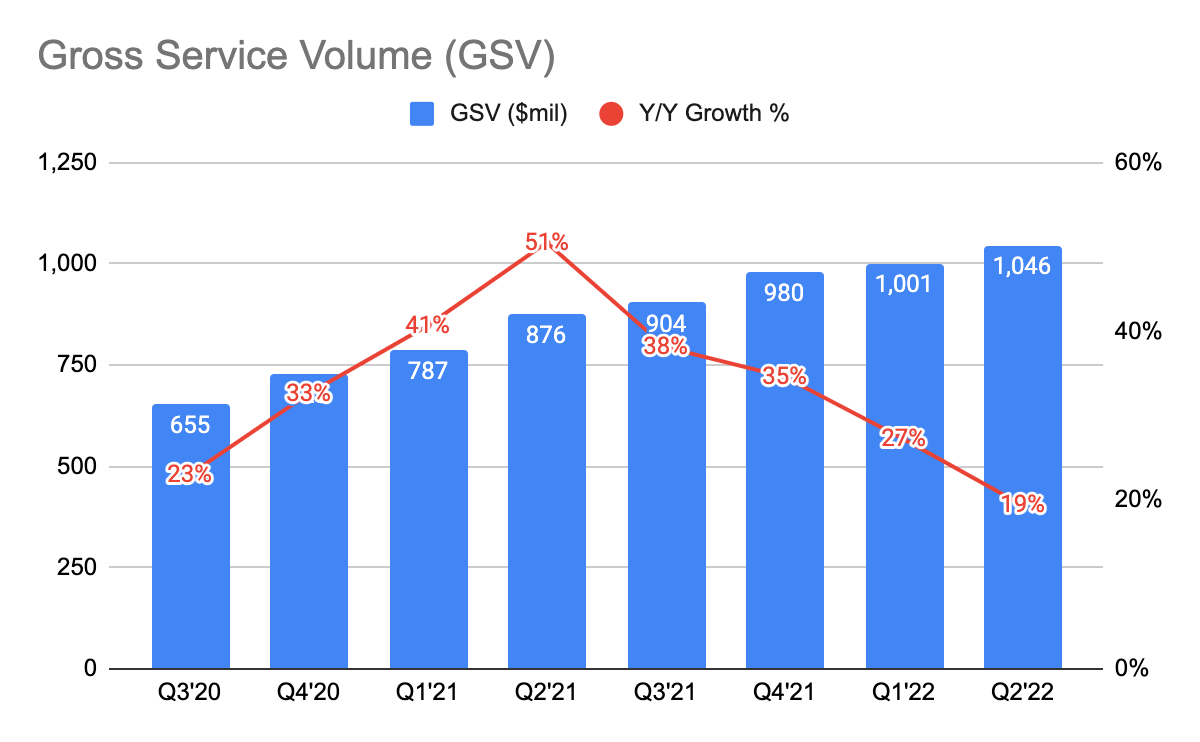

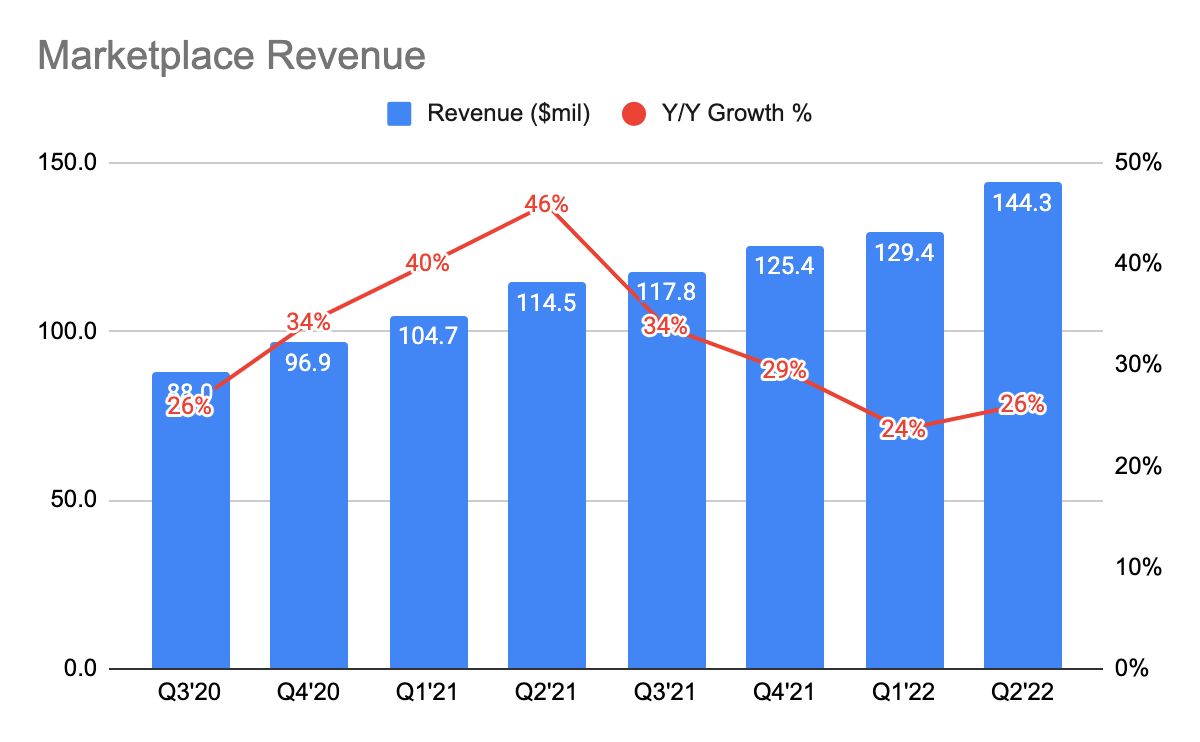

Upwork’s gross service volume (GSV) grew 19% Y/Y in 2Q22, and this is a growth deceleration from a year ago, primarily due to the growth normalizing coming out of Covid. With a take-rate of 13.1%, its marketplace revenue came in at $144.3 million, growing at 26% Y/Y. This strong revenue growth was primarily driven by the combination of its growing client base, including both enterprise and non-enterprise clients, and increasing spending from existing clients.

Upwork 10-Q Upwork 10-Q

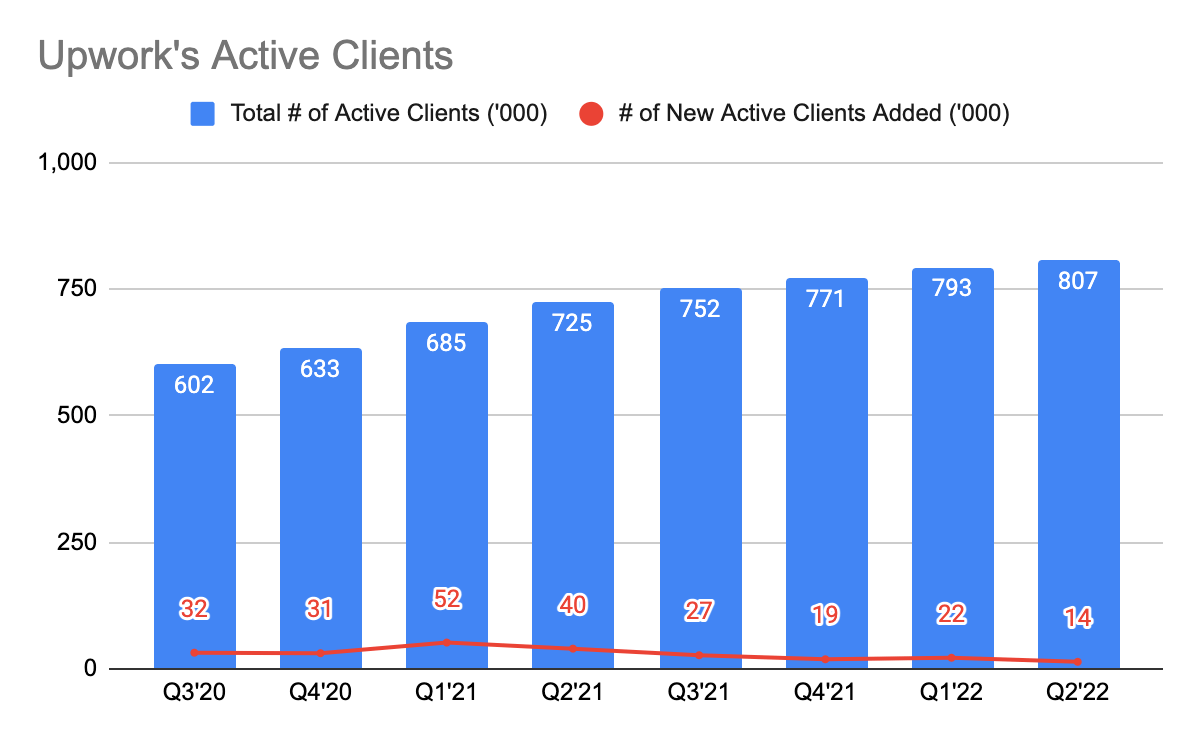

This quarter, they brought in a total of 14,000 new active clients, which is the lowest quarter ever. I believe that Covid has pulled forward lots of demand, so demand is normalizing.

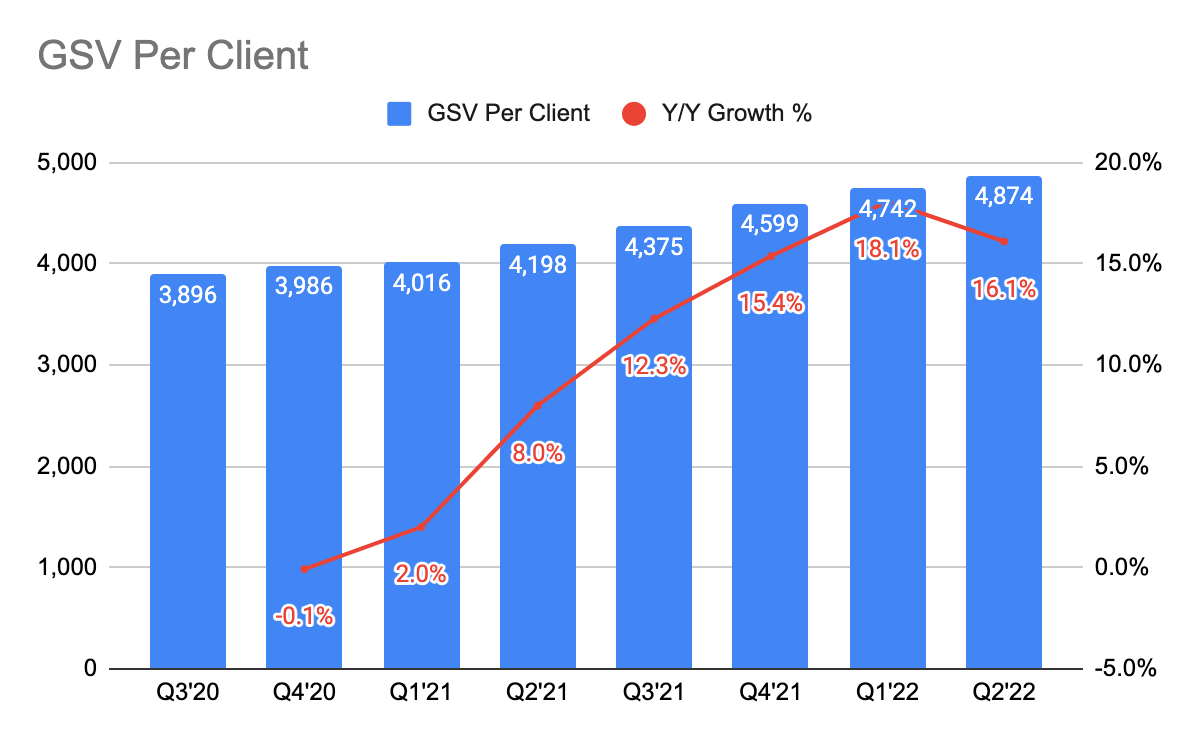

Nonetheless, they continue to bring on new clients, and this further validates that clients are increasingly looking for skilled freelancers. Moreover, its GSV per client is also growing, which is driven by (1) existing clients spending more on the platform and (2) onboarding more enterprise clients who typically have higher spending power.

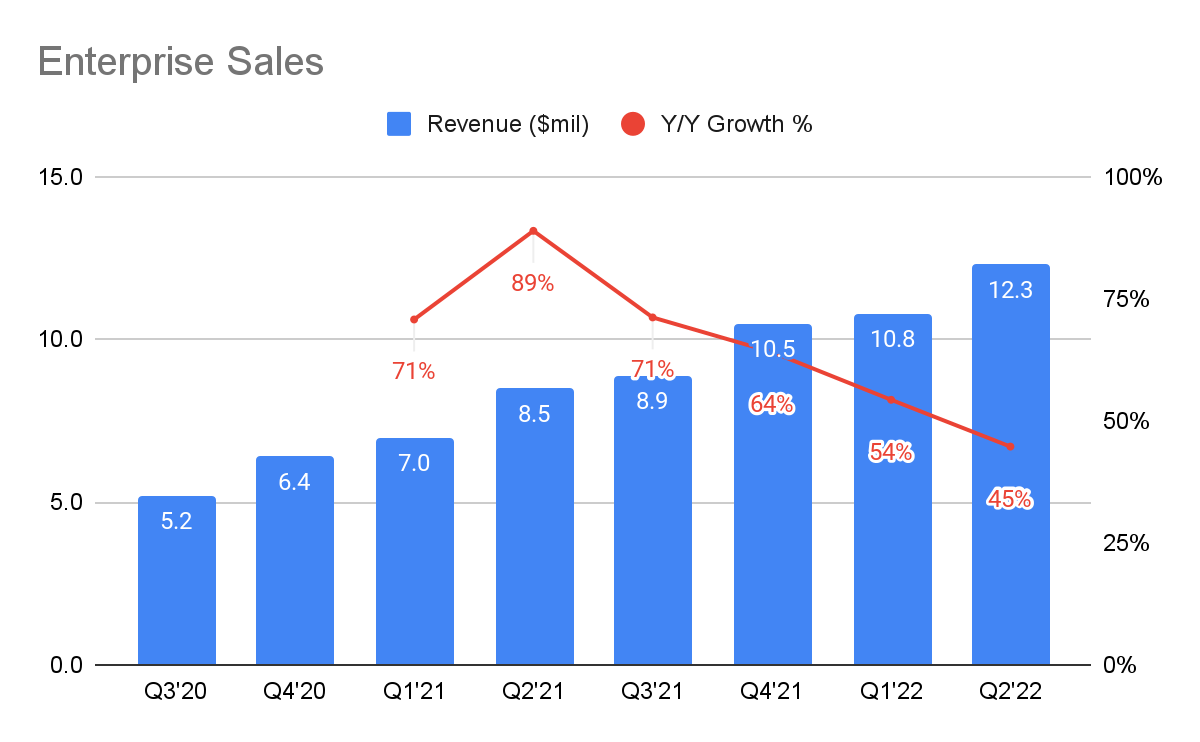

Enterprise Sales and Customers

Upwork 10-Q Upwork 10-Q

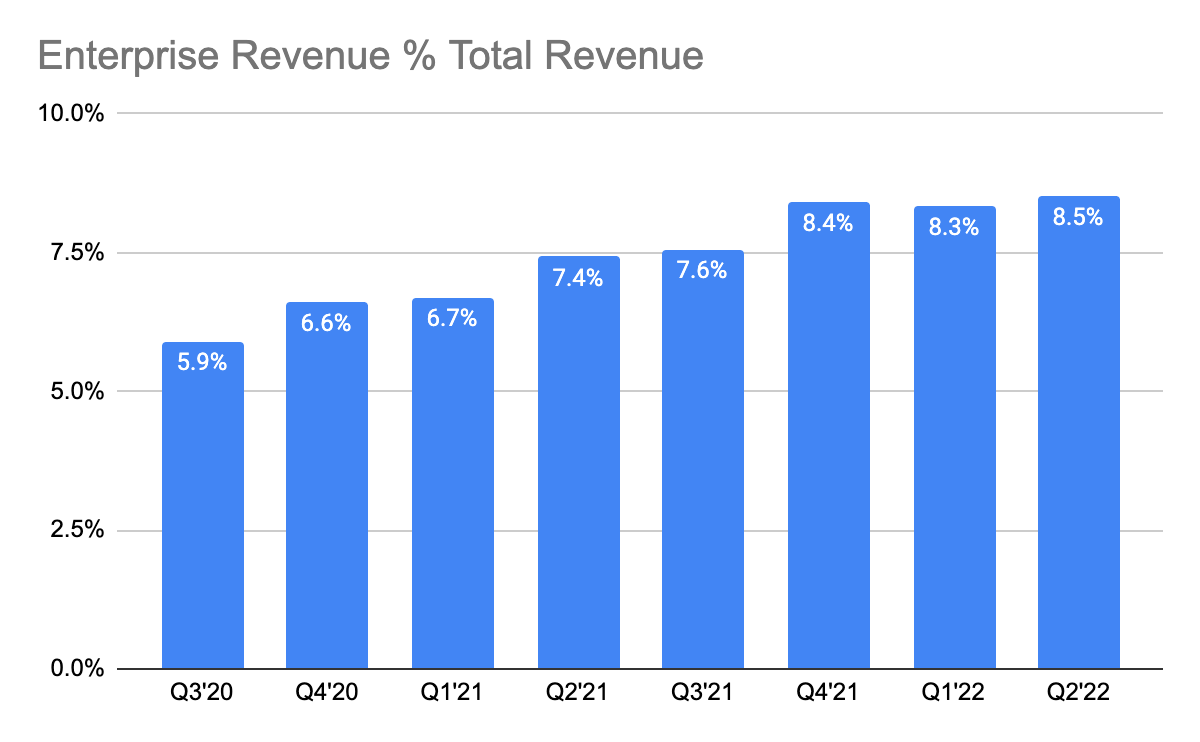

Indeed, its enterprise revenue has grown by 45% Y/Y, and it is now making up 8.5% of its total revenue. Within a span of 2 years, its enterprise revenue has grown by 2.3 times, and this is the result of its strong acquisitions of enterprise clients, and a validation of sales and marketing (“S&M”) efforts.

While its growth has been impressive, recall that management is anticipating a 70% CAGR to reach $300 million by the end of FY25. Looking at the past 2 quarters’ growth rates, it does not seem to come close to the expected CAGR. Perhaps, could the management have been too optimistic? To remain on the safe side, I would assume so for now.

Upwork 10-Q

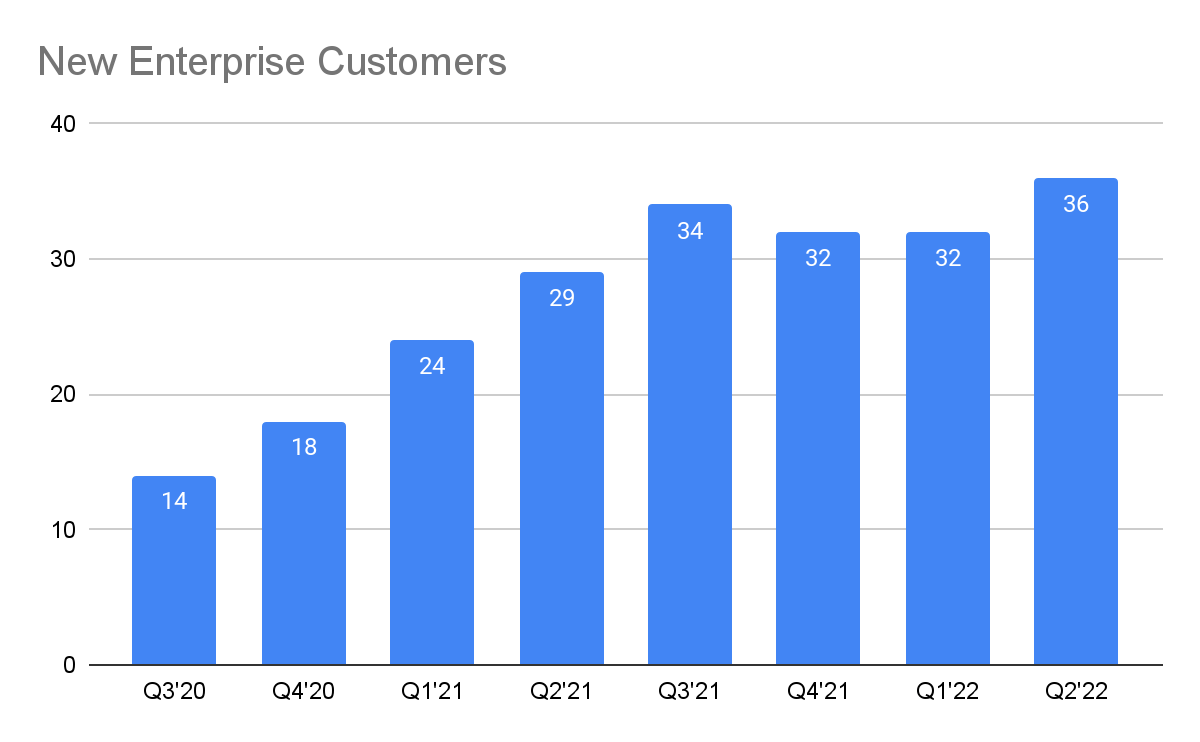

Here, you can see that its new enterprise clients are ramping up really quickly, and the rate at which they are adding new clients does not seem to be slowing down at all. In fact, this quarter, they managed to add 36 new enterprise clients, which is the strongest quarter ever for the company. During the 2Q22 earnings call, the management stated that the number of clients spending $1 million or more also grew significantly Y/Y, although the specific growth rates were not disclosed.

One observation that I made is that investors tend to look at the percentage growth rates. For instance, in 2Q22, its new enterprise clients grew 24% Y/Y, which is a growth deceleration from 107% a year ago. In my view, growth rates do not paint a clear picture because given how quickly they are ramping up its enterprise clients, it is not surprising to see its growth rates decline given the law of large numbers. In my view, it is much more meaningful to look at the absolute number of clients they are adding, and how these numbers progress over time (i.e., whether it is growing or declining). Ideally, I like to see Upwork bringing in similar or if not a higher number of new enterprise clients, given that they are investing lots of marketing dollars.

Profitability

Upwork 10-Q

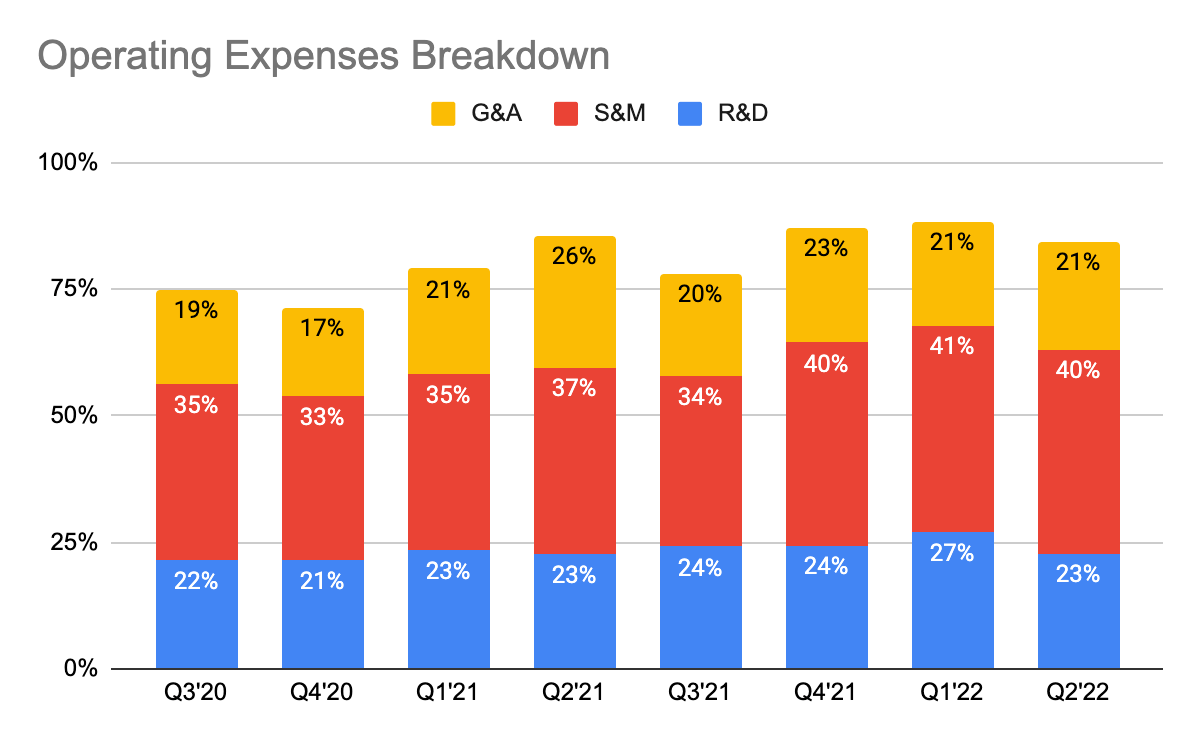

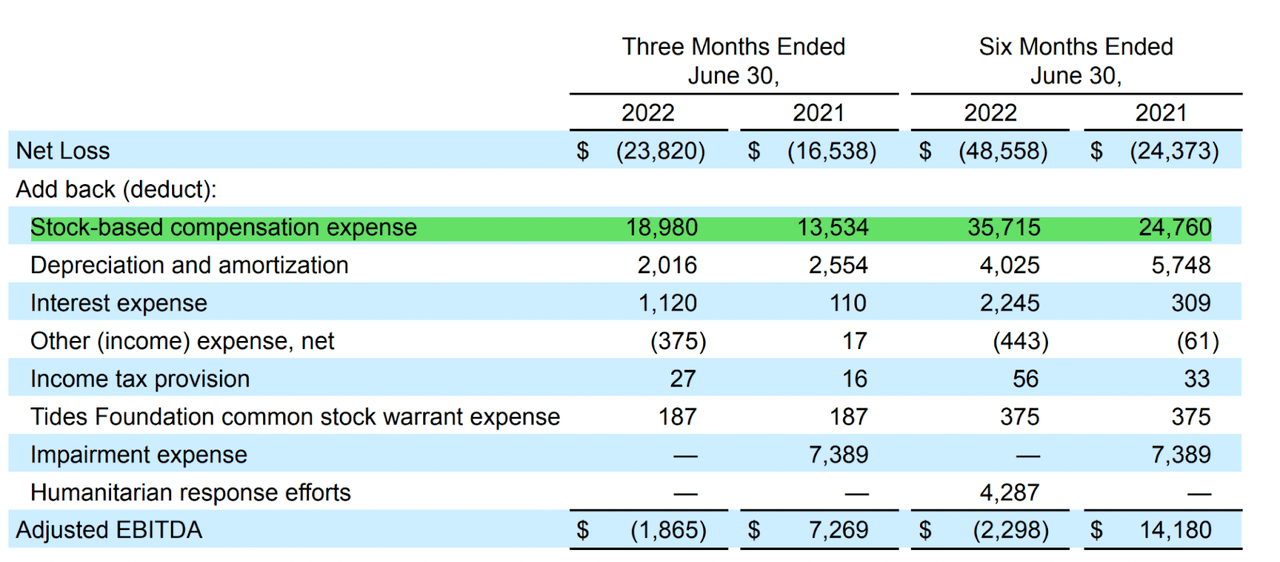

The only issue I have with Upwork is the lack of operating efficiency. Its operating expenses are still making up a huge portion of its total revenue, and this is especially so for its S&M expenses as they continue to invest heavily in brand marketing and hiring. This puts pressure on its near-term operating margin, although, the management has again reiterated that these investments will translate into higher margins (i.e., adjusted EBITDA positive) in the future:

“…over that medium to long-term mark, there will be benefits along all of the OpEx lines. So G&A, R&D, and ultimately, sales and marketing, although we’re obviously investing aggressively in those areas right now, as we look over the next several years, we continue to believe that there’s good opportunities to drive that…the target for 2023 of achieving EBITDA profitability. And that will continue to expand that EBITDA margin by several 100 or by few 100 basis points each year thereafter.”

Upwork’s 2Q22 10-Q

Another issue with using adjusted EBITDA positive is that this excludes the stock-based compensation (“SBC”) expenses, which is making up a hefty amount of its adjusted EBITDA. Considering that Upwork is expected to continue its pace of investments, and will continue to incur SBC expenses down the road, this should not be excluded. So, for simplicity’s sake, I prefer to use its operating profit over its adjusted EBITDA.

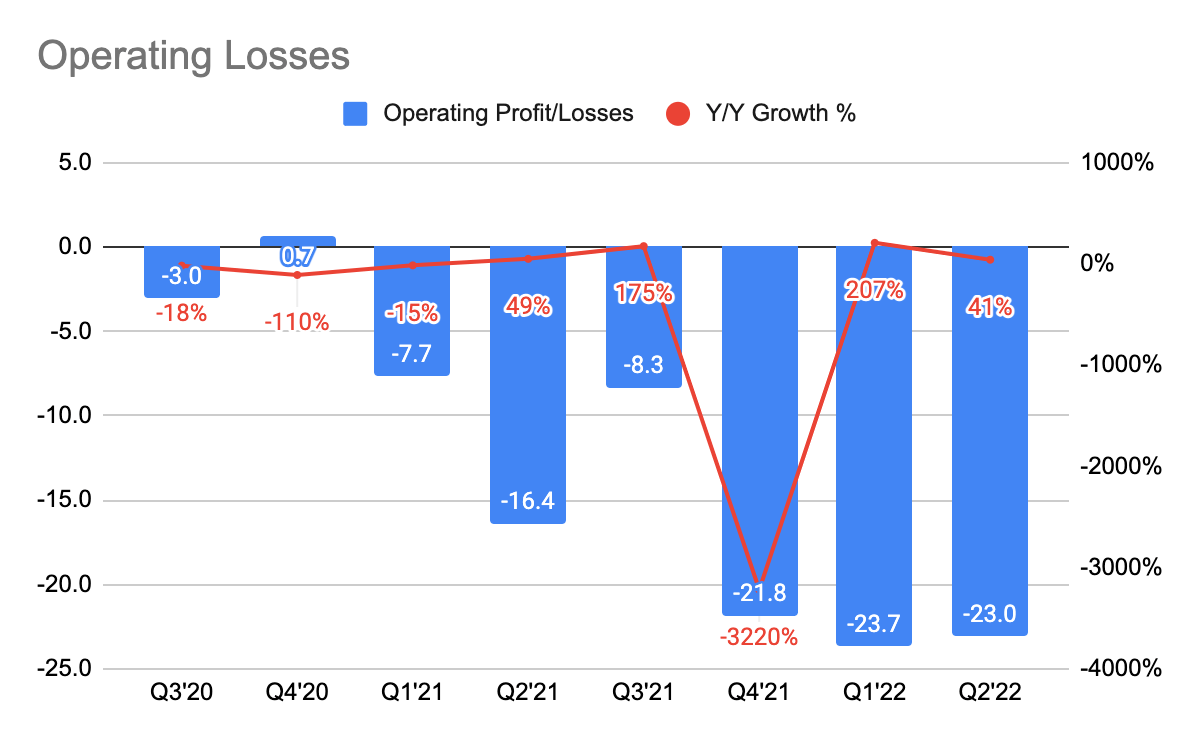

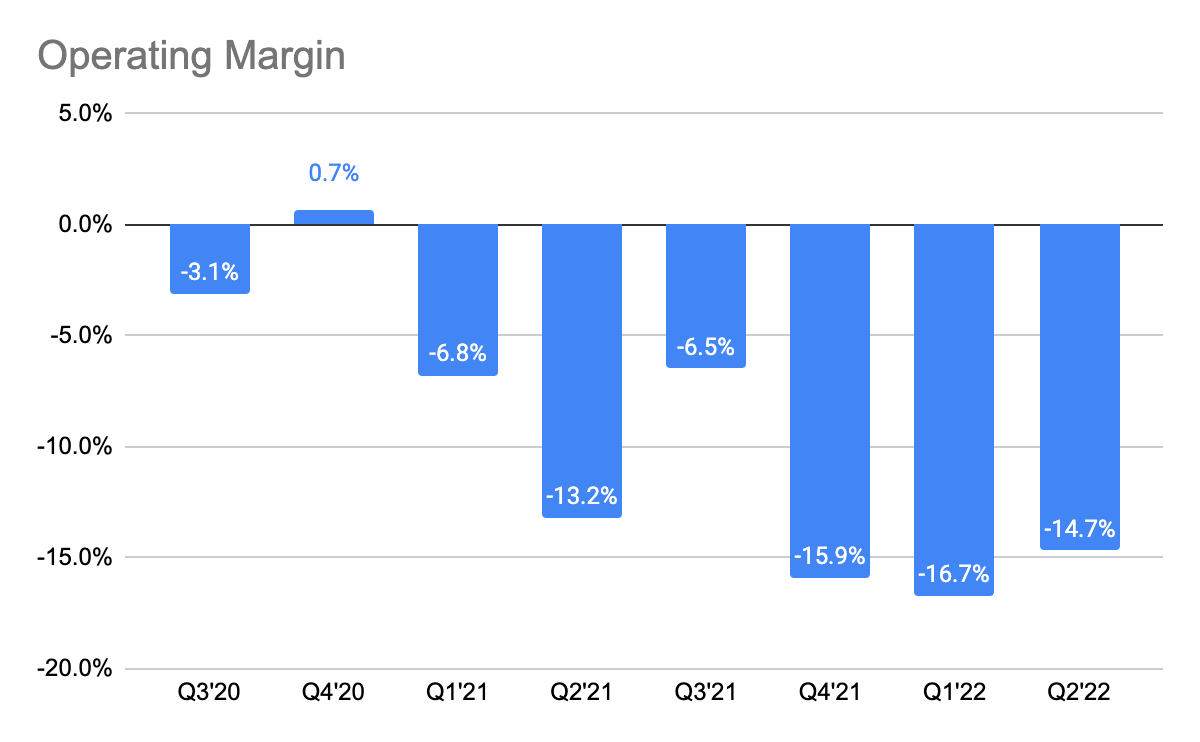

Upwork 10-Q Upwork 10-Q

Thus, as the company is in reinvestment mode and has yet to extract any operating efficiency, its operating losses continue to increase on a Y/Y basis and its operating margin is -14.7% as of 2Q22. Looking at this quarter’s $63.3 million of S&M expenses, and in the case if Upwork decided to scale back on its S&M spending, I believe the company can choose to be profitable anytime soon.

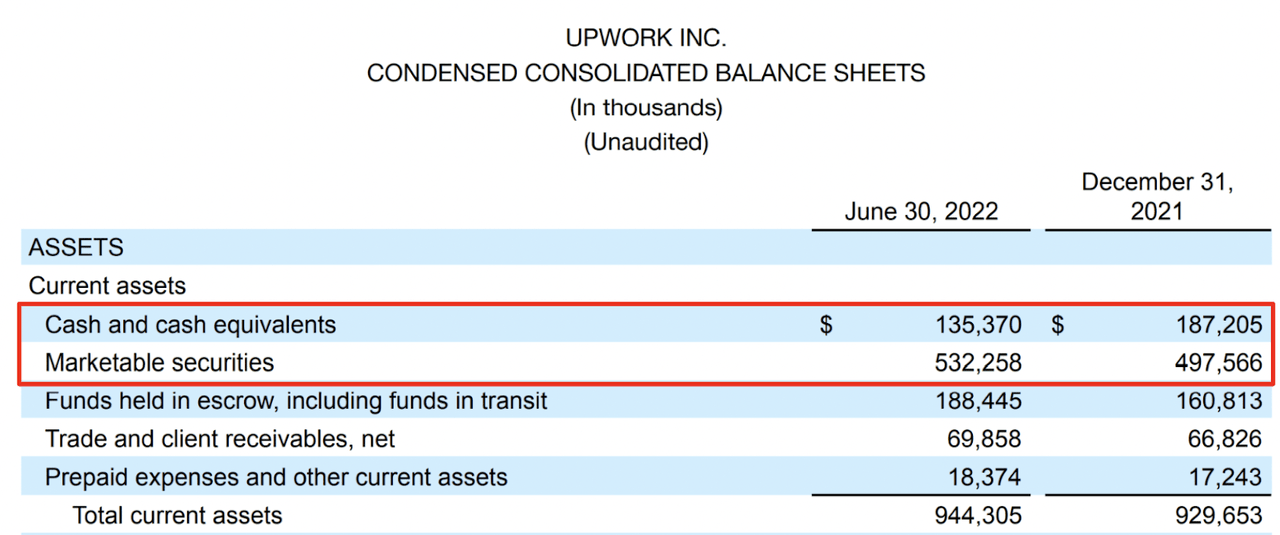

Upwork’s 2Q22 10-Q

Moreover, there is substantial capital in its balance sheet to fund its near-term operating losses, and there will likely be sufficient time to hit profitability. Therefore, some of the key metrics to monitor going ahead are (1) whether its S&M expenses as a % of total revenue are coming down, demonstrating sales efficiency, (2) growing active client base, including enterprise customers, and lastly, (3) improving operating losses.

Valuation

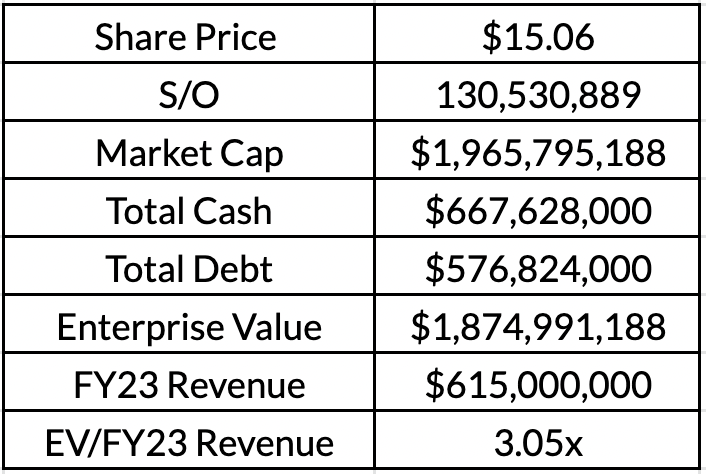

Author’s Estimates

The management guided a midpoint revenue guidance of $615 million by FY23, and using its current enterprise value of $1.87 billion, this gives us a price multiple of 3.05x. Given that it is still unprofitable, this seems to imply that there is a slight premium baked into the share price today. However, if Upwork can achieve similar margins as those of mature marketplace businesses such as eBay (EBAY) and Etsy (ETSY) in the range of 20%, the valuation may be reasonable in the long run.

Conclusion

This was an overall decent quarter for Upwork as the continuous reinvestments have resulted in a growing number of active clients, including the strongest quarter in terms of new enterprise clients, and strong top-line growth. However, the issue is that Upwork has yet to show signs of operating efficiency, which is putting pressure on its near-term operating margin. And I believe investors should be looking at its operating margin instead of the adjusted EBITDA margin, given that SBC expenses are likely to be recurring. If Upwork can demonstrate that it can achieve a mature operating margin of 20%, the valuation can be reasonable in the long run.

Do you agree with my analysis? Let me know in the comments section below!

Be the first to comment