Jeff Schear

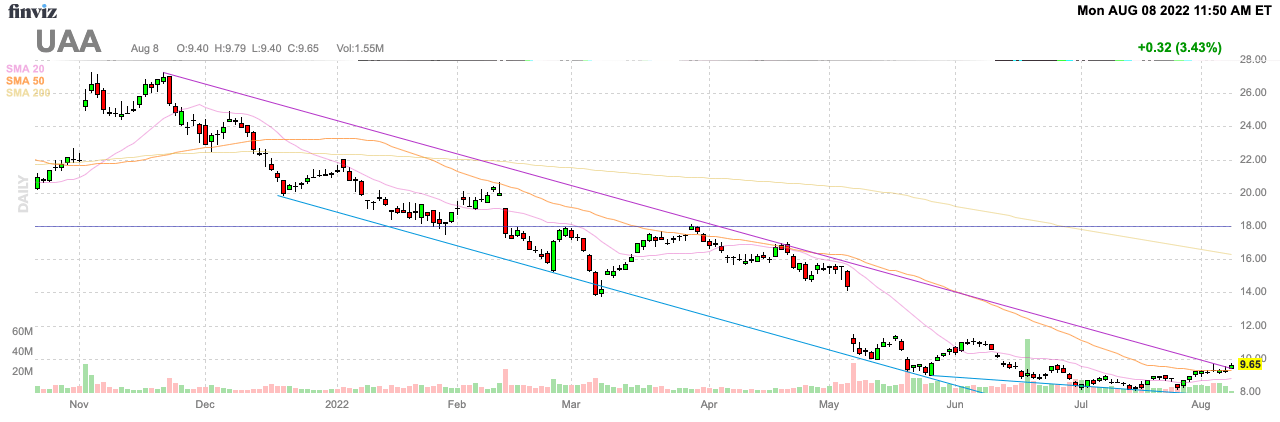

As with all retailers, Under Armour (NYSE:UA, NYSE:UAA) has fallen on tough times with supply chain issues. The athletic apparel retailer is being hit with higher costs and headed into a promotional environment, despite making smart moves on constraining inventory levels. My investment thesis is ultra-Bullish on the stock, trading at $9 with all of the hidden improvements.

FinViz

Remarkable quarter.

Despite a hit to sales from constraining orders earlier this year, Under Armour still reported flat FQ1’23 revenues. With EPS in line with expectations, the actual quarterly numbers for June were solid.

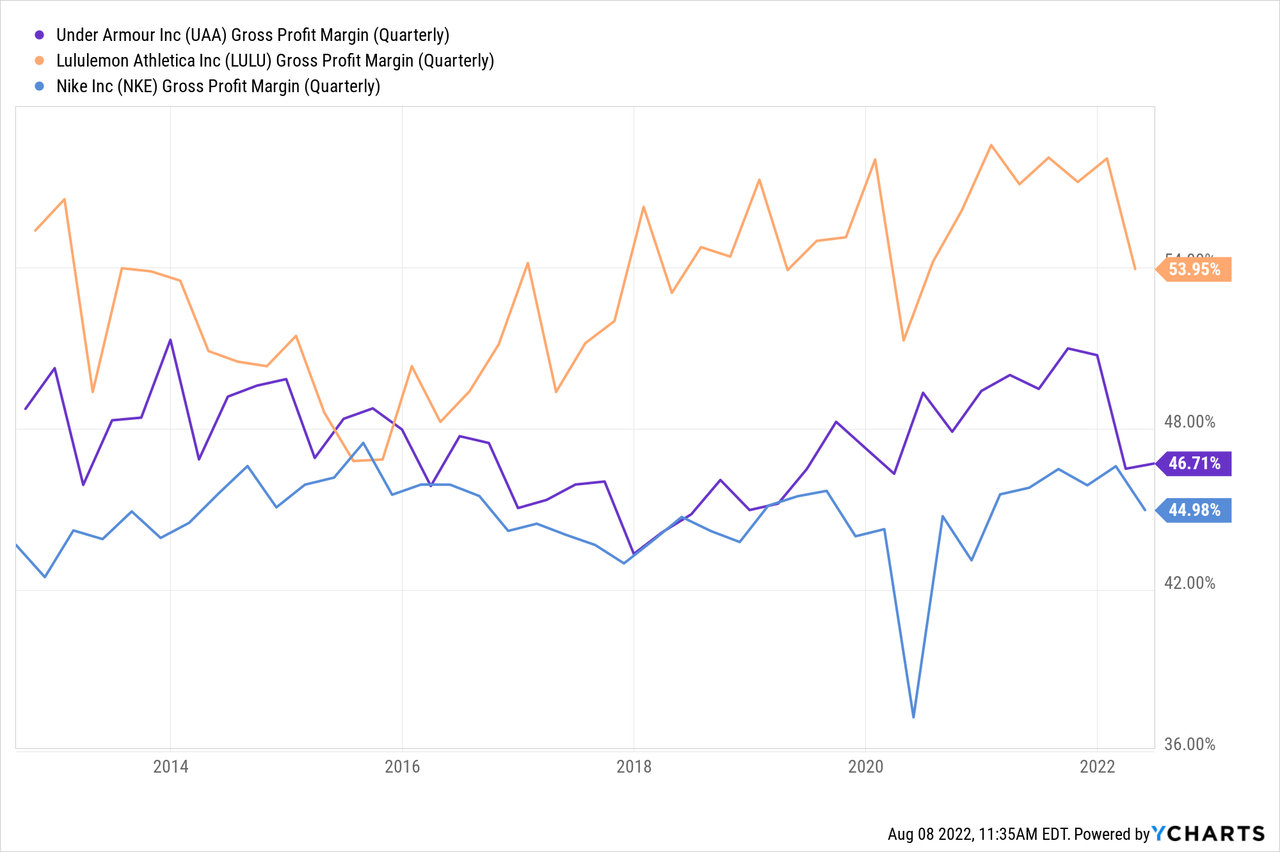

The problem is that the athletic apparel maker continues to see gross margins get smashed due to higher shipping costs and the expectation of a higher promotional environment going forward. For FQ1, gross margins fell 280 basis points to 46.7%.

As the below chart highlights, Under Armour has spent the last couple of years restructuring during covid to improve the gross margin profile. The company successfully separated from peer Nike (NKE) with up to a 400 basis points difference until the last quarter. Under Armour shifted focus back to producing premium athletic products to place the company in the middle of the margin picture with Lululemon Athletica (LULU) and Nike.

Unfortunately, the higher freight costs from orders along with a larger promotional environment from a market with too much inventory, Under Armour forecasts gross margins to now fall 375 to 425 basis points in FY23 from a baseline of 49.6% last year. All of the progress of the last couple of years has been lost in the short term.

The positive for Under Armour is that the constrained orders from early this year place the athletic apparel maker in a strong position. The company has virtually flat inventories from 2019 at $954 million, yet revenues have risen 13% in the period.

Even more amazing, revenues are still forecast to rise 5% to 7% for the year, despite the currency headwinds of 200 basis points and the reduced inventories. Under Armour forecasts a 3 percentage points impact from the proactive order cancellations earlier this year.

The biggest question is whether Under Armour will actually benefit from the lower inventories, considering the expectation is for the company needing to compete on price due to other apparel makers having too much clothes.

Still Profitable

Under Armour has proven to the market that the business is far healthier now. The company still forecasts operating income for the year of over $300 million.

The market claims to prefer investing in profitable companies, but Under Armour being profitable with ~400 basis points of gross margin hit hasn’t helped the stock. With profits not growing, the market has sold Under Armour back to the covid lows.

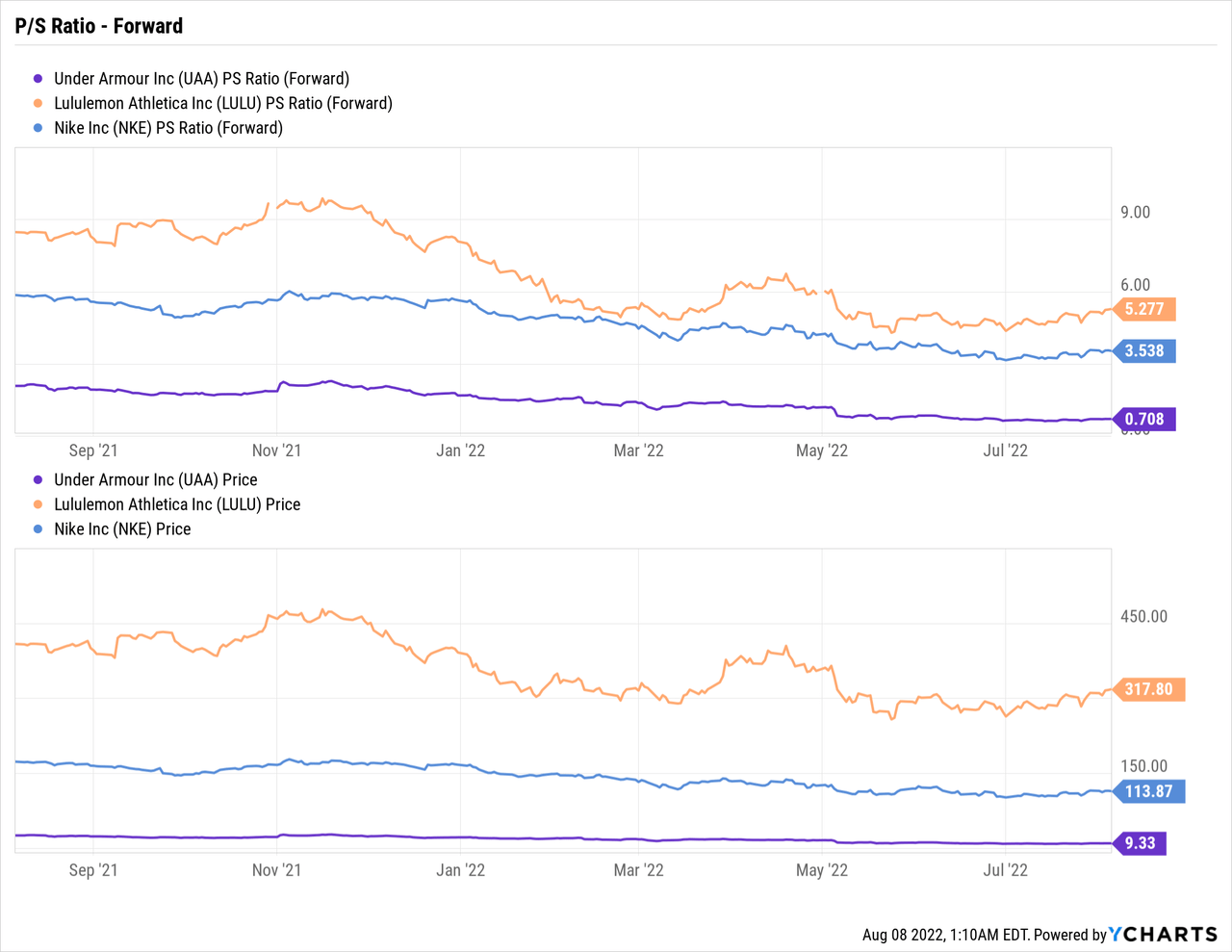

My past research has highlighted that the only separating feature between Under Armour and the peer stock valuations is the margin issue. The company has similar growth and will return to higher gross margins than Nike when covid impacts disappear.

The only thing Under Armour would lack is scale, with ~10% of the revenues of Nike. Lululemon has used their much higher gross margins to produce elevated valuation multiples. Oddly, Under Armour is still valued like the dog in the group despite clear improvements in operations. The stock trades at a massive discount to Nike and would need to rally 400% to match the premium P/S multiple assigned to the athletic footwear giant.

Under Armour isn’t losing ground anymore, with a profitable business and $1 billion in cash providing a solid foundation to invest in growth and product innovation where needed.

Takeaway

The key investor takeaway is that the market always likes to extrapolate weakness and refuses to acknowledge the actual problem. Under Armour has turned the corner towards a very profitable future, reinvigorating the premium athletic apparel brand.

The stock remains far too cheap, trading at a fraction of the valuation multiple of sector peers. The current market environment is hiding the improvements made by Under Armour, providing a great opportunity to own the stock at only 0.7x constrained sales targets.

Be the first to comment