imaginima

Over the last few months, we have closely followed the European gas evolution and its implication across many companies. In particular, we focused our analysis on Uniper (OTCPK:UNPRF) and Fortum Oyj (OTCPK:FOJCF). We were not surprised to read that the German government is taking over a controlling equity stake in Uniper. In our previous analysis, we reported a few comments from the Minister of Economy Robert Habeck and the German Chancellor Olaf Scholz that respectively said: “we will not allow a company of this magnitude to become insolvent and cause turbulence on global energy markets” and “Uniper is crucial for the German economy“. These comments more than justified a possible takeover.

Gas Sensitivity Analysis

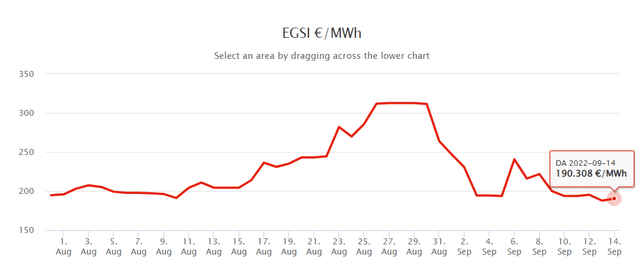

In our initiation of coverage, we concluded that with a gas price of €130 per MWh, Uniper was in a deficit of almost €1.5 billion on a monthly basis. The gas spot price is now at €190 per MWh.

Gas spot price (EEX market data)

In our second follow-up, we emphasized how the financial package was a first-aid support for the energy company, but this was not solving Uniper’s cash burn evolution.

What Has Happened?

The Nord Stream 1 pipeline reopening that was scheduled for September 3 is still not in place. Moreover, there is no timeline for a restart. Gazprom found out an oil leak and maintenance works are required. This is just an excuse to leverage better terms in the Ukraine conflict, but once Moscow cuts off its supplies, Uniper was forced to find gas elsewhere for its end-clientele, thus paying spot gas prices and burning cash. In fact, in fixed-term contracts, the higher expenses cannot be automatically passed on to customers. Moreover, this situation represents a serious issue for all those energy companies operating in the futures market.

In order to be able to operate in the derivatives market on a stock exchange, it is mandatory to pay a margin, i.e. an initial guarantee. The margins for electricity and gas futures are currently very high and equal to about 20% of the value. These margins are also updated daily, based on changes in the price of contracts: if this rises, it is necessary to supplement the clearing house with additional sums in order to contain structural damage in the event of insolvency. These margins have grown a lot, and some governments have granted credit lines to guarantee liquidity to companies in difficulty.

Conclusion and Valuation

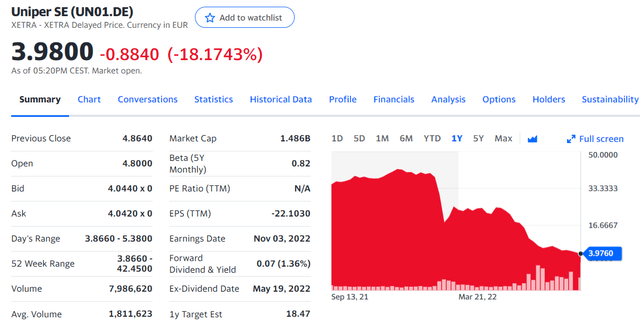

Last week, the third German group for gas import called Vng was forced to call for help. Similar problems are now occurring across many European countries. However, the EU Commission’s supportive package does not introduce cash support for companies affected by the ongoing energy crisis. Regarding Uniper, the German government already got 30% of its capital. Now there is talk of a real nationalization, with the German government taking its stake above 50% and beyond. This follows the recent EPD nationalization. Uniper confirmed that discussions are underway. The stock simply collapsed, and we continue to remain neutral.

Uniper stock price evolution (Yahoo Finance)

Mare Evidence Lab’s sector coverage:

- Engie: Great Progress But Uncertain Times Ahead

- Fortum Oyj: A Clear No Go

Be the first to comment