imaginima

The USCF Midstream Energy Income Fund ETF (NYSEARCA:UMI) (the “Fund”) strives to provide a high level of income as its primary objective. Capital appreciation is its secondary objective, according to its Registration Statement.

The Fund is an actively managed exchange-traded fund “ETF” to invest in “midstream” energy sector companies, as opposed to “upstream” (i.e., producers) or “downstream” companies (i.e., marketer). Midstream energy services are generally transportation, storage, and gathering & processing infrastructure that primarily collect fees for transporting customers’ oil, natural gas, and other products, and are not typically exposed to commodity price movements.

In the energy sector, midstream companies include (per the registration statement):

“publicly-traded master limited partnerships and limited liability companies taxed as partnerships (‘MLPs’), and companies structured or who elect to be taxed as C-corporations that derive the majority of their revenue from operating or providing midstream energy services.”

USCF

USCF Advisers LLC lists three reasons to consider UMI:

- UMI permits exposure to the midstream energy market including master limited partnership, without a K-1.

- UMI is actively managed, integrating forward-looking fundamental and Environmental, Social, and Governance (ESG) research.

- UMI invests in companies whose cash flows are typically supported by long-term contracts and generally have limited direct commodity price exposure.

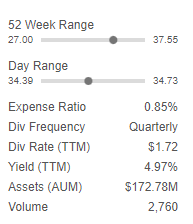

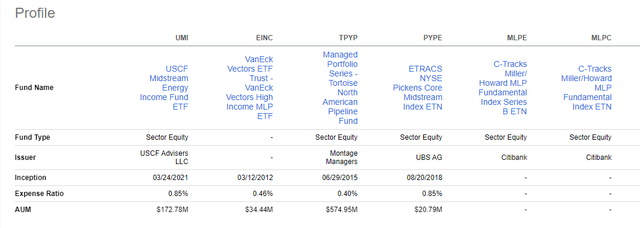

The Fund charges an expense ratio of 0.85% and has around $175 million in assets under management (“AUM”).

Seeking Alpha

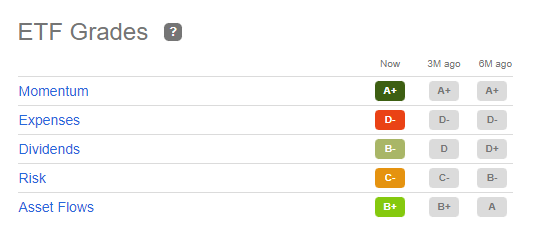

Seeking Alpha gives UMI’s expenses as a “D” grade.

Seeking Alpha

Holdings

As of 09/02/2022, USCF lists the securities below:

Performance

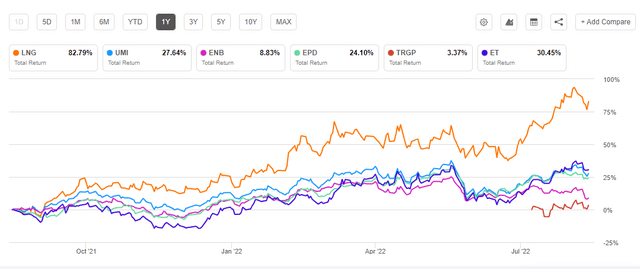

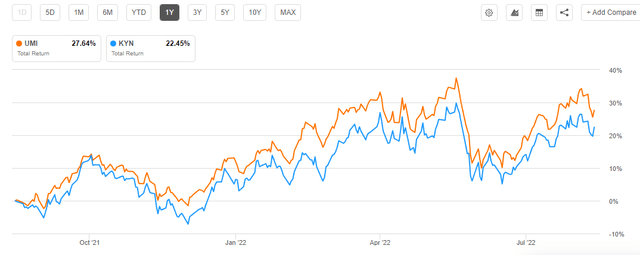

Over the past year, UMI has returned 27.64%, whereas the S&P 500 (SP500TR) index has lost 12.17%.

Comparisons

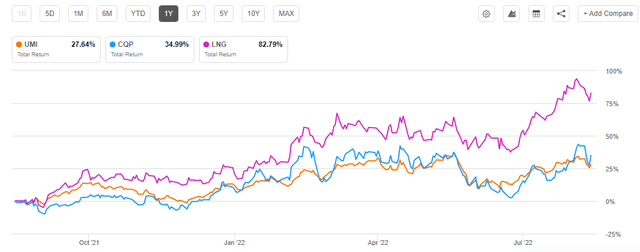

In the graph below, I provide the return of UMI compared to its top holdings.

Cheniere Energy, Inc. (LNG) has the highest return of returned 82.79%. I recently published an article about Cheniere Energy Partners (CQP), Cheniere Energy Partners: Solid Long-Term Investment Outlook. It is the general partner of LNG, a leader in LNG and natural gas marketing. CQP has returned 34.99%, so a blended average of CQP AND LNG would be 58.89 %.

Given the disruption of natural gas imports from Russia, and soaring natural gas prices there, the outlook for LNG infrastructure is superior to petroleum-related infrastructure investments, as discussed in my articles about the Kayne Anderson Energy Infrastructure Fund, Inc. (KYN). It is the largest U.S. closed-end fund (“CEF”) focused on energy infrastructure investments. The company’s net assets under management is around $1.5 billion.

In my two articles entitled, Kayne Anderson Energy Infrastructure Prospects And DIY Portfolio (Part 1) and (Part 2), I concluded that investments involving fossil fuels face a tough future, given investor sentiment and climate change imperatives. However, energy infrastructure investments are required, and there are some bright areas, such as natural gas liquids and renewables. I recommended a DIY portfolio, positioning in natural gas liquids infrastructure, as opposed to petroleum infrastructure.

Over the past year, UMI returned 27.64 %, as compared to KYN’s 22.45 %. UMI’s largest allocation is LNG, whereas it is KYN’s 8th largest.

Seeking Alpha lists UMI’s peers, and its largest listed competitor, Tortoise North American Pipeline Fund (TPYP).

TPYP had a return of 24.17% over the past year, lower than UMI’s 27.64%.

Conclusions

UMI has provided a somewhat better return than the competitors I named here. That appears to be due to its larger allocation to natural gas liquids (“NGLs”) infrastructure, namely LNG. However, a DIY portfolio that concentrates on NGLs should be considered and may provide a higher return due to the outlook for NGLs v. petroleum.

As always, readers are responsible for their own due diligence and should obtain the advice of an investment advisor, accountant or tax attorney to understand the tax implications of any investment.

Be the first to comment