Wolterk

Investment Thesis

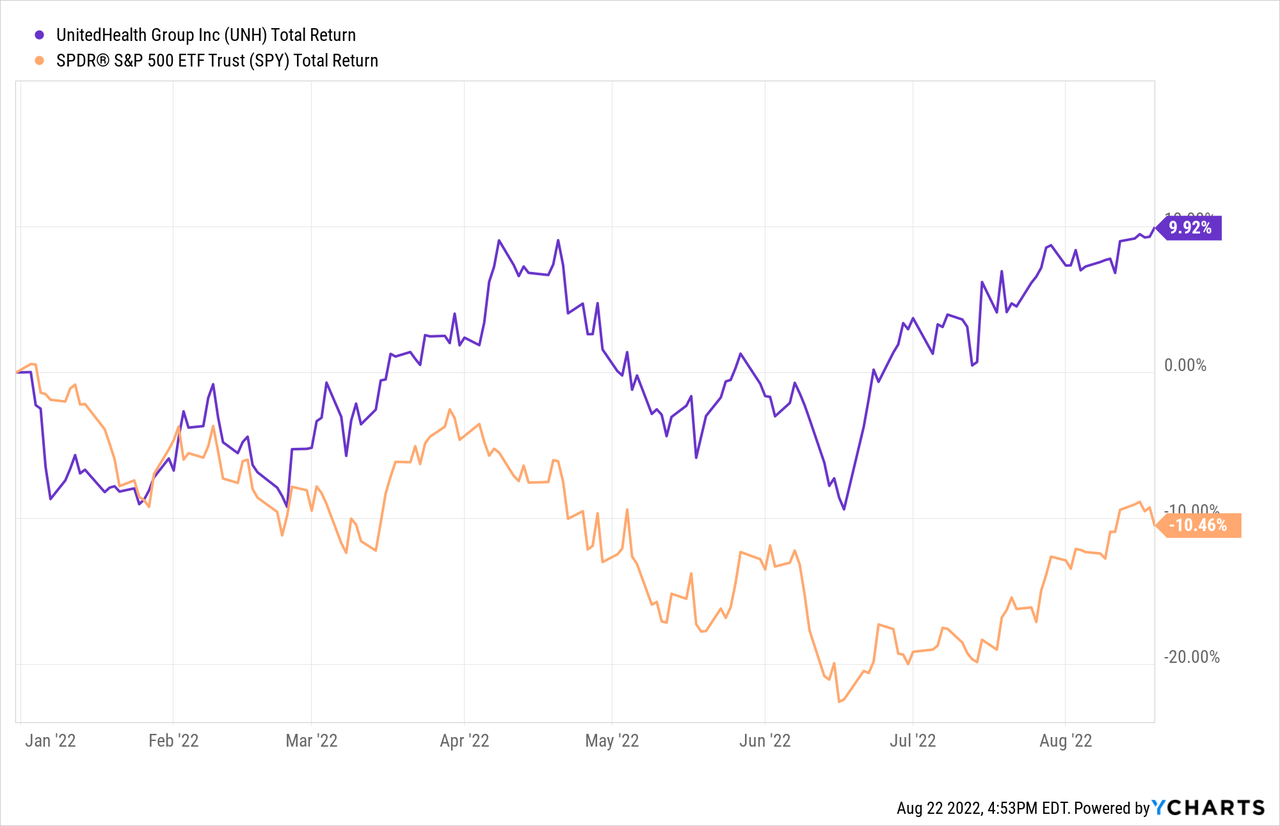

UnitedHealth Group Incorporated (NYSE:UNH) showed resilience against this year’s market selloff, and many ask why. It is not particularly cheap, and we all have seen companies with faster (and more organic) growth fall out of grace. What makes it unique? Should we expect these dynamics to continue?

UNH is where smart money went this year, gaining popularity as a defensive play in light of recent macroeconomic disruptions, underpinned by its predictable revenue stream and market position as the largest healthcare insurer in the U.S. However, this defensive trade seems to be exhausted for two reasons: 1) Improving macroeconomic fundamentals; and 2) UNH’s high valuation.

If you look at the most critical macroeconomic data releases this month, namely the ISM manufacturing, ISM services, and Philly Fed manufacturing index, you’ll see an improving economic picture. What investors widely perceived as a macroeconomic crash is turning out to be a Fed-sponsored, orderly slowing down of the economy. Omens of an economic hard-landing is yet to be seen. As more data emerge and uncertainty subdues, UNH’s appeal as a defensive trade will decrease.

Secondly, UNH’s P/E ratio of 25x is pretty high given current interest rate levels. The 10-year treasury yield trades between 3 %- 3.5% these days, not much below UNH’s earnings yields which stands at 4%. Even if management delivers on its 13% EPS growth in the medium run, I don’t see shares outperforming the broader index, primarily due to valuation.

Revenue Trends

UNH is huge and maintains three vertically-integrated business segments, with insurance being the largest, constituting 80% of total sales and about 50% of operating margins. The company also owns hospitals, pharmacies, and a high-margined data analytics segment.

UNH is subject to several industry trends shaping its revenue and profitability. First is an industry-wide consolidation, guiding UNH and its peers to swallow up smaller peers, enhancing their competitive position, volume negotiation power, and taking more control over the supply chain to manage costs. UNH has $14 billion pending deals awaiting regulatory approvals, namely Change Healthcare (CHNG) and LHC Group (LHCG), in addition to the $7 billion it spent on acquisitions in the first half of this year. M&A lies at the heart of the company’s investor pitch to increase EPS by 13% in the medium run.

We all know that M&A carries risk, exacerbated by leverage, the main funding source of UNH’s acquisitions. There is a risk that management overestimates synergies, overpays for a particular deal, or fails to integrate processes without fundamentally changing operations. M&A also underpins UNH’s large intangible assets holdings, constituting nearly 40% of total assets.

As a standalone measure, Good Will and Intangible Assets don’t say much about the quality of the company’s M&A efforts. Instead, I believe a comparative analysis of return on assets “ROA” is a more accurate index. As shown in the table below, UNH has a comparatively higher ROA compared to peers, giving some reassurance of the quality of its deal-making, at least compared to peers.

| Company | Return on Assets |

| UnitedHealth (UNH) | 0.09% |

| Elevance (ELV) | 0.07% |

| Humana (HUM) | 0.05% |

| Centene (CNC) | 0.04% |

| Molina (MOH) | 0.08% |

| HealthEquity (HQY) | 0.01% |

UNH is facing rising competition from managed care startups going public recently, including Clover Health (CLOV), Alignment Healthcare (ALHC), and Progyny (PGNY), leveraging their newly-acquired liquidity to expand their market offerings. Each of these companies has a different strategy and market position, making it harder for UNH to respond to these competitive dynamics. CLOV focuses on marginalized groups, adopting an open provider network that allowed it to gain a disproportionately large share in the Medicare Direct contracting scheme. ALHC offers one of the most comprehensive and rich Medicare Advantage plans in California, leveraging the 2019 Budget Act that permanently expanded Medicare Supplementary benefits. These small startup companies have a narrow scope, operating in a handful of states. However, all plan to expand geographically in the coming years, increasing the competitive pressure on UNH.

The industry is also susceptible to rapidly changing regulations that impact coverage, benefits’ scope, and income. The impact of these regulations is buried under UNH’s rapid growth through M&A. Nonetheless, on absolute terms, they directly impact revenue trends. Moreover, abiding by these regulations is expensive, and the industry is notorious for its law transgressions. For example, in the past two decades, UNH paid $600 million in fines for more than 300 offenses, and ELV paid a slightly higher sum, while CNC coughed up $1.1 billion for 204 recorded violations.

For this reason, audits and investigations are a normal course of business in the managed care industry. If you hear that DOJ is asking for some documents from UNH, don’t be alarmed, but bear in mind that in some instances, these audits escalate into something more serious.

Margin Trends

The Affordable Care Act set maximum gross margin limits on healthcare insurance companies to 15% – 20%, depending on their size. Somehow, UNH is operating at the upper limit of this range, posting a Medical Care Ratio of around 81% in the past few years. I’m unsure whether it found a loophole or is abusing the law as it did in 330 other instances mentioned above. Nonetheless, we know that the government is adamant about lowering costs, and rules change rapidly to achieve this goal.

Insurance contributes around 50% of operating margins, with other segments generating the remaining half. According to my estimates, its data analytics segment has the highest operating margin, standing at 76%, while its healthcare centers generate a 40% margin. The company doesn’t make much profit from its pharmacy business, with operating margins standing at 10.5%, the second to last after its insurance business, with operating margins of 6.2%.

Beyond regulatory dynamics, the company faces a tight labor market, pushing the wages of its 350,000 employees higher. More than a third of UNH’s employees are medical professionals, one of the most competitive labor markets in the US. The company also competes with peers for talented sales personnel necessary to drive organic growth.

Valuation

A significant part of UNH’s valuation is attributed to its role as a defensive trade in recent months in response to the Fed’s abrupt monetary tightening, raising recession fears. These dynamics are manifested in the company’s increasing valuation ratios above historical averages, notwithstanding peers. For example, on average, UNH has historically traded at 1.27x EV/ Forward Sales, but today it trades at 1.7x this ratio. The earnings season offered some light on the impact of inflation, and Q3 will add to this progress. As macroeconomic uncertainty subdues, cash inflows to the ticker will turn outflows.

In addition to the defensive trade characteristics, the company has been delivering on its targeted EPS increase of 13% for six years now, mainly through acquisitions. The company also kept its shares outstanding in check, relying primarily on leverage instead of new equity offerings to fund its investments. However, despite its EPS growth, I don’t see it outperforming the broader index due to its valuation.

Summary

UNH’s defensive trade seems to have been exhausted, leaving little room for capital appreciation in the coming periods. Economic soft-landing is slowly becoming the base-case scenario as macroeconomic data emerge, showing a resilient economy. Still, UNH remains near an all-time high, and its ticker hasn’t mirrored the clarity brought in by these data or that from this earnings season, showing solid earnings and, in many instances, growth. As macroeconomic uncertainty subdues, cash inflows to the ticker will turn outflows, underpinning our sell rating this year.

Be the first to comment