Spencer Platt

Electrical wire and cable manufacturer Encore Wire Corporation (NASDAQ:WIRE) has led the market for the last five years. Even in the year-to-date period, when its stock has been down, the company is still doing better than the overall market. This is because the company’s underlying business is uniquely good, with strong competitive advantages and stellar financial performance. The company is a long-term investor’s dream.

Encore is a Market Beater

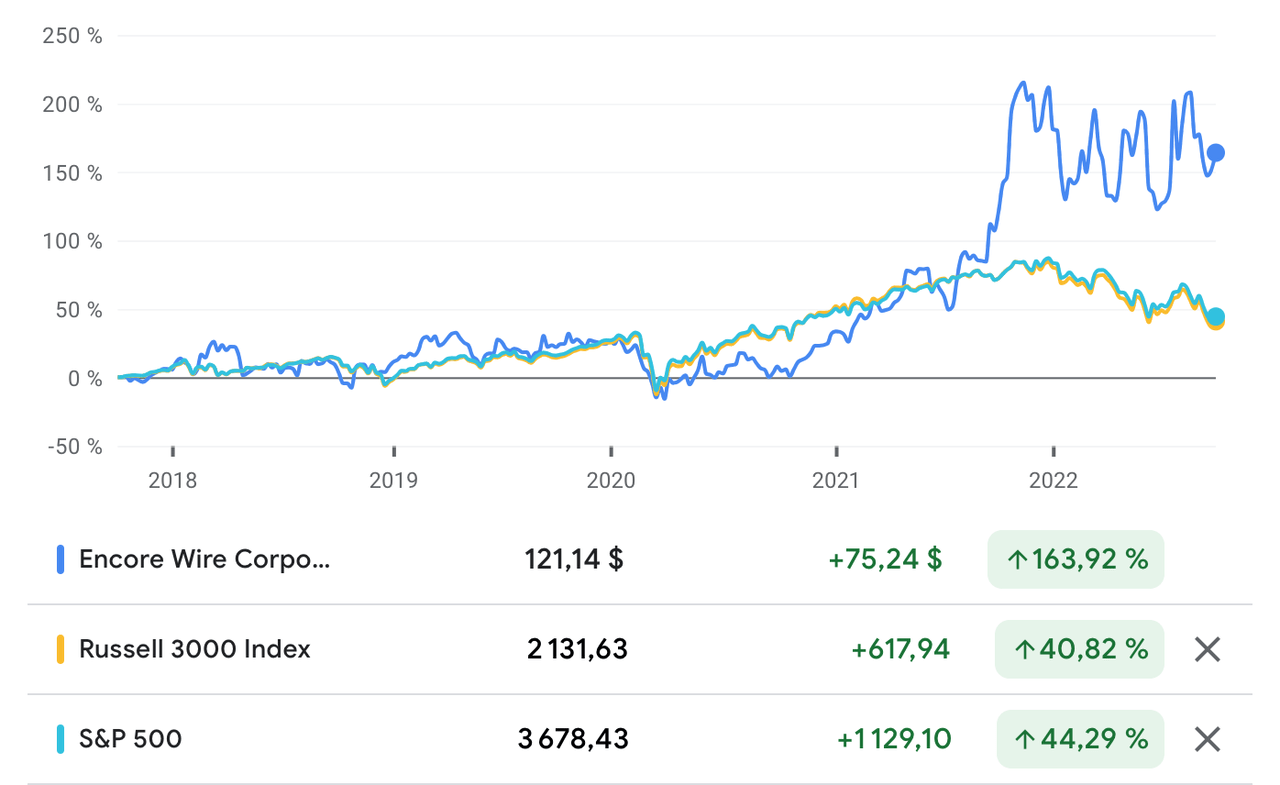

In the last five years, Encore has sharply overperformed the Russell 3000 and S&P 500, gaining 163.92% compared to 40.82% for the Russell 3000 and 44.29% for the S&P 500.

Source: Google Finance

Year-to-date, the company’s stock has declined by 14.08%, compared to 24% for the Russell 3000 and 23.31% for the S&P 500. While results are poor, the stock remains superior to the broad market. The company’s strong stock market performance is a reflection of the strong financial performance of the business in the last 5 years.

Exceptional Financial Performance

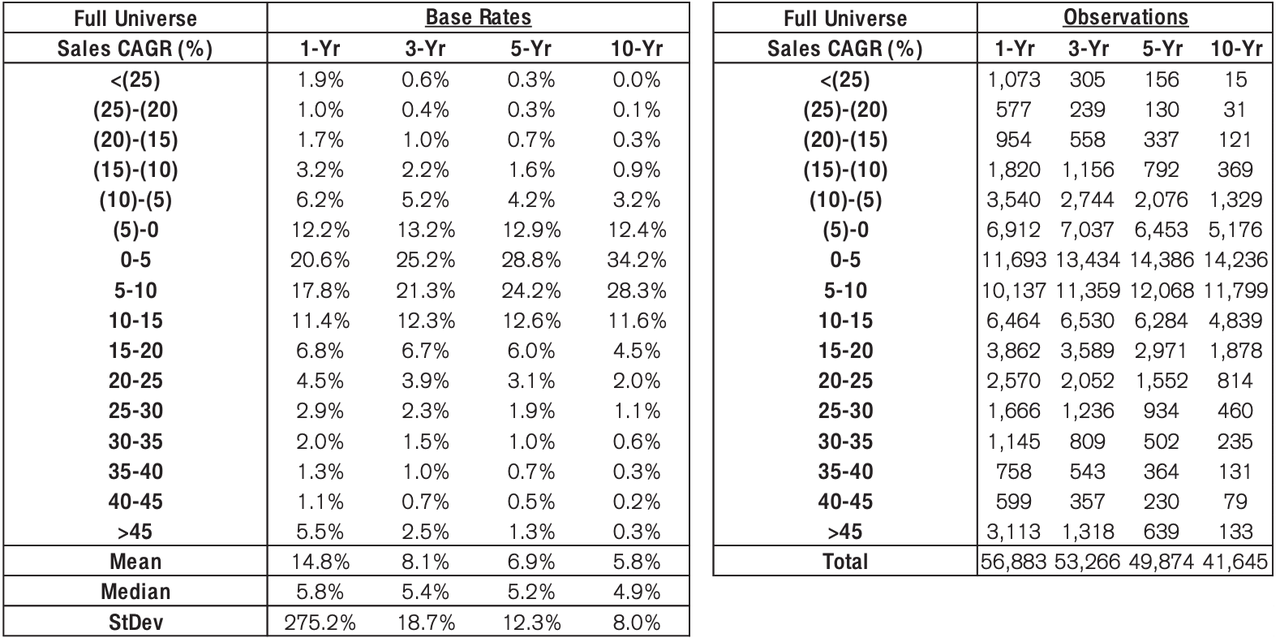

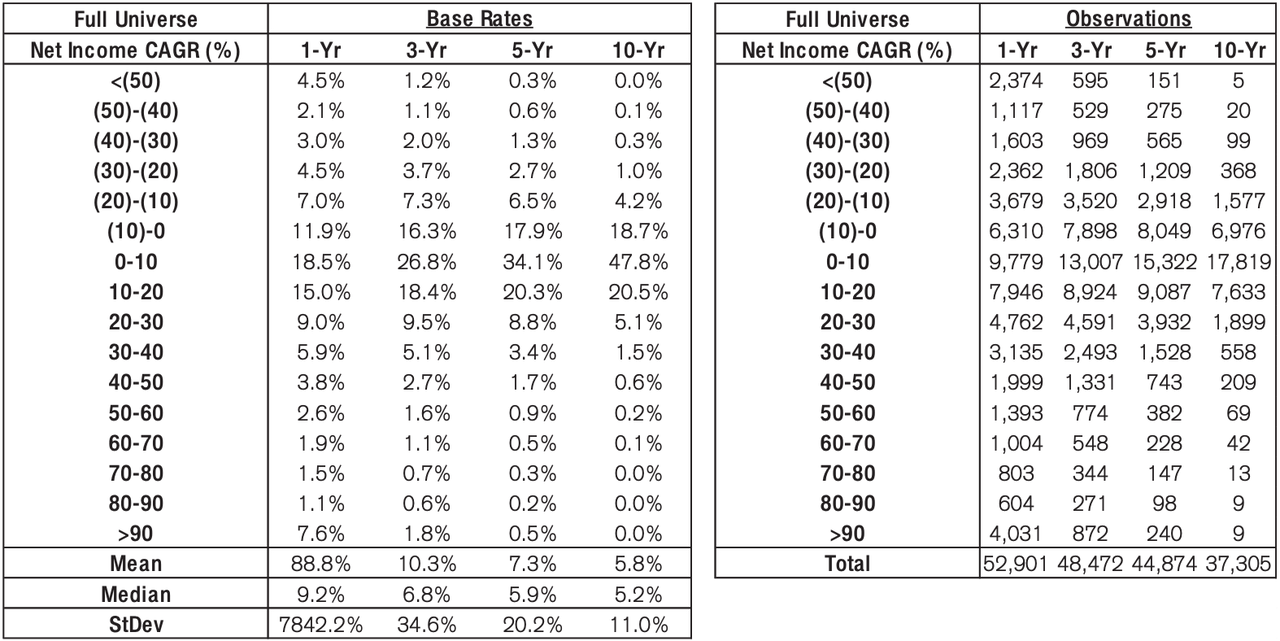

In the last five years, revenue has grown from just over $1.16 billion in 2017, to over $2.59 billion in 2021, representing a 5-year revenue compound annual growth rate (CAGR) of 17.37%. According to Credit Suisse’s The Base Rate Book, just 6% of firms enjoyed a similar level of growth between 1950 and 2015. In the TTM period, revenue has risen to nearly $2.97 billion.

Source: Credit Suisse

Gross profitability has risen from 0.21 in 2017, to 0.56 in 2021, well above the 0.33 threshold that Robert Novy-Marx’ research says characterizes attractive stocks. In the trailing twelve months (TTM), gross profitability has risen to 0.60. This shows that profitability continues to improve in the TTM period.

Operating profit margin has increased from 6.8% in 2017 to 27%. This again reflects the growing profitability of the firm. In the TTM period, operating profit margin has risen to 29.9%, showing that this trend has continued through this challenging economy. This is in comparison with the 11% average for industrials, according to Credit Suisse’s research.

Net income has risen sharply from $67 million in 2017, to over $541 million in 2021, for a 5-year net income CAGR of 51.87%. Only 0.9% of firms have been able to achieve a similar level of success. In the TTM period, net income has risen to more than $689 million.

Source: Credit Suisse

Free cash flow (FCF) has risen from $26.26 million in 2017, to more than $300 million in 2021, at a 5-year FCF CAGR of 62.79%. Again, the company has shown an incredible amount of growth. In the TTM period, FCF has continued to grow, rising to nearly $488 million.

The company’s balance sheet reflects the conservative management that the company has enacted, with the company having more than $469 million in cash in the TTM period, up from $439 million in 2021. The company has no long-term debt.

The company’s low-cost, highly profitable business is reflected in the company’s return on invested capital (ROIC), which has risen from 14.8% in 2017, to 78.1% in 2021. In the TTM period, the company has a ROIC of 87.8%.

The Business

Encore is a low-cost manufacturer of electrical building wire and cable, made with copper or aluminum. The company’s end market is the wholesale electrical distributors, which the company supplies largely through independent manufacturers’ representatives in the United States, and secondarily, through direct in-house marketing. These distributors supply electrical contractors across the country.

The customer base is diversified, with just three customers having a share of revenues slightly in excess of 10%. This adds resilience to the company, which is unique for such a small firm. Encore has managed to grow its revenues because it is able to quickly fill their orders, and, because customers want to have lean inventories, Encore’s ability to quickly supply them is an advantage.

Encore’s success relies on the quality of its customer service, the provision of new products, and maintaining its position as a low-cost producer. As a single-location business, Encore has been able to build an efficient, highly automated plant, with an integrated production process. Workers and management are incentivized through a long-term incentive plan, high safety standards and a 401(K) plan for all its workers. Finally, having one location makes it easier to build a strong culture.

Encore’s business model is simple, and easily analyzable, and this helps investors to assess the risks and potential upsides of owning a stake in the business.

Evernote Thrives Under Inflation

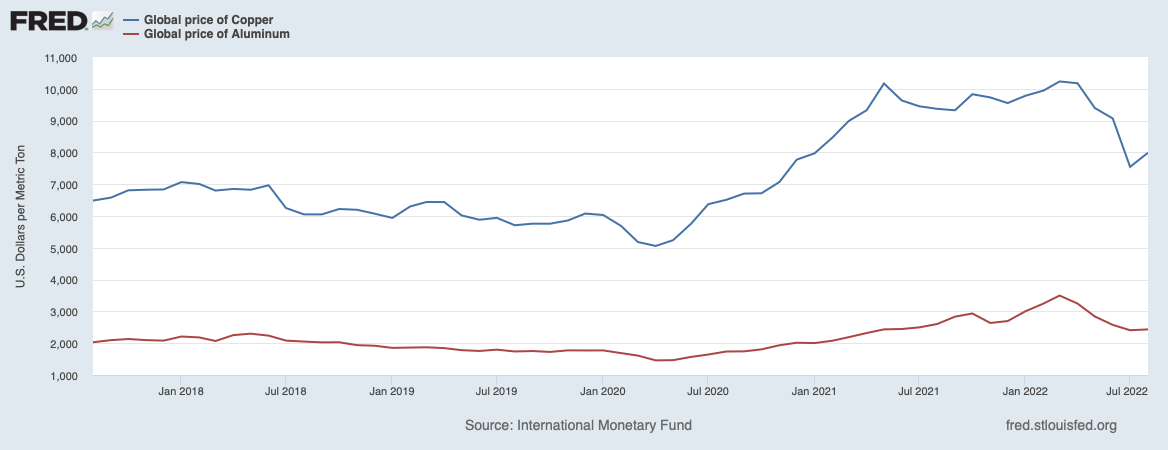

In the last five years, the global price of copper has shot up, rising by a CAGR of 4.26% through that period. Having peaked in May 2021 and fallen since April 2021, the price has risen since July. The global price of aluminum has risen by a 5-year CAGR of 3.7%. Having reached an all-time high in May 2022, the level till June, and has been rising since July 2022.

Source: FRED

The company’s financial results show how it has thrived as the price of copper and aluminum have risen. This reflects the company’s ability to pass on the rising costs of its raw materials, to its suppliers, growing revenue and profits in the process.

The recession and deeper economic problems may hurt the company in the long-term, if demand softens, but the company may still be able to pass on any rise in the price of raw materials, and maintain profitability. This reflects the competitive advantages that the company has. This is especially true in the TTM results, which show that this ability has remained as inflation has risen and the U.S. has entered a recession.

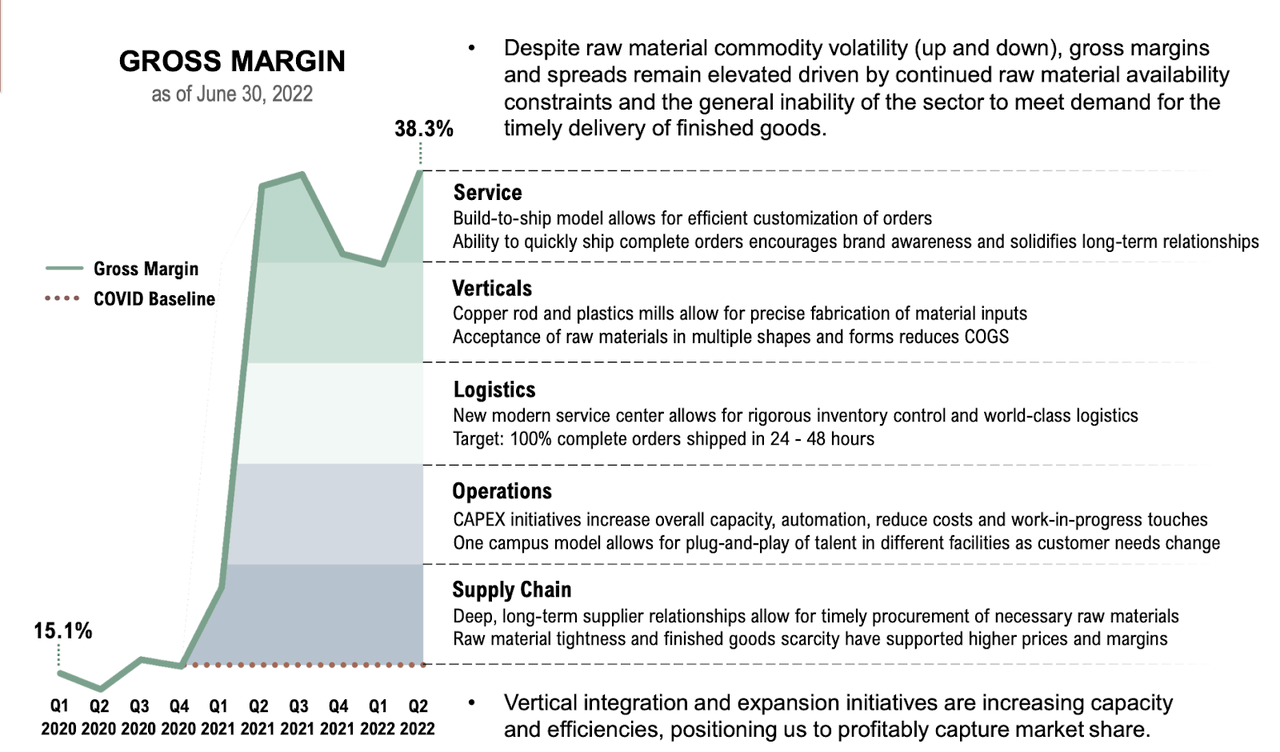

Source: Encore, “Electrifying the Future”, June 30, 2022 presentation

This ability to pass on rising costs is impressive given the competitive nature of the electrical wire and cable industry, with peers such as Belden, Inc. (BDC), AFC Cable Systems, Inc, Apogee Enterprises, Inc, Atkore International Group, Inc, Southwire Company, Cerro Wire, General Cable (owned by the Prysmian Group), Masonite International Corporation and Quanex Building Products Corporation.

Is Encore a Buy?

With nearly $488 million in free cash flow (“FCF”) in the TTM period, and an enterprise value of $1.88 billion, Encore has an FCF yield of nearly 26%. This is far in excess of the 1.5% FCF yield of the 2000 largest companies in the United States, as calculated by New Constructs. This suggests that the company is not only undervalued, but that its future stock price performance will be much better than that of the broad market.

Conclusion

Encore has been a market beater for the last five years. While the company’s stock is down year-to-date, the stock is still performing better than the broad market. This reflects the company’s underlying financial performance, which has been uniquely good, and the competitive advantages Encore has. Encore is a long-term buy that should reward shareholders.

Be the first to comment