mtcurado/iStock Unreleased via Getty Images

United Airlines Holdings, Inc. (NASDAQ:UAL) turned its first quarter earnings call into a billboard for investment in airline stocks. Looking back at it, it would have been better not to do so, as shares significantly underperformed the broader market, losing over 20% of value compared to a 12.5% loss for the broader markets. With recession fears, high oil prices, staffing issues, and inflationary pressures affecting the industry, it barely comes as a surprise that airline stocks have been under significant pressure.

In a previous report, I discussed why I think Delta Air Lines, Inc. (DAL) has one of the best, if not the best, strategies in the airline industry. That, however, does not mean that United Airlines has nothing going for them that could help the company forward. In this report, I discuss the return of the Boeing 777, which should provide a significant step down in cost per available seat mile excluding fuel (“CASM-ex”) costs.

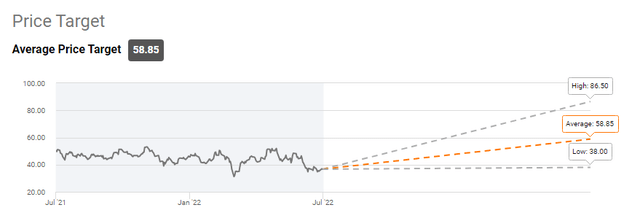

Wall Street Believes In Take Off

Share price consensus United Airlines (Seeking Alpha)

Wall Street has given United Airlines a $58.85 per share price target, implying a 60% upside in the coming twelve months. With the pressure on airlines, it is hard to see a 60% appreciation in share prices happening, but as some pressures unwind that could provide a lift to share prices.

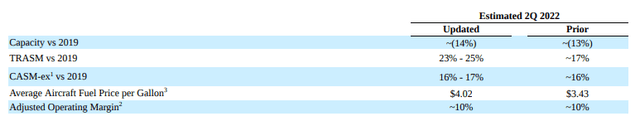

United Airlines Q2 2022 guidance update (United Airlines)

What should have provided support to shares prices in 2022 is the strong pent-up demand being released to the market, resulting in strong volume as well as unit revenues. However, what we are now seeing is that one of my biggest fears is turning into reality, and that fear was that earlier estimates on average fuel prices per gallon were too low. The updated guidance from United Airlines confirms this.

The guidance update shows that stronger than expected unit revenue is not translating into stronger margins, as the average cost for jet fuel are 17% higher than previously anticipated and capacity is slightly lower. This is resulting in a slightly higher CASM-ex.

For the second quarter, the consensus is that United Airlines will book $12.06 billion in revenues with EPS of $1.82. This is not too shabby, given the $4.24 per share loss in Q1. Recently, Argus reduced its full year 2022 EPS estimate to $1.80. This realistically should still align the airline for average earnings per EPS of $2 per quarter, making Argus expect more from United Airlines than the consensus estimates.

Boeing 777 Return A Tiny Bright Spot

During the first quarter earnings call, I got the impression that United Airlines tied too much of its financial upsides to “ifs” and “if thens.” One of those conditions for success was the Boeing 777’s return to service. A significant number of the Boeing 777s that United Airlines has in its fleet were grounded following an incident in December 2020 with the Pratt & Whitney (United Technologies, now Raytheon (RTX))-powered turbofans. It led to a grounding of 128 aircraft, of which 52 were in the United Airlines fleet. So, United Airlines was forced to keep a quarter of its wide body fleet grounded, representing around 10% of its capacity.

The uncertainty regarding the return of the affected Boeing 777s to service provided a negative impact on the company’s CASM, as the aircraft is United’s best CASM performer and the airline considers it a big cargo machine that could potentially offset lower unit rates by transporting more cargo. Initially, I was somewhat skeptical on any benefits that United Airlines connected to the Boeing 777 return, as the timeline was uncertain and the airline shared that it would take around nine months to get all aircraft flying.

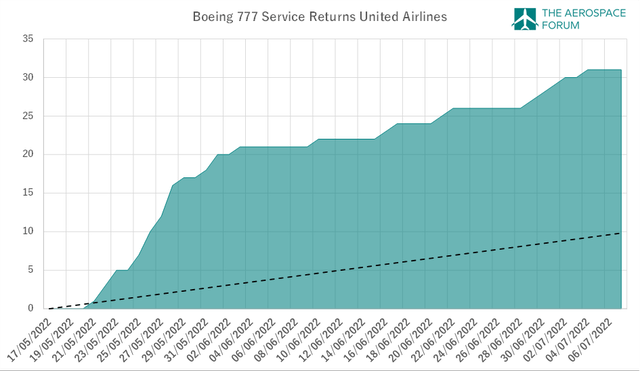

United Airlines Boeing 777 service re-entries (The Aerospace Forum)

However, after the aircraft were cleared by the FAA for commercial service, a review of the number of aircraft shows a very strong trend for aircraft being returned to service. Linearizing the nine months, by now around 10 aircraft should be returned to service. However, United Airlines has already returned 31 aircraft to service, which should provide some tailwind to CASM-ex reductions. Our analysis also found that nearly 8,700 flight hours were clocked by the aircraft combined. Right now, the utilization of those jets is just 5.8 to 6 hours per day, as the ramp-up is still underway. However, we expect that the Boeing 777 fleet will be utilized quite efficiently by United, as the highest utilized aircraft currently does around 12 hours of service per day.

The estimated capacity of 1.9 billion seat-miles on these 31 aircraft already is equivalent to 2% to 3% of the Q1 2021 capacity. So, there is little doubt that the capacity addition from the Boeing 777 returning to service is going to be significant. Activating all of the fleet members suggests that the Boeing 777 fleet represents 8% to 10% of the capacity, while improving utilization would even push it to 18.5% of Q1 2022 capacity and around 12% of pre-pandemic capacity. So, that the Boeing 777 represents roughly 10% of the capacity seems to be correct. Indeed, according to our calculations they should contribute to some CASM-ex improvement even more so if the current guidance does not include the timing issue of the Boeing 777 return.

Conclusion

United Airlines updated its unit revenue guidance, but it does not expect this to translate to the bottom line, as jet fuel prices exceeded previous guidance. A positive is that United still sees opportunity for unit revenue strength to offset higher fuel prices, but one can wonder how long that will last. Another positive is that United Airlines is bringing back the Boeing 777s, which are their best CASM and cargo machines, at a faster pace than expected. Initially, I was skeptical about the contribution of the Boeing 777 to CASM-ex, as I thought the process would take months, but United Airlines has now brought back 3 times the number of jets I would have expected earlier.

That is going to provide some CASM relief, but one should wonder how strong United Airlines will perform given that the Boeing 777-200 and Boeing 777-200ER are aging machines and consume significantly more fuel than current generation aircraft such as the Airbus A350 that Airbus operates. So, the Boeing 777 will do something for the CASM reduction, but it doesn’t do much for the fuel efficiency, which is superior on the Airbus A350 and Boeing 787-810. The delivery resumption of the Boeing 787 is in fact the better hedge against fuel prices and cost reductions.

Overall, while I believe that things will improve for United Airlines I feel that Delta Air Lines has the more appreciable fleet strategy and United Airlines lacked a useful input during the Q1 earnings call laying out how it will navigate the current environment.

Be the first to comment