filadendron

The constant issue facing upstart fintechs involved in the lending space is access to funding capacity as the business scales and the economic cycle weakens. Upstart Holdings (NASDAQ:UPST) is a prime example of this cycle destroying an investment thesis with the stock. The fintech isn’t attractive at any price until the business model constraints are resolved.

Platform Constraints

No matter how strong the credit metrics of a lending marketplace, whether based on artificial intelligence or not, the platform must have a source of funding. Without an internal source to fund loans, a platform, such as Upstart, is reliant on bank partners to continue funding loans.

The typical move during any economic weakness is to especially pull back on unproven lending platforms. Other lending platforms such as competitor LendingClub (LC) and SoFi Technologies (SOFI) have acquired digital banks in order to collect cheap deposits to fund loans and reduce such constraints going forward.

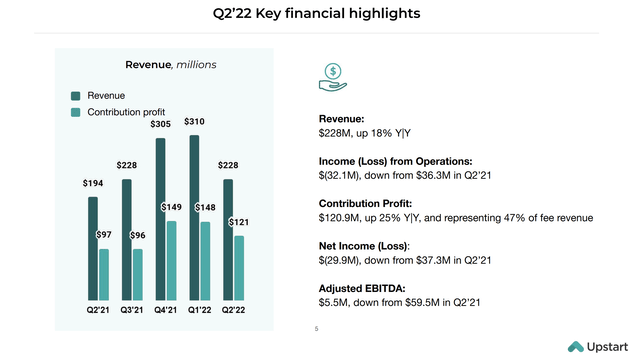

In Q2’22, Upstart saw revenue dip to $228 million, below the $300+ million levels of the prior quarters. Even worse, the fintech had guided Q2 revenues sticking around $300 million for the quarter only a few months prior to cutting guidance back on July 7.

Source: Upstart Q2’22 presentation

Upstart Chief Financial Officer Sanjay Datta confirmed this standard issue facing the company during the Q2’22 earnings call.

The macro uncertainty and the impact of economic stress on consumer delinquencies have led to a decrease in available funding for loans on our platform, which has become the operating constraint of the business.

The company only converted 13% of loan requests during the quarter, down from 24% in the prior Q2. Again, these numbers are supportive of lending partners pulling back from aggressive lending standards and reducing risk in the face of economic uncertainty when the whole point of the AI-based lending model was an improved risk model to avoid these volatile credit decision outcomes.

Upstart even ended Q2’22 with 71 bank and credit union partners, up from just 57 in the prior quarter when lending volumes were strong. Credit quality has returned to prior loss levels with major lending delinquencies from credit cards, personal loans and auto loans back to pre-covid levels.

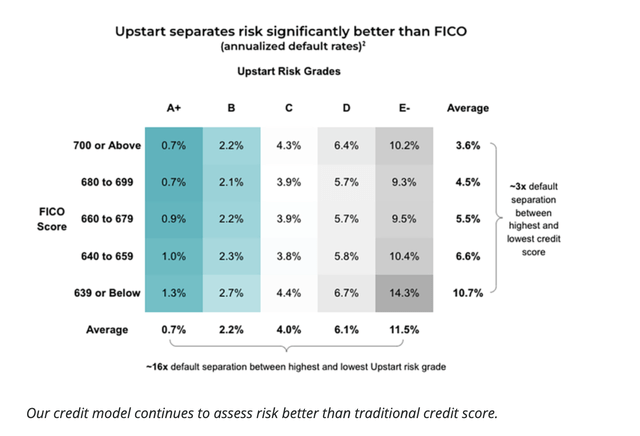

The company still continues to access credit risk better than traditional credit scores like FICO. Unfortunately, this doesn’t matter when Upstart is reliant on bank partners to fund new loans.

Source: Upstart Credit Performance

The company guided to Q3’22 revenues of only $170 million suggesting another major pullback in partner lending. The business will have been cut nearly in half since the peak just in Q1’22 when revenue reached $310 million. In addition, the business is highly unprofitable now.

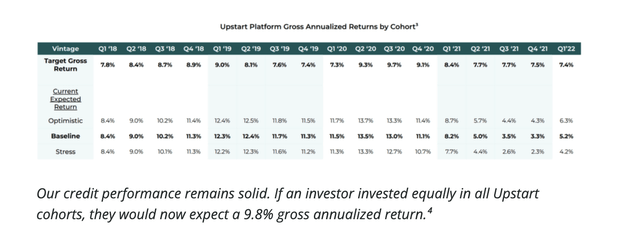

Part of the problem is that expected outcomes for loans have recently underperformed expectations. The model spent most of 2020 and 2021 outperforming expected results with in-period defaults 50% below expectations. The average returns are still stellar at 9.8% over the period, but naturally lending partners aren’t as aggressive when the expected returns dip to a baseline of 5.2%.

Source: Upstart Credit Performance

New Model Gets Interesting

The stock is turning interesting below $30 with a market cap of only $2.4 billion. The company has a strong balance sheet with nearly $0.9 billion in cash. Upstart does have nearly $850 million in borrowings offset mostly by $625 million in loan investments sitting on the balance sheet. The net enterprise value is only $1.7 billion.

Investors need to understand that Upstart won’t ever trade at similar valuation premiums as in the past. The market won’t trust the funding problems not to pop up during the next cycle.

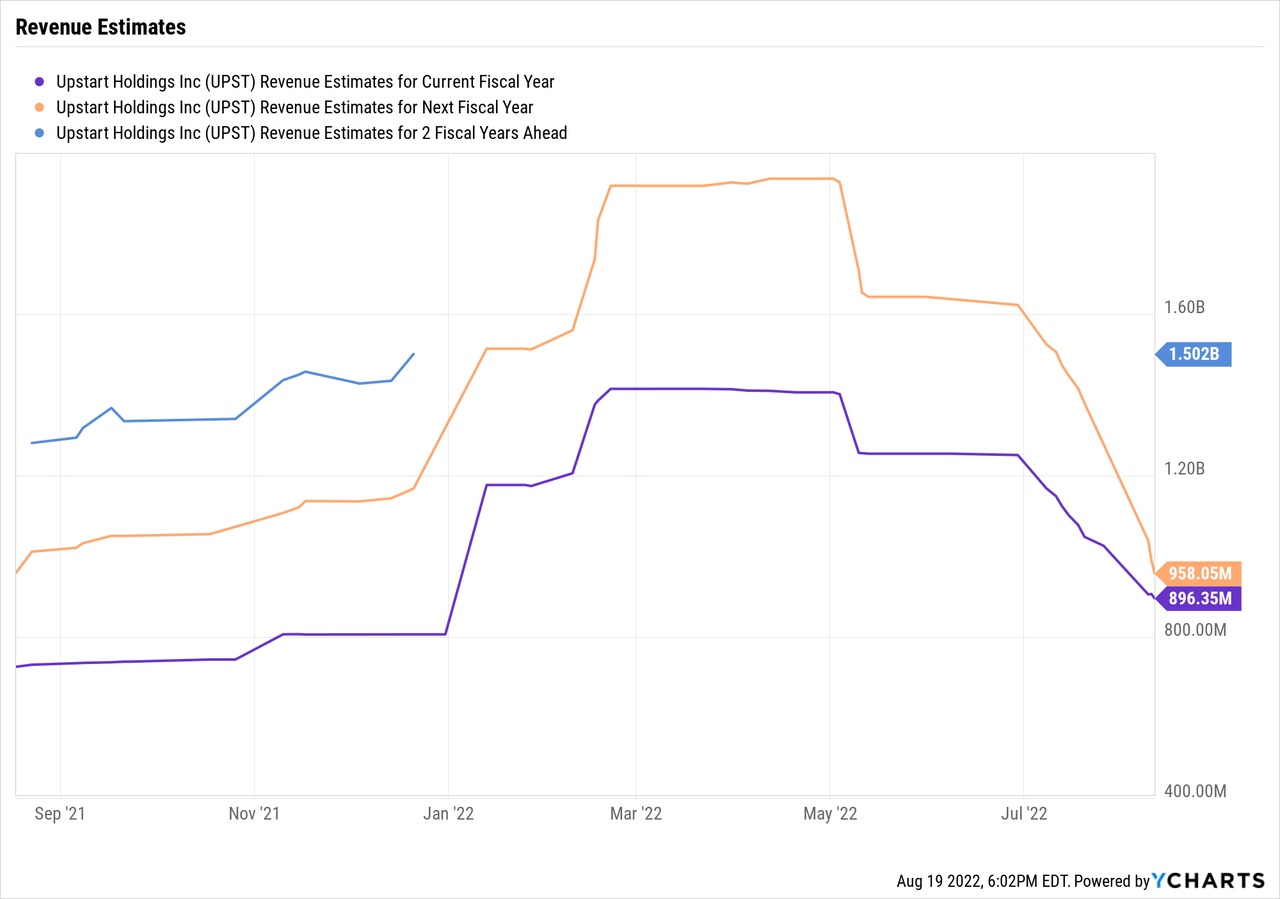

In addition, valuing the stock is difficult not really knowing the ultimate revenue low point. The market forecasts revenues hitting the $900 million range in the next couple of years making the current EV appealing.

The real key to the stock being attractive is whether Upstart can resolve the funding issues. The management team is working on a new plan for committed funding from bank partners while utilizing existing capital to fund loans during periods of reduced funding.

Any scenario offering Upstart with funding to avoid the current problem would make the stock appealing here. The current business model is flawed and the only acceptable solution to the problem is a source of funding that won’t disappear in the next weak economic cycle.

While the market loves the concept of a fintech not taking credit risk, the business model only works when the risk model works. If banking partners aren’t willing to fund the loans, Upstart should without doubt step up and use available capital or pursue a digital banking license to fill the gap. In essence, the company and shareholders should be willing to bet on the AI-credit model, or they shouldn’t expect banking partners to take that risk.

LendingClub had the same problems resolved via acquiring a digital bank. The lending platform saw revenues stall in these same levels as Upstart. Yet, the business is now producing quarterly revenues above $300 million in the current period due to not running into the same hit to loan funding with the flexibility to self fund up to 25%, or more, of new loans.

Upstart has a plan to alter the business model to a structure with committed capital. The stock will be more investable at this point, but as highlighted by CEO Dave Girouard on the Q2’22 earnings call, the transition will take time:

As a result, we’ve concluded that we need to upgrade and improve the funding side of our marketplace bringing a significant amount of committed capital on board from partners who will invest consistently through cycles. We’re currently evaluating a variety of opportunities to do just that. So we expect this will take some time to bring to fruition. Furthermore, while we continue to believe that it doesn’t make sense for Upstart to become a bank, we’ve decided it may make sense to at times leverage our own balance sheet as a transitional bridge to this committed funding.

Takeaway

The key investor takeaway is that Upstart ran into predictable problems facing most fintech lending platforms in the past. The new business model is too murky for an investment here, but the stock will become appealing when a more committed funding model is in place. At that point, investors can’t correctly analyze the investment opportunity based on the terms of the committed funding model. As such, investors should just watch Upstart develop the new model on the sidelines.

Be the first to comment