Spencer Platt/Getty Images News

If the world population continues to grow and if e-commerce is slated to continue taking up an ever-larger part of our consumer activities, then the package delivery industry should very well make for a great long-term opportunity for investors to consider. It is true that current economic conditions are looking rather unfavorable in many respects. It wouldn’t be a surprise even if the e-commerce space, like many other industries, suffers as a result. But in the long run, the companies that operate here should perform quite well. One player in this industry that has proven itself to be a behemoth is United Parcel Service (NYSE:UPS). Although profits and cash flows can be rather lumpy from year to year, the firm continues to expand its top line as it handles more and more packages. Given near-term risks opposed to the economy, combined with a real likelihood that an economic downturn could impair pricing, United Parcel Service may see additional downside. But considering that shares are already near their 52-week low point and factoring in how affordable the stock is, I do believe that some upside potential does exist in the long run. Because of this, I have decided to rate the firm a soft ‘buy’ at this time, reflecting my belief that it’s likely to outperform the broader market for the foreseeable future.

A great play on e-commerce

Most people, especially those located in the US, have heard of United Parcel Service at some point. Since its founding in 1907, the company has dedicated itself to delivering packages and offering global supply chain management solutions. While the company’s focus is most certainly on the domestic market, it is also true that it has operations all across the globe, including throughout Europe, India, the Middle East, Africa, the Asia Pacific region, and Latin America. Using data from the 2021 fiscal year, the business provided shipping services to roughly 1.7 million customers daily, delivering those goods to 11.8 million package buyers every day.

If this all sounds like a herculean task, it’s because it is. To get to this point, United Parcel Service has had to make significant investments over its entire lifetime. Today, the company’s global network is extensive. Under the global small package category, the company has created 188,000 entry points where customers can tender their packages to the enterprise, after which those packages are sent through the company’s extensive network to ultimately arrive at their final destination. Thanks to its massive reach, the firm has become a global player, with operations and roughly 140 different countries. But this doesn’t change the fact that its primary emphasis is on the domestic market. Of the roughly 25.2 million packages that the company delivered each day, on average, in 2021, 17 million involved the firm’s U.S. Domestic Package segment.

Of course, United Parcel Service does have other segments worth mentioning. Next in mind, we have the International Package segment, which consists of its small package operations throughout Europe, the Asia Pacific region, Canada, Latin America, and a variety of other regions. The firm is currently able to deliver packages to 80% of the European population through its network. The Asia Pacific region is ultimately very important as well, with more than 40 countries and territories through more than two dozen alliances with local delivery companies being serviced by the business. And also, we have a much smaller Supply Chain Solutions segment. This includes the companies forwarding, truckload brokerage, logistics and distribution, Roadie, UPS Capital, and other business operations. To put it in context just how large each of these segments are, consider that in 2021, 62% of the company’s revenue and 50.2% of its profits were associated with the U.S. Domestic Package segment. 20.1% of its revenue and 36.3% of its profits came from the International Package segment, while 17.9% of its revenue and 13.5% of its profits were associated with the Supply Chain Solutions operations.

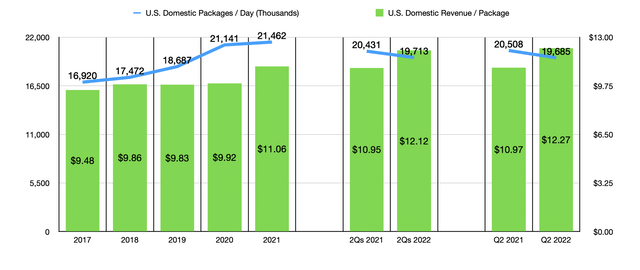

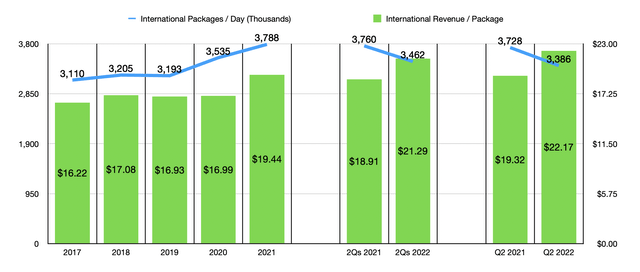

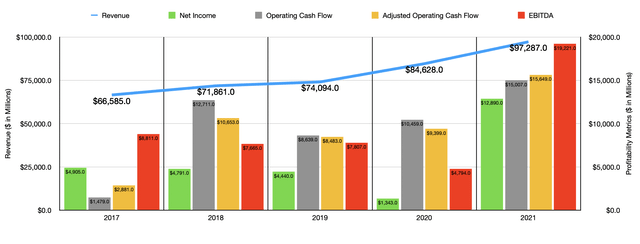

Over the past five years, the management team at United Parcel Service has successfully grown the company’s top line year after year. Revenue has risen from $66.59 billion to $97.29 billion over that five-year window. Much of the activity here came from the U.S. Domestic Package and International Package operations. Under the former, the company saw the average daily package volume rise from 16.92 million to 21.46 million. And under the International Package segment, package volume grew from 3.11 million to 3.79 million. Another driver of growth has been an increase in pricing. Between 2017 and 2020, U.S. Domestic Package revenue per package increased from $9.48 to $9.92. Although this may not seem like a significant increase, when applied to the kind of volume the company achieved in the 2020 fiscal year, price increases alone would have contributed $3.40 billion to the firm’s revenue growth over what it saw in 2017. Then, in 2021, pricing rose even further, hitting $11.06 per package on average. Internationally, pricing rose from $16.22 to $16.99 in the four years ending in 2020. And in 2021, pricing spiked to $19.44.

Author – SEC EDGAR Data Author – SEC EDGAR Data

This increase in revenue has been great for the company. But profits and cash flows have been rather volatile. Between 2017 and 2020, for instance, net income for the company actually decreased year after year, dropping from $4.91 billion to $1.34 billion. Admittedly, most of this decrease came from 2019 to 2020 because of the COVID-19 pandemic. It’s also true that profits surged to $12.89 billion in 2021. In my opinion, a more accurate barometer of the company’s success would be its cash flow. However, as the first chart in this article illustrates, this has also been volatile. Even if we adjust for changes in working capital, we would see a decent amount of volatility here. At the same time, it is true that from 2019 through 2021, we did see a consistent increase year after year, with the metric climbing from $8.48 billion to $15.65 billion. Similar volatility to what we saw with net income can also be repeated when looking at EBITDA. But thanks to stronger pricing in the 2021 fiscal year, it too hit an all-time high for the firm of $19.22 billion.

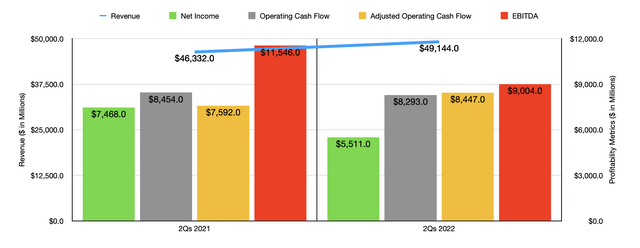

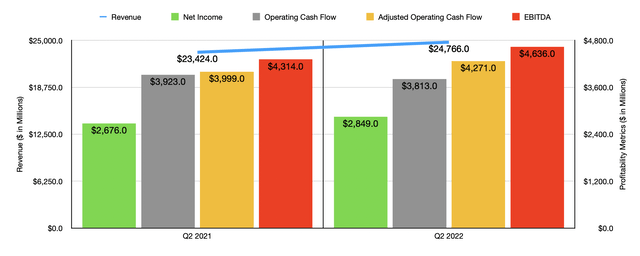

For the 2022 fiscal year, the picture is looking rather interesting. For starters, revenue at the company does continue to increase. In the first half of the year, sales came in at $49.14 billion. That compares favorably to the $46.33 billion reported the same time one year earlier. So far this year, the company has actually seen the volume of its U.S. Domestic Package segment decrease, with average daily packages transported declining from 20.43 million to 19.71 million. However, we did see this offset by a rise in pricing from $10.95 to $12.12. A similar trend can be seen when looking at the International Package segment, with volume dropping from 3.76 million packages per day to 3.46 million, while pricing rose from $18.91 to $21.29. This trend suggests to me that the firm has reached a limit in the near term for how much it can charge and as supply chain issues and other factors have resulted in volume declines.

Profits, meanwhile, have proven once again to be all over the place. This decline came even as total operating expenses fell from 87% of revenue to 86.2%. Instead, it was driven by investment income and other items decreasing from $3.96 billion to $648 million. The lion’s share of this change seems to have been attributed to a re-measurement of benefit obligations that previously increased the company’s bottom line the same time last year. But that doesn’t mean that other profitability metrics came in strong. For instance, operating cash flow fell from $8.45 billion in the first half of the 2021 fiscal year to $8.29 billion at the same time this year. However, if we adjust for changes in working capital, it would have risen from $7.59 billion to $8.45 billion. But this is the only time in which profits or cash flows seem to have increased year after year. This is because EBITDA for the company also worsened, dropping from $11.55 billion to $9 billion.

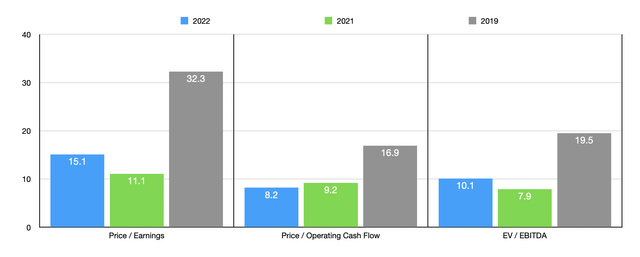

Despite these troubles, management does have some pretty high hopes for the 2022 fiscal year as a whole. They currently anticipate generating revenue of roughly $102 billion. If this comes to fruition, it would translate to a 4.8% increase over the $97.29 billion in sales achieved in 2021. No real guidance was provided when it came to profitability. But if we annualize results experienced so far for the year, we should anticipate net income of $9.51 billion, adjusted operating cash flow of $17.41 billion, and EBITDA of $14.99 billion. As you can see in the chart above, this results in pricing from a price to earnings perspective and an EV to EBITDA perspective that is higher than what the company was priced at using data from 2021. Meanwhile, the price to operating cash flow multiple seems to be declining. All of this pricing though is lower than the pre-pandemic year of 2019. Although the uncertain market conditions we are dealing with may cause some worsening in the company’s top and bottom lines, I have a difficult time believing we could go back to that kind of performance. After all, e-commerce continues to expand and will likely continue with that trend for many years to come. Even if the worst does come though, the company would likely be only slightly overvalued.

In terms of relative valuation, I did compare the company to the only true comparable that it has. That would be FedEx (FDX). Using data from the 2021 fiscal year, FedEx is trading at a price-to-earnings multiple of 14.3. The price to operating cash flow multiple would be 7.8, while the EV to EBITDA multiple would come in at 7.2. These numbers are all lower than what United Parcel Service is trading for using data from that same year.

Takeaway

Based on the data provided, I do think that the long-term outlook for United Parcel Service is still solid. It’s a quality enterprise that should continue to benefit from a globalized world. Even if financial performance reverts back to what it was prior to the pandemic, which I think is improbable, shares would likely not be all that pricey. Perhaps they could warrant some downside in that scenario. But any turn back to that kind of performance would almost certainly be temporary in nature. Long term, growth is on the horizon for United Parcel Service and this should lead to higher trading multiples than what the company is experiencing today. Having said that, I do also believe that FedEx is the superior play here because of pricing. But for investors who don’t mind paying a little bit more for an ownership stake in one of the two big industry leaders, United Parcel Service should definitely make for a soft ‘buy’ prospect at this time.

Be the first to comment