400tmax/iStock Unreleased via Getty Images

Sometimes boring is good and investing in companies that have stood the test of time is exactly what is needed. The S&P 500 has declined by -22.13% in 2022, officially placing it into a bear market. While many portfolio values have declined, this is the perfect environment to load up on quality companies at discounted prices. Nobody can accurately predict the day a bottom will occur, and we likely won’t know that a bottom was established for weeks or even months after it occurs. It’s interesting how so many investors rush to plow their capital into the markets on the way up but are worried about piling capital into the markets on the way down. Prior to the S&P 500 entering a bear market last week, there had been 28 bear markets, with an average decline of -35.62%, lasting an average of 289 since 1928. Bear markets are part of the investment landscape, but ultimately the markets appreciate over long-term periods.

We have been in a bear market on the Nasdaq and officially entered a bear market on the S&P. It could certainly get worse, but if you have several years on your investment time horizon, statistically, markets will make new highs. As a long-term investor, I welcome downturns such as the one we’re experiencing because some of the best companies are trading at a discount. United Parcel Service (NYSE:UPS) is a company that many of us use but have rarely thought about investing in. UPS doesn’t operate in a flashy category, it’s a boring business, and they aren’t redefining how businesses operate. UPS is a critical part of our infrastructure and does a great job at generating Free Cash Flow (FCF) and paying dividends. UPS is approaching Dividend Aristocrat status and looks extremely undervalued at today’s level. UPS is a company that will continue to print billions of FCF, distribute billions of earnings back to shareholders in the form of dividends, and should rebound after the market’s bottom. I believe UPS is a dividend growth and capital appreciation opportunity that also provides a margin of safety for investors.

Seeking Alpha

UPS has been growing its top line and there could be more growth ahead for UPS

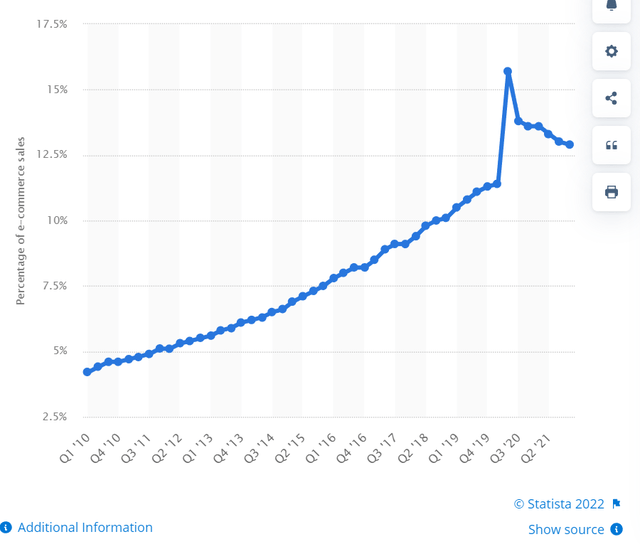

We’re so used to seeing UPS, FedEx (FDX), and Amazon (AMZN) Prime trucks on the road that we often assume that e-commerce has taken over physical retail. The actual stats about how much of the annual retail spend is attributed to e-commerce is quite interesting. In the United States, since Q1 2010, the total market share of retail sales that e-commerce represents has grown from 4.2% to 12.9% at the end of Q4 2021. In Q2 of 2020, e-commerce sales in the United States reached their highest level as the percentage of retail sales it represented was 15.7%, an increase of 4.3% from Q1 2020 11.4% level. As the United States reopened, e-commerce saw decreases in market share from its Q2 2020 peaks but still remained above the 11.4% level in Q1 of 2020. It looks like e-commerce is leveling off, representing 13% of retail sales in Q3 2021 and 12.9% in Q4 2021 within the United States. For many, this could be shocking as it may feel as if your normal shopping habits have trended toward online purchases over the past several years. The first time I looked at these stats, it was certainly surprising, but not as surprising as the projections over the next several years.

Statista

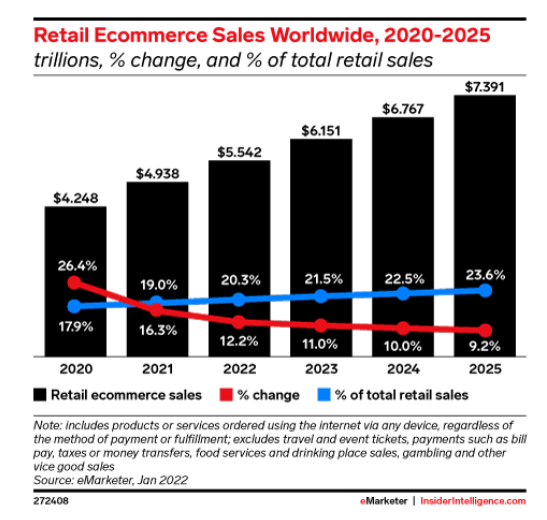

In 2022, global e-commerce is expected to break the 20% barrier of total retail sales for the first time. Over the next 4 years, e-commerce is expected to grow by $2.35 trillion or 49.67%. In 2022, e-commerce is projected to grow by $604 billion or 12.23%, then by $609 billion in 2023 (10.99%), $616 billion (10.1%) in 2024 and by another $624 billion (9.22%) in 2025. It’s not just e-commerce that will grow. Retail sales, in general, will grow from $26.03 trillion to $31.27 trillion over the next 4 years as well. These statistics are coming from Insider Intelligence eMarketer, which was used in the Shopify (SHOP) Plus report.

Insider Intelligence

What does this mean for UPS? Both retail and e-commerce growth is critical for UPS’s top and bottom line. As global retail market sales increase YoY, more products will need to be moved from manufacturers and warehouses to traditional brick and mortar stores. As global retail sales increase, so will the percentage of e-commerce sales. Globally, e-commerce sales accounted for $938.22 billion in 2021 and are expected to rise 85.91% ($806.06 billion) to $1.74 trillion in 2025. Over the next 4 years, global retail sales are projected to increase by $2.45 trillion, while e-commerce increases by $806.06 billion.

The additional growth across retail sales should positively impact UPS’s top line as transportation needs will increase across the board. Companies will need more materials transported to create products while transporting finished products to retail outlets, and consumers will also increase. UPS is an intricate part of the commerce ecosystem, and as it grows, so should UPS.

UPS is a growing cash-generating machine with a fortress balance sheet.

UPS may be a boring transportation company, but it continues to grow. Over the previous 5 years (the TTM counting for the 5th year), UPS has increased its annual revenue by $32.17 billion (48.32%) to $98.76 billion. There is a strong correlation between YoY retail sales growth and UPS’s revenue growth. In the same period, UPS increased its gross profit by $10.92 billion (83.2%), which has led to an improved gross profit margin. At the close of 2017, UPS had a 19.72% gross profit margin, and in the TTM this has grown by 4.64% to 24.36%.

When it comes to profitability, I look at net income, and FCFUPS grew its net income by $5.86 billion (119.37%) over the previous 5 years and improved its profit margin by 3.53% to 10.9%. Historically, over the previous decade, 2021 was the only full fiscal year where UPS generated over $10 billion of net income, and this still holds true in the TTM.

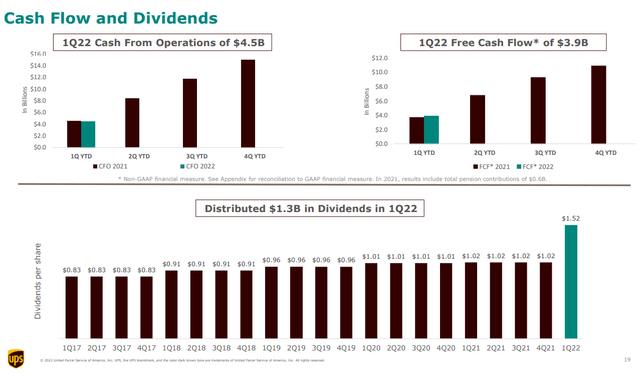

I have been a believer in putting a larger emphasis on FCF than net income. FCF is a measure of profitability that excludes the non-cash expenses of the income statement and includes spending on equipment and assets as well as changes in working capital from the balance sheet. FCF could be the most underrated and important financial metric to look at as this is the pool of capital companies can utilize to repay debt, pay dividends, buy back shares, make acquisitions, or reinvest in the business. UPS has been generating large amounts of cash from operations and FCF for years. In the fiscal year 2018, UPS generated $12.7 billion in cash from operations, spent $6.28 billion on CapEx, and produced $6.43 billion in FCF. In the TTM, UPS has generated $14.96 billion in cash from operations, spent $3.91 billion on CapEx, and generated $11.05 billion in FCF. Since the close of 2018, UPS has increased the amount of cash from operations it produces by $2.25 billion, reduced its annualized CapEx by -$2.38 billion, and increased its annual FCF by $4.62 billion.

UPS checks off all the boxes on the income and cash flow statements. This boring old company has improving margins, growing revenue, and growing profitability. It also has immense barriers to entry to fend off new competitors. It’s not realistic for most companies to handle their own shipping needs and external shipping companies fill the void. There is certainly competition from the United States Postal Service (USPS), FDX, and Amazon Prime, but it’s unlikely that a new company will emerge to try and steal market share away from UPS, FDX, and the USPS as it would take a large number of resources to build out the logistical infrastructure needed to compete.

UPS

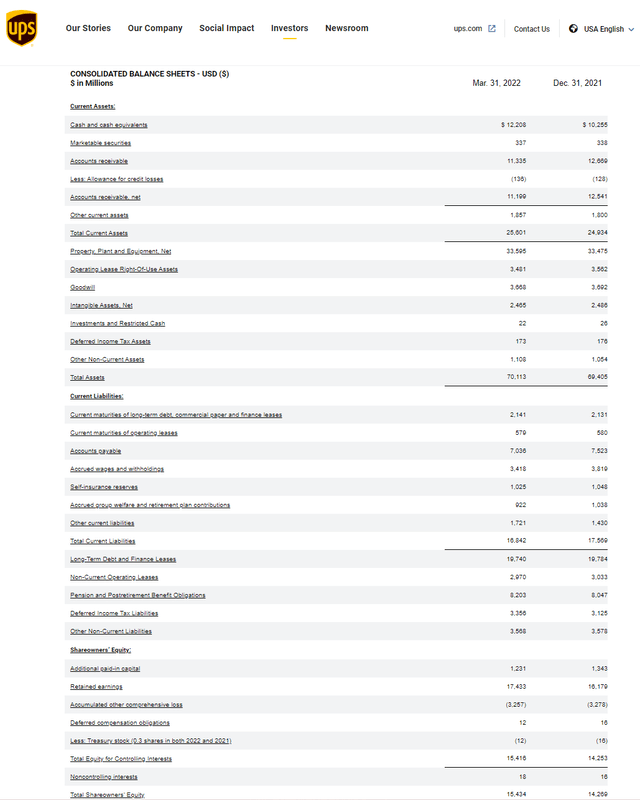

When I look through UPS’s balance sheet, there isn’t much to criticize. As of the last report, UPS had $12.55 billion in total cash and short-term investments on the books. UPS had $498 million in short-term borrowings and $19.44 billion of long-term debt under its liabilities. UPS has enough cash on hand to eliminate 62.95% of its debt with a single check. Without tapping its cash reserves, UPS could eliminate its debt with less than 3 years of the remaining FCF after paying its dividend. In the TTM, UPS has a payout ratio of 36.91%, which leaves $6.97 billion in FCF after its dividends are paid. If all of UPS’s remaining FCF after dividends was allocated toward its debt, it could eliminate 100% of its debt in 2.86 years.

UPS has also been reducing its outstanding shares over the years. At the close of 2012, UPS had 954 million shares outstanding, and as of the last report, UPS had 874 million shares outstanding. Over the past decade, UPS has eliminated 80 million shares, reducing its outstanding shares by -8.39%.

UPS

UPS is a Dividend Aristocrat in the making

To earn the title of Dividend Aristocrat the company must be in the S&P 500 index, have a market cap that exceeds $3 billion, and most importantly, raise its dividend for 25 years consecutively. Many investors like searching among Dividend Aristocrats for yield because these companies tend to have recession-proof products, allowing them to keep taking in profits and paying dividends even while other companies are struggling. The Dividend Aristocrat title is prestigious as dividend powerhouses with enormous FCF can fall off the list, such as AT&T (T). Dividend Aristocrats are normally solid companies. If you have paid and raised your dividend for 25 consecutive years, you understand your business well and can predict future cash flow to a certain degree. There are currently 65 companies holding the Dividend Aristocrat title.

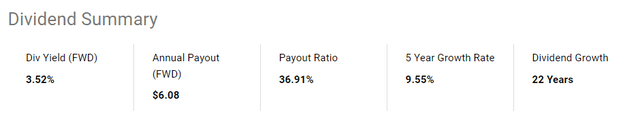

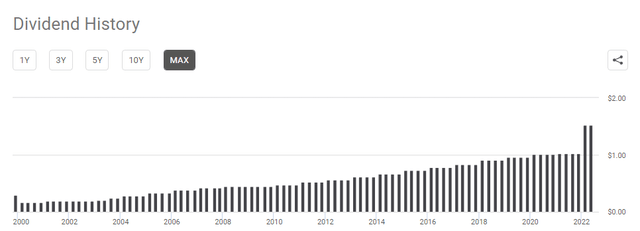

UPS has grown its dividend for 22 consecutive years, placing it on track to becoming a Dividend Aristocrat in 2025. UPS rewarded shareholders in a big way this year by increasing the annual dividend by 49.02% as it was raised from $4.08 to $6.08. UPS was always a slow dividend grower, providing modest increases, but in 2022 UPS allocated a larger portion of its FCF to the dividend program. Even after the large increase in 2022, UPS still has a payout ratio of 36.91%, which indicates there is more than enough room for future dividend increases. I wouldn’t expect monster increases anytime in the next several years, but I would expect UPS to return to its previous modest annual increases and continue rewarding shareholders with a larger portion of their annual FCF being allocated in back in the dividend.

Seeking Alpha

Seeking Alpha

UPS is on sale and this opportunity may not last

UPS has provided a slim margin of comfort as its declined by -18.43% YTD compared to the S&P’s -22.13%. UPS has declined by -$59.56 (-25.48%) per share since its 52-week highs, as it looks like a bottom may start to form. It’s too early to tell, and if the market has another downward turn, UPS will likely follow it down further, but shares are looking very attractive.

Seeking Alpha

UPS is currently trading at a 14.16 P/E ratio with a forward P/E of 13.50. The analysts are estimating that UPS will generate $12.79 of EPS in 2022 and $13.32 in 2023. This is important because it established a positive growth trend and strong future earnings. UPS has established a record of quarterly beats on its EPS and based on analyst’s estimates, that track record should stay intact throughout 2022. When I think about the projections for the retail landscape, I believe UPS can string together several years of increased EPS generation. A current P/E of 14.16 for a company of UPS’s size and ability to grow earnings looks cheap, as I think UPS could trade at 20x earnings and still be a value stock.

UPS has a current market cap of $151.21 billion. In the TTM, UPS has generated $11.05 billion in FCF. Every investment is the present value of all future cash flow. This is why investors should look at the price to FCF valuation and want to pay the cheapest multiple for a company’s FCF. Many investors don’t think about this, but if you were buying an entire company, would you pay $1 million for a company that generates $50,000 in FCF? Without FCF growth, it would take 20 years to generate your initial investment in FCF. Some of the most well-known and sought-after companies are trading at over 100x their FCF; their FCF is growing, but some of the multiples are quite expensive. Many value investors look at any company under a 20x FCF multiple as the threshold for being classified as a value stock. Today, UPS is trading at 13.68x its FCF ($151.21B market cap / $11.05B FCF). As a comparison, FDX is trading at 17.79x its FCF ($53.59B market cap / $3.01B FCF).

Even though the markets have sold off, UPS looks to be in deep value territory. UPS is a staple in the American economy and is intricate in its day-to-day operations. From a valuation standpoint, a 14.16 P/E and trading at 13.68x its FCF looks to be a great deal. This is also a company that is paying investors a dividend that is yielding 3.52% with future growth ahead of it.

Conclusion

The market sell-off has created many long-term opportunities, and UPS should be on that list. UPS is a well-run, established company that is intricate throughout society. Over the years, UPS has proven it can grow its revenue, improve its margins, and produce large amounts of cash from operations resulting in billions of FCF. As the retail sector grows in addition to the projections for overall GDP growth, UPS should maintain YoY revenue growth, translating to its operations generating more cash. The analyst estimates indicate that UPS will produce growing EPS over the next several quarters, and at a 14.16 P/E ratio and a 13.68 FCF multiple, UPS looks undervalued. In 2025 UPS will be added to the Dividend Aristocrat list as they have provided over 2 decades of annual dividend growth. UPS is currently yielding 3.52% as its share price has declined throughout 2022. The market is presenting us with an opportunity to buy one of the great American companies on sale, and there is nothing not to like about UPS at these levels. I think we will see UPS over $200 again before the close of 2022.

Be the first to comment