Ari Widodo

In this article, I will look to determine the best pure-play copper producer in the world. This article follows my previous article that highlights the bullish case for copper prices due to the expected supply shortfall.

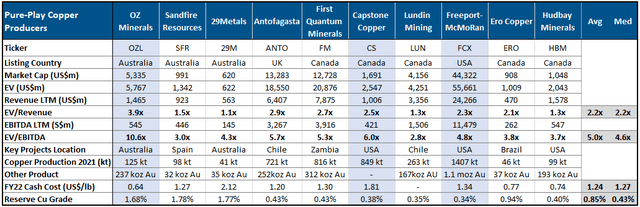

This article will focus on pure-play copper producers and thus excludes companies not yet at the production stage as well as diversified miners such as BHP (OTCPK:BHPLF) & Glencore (OTCPK:GLCNF) (despite their significant copper production). I will focus on the key assets of the company, its position on the cost curve, potential to increase production and capital allocation. I believe these will be the key attributes that will drive outperformance should the bullish copper thesis play out. I have highlighted below what I deem to be the top three producers to analyse further:

Author Created (Capital IQ Data)

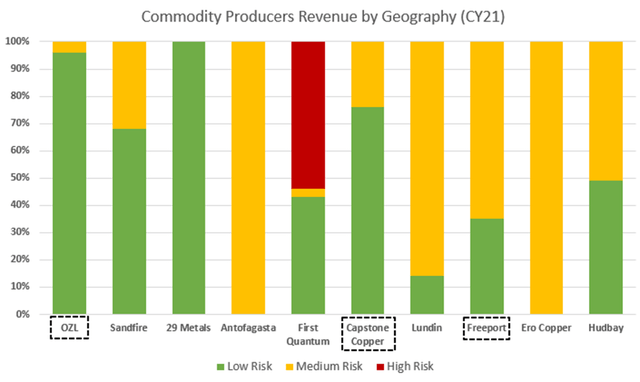

Author Created (Capital IQ Data)

OZ Minerals

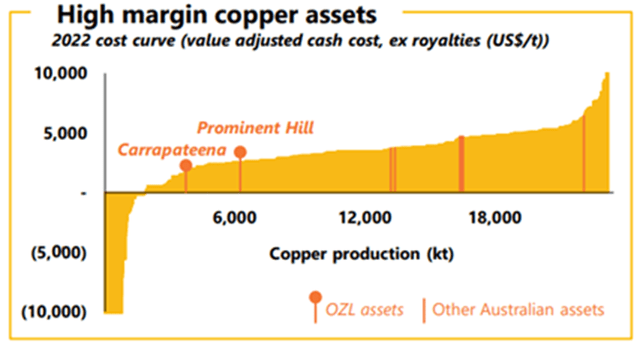

OZ Minerals (OTCPK:OZMLF) is a mid-tier Australian copper producer with its two primary copper assets located in South Australia. It is one of the few copper producers positioned in the 1st quartile of the production cost curve that also operates primarily in tier 1 jurisdictions (~95%). OZ Minerals owns 2 of the 5 >50ktpa copper-producing assets in Australia. It also has the option to acquire the 6th largest copper project in Australia for A$205m. Its two primary assets; Carrapateena and Prominent Hill, are two of the premier copper mines in the world. These mines operate in the 1st quartile of production costs despite being located in one of the best mining jurisdictions in the world in South Australia:

Company Presentation

OZ Minerals’ Key Operating Assets:

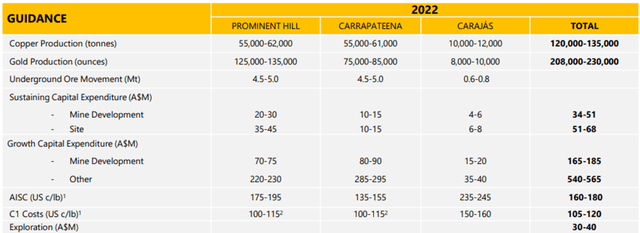

- Carrapateena (~47% of copper production) is a Long-life (>20 years) underground copper mine in South Australia that commenced production in 2020. It is the 2nd largest copper resource in Australia and one of the premier copper mines in the world. Its block cave unlocks multigenerational production with lowest cost quartile positioning. Its low-cost production can be attributed to its significant gold by-products, high-grade ore (~1.1% Cu) and modern infrastructure. There is significant resource outside the mine plan to extend LOM.

- Prominent Hill (~47% of copper production) is an underground copper mine in South Australia with a ~14-year mine life. It is the 5th largest copper resource in Australia. Prominent Hill is not processing constrained with latent mill capacity. This has enabled Prominent Hill to successfully deliver on production guidance in the last 6 years.

2022 Production Guidance (Company Presentation)

Oz Minerals’ Key Expansion Projects

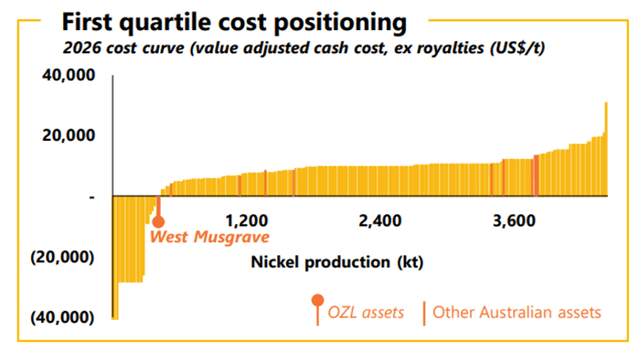

- West Musgrave is an open-pit nickel & copper project in Western Australia with significant expansion opportunities identified. Expected to be positioned in the first quartile on the cost curve. It is the 2nd largest nickel sulphide asset in Australia.

Musgrave Cost Curve Estimate (Company Presentation)

- Kalkaraoo – OZ Minerals has the option to purchase the 6th largest copper asset in Australia. OZ Minerals has the flexibility to exercise the option once project knowledge is improved. Kalkaraoo has the potential for a low-cost, long-life asset that will add ~30kt of Cu production.

There is a clear pathway to more than double production through both brownfield and greenfield expansion projects. Key medium-term opportunities to increase production from the ~142kt p.a. run rate include:

- Carrapateena block cave expansion – ~65kt p.a. increase to copper production.

- Carrapateena block cave expansion – ~65kt p.a. increase to copper production.

- Prominent Hill Shaft expansion – ~12kt p.a. increase to copper production.

- West Musgrave – targeting production by 2025 with ~93kt p.a. of Nickel production expected.

- Gurupi Province – pending removal of injunction to increase copper production by ~21kt p.a.

- Kalkaroo – option to acquire the 6th largest Australian copper mine. Expected to produce ~44kt p.a. with ~15-year mine life.

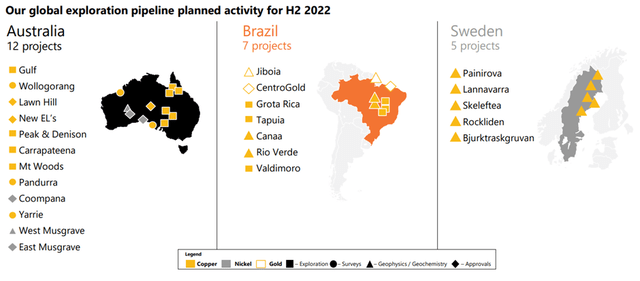

- Global exploration portfolio – potential to convert its global exploration and resource portfolio

Company Presentation

OZ Minerals’ Capital Management

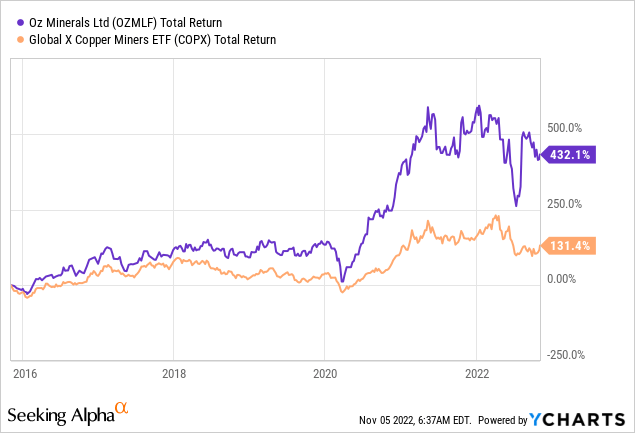

OZ Minerals’ capital management has been strong in recent years. The management, led by Andrew Cole since 2014 has improved efficiencies at Prominent Hill and successfully developed Carrapateena into one of the world’s premier copper mines. Oz Minerals has maintained a relatively low distribution yield of ~1.8% over the last 5 years, as it focuses on maintaining a strong balance sheet and invests in expanding production. The balance sheet is in robust shape as of the Sep-22 quarter, with a net debt position of A$84m. With LTM EBITDA of A$751m, this implies a healthy net debt to EBITDA ratio of 0.11x. If the West Musgrave project is approved, the capital expenditure required to develop the mine combined with the Carrapateena and Prominent Hill expansions will likely see this net debt figure increase, albeit likely only to a modest level. Oz Minerals’ effective capital management has translated to outperformance over its copper peers, with ~787% shareholder returns (including dividends) since 2015 (when Cole took charge of operations and moved the headquarters to Adelaide).

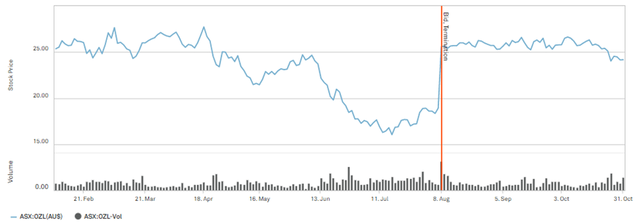

OZ Minerals recently rejected a takeover bid from BHP in Aug-22 for US$5,769m (A$8,369m) or A$25/share, with the implied pricing ratios as follows:

- EV/Revenue (LTM) – 3.93x

- EV/Revenue (NTM) – 4.20x

- EV/EBITDA (LTM) – 10.58x

- EV/EBITDA (NTM) – 9.77x

OZ Minerals rejected the takeover bid on the grounds that it “undervalues” the company. Until recently, shares had been trading above the bid price, suggesting the market is expecting a higher bid to come. BHP is seeking growth in commodities tied to trends including low-emissions transport and clean energy, which is increasing confidence in the market that BHP will pay a high multiple for copper assets in a Tier 1 jurisdiction. Given the takeover speculation surrounding OZ Minerals at the moment, the valuation is not as attractive as in recent months, although BHP may come forward with another bid.

OZL Share Price Reaction To BHP Bid (Capital IQ)

Capstone Copper

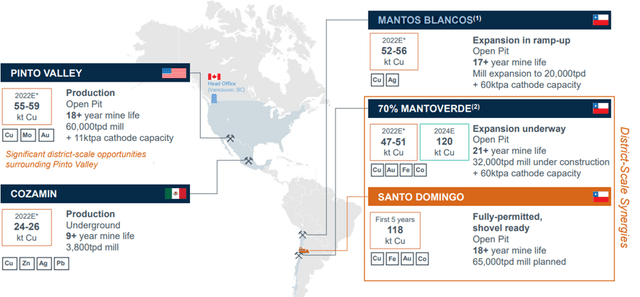

Capstone Copper (OTCPK:CSCCF) is a mid-tier Canadian copper producer with a focus on the Americas. Its key projects are located in the USA, Mexico and Chile. Capstone Copper was formed during the recent merger between Canada’s Capstone mining and Chile’s Mantos Copper. The merger has unlocked synergies between key projects in the mining-friendly Atacama region in Chile.

Capstone Coppers operates the 7th largest copper mine in the USA, in one of the best mining jurisdictions in the world (Arizona). Capstone Copper is in the process of expanding production at its second-biggest copper mine (soon to become the biggest) located in the Antofagasta region of Chile. Capstone Copper’s strategy is to expand the production of long-life mines whilst executing cost and operational improvements.

Key Copper Assets (Company Presentation)

Capstone Copper’s Key Operating Assets

- Pinto Valley (~30% of copper production) is a long-life (>18-year mine life) open pit copper mine and is currently the only operating mil in the Globe-Miami district of Arizona, one of the oldest and most productive districts in the USA. The Pinto Valley mine has a long history of consistent production due to its favourable jurisdiction and significant infrastructure developed over the long-mine life. The trade-off to this reliable production is that the mine is positioned in the 4th quartile on the cost curve due to lower copper grades (~0.3%). The mine has recently completed US$31m in capital expenditure to decrease bottlenecks in the crushing plant and improve mill throughput by ~10%.

- Mantos Blancos (~30% of copper production) is a long-life (>17-year mine life) open pit copper mine located in the Antofagasta province in Chile. The Mantos Blancos mine is positioned in the 3rd quartile on the costs curve and is currently benefiting from increased production. The mine recently completed an expansion project and is in the process of increasing throughput capacity from 11k tonnes per day to 20k tonnes per day.

Capstone Copper’s Expansion Opportunities

- 70% owned Mantoverde is a long-life (>21-year mine life) copper mine located in Chile that is currently undergoing significant expansion works. The development project is ~67% complete as of the Q3 2022 update and is expected to increase copper production from ~51kt to ~120kt at completion in 2024.

- The next stage of expansion at Pinto Valley (PV4) aims to extend the mine life to the 2050s and increase annual copper production from ~55kt to an average of ~72kt over the next 30 years. This expansion will be low CAPEX as Capstone Copper intends to utilise existing optimized infrastructure with higher mill cut-off grades.

- Santo Domingo is a fully-permitted and shovel-ready open pit long-life (>18-year mine life) copper-cobalt project located near Mantoverde. There are district-scale synergies between the two projects that will enable Santo Dominigo to build a top-quartile copper cold project along with a low-cost battery-grade cobalt business. The synergies between the two mines were a key reason for the merger of Capstone and Mantos. Importantly, Santo Dominigo is Chile’s only fully-permitted greenfield project with support from locals.

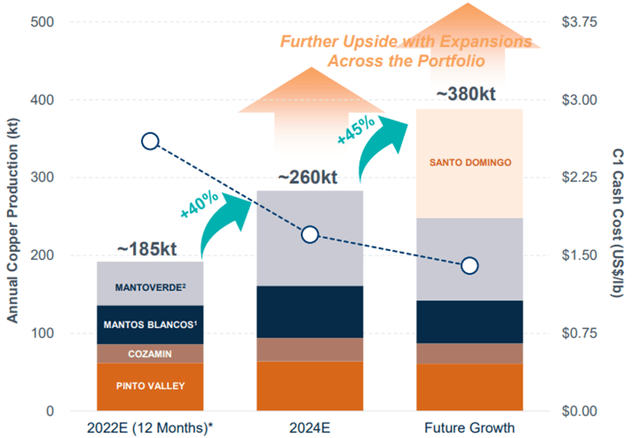

Capstone Copper is expected to expand copper production from ~185kt in 2022 to ~260kt in 2024 through these expansion initiatives. The Santo Domingo mine is expected to be operational by 2024 and will help improve copper production to ~380kt post-2024. As Capstone Copper increases its production it expects to improve its unit economics and reduce its cash cost from US$2.60/lb in 2022 to ~US$1.70/lb in 2024.

Forecast Production Increase (Company Presentation)

Capstone Copper’s Capital Management

Management has begun leveraging the balance sheet to fund the aggressive expansion of production, with net debt increasing to US$414m as of the recent quarter. This implies a net debt to EBITDA ratio of 0.98x, which remains reasonable, albeit it is likely to increase over the coming quarters. Management has recently reduced capital expenditure guidance for 2022 from US$620m to US$580m due to a combination of deferments and cost-cutting. Importantly, the Mantoverde development remains fully financed and on time to complete construction/commissioning. Management’s ability to manage debt levels with significant future capital expenditure will be an important factor to watch moving forward.

Freeport-McMoRan

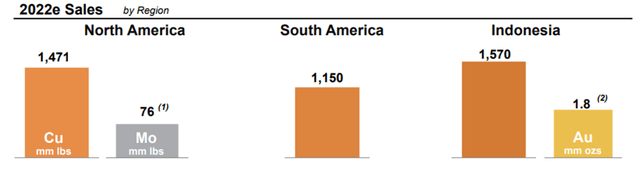

Freeport-McMoRan (NYSE:FCX) is a large-scale, geographically diverse copper miner with headquarters in Arizona, USA. It operates 3 of the top 10 largest copper-producing mines in the world. Its key projects are located in the Grasberg minerals district in Indonesia, one of the world’s largest copper deposits as well as throughout the Americas, including the largest copper mine in the USA. Freeport-McMoRan is the third biggest copper producer in the world and as such operates at a lower cash cost than most competitors.

Company Presentation

Freeport-McMoRan’s Key Operating Assets

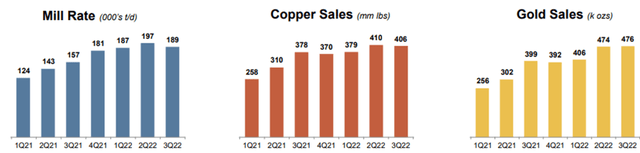

- Grasberg (~27% of copper production) is an underground and open pit copper mine located in the remote highlands in the province of Papua, Indonesia. The mine is the third-largest copper mine in the world by production and is operated as a JV (48% ownership) with the Indonesian government. Grasberg mine is one of the lowest-cost copper-producing mines in the world and is positioned in the lower half of the first quartile of the cost curve. Grasberg has the single largest known gold reserve and the largest copper reserve in the world. As such, it is a very long-life mine with low production costs. In early 2021 mining transitioned from open pit mine to underground operations. This transition has improved production:

Grasberg Production (Company Presentation)

- Morenci (~25% of copper production) is the largest copper mine in the USA (7th largest globally) by production and has been in operation since ~1940. The open pit mine is operated as a JV (72% ownership) with Sumitomo and has a 20+ year mine life. The mine is located in the tier 1 mining jurisdiction of Arizona, USA. Freeport invested billions into expanding the reserves and production from 2007-2015 and successfully increased production from 50kt to 115kt of ore per day. Morenci has maintained its long life by offsetting declining grades with increasing scale and through improvements in technology. Because of the low grades (typically < 0.3% Cu), Morenci is positioned in the 4th quartile of the cost curve. Morenci is thus a high-cost but very reliable, low-risk mine with a stellar track record of production.

- Cerro Verde (~25% of copper production) is a long-life (>30 years) open pit mine located in the Arequipa region of Peru. The mine is operated as a JV (53% ownership) with Sumitomo. The mine completed a large-scale expansion in 2015 which has increased its production by 3x. The mine has low-grade ores (<0.4% Cu) with high tonnage, as such the mine is positioned in the 4th quartile of the production cost curve.

Freeport-McMoRan’s Key Expansion Opportunities

- A key opportunity for FCX to expand future low-cost copper production is through its new leach technologies. FCX is a market leader with a long history of leach production and is advancing sulfide leaching technologies to improve recovery. FCX estimates there are 17m tonnes of copper in leach stockpiles in its operating mines that are unrecoverable by traditional leach methods. The new leach technologies are primarily being applied to low-grade operations (Morenci) in the Americas.

- FCX is prudently making low capital intensity investments into its Lone Star project, with a planned production rate of ~136kt p.a. to be achieved in 2023, which will make it FCX’s 4th largest mine.

- ~US$120m in capital expenditure is being spent on mill upgrades at the Grasberg mine with an expected uplift of ~27kt p.a. with improved operating efficiencies.

Freeport-McMoRan’s Capital Management

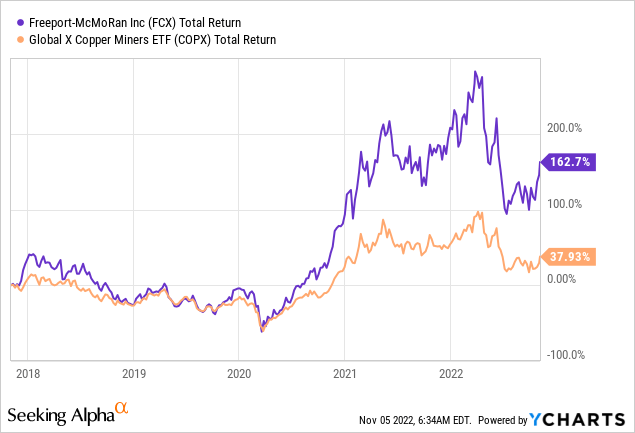

FCX has successfully deleveraged its balance sheet over the past decade, reducing its net debt from ~US$18b in FY13 to US$2.1b in Q3 2022. Whilst its debt levels remain relatively high at US$9.66b, its net debt is only 0.21 times its LTM EBITDA of US$10.01b. Additionally, its EBIT is ~16 times the size of the interest expense. Since deleveraging its balance sheet FCX has turned to more friendly shareholder actions, with US$2.7b returned to shareholders since Jun-21 (when the net debt target was reached) through dividends and share buybacks. With US$3.2b in share buybacks remaining under board approval and strong FCF for dividend payments, the strong shareholder returns are likely to continue.

Which Company Is The Best Copper Producer?

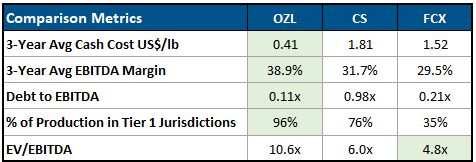

OZ Minerals is the clear winner when it comes to the key metrics assessed. It has the best unit economics with the lowest cash cost, the strongest EBITDA margin, the highest proportion of production in tier 1 jurisdictions and the most robust balance sheet. This superior quality comes at a price with a premium valuation applied to OZL, which has been exacerbated by the BHP bid, with shares now trading at a premium:

Author Created (Capital IQ Data)

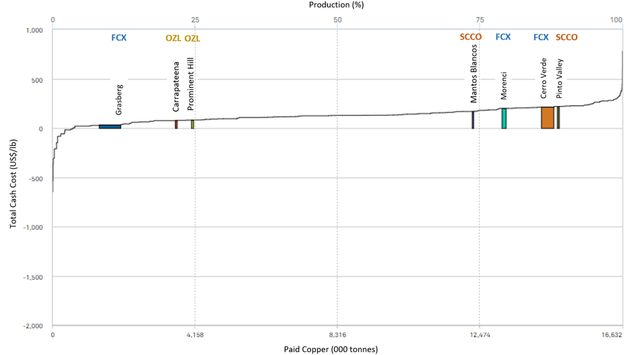

As we can see from the chart below, FCX operates the lowest-cost and largest-producing copper mine of the companies analysed. The downside to this is that the mine is operated in Indonesia which is considered a higher-risk mining jurisdiction. Of the stock analysed, OZL operates the only other two mines positioned in the first quartile of the cost curve. Given these assets are low-cost producers and operate in the tier 1 mining jurisdiction of South Australia, it is clear that OZL has the highest quality copper assets.

Copper Production Cost Curve (Author Created (Capital IQ Data))

All three companies have unique production expansion opportunities. OZ Minerals’ opportunities to increase production will come primarily from the acquisition and development of new projects. Capstone Copper is aiming to increase production through synergies from its merger with Mantos and the development of new mines. FCX is primarily focusing on production increase through technological innovation and improvement in efficiencies at existing long-life large-scale mining operations. In terms of short-term opportunities to increase production, I would give the edge to Capstone Copper as it stands to benefit from the Mantoverde upgrade works in 2023, the low-CAPEX Pinto Valley expansion and the opening of the Santo Domingo mine that will benefit synergies from the merger. I view Oz Minerals’ expansion as higher risk given it involves the development of new mines and the acquisition of Kalkaraoo. FCX’s expansion is the lowest risk in my opinion given its large-scale and low-CAPEX expansion projects.

Conclusion

I believe that OZL is the highest quality listed pure-play copper producer in the world given its low-cost production, future expansion opportunities and the fact it operates primarily in South Australia, which is considered one of the best mining jurisdictions in the world. With the stock price up ~32% since BHP’s attempted takeover in August shares now trade at a premium valuation. I believe Capstone Copper is well positioned to benefit from a more immediate recovery in the copper price and is considered a low-risk option given its track record of production. FCX is a large-scale producer with fewer growth ambitions and is a low-risk long-term option that is optimised for shareholder-friendly actions such as share buybacks and dividend payments. I will look to start a position in OZ Minerals should the shares fall to a more attractive valuation.

Be the first to comment