benimage

Unibail-Rodamco-Westfield (OTCPK:UNBLF) just published their Q3 results, and we are happy to see that they have recovered for the most part from the pandemic. There remain some weak spots, such as the UK, and central business district assets, which still have significantly higher vacancy compared to pre-pandemic, but in general the group is back to posting solid results.

Turnover was up +21% y/y, including the delivery of some new assets, and tenant sales in Q3 were at 103% of pre-Covid levels. Leasing dynamics were solid, both in terms of volumes and conditions, with a +5.6% uplift in minimum guaranteed rent (MGR) for the first nine months of 2022. There was a steady improvement in US and UK vacancy levels. The Convention & Exhibition business has also rebounded from the extended closures of the pandemic and is on track to reach pre-Covid levels.

One big worry for investors has been the significant leverage the company had after the Westfield acquisition, which was of course made worse by the pandemic. The company has made significant progress in its deleveraging program, which included cancelling the dividend for a couple of years and disposing some assets, mainly aimed at reducing the US exposure. The company made progress during the quarter with the disposal of Westfield Santa Anita in the US and the closing of five transactions in Europe.

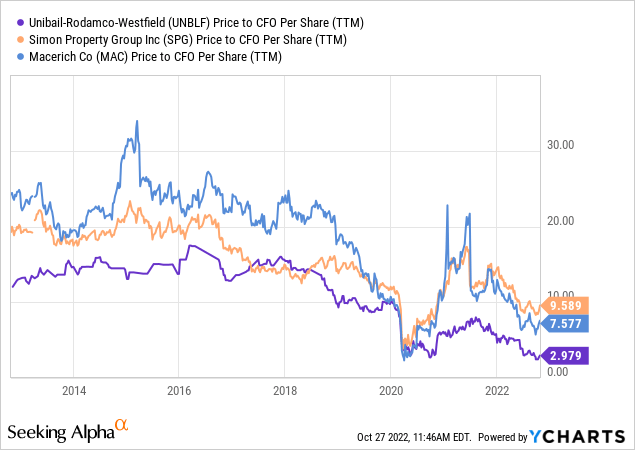

Based on the performance of the first nine months of 2022 Unibail is upgrading its 2022 Adjusted Recurring Earnings per Share (AREPS) guidance from at least €8.90 to at least €9.10 per share. With shares currently trading around €47 per share, this places the price/earnings ratio at just a little over 5x. Given the quality of the assets and the clear recovery trend, we believe shares are incredibly attractive at these prices. We believe part of the reason shares are trading so cheaply is that investors are upset that the company has guided that a dividend shouldn’t be expected until 2024 (for FY 2023). While mall REITs are trading at what we consider bargain valuations, including REITs such as Macerich (MAC) and Simon Property Group (SPG), we believe Unibail is trading at an even bigger discount.

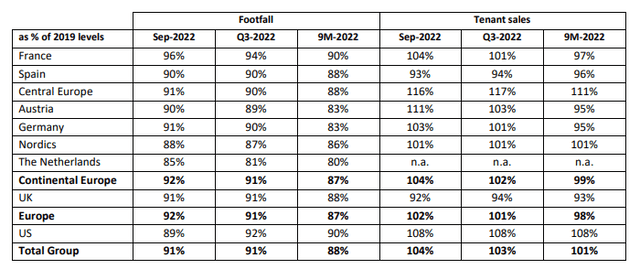

Footfall & Sales

In what has become a common post-pandemic characteristic for malls, people appear to visit a little less often, but they buy more when they do. That is why, despite footfall still being below pre-Covid levels at ~91%, tenant sales are now at 104% of 2019 levels. In any case, it is quite reassuring to see sales above 2019 levels, with only a few weak spots, mainly Spain and the UK, both of which are still below pre-Covid levels. The US has been surprisingly strong, now at 108% of 2019 levels.

Unibail Rodamco Westfield Investor Presentation

Leasing

Leasing activity remained strong, with 554 deals signed in Q3, for a total Minimum Guaranteed Rent (MGR) of €100.0 million. The total number of deals signed for the first nine months of 2022 was 1,755, corresponding to an MGR of €311.2 million. MGR uplift year-to-date was +5.6% confirming there is still good appetite and willingness to pay to rent space at Unibail’s properties. MGR uplift was +9.0% in Continental Europe and +4.0% in the US, offset by the UK at -3.3%. Our main worry remains the UK, with its weak sales, high vacancy, and negative MGR trend.

Vacancy

Vacancy remained stable during the quarter at 6.9% and was 100 bps below Q3 of 2021. The vacancy is expected to decrease further in Q4. In Continental Europe, vacancy increased by +30 bps in June 2022 to 4.3%. In the UK, the vacancy decreased from 9.7% in June 2022 to 9.5% in September 2022. In the US, the vacancy decrease was -60 bps from 10.4% to 9.8% from June to September. Central Business District (CBD) assets, most affected by work from home, had a vacancy level of 23.7%.

Deleveraging

Unibail has completed €3.2 billion of its €4.0 billion European disposals program. In the US, Unibail announced the sale of Westfield Santa Anita, a regional shopping center, in August for $537.5 million (at 100%, Unibail’s share is 49%).

At the end of the quarter, net financial debt was €23.3 billion, down from €24.1 billion the previous quarter. Cash on hand increased to €3.0 billion from €2.4 billion the previous quarter, in part thanks to the asset disposals.

Thanks to the combination of improved operational performance and debt reduction, the Net debt/EBITDA ratio improved from 11.0x on June 30, 2022 to 10.4x on September 30, 2022. The interest coverage ratio remained stable at 4.5x.

Valuation

We believe Unibail’s US peers are cheap, mainly Macerich and Simon Property Group. Both these companies currently have high dividend yields and trade at low multiples of funds from operations. Unibail does not report FFO, but instead adjusted recurring earnings per share. With AREPS guided a more than €9.10 per share for the year, Unibail is trading at a ridiculous p/e of just a little over 5x. Similarly, if we compared Unibail to Simon and Macerich in terms of cash flow from operations, it is clear that it is cheaper too. We believe all three mall companies offer significant value at current prices, but we think Unibail-Rodamco-Westfield is the biggest bargain.

Risks

The risks are well known at this point, the biggest of which we believe to be mandated government closures due to Covid. It seems we are past that phase of the pandemic, but the risk remains. There is also the threat from e-commerce continuing to take market share from brick-and-mortar retailers, but so far class A malls have proven resilient. Quality malls have found ways to reinvent themselves, bring new exciting tenants into the mix, more services and experiences, and retailers are increasingly implementing omni-channel sales strategies. The final risk worth mentioning is that of leverage, which remains high but has come down significantly, and it seems that Unibail will hit its target leverage within the next couple of years.

Conclusion

Overall, we believe Q3 results from Unibail are quite positive, with only a few weak spots. The main weak spots are the UK, Spain, and Central Business District assets. With average tenant sales above 2019 levels, it seems that the recovery is mostly complete. Occupancy and rents are also moving in the right direction for the most part, with some weak spots remaining, such as Spain and the UK. Importantly, the company has made significant progress on its deleveraging, and it should be able to restart the dividend in 2024 if things go according to plan. Unibail has some very high quality assets, particularly in Continental Europe, and is trading at a bargain valuation that is even cheaper than that of its US based peers.

Be the first to comment