loveguli

Universal Display Corporation (NASDAQ:OLED) is a New Jersey-based developer of OLED technology or organic light emitting diodes. The company is best known for supplying key display technology to many of the mobile devices we use on a daily basis. The company owns over 5,500 patents and currently has a market capitalization of $5.7 billion. The recent market volatility has brought this stock down to multi-year lows, which presents investors with a rare opportunity.

Company Profile

Universal Display Corporation owns several patented technologies that compose its core product and service offerings. Its Flexible OLEDs or FOLEDs are novel technology that allow for a flexible and stronger screen on devices. While this technology is still in its infancy, they are already being incorporated into screens of new smart devices, albeit with minimal flexibility from the user’s perspective. The new line of foldable smartphones from Samsung has incorporated this technology.

Oled Presentation

The White OLEDs or WOLEDs are revolutionizing the lighting industry. These OLEDs have the potential to reach an energy efficiency that far surpasses standard light bulbs, which have the equivalent of about 12 lumens per watt of usage. WOLEDs can potentially offer an efficiency of up to 150 lumens per watt, significantly decreasing the 15% of global energy consumption that lighting accounts for.

Perhaps most promising is the company’s Universal PHOLED Materials segment, which uses phosphorescent OLED materials, which account for much lower energy consumption. PHOLEDs are up to four times more energy efficient than fluorescent OLEDs, and have several benefits for both the consumer and the manufacturer. PHOLEDs provide higher vibrancy in color presentation, have record-breaking energy efficiency performance, and offer much longer operating lifetimes than traditional fluorescent OLEDs. Not only is this the core product offering from the brand, but it has helped to strengthen the sustainability of the company’s footprint.

Company Outlook

OLED’s second quarter 2022 revenue was $136.6 million, and operating profit was $53.3 million, with net income of $41.5 million and earnings of $0.87 per diluted share. The second quarter started off on a solid note. OLED’s customers have lowered their expectations as the summer approaches, given the downward trend in forecasts and revisions due to the hawkish Fed and supply chain challenges with China. This caused the company to lower its 2022 revenue forecasts to approximately $600 million.

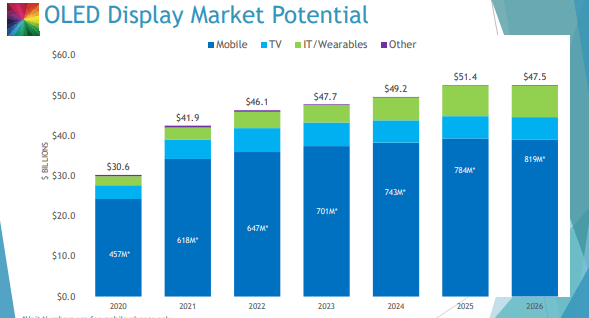

The near-term headwinds are expected to continue weighing on the economy and impact consumer spending, but long-term trends and the firm’s robust pipeline continue to improve. As the OLED industry continues to evolve and expand, all major industry roadmaps remain promising, and there is every sign growth will continue on the other side of the Fed tightening.

Recent reports are revealing that Samsung, LG Display, DOE, Tianma, China Star, and Vision RX are all looking into new investment plans. This new surge in capacity is expected to be beneficial for the OLED industry.

Panel manufacturers are working on new technologies in addition to their capital investment plans. This includes LTP for backplanes and tandem OLED-material structures for OLED TVs. This is consistent with increasing digital adoption trends globally.

Universal Display Corporation has also partnered with the juggernauts of the tech industry. Its technology is found in the latest models of smartphones and smartwatches from both Samsung and Apple (AAPL). In larger products, OLED’s materials are used in high-definition smart televisions for LG, Sony Bravia (SONY), and Samsung, while it is also found in the laptop screens for Samsung, Lenovo, and Asus. Finally, its OLED products are also powering the screens for the Nintendo Switch platform and the touchscreen dashboard systems for both the passenger and driver in the all-new Mercedes EQS luxury sedan.

The stage is being set for the market’s next growth phase. In the face of recent economic uncertainties, consumer demand is expected to be restrained in the near future. Today there are many expanding panel manufacturers entering commercial large and medium area OLED production, with an increasing number of companies investing in the manufacture of OLED products.

Valuation and Forward-Looking Commentary

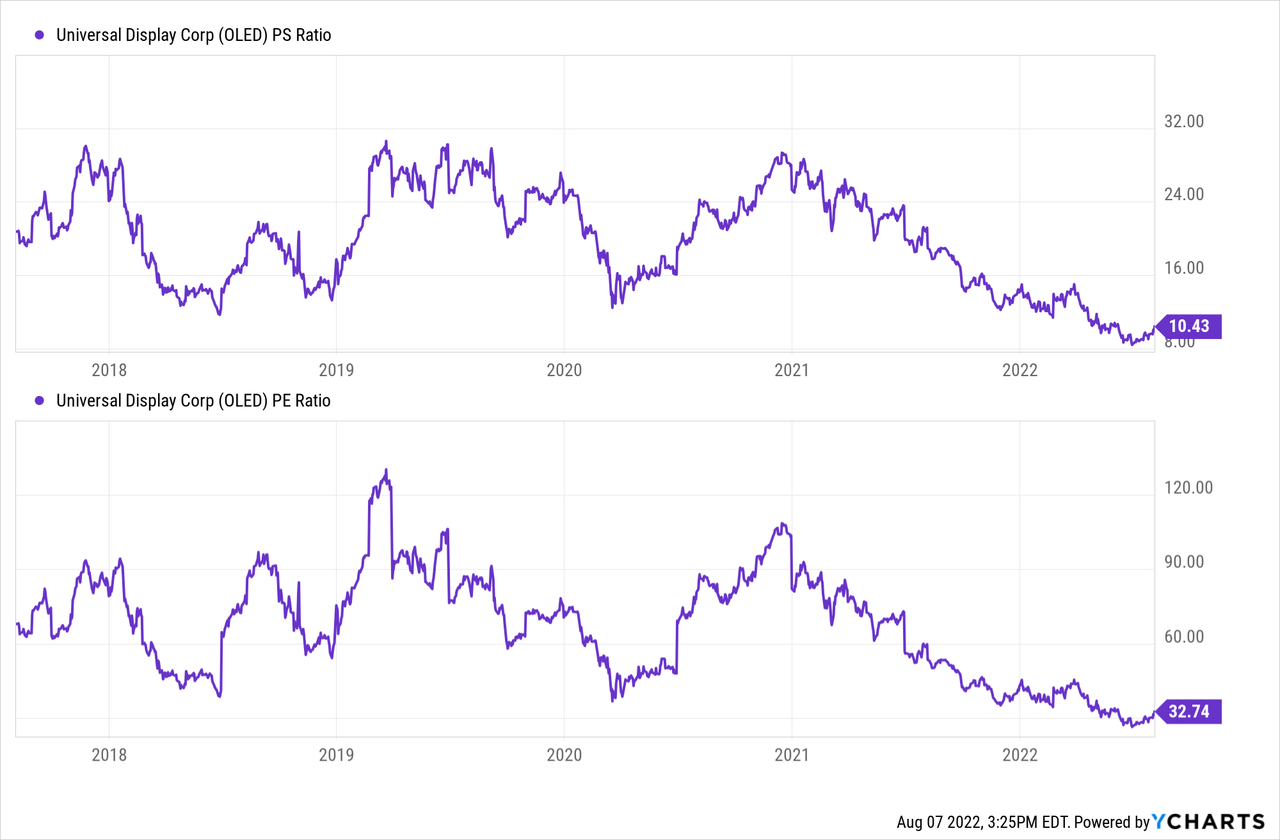

OLED was a high-flying tech company in recent memory, but the hikes by the fed rewrote the valuation story across the board for tech companies. The result is high-quality companies like OLED trading at remarkably low multiples relative to historical levels. Investors will argue that this alone should be enough to indicate value at current levels, but OLED offers even more with affiliation with high-growth markets that are being fueled by secular growth trends. We can see that the stock is currently trading at the low end of its historical range for many of the key valuation multiples.

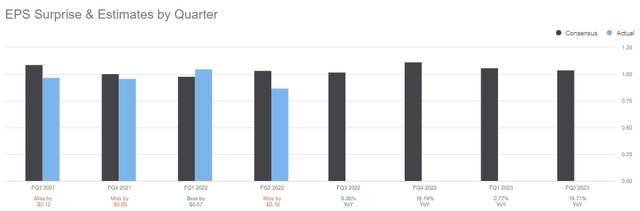

We can also see that the company does a somewhat acceptable job at delivering on earnings expectations. There has been only one beat in the last four quarters, but despite clear macroeconomic headwinds, they have seen no shocks to the downside.

The company recently updated its revenue guidance to six hundred million dollars for 2022. Which I believe is a reasonable target as long as we don’t see financial shock over the next few quarters. The stock is currently trading at roughly $121 per share and has A PS ratio of roughly 10.5, which is a significant departure from the multiples in excess of 25 at the start though the calendar year 2021. The general expectation is that as the tightening cycle by the Fed comes to a halt, we should begin to see multiple expansion for high-quality technology stocks like OLED. It’s also possible for revenue improvements throughout the year 2023, but I believe investors should instead target the calendar year 2024 as a safer bet for robust revenue improvements. Once the conditions for growth stocks begin to ease on the macro-level, we should easily be able to get back to a price-to-sales ratio of 15 on high-quality stocks like these. If we target $600 million in revenue, then that should be good for a market capitalization of roughly nine billion dollars which would represent a price target of roughly $191 per share. We can then take a 20% margin of safety which leaves us with a price target of roughly $153 per share, Roughly 25% more than current levels.

The Takeaway

The opportunity is pretty straightforward for long-term investors here. OLED is a company that supplies key technology to high-growth firms that are backed by strong secular trends. Even if there is a recession or financial crisis, the company will likely make it to the other side just fine and continue to see strong tailwinds. Investors should feel very good about starting a position here I rate OLED as a strong buy.

Be the first to comment