martin-dm/E+ via Getty Images

Thesis

With shares of Upstart Holdings (NASDAQ:UPST) falling sharply recently, some investors may be tempted to buy the company “at the right price”. However, I would not jump to conclusions – I warn potential dip buyers not to catch the stock’s upswing in this article. I think it is better to wait for the quarterly results (8 August) to judge how bad things are in the company.

What may attract potential buyers?

This happens all the time in the market – when stocks fall by 10-20% on a trading day, this fact always attracts potential dip buyers who want to try their luck on a “pullback”.

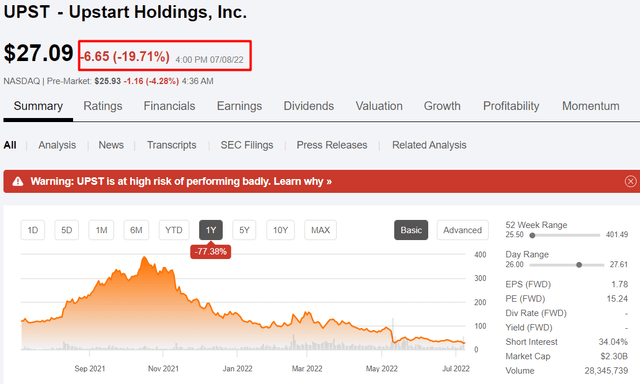

At the end of last week, we saw such price action in the Upstart Holdings share – it fell almost 20% in just one trading day, followed by a drop today in the pre-market session:

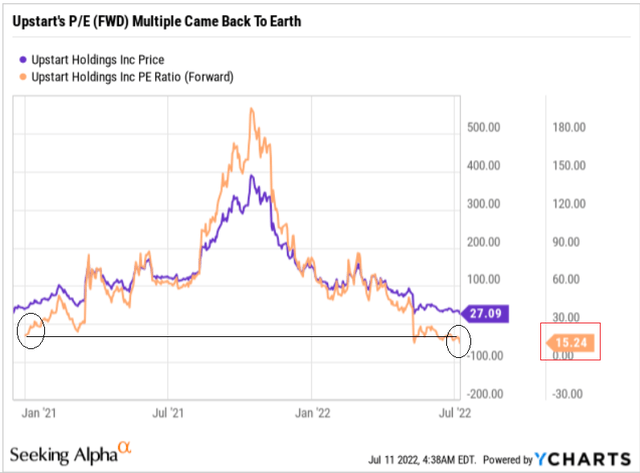

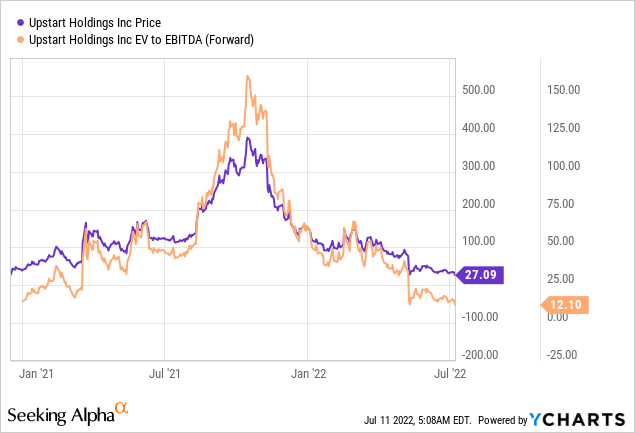

This rapid stock price decline led to a drop in valuation to about the level of the company’s IPO:

YCharts, author’s notes

Add to that the popularity of this company among retail investors, as well as the oversold levels that the technical indicators are showing us, and the belief in a quick recovery may indeed become strong among some investors, in my opinion.

Investing.com, UPST, author’s notes

Why I would not recommend you to buy this dip?

We need to understand the reason for this decline – management’s forecasts for the preliminary operating results that UPST will present in a month have been released. The updated forecasts do not bode well for investors – instead of the planned break-even quarter, management is now talking about a net loss in the range of $31 million to $27 million, while preliminary data suggests that revenue will be about 24% below the previous consensus forecast.

Our revenue was negatively impacted by two factors approximately equally. First, our marketplace is funding constrained, largely driven by concerns about the macroeconomy among lenders and capital market participants. Second, in Q2, we took action to convert loans on our balance sheet into cash, which, given the quickly increasing rate environment, negatively impacted our revenue.

Source: Dave Girouard, co-founder and CEO of Upstart, [Seeking Alpha News]

Even if we assume that the conversion of loans to cash was a one-off event, we need to understand that the company is set back by six months in terms of revenue – Q3 2021 revenue was $210.4m (only $17.6m less than now expected in Q2 2022), while the company was then operating against the backdrop of a completely different monetary policy.

This is important because the AI-based scoring system that UPST is commercializing depends entirely on the health of US commercial banks, which seem to be having a tough time at the moment.

With US household debt at an all-time high and credit card debt growing at its fastest pace since 2008 (+20% since April), monetary tightening could have a strong impact on second-tier banks in terms of the quality of their loan portfolios and the resulting earnings. Banks will be choosier in lending and lower their costs, which could fall under the Upstart system. On the contrary, it seems that banks need good scoring models in such a situation – a direct inference to a positive catalyst for UPST. But if this is so, why is management talking about problems shortly?

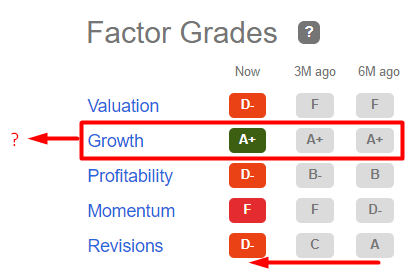

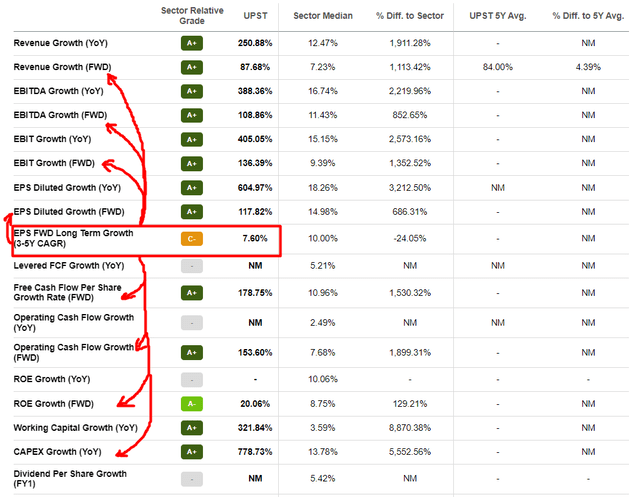

What we see in terms of the company’s operational growth in the past is impressive – but in the same past, it was all reflected in the share price, which was then almost 15 times the current price. And what about today? Now we see a steady decline in earnings revisions. In my opinion, the “Growth” grade may suffer too because if The Street is right and EPS grows much slower than previously expected, this will most likely be due to slower revenue growth (or margin stagnation). Moreover, this cannot be without impact on the dynamics of ROE / ROA as well as on the company’s cash flows and capital expenditure – in other words, the growth rates now priced in probably do not fully reflect the downgrades in the earnings revisions. The recalculation of these indicators, which should be done regularly by investment houses to take account of share price developments, will most likely have an impact on forward growth rates – the last bastion now used to explain Upstart’s high valuation multiples.

Seeking Alpha, author’s notes Seeking Alpha, UPST’s Growth grades, author’s notes

In addition, it should be noted that Upstart Holdings is highly dependent on the effectiveness of its AI algorithms (of course), which, as can be seen from the risk section of the last quarterly report, have not been tested on a sample from the down cycle period.

Our AI models have not yet been extensively tested during down-cycle economic conditions. If our AI models do not accurately reflect a borrower’s credit risk in such economic conditions, the performance of Upstart-powered loans may be worse than anticipated.

Source: UPST’s last 10-Q

This sounds like a standard warning that companies give in their reports, but in my opinion, this very risk cannot be ignored – a training sample for a machine learning model is literally everything. It is absolutely wrong to have your model trained with a sample that is completely different in properties from the input data (and vice versa) – ask any data scientist you can find.

Due to the increasing indebtedness of the population (this was not the case before) and the rapid increase in interest rates (this was not the case before), there is a risk of a rampage (this was not the case after the establishment of the company in 2012) – the UPST models run the risk of not adapting to the new economic reality and causing huge losses to their partner banks and putting its own reputation at stake.

Bottom Line

Based on the above, I conclude that it is too early to buy the dip in Upstart Holdings stock – the company’s medium-term prospects are completely incomprehensible to date.

However, the risk (to my thesis) of a strong recovery is definitely there – retail investors love this company, and committed shareholders are willing to buy dips despite unrealized losses piling up. However, if the stock falls so sharply amid such mass popularity, does this mean that the smart money is divesting and probably knows something we do not?

I rate UPST neutral, as its valuation is indeed at a historic low at the moment. However, if you take a broader look, 12 times EBITDA still seems too expensive to me for such a risky fintech company. Therefore, I would avoid UPST and not recommend buying the recent drawdown.

Be the first to comment