Editor’s note: Seeking Alpha is proud to welcome The Big Spike as a new contributor. It’s easy to become a Seeking Alpha contributor and earn money for your best investment ideas. Active contributors also get free access to SA Premium. Click here to find out more »

Alistair Berg/DigitalVision via Getty Images

UP Fintech (NASDAQ:TIGR) presents enormous upside for investors looking for a high-growth stock or short squeeze opportunity. Its all-time low valuation multiple presents an attractive risk/reward ratio in the event of an upward reversal to its 52-week high of $29.93. That represents more than a fivefold increase from the current price of $5.48. Moreover, it’s a promising stock with growing revenue, and its financial metrics have been improving from quarter to quarter. Its outlook remains bright, with operating expenses projected to decline due to its effort to vertically integrate its business and growing demand for its services in its target market. This article will also analyze TIGR’s related party transaction and its execution and clearing costs outlined in its third-quarter financial 2021 results.

Company Overview

TIGR is a rising star in the brokerage industry, which is mainly dominated by traditional banks that have outdated apps with poor user interfaces, and some of which are poorly built overall. TIGR currently has licenses to operate in the United States, Australia, Singapore, New Zealand, and Hong Kong. As per its Q3 2021 report, TIGR has recorded 612,000 accounts with deposits in Q3 2021 compared with 214,700 recorded during Q3 2020. TIGR received more than 80% of its income outside of China, according to its Q3 earnings report.

TIGR brands itself as a low-cost retail brokerage firm that emphasizes a “mobile-first strategy” and superior user experience. Apart from its main brokerage business, TIGR also generates revenue from margin financing, investment banking (underwriting), IPO subscription, and ESOP management. Its investment banking arm has provided underwriting services to XPeng (XPEV) and other Chinese firms for their U.S. and Hong Kong listings. Its underwriting segment is improving and is expected to contribute to 2022 revenue.

Its ESOP management arm currently has 262 clients, including the 46 new clients added during Q3 2021. TIGR is backed by Interactive Brokers (IBKR), legendary investor Jim Rogers, and Xiaomi (OTCPK:XIACF). It has been aggressively expanding in recent months through acquisitions and launching its services in the U.S. and other markets. TIGR is expected to shine with its cutting-edge app, primarily in countries where traditional players with outdated apps dominate the retail brokerage industry.

TIGR’s Competitive Advantage

On the retail brokerage side, TIGR’s competitive advantages are its cutting-edge app with a modern user interface, its low commission business model, and its IPO subscription to their underwriting clients such as XPeng. The meteoric rise of Robinhood Markets (HOOD) among Millennials and the working class in the U.S. validated the business concept of low-commission brokerages, and Asia is currently the untapped market of low commission brokerages. Traditional banks and brokerage houses dominate the retail brokerage landscape in many countries, with a traditional brokerage business model where retail traders are confronted with high entry costs. TIGR charges a minimum of $1.99 per trade, while most traditional brokerage companies still charge a minimum brokerage fee ranging from $18 -$30. TIGR’s pricing structure allows its investors to invest more frequently and diversify their share portfolio. Its average “first-timer” deposits are around $5,000, according to its Q2 earnings transcript, and high brokerage fees would certainly discourage investors from doing that.

TIGR’s Southeast Asia target markets are Singapore and Hong Kong, both of which are high-income nations with GDP per capita of $59.8 thousand and $46.3 thousand, respectively, according to the World Bank. Despite having a high GDP per capita, the house price/average income ratio in Singapore and Hong Kong stands at around 17.5 and 47 respectively, while the U.S. ratio is approximately four. Therefore, equities will still be an attractive wealth-building option for the ever-expanding middle and working-class due to the lower cost of entry compared to real estate.

A 2021 research study by DBS (Development Bank of Singapore) shows that the attractiveness of property as an investment asset class is declining due to high acquisition costs and lack of diversification. The study also indicated that the S&P 500 exhibited the highest growth of invested capital compared to property assets since the first quarter of 2009. According to the UOB Asean Consumer Sentiment Study, 51% of Singaporeans indicated that they are choosing to buy more stocks and bonds, and 46% of Singaporean Millennials indicated that they allocated more money into investments in the past six months and plan to invest more. This trend will increase TIGR’s number of funded accounts and the average account size as investors’ appetite for shares grows.

Moreover, TIGR has a proprietary mobile and online trading platform with cutting-edge functionality and user interface. In the case of Singapore, TIGR’s app received significantly higher reviews in the App Store than the apps offered by traditional brokerage houses. According to the latest App Store and Google Play reviews, the DBS Vickers Securities and the Standard Chartered (OTCPK:SCBFF) trading apps received less than three out of five stars, while TIGR received more than four out of five stars. In addition, TIGR also has the first-mover advantage because many traditional brokerage companies outsource third-party software companies to create their apps or platforms.

TIGR app also offers a better ease of use as it allows retail traders to trade instruments on multiple exchanges instead of using a different app or transferring money to different custodian accounts, which is the case for Commsec – the Commonwealth Bank (OTCPK:CBAUF) trading platform. For example, the Commsec trading app by Commonwealth Bank Australia requires users to have two different platforms to trade Australian and U.S. shares as its U.S. shares trading is conducted through NetExchange, while the Australian equities are traded through its proprietary platform. Customers will have to deposit into a Pershing bank account in advance in order to trade U.S. financial products, and it might take up to two days. Commsec’s U.S. trading platform is not proprietary and it licenses Netexchange to use its platform.

Commsec also licensed Pershing for trade execution, clearing, settlement, and custody of international securities for its U.S. trading platform. It is common for traditional brokerage companies to use third-party custodians and clearing facilities. On the other hand, TIGR’s app can support trades across multiple currencies, markets, products, execution venues, and clearinghouses.

TIGR has also acquired a clearing house as part of its self-clearing infrastructure investment to vertically integrate its business and give itself a competitive advantage over its peers when executing U.S. equities. It acquired a self-clearing broker (TradeUP, formerly known as Marsco) back in 2019, and currently 70% of TIGR clients’ trades are cleared by TradeUP. The synergy from the acquisition has already been reflected in its Q3 financial statement, where “the more efficient self-clearing margin operation given lower margin balance in the third quarter versus the second quarter.” TIGR execution and clearing expenses for its Singaporean brokerage operations are also expected to decline in the coming years as it became a SGX trading and clearing member last October. Prior to being a member, it used an external custodian for its operations for its client assets.

TIGR is currently aiming to gradually move from IB clearing for HK securities to their self-clearing in HK to reduce clearing expenses. TIGR’s attempts to vertically integrate its trading platform would translate into higher profit margins in the future. Moreover, the recent acquisition of Ocean Joy Securities Limited (a Hong Kong licensed broker-dealer regulated by the Hong Kong Securities and Futures Commission) will enable TIGR to move from Interactive Brokers clearing to self-clearing gradually.

Investment Banking (Underwriting) and ESOP Management Arm

Despite being labeled as the “Robinhood of Asia” by The Wall Street Journal, TIGR’s business model is more than just a pure-play brokerage business. TIGR currently generates secondary revenue from underwriting and ESOP business. TIGR has underwritten more than 60 Chinese ADR listings and served as an underwriter for several high profile Chinese ADR listings, such as XPeng (secondary listing in Hong Kong). TIGR participated in five IPOs in Hong Kong and the U.S. in the third quarter (despite 2021 being a slow year for Chinese IPOs). Its underwriting business will complement its brokerage business by allowing its users access to participate in IPOs underwritten by TIGR. The recent reassuring statements from the Chinese government might once again spur overseas listing and boost TIGR’s underwriting revenue. The TIGR ESOP management arm currently manages 262 clients, with 46 new clients added during the third quarter.

Interest Income

TIGR’s financing service fees and interest income make up the company’s second largest revenue category after commissions. They reported revenue of $6,986,841 and $50,067,532, respectively, for the nine months ended Sept. 30, 2021. TIGR’s financing service fees were up 51.7% and interest income was up 116% compared to the same quarter last year (ended Sept. 30, 2020). In addition, TIGR’s total margin financing and securities lending balance have grown by 49.1% on a year-on-year basis, reaching $3 billion and making $20.1 million during the March quarter.

Interest rates are expected to rise in 2022 as high oil prices get further exacerbated by the conflict in Ukraine, retaliatory sanctions, and supply shortages. Goldman Sachs predicts that the Federal Reserve will raise interest rates seven times this year to contain U.S. inflation. It projects a 25-basis-point hike in each of the seven remaining meetings this year. The interest rate hike could translate into higher margins for TIGR’s margin lending division. Despite the recent fear-mongering sentiment about the Federal Reserve rate hike, TIGR’s current USD financing interest rate of 4.33% is still below the current U.S. inflation rate of 7.5%. In my opinion, TIGR’s margin lending division is expected to grow as real interest rates still remain negative if we take inflation into account and margin lending is still an attractive option for investors to grow their portfolios. The interest rate hike could be translated into higher financing service fees and interest income.

Declining Trend of Related Party Transactions

According to TIGR’s 2020 Annual Report published in April 2021, the company offers two types of accounts to its customers: consolidated and fully disclosed accounts. Consolidated accounts “offered more functions, products and services than fully disclosed account customers.” TIGR has also indicated that it would like to increase the number of consolidated accounts as most of the increase in interest related income can be attributed to the growth in consolidated accounts, as per its 2020 fourth-quarter financial highlights.

Increasing the share of consolidated accounts will have the effect of lowering operating costs as TIGR plans to increase its self-clearing and move HK equities to self-clearing and rely less on IB for HK equities clearing, which will increase the margins due to the synergies created. The percentage of TIGR net revenues that were executed and cleared by Interactive Brokers has decreased significantly from 99.5% in 2017 to 78.4% in 2019, according to the 2020 Annual Report.

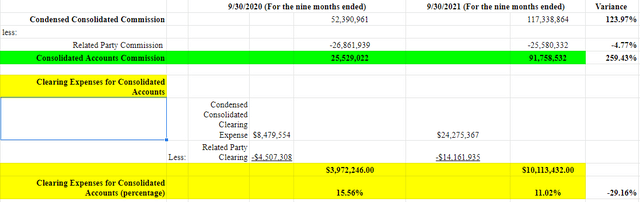

TIGR’s Q3 2021 consolidated statement of comprehensive income consists of multiple related party transactions, mainly arising from commission and execution and clearing expense for fully disclosed accounts. Related party transactions as a percentage of consolidated revenue have been decreasing due to the growth of consolidated accounts. The percentage of consolidated revenue arising from fully disclosed accounts has decreased from 51.27% (for the nine months ended Sept. 30, 2020) to 21.8% (for the nine months ended Sept. 30, 2021). Despite the consolidated execution and clearing costs increasing by nearly 300%, from $8,479,554 to $24,275,367, the execution and clearing costs as a percentage of consolidated accounts commission have actually decreased. In the table below we can see that consolidated accounts commission experienced more than 250% growth, while the clearing expenses for consolidated accounts decreased by nearly 30% as a percentage of consolidated account commission. It is evident that the synergies of its acquisition efforts and vertical integration efforts are starting to pay off.

Please note that condensed consolidated account commission refers to the commission revenue arising from the account type, while consolidated commission refers to its total commission for the period.

TIGR’s Related Party Transaction Analysis (Author)

Valuation

TIGR currently has 1.77 million accounts with 612,000 being funded accounts. TIGR CEO Wu Tian Hua expects the total funded accounts to reach 1 million in 2022, an increase of approximately 63%. However, it stresses that some of those accounts are not funded due to Chinese restrictions, and they haven’t started acquiring customers in some countries where they have obtained a license to operate. TIGR has a net profit margin of 9.92% for the nine months ended Sept. 30, 2021, and an ARPU (funded) of $330.54. Assuming TIGR is able to achieve the 1 million total funded accounts in 2022 with an ARPU of $330.54, 9.92% net profit margin, and current P/E ratio of 20.39, it will have a valuation of approximately $620 million, which implies a 33% upside from the current market cap of $465.96M.

TIGR’s historical P/S ratio ranges from the current 2.4 to 18.58, while its P/E ratio ranges from its current 20.39 to 233.71. The bullish catalysts for TIGR valuation to revert to its historical high could be the normalization of Chinese ADR appetite or a short squeeze. TIGR is valued at a P/S and P/E ratio of 18.58 and 233.71, respectively, before the Chinese ADRs sell-offs in the third quarter of 2021. According to Seeking Alpha, TIGR has a three-year annualized revenue growth of 97.01%, complemented by its rapidly growing ESOP and underwriting business. TIGR presents a deep value and growth opportunity in the event of improved appetite for Chinese ADRs, where we might see a reversion back to its historical multiple.

High Short Interest for High-Performing Stocks or Chinese ADRs

Despite many positive catalysts for TIGR’s major income streams, TIGR is currently heavily shorted with short interest reaching 27.28% of the float. Its short interest is extremely high compared to Chinese ADRs, where most of them – such as Alibaba (BABA), HUYA (HUYA), Sohu (SOHU) – have less than 5% of their outstanding shares shorted. At the time this was written, TIGR shares traded at $3.91 with a market cap of $465.96M and 151.28M outstanding shares. Approximately 16 million shares are currently being shorted out of the 58.8 million shares float, and the shorts account for almost four times the average daily volume.

To put this into perspective, the low market cap and risk/reward profile present an attractive investment opportunity for retail and institutional traders looking for growth or a short squeeze opportunity. Its fundamentals are unlike most mainstream short squeeze counterparts with bloated balance sheets and poor CAGR (or declining annual revenue), such as GameStop (GME) and AMC Entertainment (AMC).

It must be noted that the depressed share price is not due to business outlook or fundamentals, but the sentiment surrounding Chinese ADRs. However, the sentiment toward Chinese ADRs is improving as the government is providing relief to alleviate several market concerns and changing its stance on U.S. stock market listing. Most Chinese ADRs, such as Alibaba and Tencent (OTCPK:TCEHY), rebounded by more than 20% briefly after the news.

Risks

Regulatory headwinds

Despite a compelling turnaround story, Chinese ADRs might face regulatory pressure from both the U.S. and Chinese authorities on multiple fronts. The tone of the Chinese government toward ADRs might change or U.S. regulators (e.g., the U.S. Public Company Accounting Oversight Board) might target TIGR for a financial audit, which would trigger a mass sell-off. In addition, their underwriting business might also suffer a further decline. TIGR’s third-quarter other revenue, which mainly consists of underwriting revenue, was down 19% year over year and 30% quarter over quarter due to a weak IPO market, as investors are reluctant to participate in the Chinese ADR listing due to the uncertainty. The Chinese authorities deem these U.S. regulations as politically motivated and “positive progress” has been made in talks. Chinese security regulators also reassured investors claiming that they would reach an agreement with U.S. authorities to solve the auditing issue.

Loss of Market Share

Low-commission brokerage is still in its infancy in many parts of Asia where TIGR generates a majority of its revenue, and there is a huge total addressable market. However, multiple fintech companies such as Futu Holdings (FUTU) also operate in the same market. However, TIGR has been spending aggressively on marketing and branding, spending 40.6% of its commission revenue on advertising, while Futu spent 34.5% of its brokerage commission on its “selling and marketing expenses” as per their respective third-quarter report. If, for instance, TIGR decides to increase its advertising expenses in a bid to increase its market share, its profit margins might decline in the future, decreasing its market capitalization at the same valuation multiple. However, with its price/earnings ratio at a historical low, I believe the growth in those valuation multiples will outpace the decrease in earnings.

If a price war does occur with Futu Holdings, TIGR might also be able to remain competitive because it has a similar execution and clearing fee as a percentage of commission – 20.69% for TIGR and 15.85% for Futu. This ratio is expected to decline for TIGR in the upcoming quarters as it improves its self-clearing capabilities, decouples from Interactive Brokers clearing, and reduces its related-party transactions.

Conclusion

TIGR presents investors an opportunity to invest in a high-growth company with strong fundamentals at a low valuation multiple. Its consolidated revenue is expected to grow significantly in the near future, complemented by the growth in interest income and underwriting income. The sentiment toward Chinese ADRs is starting to improve and TIGR’s low valuation multiple is expected to revert to a higher historical multiple. Its high short interest ratio, coupled with a market cap below $500 million, also qualifies as an attractive short squeeze candidate.

Be the first to comment