STRINGERimage/iStock via Getty Images

The buy thesis

Uniti Group (NASDAQ:UNIT) is the 8th largest fiber provider in the U.S. with 133,000 route miles and 7.8 million strand miles of fiber. I think UNIT is undervalued both from an asset and cashflow perspective.

The assets are valuable for 2 reasons:

- Demand is increasing as 5G rolls out and data usage continues to rise.

- Replacement cost has become insurmountable

UNIT is valued at just a fraction of replacement cost and an abnormally high AFFO yield which gives the stock upside from dividends, multiple expansion and/or a potential major asset or company sale.

Let us begin on the cashflow side of the analysis because the asset value is only relevant if the assets can generate revenues.

Income generation and growth outlook

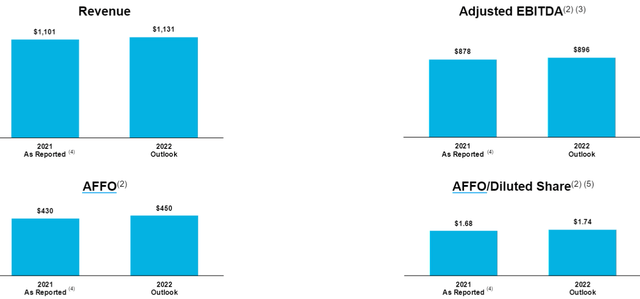

Earnings metrics are guided as follows:

- 2022 revenue of $1.131 billion

- 2022 Adjusted EBITDA of $896 million

- 2022 AFFO of $450 million

- 2022 AFFO/share of $1.74

Each of these metrics is up moderately from 2021.

Against a stock price of $9.83, $1.74 of AFFO represents an AFFO yield of 17.7%.

The average REIT has an AFFO yield of 4.23%, so as a runrate, capital invested in UNIT is generating about 4X as much cashflow.

If UNIT were to continue earning at this pace, it would obviously be undervalued. Clearly the market thinks earnings are going to come down substantially and the clear reason is the ongoing battle with Windstream.

Contractual revenues from Windstream will continue to increase over the length of the term, but eventually the lease will be renegotiated with arbitration expected potentially in 2027.

It is quite uncertain what the eventual outcome will be. Uniti says the lease revenues are fair while Windstream claims they need to come down substantially.

The basis of Windstream’s argument is that the copper portion of the network has depreciated substantially and this is true, but the fiber portion of the network has become exceedingly valuable. Even as Uniti owns the assets, Windstream has spent $1.1 billion in building out the fiber network, including $85 million already in 2022.

Investing $1.1B in one’s own network demands a certain return on investment but investing $1.1B in a network that someone else owns requires a much higher hurdle rate.

So I don’t really buy Windstream’s argument that the network isn’t massively valuable to them. If the network was not generating serious revenue for Windstream there is no way they would invest $1.1B in assets that they don’t even get to keep.

Looking at the cost basis of the network and the replacement cost of the network, I lean toward the current lease levels being fair. However, there is no doubt that it will get messy and be bad PR for everybody involved. I also do not deny the potential risk of a haircut somewhere in the vicinity of 30%.

That is a long way off and in the meantime Uniti is growing its non-windstream revenues quite nicely.

Growth is coming from 2 sources:

- Lease-up of existing fiber

- New-builds made more economic by existing fiber

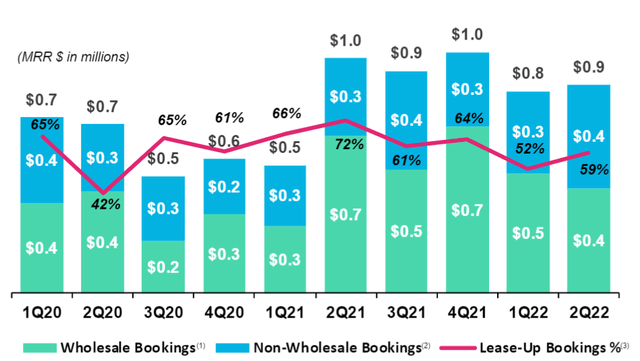

Starting in 2Q21, fiber leasing volumes accelerated to a pace of about $0.9 million MRR (monthly recurring revenue) booked each quarter.

Since this is monthly revenue, that represents $10.8 million annual revenue. 59% of this incremental revenue is lease-up, which has nearly 100% margin and the other 41% is high margin but not 100%. Out of this $10.8 million in new revenues, about $9 million flows through to AFFO which divided over 267 million outstanding shares implies about $0.033 of accretion each quarter or about $0.13 per year.

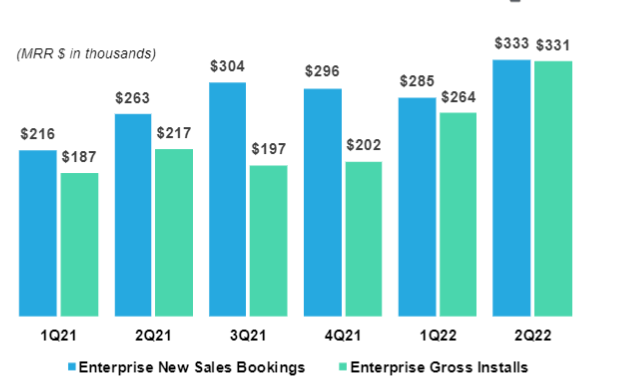

Most of the non-wholesale bookings consisted of enterprise and e-rate. Demand from these tenants is trending up nicely.

UNIT

As 5G rolls out, I anticipate UNIT’s leasing growth to maintain or increase its pace. $0.13 of incremental AFFO/share is quite a bit of growth for a sub $10 stock. Using a 10% cap rate on new earnings that is $1.30 of annual value accretion.

So, while the Windstream mess will consistently loom over UNIT’s stock price, I do want to point out that even in a worst-case scenario outcome, UNIT still owns all the fiber assets so this growth through lease-up pipeline remains in-tact.

In other words, it is only the Windstream revenues that might potentially get a haircut. The fiber business is unrelated.

Fiber asset value

Fiber is a bit tricky to value as there are a lot of route specific factors as well as add-ons like nodes or on-network connections.

As such, it is difficult to get a perfect comparison, but there are some decent comparisons available which I have tabulated below.

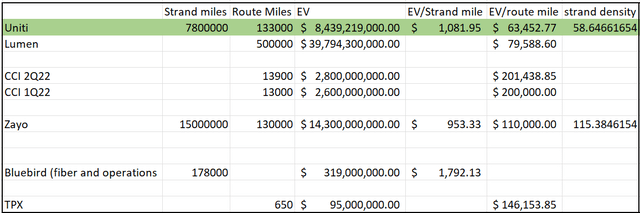

Author generated using data from company filings

The $14.3B purchase of Zayo by DigitalBridge (DBRG) is probably the cleanest example of a public buyout of a pure-play fiber company.

Zayo has 15 million strand miles and 130,000 route miles making the purchase price equate to $953 per strand mile and $110,000 per route mile. Uniti trades at an EV of $8.439B or roughly $1081 per strand mile and $63,435 per route mile.

Thus, Uniti is substantially discounted to the Zayo transaction on the basis of EV per route mile, but expensive on the basis of EV per strand mile.

What is the difference?

Zayo’s fiber is long haul routes with dense urban areas, so it has big conduits with average strand density of 115 fibers. It covers less area but has more capacity in the areas it covers.

Uniti’s fiber is a bit more tier 2 city, so it doesn’t need as many strands in each conduit to handle capacity. Its average density is 59 strands per conduit. Suburban/rural fiber like that owned by Uniti tends to have higher revenue per strand mile but lower revenue per route mile.

Overall, I would say Uniti is priced a bit cheaply relative to the ZAYO transaction. Both Uniti and ZAYO are priced extremely cheaply relative to replacement cost.

Burying new fiber conduits today is extremely expensive and time consuming. Perhaps the best measure of replacement cost is Crown Castle’s (CCI) capital invested to lay new fiber.

- In 1Q22 CCI spent $2.6B to build 13,000 route miles

- In 2Q22 CCI spent $2.8B to build 13,900 route miles

That is cost per route mile of $200K and $201K, respectively.

Clearly there are differences in location which would have some impact on replacement cost, but at $63K per route mile I think it is clear that UNIT is trading far below replacement cost of its fiber network. It is also trading below the cost of its own transactions in which UNIT bought Bluebird and TPX at $1792 per strand mile and $146K per route mile, respectively.

Additional assets not included

The above analysis of fiber value is assuming the rest of Uniti’s assets are worth $0.

Copper is out of favor, but it is still in use and generating revenue. As such, I think there is material value in Uniti’s 230,000 route miles of copper. Even if the copper itself becomes obsoleted, the in-place conduits might reduce the cost of overbuilding that network with fiber.

Summary of buy thesis

Uniti is a messy story which is keeping investors away and the market price low. However, the assets are in high demand and hard to replace which makes them valuable. I estimate UNIT is trading at just under half of NAV.

Lease-up of that fiber network provides a pathway for realization of the asset value. At current pace of leasing, UNIT can add an incremental $0.13 of AFFO each year which at a conservative 10X multiple is $1.30 of value accretion. Note that 10X is below market multiple for pure-play fiber AFFO.

This $1.30 per year more than justifies Uniti’s sub $10 market price such that the stock is undervalued even if the Windstream debacle eventually ends with bad news.

As we wait for the fiber lease-up shareholders can enjoy the 5.88% dividend yield.

Catalyst: dividend increases

Uniti’s dividend has been constrained by debt covenants, but improved financial standing has removed those restrictions. As of today, the payout is only 90% of taxable income and 34% of AFFO. In order to maximize its tax benefits as a REIT, UNIT will need to raise its dividend.

Such dividend raises on already high yield stocks tend to bring increased investor interest.

Be the first to comment