Deagreez/iStock via Getty Images

Investment Thesis

FedEx (NYSE:FDX) has had a rough week indeed, with a shocking -42.07% plunge from its 52 weeks high due to the shocking pre-announcement last week. Nonetheless, all things aside, FDX CEO has pledged to embark on aggressive cost-saving initiatives worth up to $4B by FY2025, with another $2B of benefits from its “Network 2.0” optimization strategy, significantly aided by the 6.9% increase in base rates from 2023 onwards. Thereby, explaining Mr. Market’s promising estimates for the next few years.

The Big Man will also be very closely watching United Parcel Service, Inc. (NYSE:UPS) performance in October, given the consensus’ relatively optimistic FQ3’22 estimates. In the meantime, both stocks will likely continue declining ahead, while the macroeconomics and stock market further languish post-Fed’s hawkish commentary.

For all we know, the recession could already be in our midst, with the S&P 500 Index already reporting a tragic -21.65% plunge YTD. Oops.

How Does FDX’s Performance Compare Against UPS’?

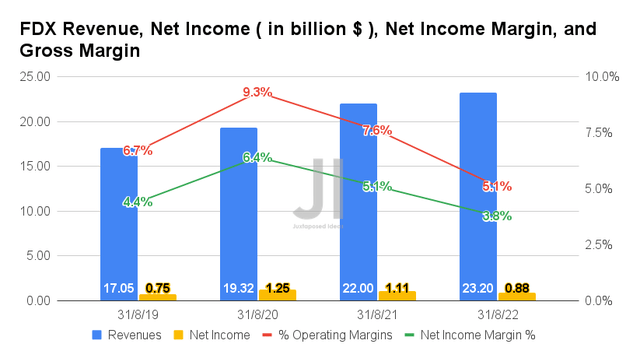

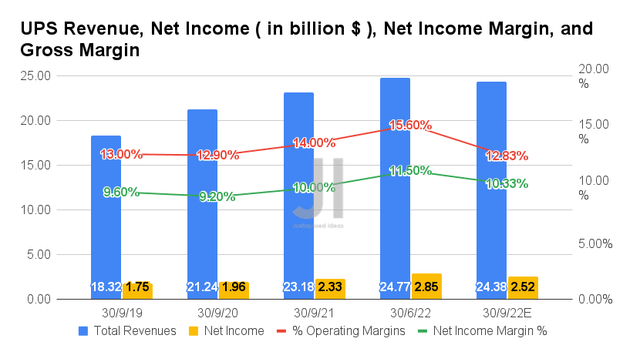

In FQ1’23, FDX reported revenues of $23.20B and operating margins of 5.1%, representing an increase of 5.45% though a further moderation of -2.5 percentage points YoY, respectively. The falling demand from worsening macroeconomics has naturally affected its profitability, with net incomes of $0.88B and net income margins of 3.8% in the latest quarter. These indicate a decline of -20.72% and -1.3 percentage points YoY, respectively.

In the meantime, UPS has outdone itself in FQ2’22, with exemplary revenues of $24.77B and operating margins of 15.6%, indicating an increase of 5.7% and 0.3 percentage points YoY, respectively. It is also immediately evident which company is more profitable from the massive differences in its margins. UPS reported an average of 13.6% in operating margins and 10.9% in net income margins over the last twelve months (LTM), as opposed to FDX at 6.4% and 4.1%, respectively.

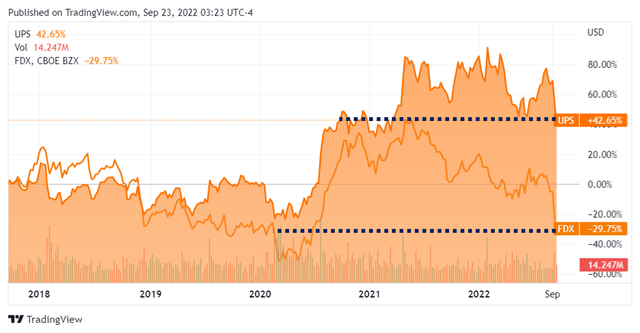

It is no wonder then, that the UPS stock has continued to outperform in the past few years, with a 5Y Total Price Return of 65.9% as opposed to FDX at -24.8%, and a 10Y Return at 213.7% against 102.7%, respectively.

Furthermore, consensus estimates remain cautiously optimistic about UPS’ performance in the upcoming earnings call, with the projected FQ3’22 revenues of $24.38B and operating margins of 12.83%, representing an increase of 5.17% though a moderation of -1.17 percentage points YoY, respectively. Naturally also indicating a notable decline of -1.57% and -2.77 percentage points QoQ, after factoring in the impact of rising inflation and reduced volume, compared to FDX’s latest decline in revenue by -4.87% QoQ.

Nonetheless, with the projected net incomes of $2.52B and net income margins of 10.33% for the upcoming quarter, UPS investors have nothing to worry about for now. These numbers still represent massive improvements of 44% and 0.73 percentage points from FQ3’19 levels, respectively, compared to FDX’s increase of 17.33% though decline of -0.6 percentage points in FQ1’23 from FQ1’20 levels, respectively. We shall see.

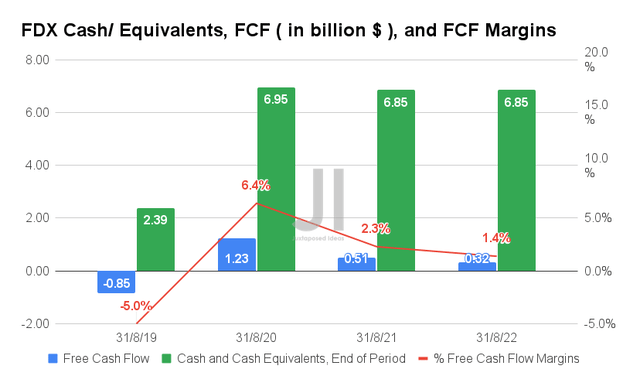

Naturally, FDX reported a lower Free Cash Flow (FCF) generation of $0.32B and an FCF margin of 1.4% in FQ1’23, representing a decline of -37.25% and -0.9 percentage points YoY, respectively. Otherwise, a tragic fall of -71.37% and -3.2 percentage points QoQ, as the economic downturn decimated consumer demand. Fortunately, its cash and equivalents of $6.85B have remained stable thus far and should hold moving forward, given its aggressive cost-cutting strategies ahead.

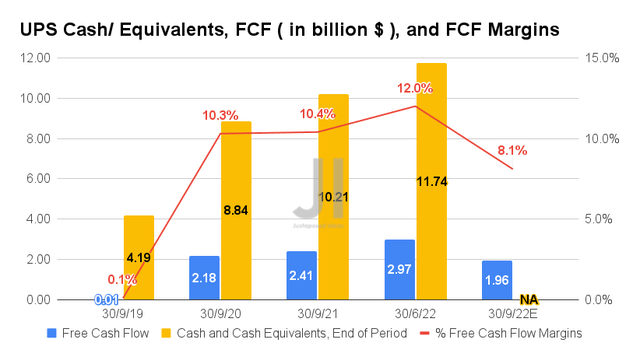

On the other hand, UPS had reported FQ2’22 FCF generation of $2.97B and an FCF margin of 12%, indicating a decline of -3.7% and -1.2 percentage points YoY, respectively, post-hyper-growth from the reopening cadence. Consensus estimates have also downgraded its projected FCF generation to $1.96B and an FCF margin of 8.1% in FQ3’22, indicating a decline of -34% and -3.9 percentage points QoQ, respectively. Otherwise, a moderation of -20.64% and -2.3 percentage points YoY, respectively, similarly indicating a deceleration in e-commerce growth during a time of economic uncertainty.

In the meantime, we still expect to see sufficient cash and equivalents for UPS’ upcoming report, given the stellar $11.74B reported in FQ2’22. Thereby, preserving its liquidity over the next few quarters of potentially reduced shipping volume.

Mr. Market Has Pessimistically Downgraded Their Forward Execution

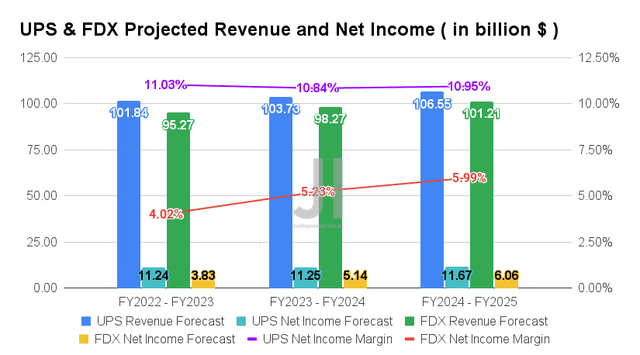

Over the next few years, UPS is expected to report an adj. revenue and adj. net income growth at a CAGR of 7.54% and 21.32%, respectively, between FY2019 and FY2024. Notably, these numbers reflect analysts’ downgrade in estimates by -2.05% since our previous analysis in July 2022. Meanwhile, FDX is expected to report revenue and net income growth at a CAGR of 7.90% and 36.47%, respectively, over the same period of time.

Nonetheless, it is impressive that the consensus estimates continue to expect UPS to report stellar growth in its net income margins, from 6% in FY2019, to 13.2% in FY2021, and finally settling at 10.95% by FY2024. Assuming that FDX’s aggressive actions play out well, the company is also expected to improve its profitability, from 1.9% in FY2020, to 4.1% in FY2022, and finally to 5.99% by FY2025.

On the other hand, it is also apparent that FDX will face massive headwinds over the next few quarters, as the company struggles to achieve cost savings while increasing its base rates during a time of worsening macroeconomics. These were painfully evident in the massive plunge in stock prices by -24.56% over the past week, similarly impacting UPS by -9.27%, further worsened by the pessimistic market from the Fed’s continuous hike in interest rates thus far.

In the meantime, we encourage you to read our previous article on UPS, which would help you better understand its position and market opportunities.

- United Parcel Service: Still No Margin Of Safety – Volatility Ahead

So, Is UPS & FDX Stock A Buy, Sell, or Hold?

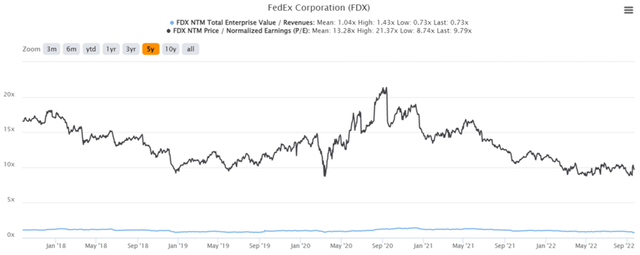

FDX 5Y EV/Revenue and P/E Valuations

FDX is currently trading at an EV/NTM Revenue of 0.73x and NTM P/E of 9.79x, lower than its 5Y mean of 1.04x and 13.28x, respectively. The stock is also trading at $154.54, down -42.07% from its 52 weeks high of $266.79, nearing its 52 weeks low of $150.34.

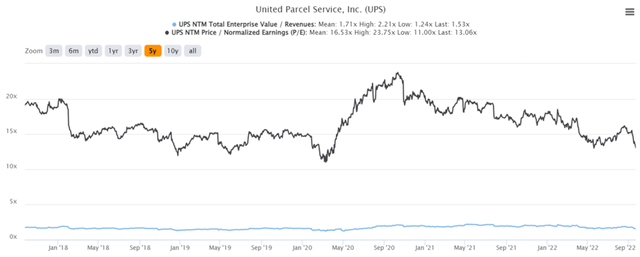

UPS 5Y EV/Revenue and P/E Valuations

UPS is trading at an EV/NTM Revenue of 1.53x and NTM P/E of 13.06x, lower than its 5Y mean of 1.71x and 16.53x, respectively. The stock is also trading at $167.86, down -28.17% from its 52 weeks high of $233.72, nearing its 52 weeks low of $165.34. Consensus estimates remain bullish about UPS’s and FDX’s prospects, given their price target of $203.70 and $237.63, respectively, with a 21.35% and 53.77% upside from current prices.

UPS & FDX 5Y Stock Price

It is painfully evident that both stocks have suffered by now, leading to UPS losing all of its gains over the past year and FDX up to two years of pandemic gains. Depending on UPS’ upcoming earnings call in October, we may likely see another bottom formed then, attributed to the persistently elevated inflation rate of 8.3% in August 2022.

As a result, we encourage investors to wait for a deeper retracement and, probably, more clarity on the UPS’ performance before adding any during the tumultuous market. More punishment may be coming, depending on September CPI results as well.

Be the first to comment