ndcityscape/iStock via Getty Images

Universal Corp. (NYSE:UVV) is recognized as the world’s largest supplier of raw tobacco leaf. This is the company that sells to the major cigarette manufacturers leveraging its global supply chain that includes relationships with thousands of large and small growers in over 30 countries.

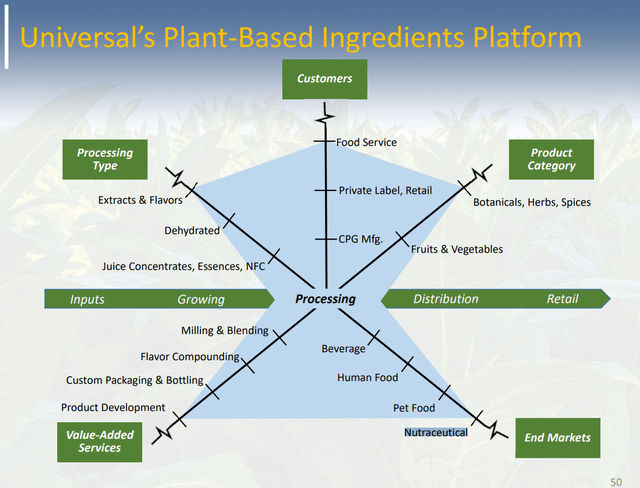

While the understanding is that tobacco is a “defensive” commodity with relatively steady demand worldwide, the attraction of UVV is its push into the “ingredients” business which includes supplying plant-based extracts to food processors and nutraceutical end markets. Indeed, Universal has expanded this segment through a series of acquisitions that are paying off by driving strong growth and adding to earnings momentum.

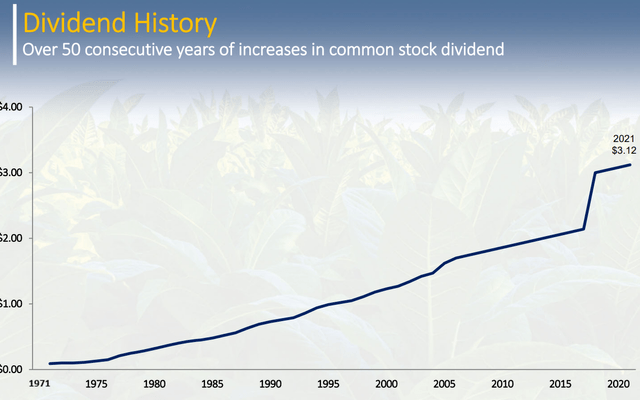

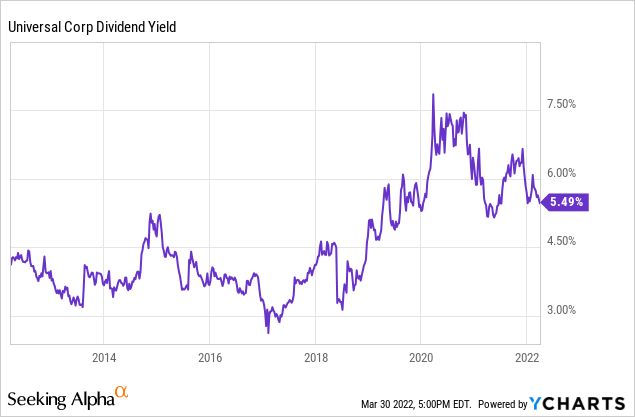

We are bullish on the stock with a view that while the core tobacco operation can continue to represent a steady source of cash flow, the real value comes from the opportunity in the ingredients business. Finally, we highlight that Universal is among a select group of companies with a 50-year history of increasing its annual dividend payout. With a current yield of 5.5%, UVV is a solid income idea that is supported by a positive long-term outlook.

UVV Key Metrics

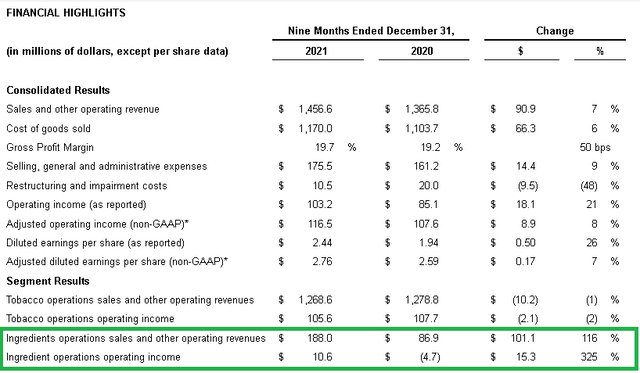

The company last reported its fiscal Q3 results in early February with non-GAAP EPS of $1.80. Revenue of $653 million was down 3% year-over-year although management explains this was due to the timing of large tobacco shipments in the period 2020.

The data through nine months better reflects the more positive underlying trends. underlying trends with revenues up 7% y/y while EPS of $2.76 compares to $2.59 over the period in 2020. The ingredient segment led growth with revenues climbing 116% y/y and now representing 13% of the total. Similarly, the segment operating income of $10.6 million has reversed a loss of -$4.7 million in 2020 which has contributed to the stronger profitability this year. So again, while the tobacco operation has been soft with a 1% decline in sales y/y, the company is expanding into a higher growth segment which is also contributing to higher margins.

source: company IR

Universal is seeing strong volume for its ingredients products in both human and pet food categories. Furthermore, there is also an aspect that benefits from trends in sustainability and demand for organic-based products. We expect these trends to continue.

For the year ahead, the company expects to see logistical challenges related to constraints across shipping and trucking in certain regions. Nevertheless, management projected optimism during the earnings conference call describing the core tobacco business as “robust with strong customer demand”.

source: company IR

Is UVV a Good Long-Term Investment?

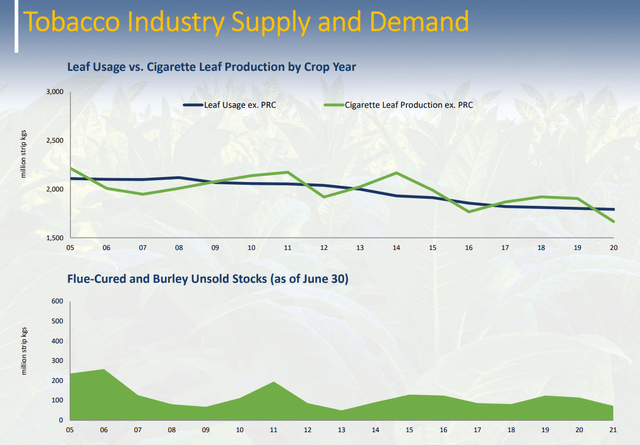

Despite rising global awareness of the health risks associated with cigarette and tobacco use, the data shows that the industry demand has been steady over the past two decades. To get a sense of Universal’s scale, the company controls approximately 30% of tobacco production from Africa, 20% in Brazil, and 40% in the United States.

source: company IR

There are an estimated 1.3 billion tobacco users worldwide with the United States representing less than 5% of the world market for cigarettes highlighting its demand in other parts of the world. Notably, while many users have shifted towards “e-cigarettes”, Universal also plays a critical part in the supply chain that manufactures the related tobacco flavored cartridges and other next-generation type of products. The point here is to say that the company’s market position is secured for the foreseeable future.

What we like about the expansion into the ingredients group is the effort at diversification which not only “future proofs” the business but also provides separate cash flow streams that are already contributing to positive earnings. We make the case that the outlook for Universal has never been stronger.

Is UVV a Good Dividend Stock?

We mentioned the company’s long dividend growth history increasing the annual payout every year since 1971. The annualized rate at $3.12, which yields 5.5%, represents an earnings payout ratio of about 76% on the EPS of $3.64 over the past year. We believe the dividend is well supported by the underlying operation and cash flow generation.

The last increase to the current rate of $0.78 per share came in Q2 of 2021 and investors can expect another increase this year, with the next announcement likely coming in May. A modest penny increase to $0.79 per share is our forecast.

source: company IR

UVV ended the last quarter with $99 million in cash and equivalents which compares to the annualized distribution of $76 million. The company has also generated around $60 million in free cash flow over the past year excluding acquisitions. UVV’s balance sheet is a strong point in the company’s investment profile.

Is UVV a Buy, Sell, or Hold?

We rate UVV as a buy with a price target for the year ahead at $66.00, which implies the dividend yield on the stock narrowing towards 4.75%. This is a level the stock previously traded at back in 2019 while we believe the momentum in the ingredients segment now adding a new layer of growth supports a higher valuation compared to its trading range over the past year.

In terms of risks, the company remains exposed to the global macro environment. Softer demand or significant disruption to its global supply chain could lead to weaker-than-expected results. Monitoring points for the next few quarters include the trends in margins and operating income to gauge the operating and financial momentum.

Be the first to comment