scanrail

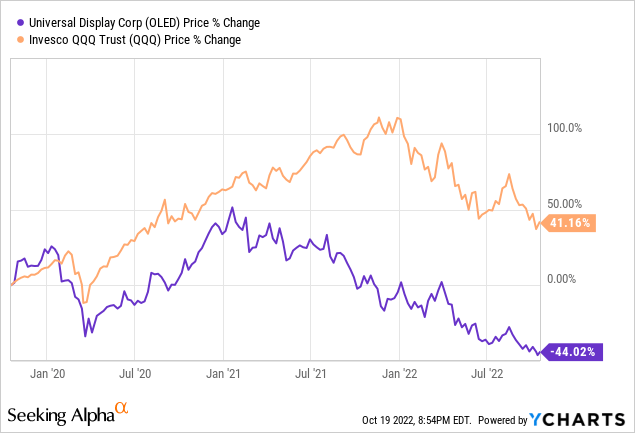

On a stock market time clock, 2020 is an eternity away. In Nov. 2020, Universal Display (NASDAQ:OLED) traded above the $200 level. In Aug. of that month, this supplier of organic light-emitting diodes held that $200 price. This year is an entirely different story. The Federal Reserve fell behind in its battle against high inflation. It raised interest rates by 75 basis points in each of its three meetings since June.

Universal Display (“UDC”) is trading at half its price since 2020. How do the company’s prospects change after it reported second-quarter 2022 results?

Customers Lower Order Forecasts

In Q2/2022, UDC posted revenue of $136.6 million and GAAP earnings per share of 87 cents. Chief Financial Officer Sidney D. Rosenblatt said that customers lowered their order forecasts in the summer. As a result, Universal Display cut its 2022 revenue forecast to $600 million. The CFO cited macro headwinds potentially hurting demand.

In the first quarter, Universal Display reiterated its 2022 revenue of $625 million to $650 million.

Despite the short-term uncertainties, the company’s strong balance sheet will enable it to get ahead of the market. For example, it will expand its materials and technologies portfolio.

Above: OLED stock fell more than the Nasdaq (QQQ) index in the last three years.

During the quarter, a deterioration in the global market economy hurt demand for OLED products that used its emitter material. Revenue fell to $71.9 million, down from $77.4 million last year. Universal Display derives most of its revenue from royalty and license fees. This rose to $60.3 million. It reduced its forecasted sales volume over the contract life. Material costs did not rise in the quarter.

2024 Opportunity

Patient investors should treat UDC’s near-term headwinds as a chance to pick up shares. The company partnered with Armstrong World Industries and various universities to demonstrate two phosphorescent OLED (“PHOLED”) luminaire systems. No other firm in the U.S. achieved this critical step in solid-state lighting.

Funded by the U.S. Department of Energy, UDC partnered with Moser Baer Technologies to achieve the same goal. The difference is that the companies are developing undercabinet lighting.

On the conference call, President and Chief Executive Officer Steven Abramson reaffirmed the company’s inventions in the new OLED phosphorescent emissive materials. Customers get better performance that meets their specifications. It will include next-generation reds, greens, yellows, and hosts. Blue is progressing. As a result, UDC will have phosphorescent blue by the end of this year. By 2024, it will have the phosphorescent RGB stack ready for the commercial market.

CEO Abramson said, “ We believe that the commercial introduction of our full color misses stack will unlock a vast array of opportunities for higher energy efficiency and higher performance across a broad range of OLED applications.”

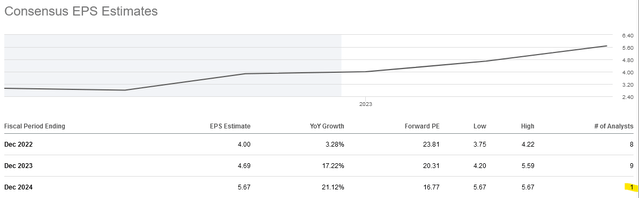

According to analysts, UDC will earn $4.00 a share this year. By Dec. 2024, its EPS will rise to $5.67 a share for a 21.12% year-on-year growth.

SA Premium

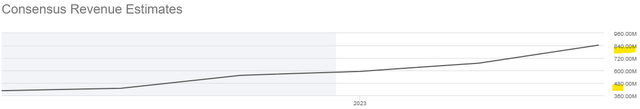

Per the above, be advised that only one analyst offers the 2024 EPS estimate. Still, the forecast is achievable. Revenue will almost double by 2024:

SA Premium

Risks

Inflationary pressures persist. This will pressure UDC’s material gross margins. The firm is forecasting gross margins at the low end of its 65% to 70% range. Since this value varies greatly in the near term, treat the next quarter’s potentially lower margins as noise.

UDC is solidifying its lead in Asia and Europe. However, high inflation driven by energy costs may slow customer projects. Despite the macro risks, the company is committed to leading the market in those two continents.

In the second quarter, demand for electronics in Asia, especially China, weakened. Inflationary pressures will hurt consumer spending and demand. The company will rely on companies like Samsung to navigate product demand weaknesses.

The company will expand its presence in the OLED TV market. Television manufacturers are increasing investments having OLED. They want higher energy efficiency and higher performance across a broader range of OLED applications. Separately, in the metaverse, wearable gear (AR/VR) could incorporate OLED.

Stock Score

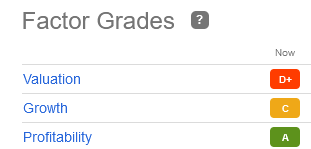

OLED stock has mixed grades. It scores poorly on valuation with a D+.

SA Premium

Growth is modest while the company has a strong profitability score. The grades suggest that fearful investors could panic sell shares in the coming weeks and months. Investors who do not react may increase their position if the stock price weakens.

Your Takeaway

OLED is a key technology for the electronics industry. Smartphones continue to innovate in features. They will embrace Universal Display’s latest offering. OLED televisions are also a long-term opportunity. The wearables market, including augmented reality and virtual reality, is in its infancy. Those sectors could expand UDC’s addressable market in the coming years.

Be the first to comment