MEDITERRANEAN/E+ via Getty Images

Consumer staples companies tend to hold up relatively well during recessions, given the stable demand for their products come rain or shine. You wouldn’t be able to tell from the stock price performance of Unilever (NYSE:UL), however, as it’s now trading well below its 52-week high of $60, while carrying a valuation that’s materially below that of its peers. In this article, I highlight what makes UL an ideal income stock to weather the current economic environment, so let’s get started.

Why UL?

Unilever PLC is a British multinational consumer goods company that’s headquartered in London. It’s home to a diversified base of 400 product brands that span across personal care to packaged foods, with top brands including Dove, Axe, and Seventh Generation, Ben & Jerry’s ice cream, and Hellman’s mayonnaise. In the trailing 12 months, UL generated $59.7 billion in total revenue.

What sets UL apart as an income stock is its defensive business model and diversified geographical revenue mix. Just over half of its revenue is generated from emerging markets, thereby giving it a growth kicker over the medium to long-term. In addition, its product mix includes both essential goods (such as food and personal care items) and discretionary items (such as ice cream), providing some degree of protection from a sharp slowdown in consumer spending.

UL appears to be faring well amidst global challenges, growing underlying sales by 7.3% YoY during the first quarter. Notably, UL’s volume’s declined by 1.0%, but this was more than offset by an 8.3% weighted average price increase along UL’s product lines. Importantly, this was driven by UL’s 13 brands with billion+ sales growing by 8.8%, and by growth in all 3 of UL’s priority markets of the USA, India, and China.

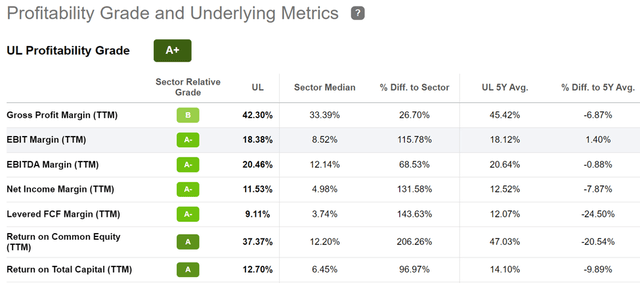

Moreover, UL is adapting well to eCommerce, as online sales now represent 14% of its turnover, representing double-digit growth. These fundamentals speak to the relative inelastic demand for UL’s products and its pricing power. As shown below, UL maintains an A+ score for profitability with sector leading EBITDA and Net Income margins of 20% and 12%, respectively.

UL Profitability (Seeking Alpha)

Looking forward, UL has its fair share of challenges with the war in Ukraine sparking raw material inflation, and management now expects costs to rise in the second half of the year by around €2.7 billion. As a result, management now expects operating margin to tilt towards the lower end of its previously guided 16-17% range.

Nonetheless, I find it encouraging that UL expects to offset some of the cost pressures with price increases, and now guides for sales growth to be towards the higher end of the previously guided 4.5-6.5% range. In addition, UL’s strategies to streamline its costs could pay off in the medium to long term, as highlighted by Morningstar in its recent analyst report:

Strategies to streamline the cost structure include 5S, which is focused on supply chain and gross margin efficiencies; zero-based budgeting, which has replaced budgets and spending targets with operational key performance indicators and primarily focuses on marketing spending and overhead; and Connected 4 Growth, which has delivered a 15% reduction in middle and senior management.

The financial targets accompanying these strategies include EUR 2 billion in annual cost savings, around half of which will be reinvested again in 2022, and returns on invested capital in the mid- to high teens, slightly higher than recent history. With a wide economic moat built on its supply chain advantages, Unilever has a better chance than most of its peers of reigniting growth in the medium term, in our opinion, but it remains in categories with relatively weak pricing drivers.

Meanwhile, UL sports a strong A+ rated balance sheet, and it’s commenced its first €750 million tranche of up to €3 billion share buyback program. As shown below, UL has reduced its share count by a respectable 8.4% over the past 5 years.

UL Shares Outstanding (Seeking Alpha)

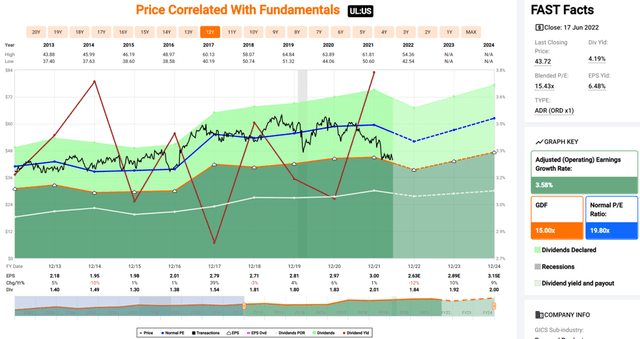

I see value in UL at the current price of $43.72, which translates to a blended PE of 15.4, sitting well below its normal PE of 19.8 over the past decade. This has pushed UL’s dividend yield to 4.2% and it comes with a 5-year CAGR of 6.3%.

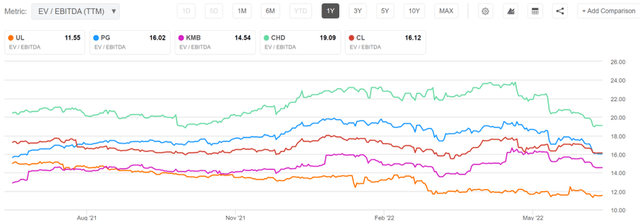

UL is also materially cheaper than its peer group. As shown below, it currently carries an EV/EBITDA of 11.6, sitting well below that of its peers Procter & Gamble (PG), Kimberly-Clark (KMB), Church & Dwight (CHD), and Colgate-Palmolive (CL). Sell side analysts have a consensus Buy rating on UL with an average price target of $58, and Morningstar has a fair value estimate of $56. This implies an up to 37% total return including dividends.

UL Peer Comparison (Seeking Alpha)

Investor Takeaway

I believe Unilever presents a compelling investment opportunity at the current price. It’s a high-quality company with wide economic moat, strong fundamentals, and an attractive valuation. While it has its share of challenges in the near term, management is taking the right steps to streamline costs while returning capital to shareholders in the form of dividends and share buybacks. As such, UL appears to be a good buy for stable income and long-term growth.

Be the first to comment