Investment thesis

Even in a bear market, I’m focused on finding high quality companies that provide close to non-discretionary services. Today I’m analyzing UiPath, a leader in the Robotic Process Automation (RPA) space. But even after a decrease of 53% YTD, I’m still not buying UiPath’s stock since I believe the company will face significant headwinds in 2022.

NanoStockk/iStock via Getty Images

Business model – How does UiPath make money?

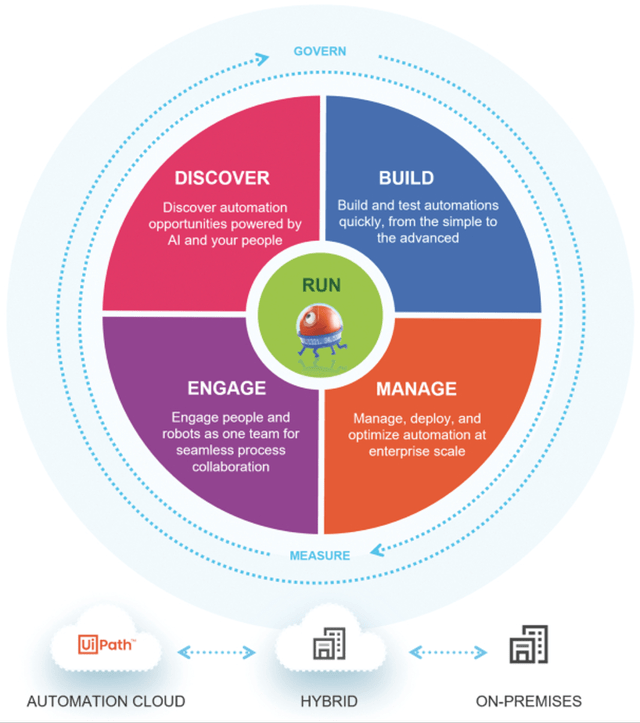

UiPath (NYSE:PATH) offers an automation platform designed to transform the way humans work. It uses computer vision and artificial intelligence, “AI” to empower software robots to emulate human behavior and execute specific manual repetitive business processes.

UiPath creates the ability to discover automation opportunities and to build, manage, run, engage, measure, and govern automations across an organization. These actions include, but are not limited to, logging into applications, extracting information from documents, moving folders, filling in forms, and updating information fields and databases. The software can be used in industries like Insurance, Telecommunications, Banking and Finance, Healthcare and even Governmental organizations.

Key Performance Indicators – Is the business healthy?

Annualized renewal run-rate (ARR)

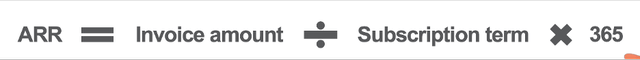

The main key performance indicator that UiPath uses is its (ARR). It is defined as annualized invoiced amounts per solution from subscription licenses and maintenance obligations assuming no increases or reductions in their subscriptions. This is the pure recurring revenue as it doesn’t include revenue from perpetual licenses or professional services:

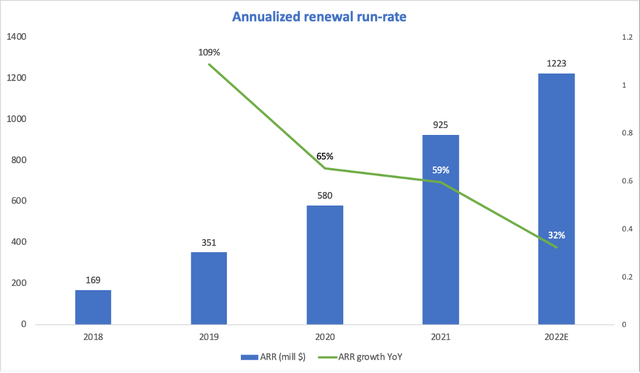

UiPath 3Q’2022 Earnings Presentation

The ARR has been consistently growing and shows an increased strength in the operational business. However, given recent events like the Ukraine war, UiPath has guided for a growth of only 32% in the ARR for full year 2022, which is still healthy.

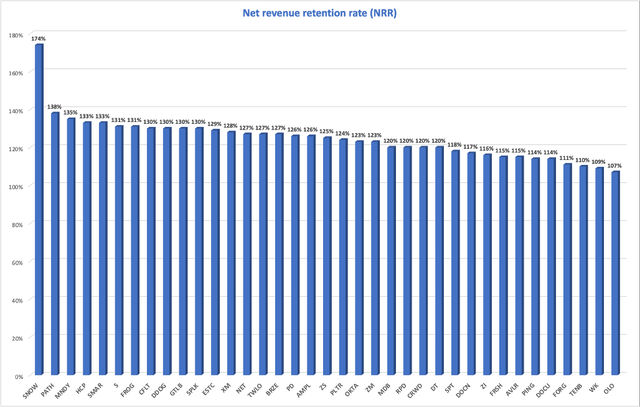

DBNRR – phenomenal monetization of existing customers

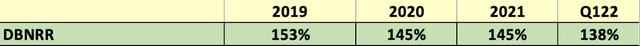

In terms of customer monetization, UiPath reports the dollar-based net retention rate (DBNRR), which represents the net expansion of ARR from existing customers over the preceding 12 months. The metric has been extraordinary for a software business and proves that UiPath’s land-and-expand market strategy has been successful so far as the DBNRR remains well above 120%, which is generally an excellent value:

Moreover, in a data set containing the fastest growing software companies, UiPath has the second biggest net retention rate, only behind Snowflake (SNOW). This is impressive, but considering that the company expects a slowdown in the demand because of factors like Ukraine war or FX volatility, I also expect their DBNRR to slightly decrease in the subsequent periods.

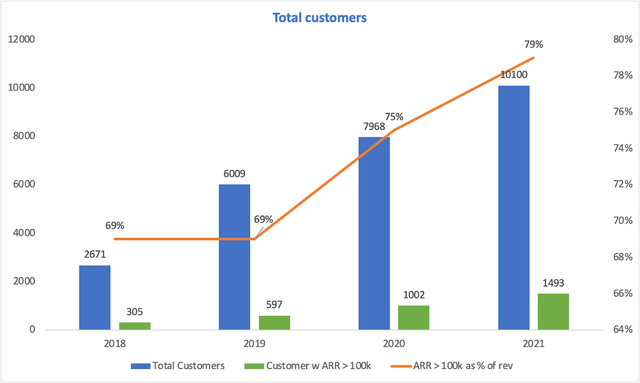

Number of customers

At the end of 2021 UiPath had around 10100 customers, out of which 1500 had more than $100k in ARR. This customer cohort represented almost 80% of UiPath’s total revenue. The customers’ growth might also be attributed to an incredible 71 (NPS) score that the company revealed in February 2021.

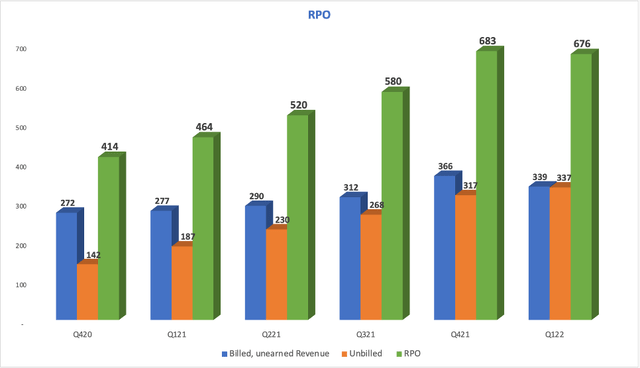

Remaining Performance Obligations

Another important metric for software companies is the (RPO). It consists of amounts that have not been recognized as revenue and offers a good image about the future revenue prospects.

RPO = deferred revenue (billed, unearned revenue) + backlog (future performance obligations that haven’t been invoiced)

Besides the billed, unearned revenue that can also be found in the balance sheet, on the liabilities section, we can see the backlog, which represents non-cancellable future performance obligations that the company already signed with its customers. As a result, the RPO tells us how strong the future demand is for UiPath’s services.

Unfortunately for UiPath, the RPO slightly decreased on a Q/Q basis for the first time ever, because of a decrease in unearned revenue. This confirms that demand for UiPath’s services is slowing down and we might see this trend persist in the next quarters. RPO is one of the metrics that I’m going to be following closely to see if UiPath can get its momentum back.

Customer Acquisition Cost

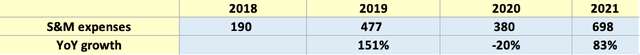

(CAC) = S&M Expenses period n-1 / Net new ARR

This metric shows how well the company is using its sales & marketing team by showcasing how much is spent on S&M for every $1 added in ARR. It’s important to analyze sales efficiency to ensure that growth is sustainable and not inflated due to an exacerbated amount of sales & marketing spending.

The company improved its customer acquisition cost significantly in 2021, which decreased from around $2.1 per $1 or ARR to around $1.1. This is an encouraging sign as the company managed to navigate well through the pandemic.

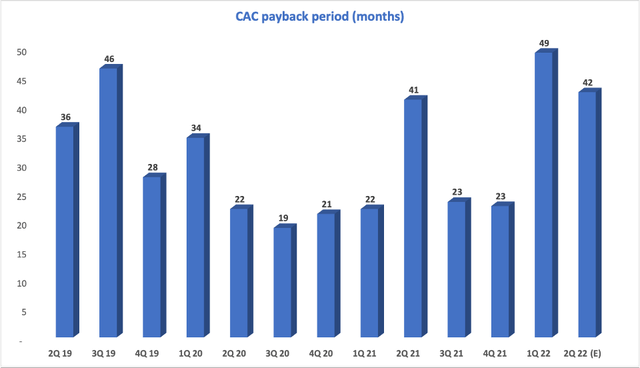

CAC payback period

This shows how many months it takes on average for a customer to produce enough gross profit to pay back its CAC. It incorporates the S&M expense from the previous year, the new ARR gained, as well as the gross margin of the company:

CAC payback period = S&M Expenses period n-1 / Net New ARR x Gross margin x 12

Since UiPath increased its S&M spending significantly in 2021, this won’t appear on a yearly measurement so to get a better picture about the current S&M spending, let’s see how the CAC payback period looks like on a quarterly basis:

The CAC payback period based on new ARR has already increased significantly in the last 2 quarters (for 2Q 22 I used the (ARR) guidance offered by the management). During 2020 the company did a fantastic job in terms of acquiring new ARR at a low cost. The same trend has reappeared during H2 of 2021, but unfortunately 2022 didn’t sustain it as it hit a new high with around 49 months needed for the payback period.

Rule of 40 – Another downside

Rule of 40 is a metric used for software companies that incorporates revenue growth and operational margin / free cash flow margin. As long as the total is bigger than 40%, the company is executing well.

Rule of 40 = Revenue growth + Operating margin / (FCF) margin

I’m using the full year 2022 revenue growth as it removes the seasonality that appears when using quarterly data. Here’s a summary for UiPath’s Rule of 40:

UiPath 10-K FY 2022

Unfortunately for UiPath, the Rule of 40 doesn’t look good at all. Considering that revenue growth for 2022 is only around 22%, its operating margin is negative and the company doesn’t have free cash-flow, the Rule of 40 puts the company in the subpar category.

Management – fundamental pivot in leadership?

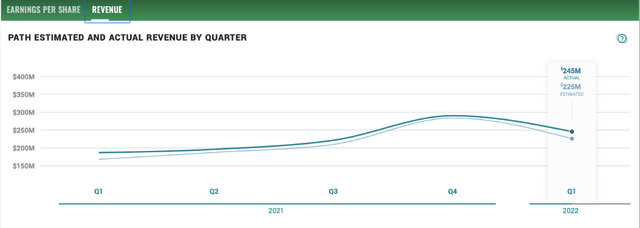

UiPath is still a founder-led company, with its CEO and co-founder owning around 25% of the company at the end of January 2022. Moreover, management owns around 45% of the company, so I believe the management’s interest are aligned with the shareholder’s. Regarding the quarterly results, management has delivered on its guidance in the 5 quarters when the company was public:

This is obviously a limited set of data and I believe that the management will be truly tested in 2022, when there will be numerous exogenous factors that might severely impact the top-line (ex: Ukraine war, FX rates etc). As a way of navigating the difficult environment, the company announced that starting with May 2022 the company will have a co-CEO, Robert Enslin, a former Google Cloud executive with 30 years of experience. This seem to be a solid move for the company’s future especially since the company has also installed a new Chief Business Officer with 25 years of experience that will supervise the global go-to-market strategy and execution.

Competition

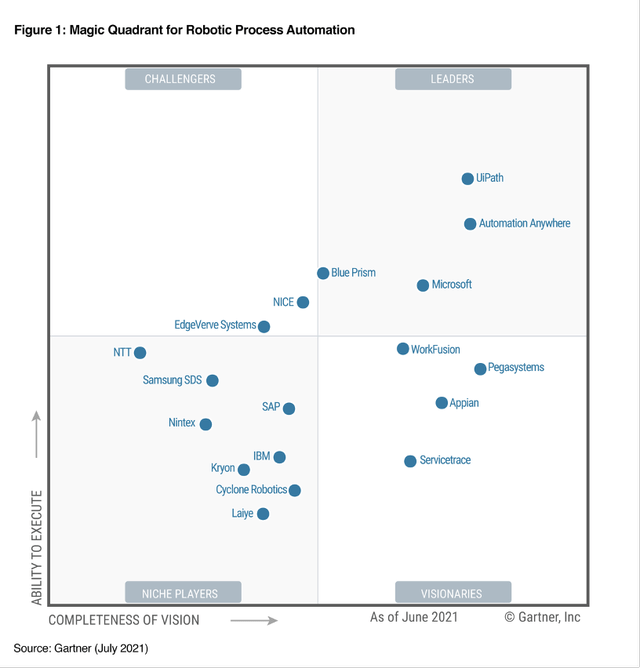

UiPath is the current leader in the RPA market, as confirmed by technological research companies Gartner and Forrester.

UiPath’s biggest competitor is Microsoft, which offers its software for automation of recurring tasks called Power Automate. This is obviously a big hurdle for every company competing with Microsoft as the US giant controls around 50% of the office market. The pricing for small firms is similar for Microsoft, UiPath and Automation Anywhere, but the lowest level of access to Microsoft Power Automate comes free with the 365 Suite, which makes it easier for Microsoft to land customers and later on up-sell them to Power Automate.

Still, considering that UiPath is the market leader, that shows that for now, UiPath has a better product and can go toe to toe with a deep-pocketed company like Microsoft, which is encouraging for potential investors in UiPath.

Risks (Bear case)

The most common argument for a bear case is the obvious slowdown in demand, which means that fast growth is in the past. UiPath guided for only a 22% revenue growth for full year 2022, which isn’t impressive at all for a company with -56% (GAAP) operating margin. Besides UiPath’ exposure to Russia, the economy seems to be on the verge of a recession. On top of that, competition from a much bigger player like Microsoft is yet another important risk for UiPath.

Financial overview

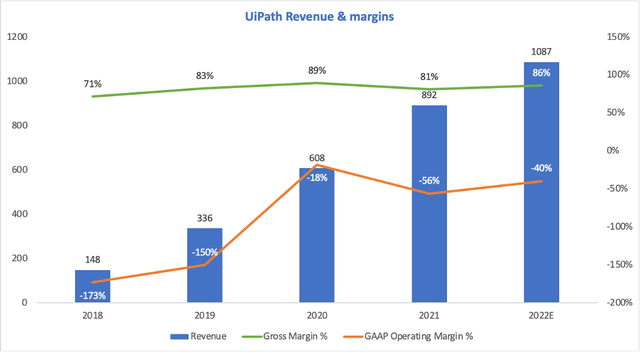

Revenue and margins

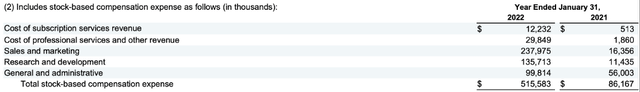

UiPath grew its revenue explosively, while the gross margin improved significantly since 2018, growing from 71% to almost 90% in 2020. However, it slightly decreased in 2021, sitting around 81%, which is still a good mark for a software company. This came mostly as a result of the (IPO), which generated a high cost with the stock-based compensation since the vesting conditions for the restricted stock units (“RSUs”) were satisfied.

Additionally, the operating margin has also decreased drastically, from -18% to around -56% as a result of the gigantic $473 million stock-based compensation expense recorded on operational expenses (S&M, G&A and R&D) for 2021:

UiPath has done a good job on growing its top line and it has one of the better gross margins in the software space. This proves operating leverage, which creates the chance for optimizing operational expenses, which might create an easier way towards operational profitability in the next financial periods.

Balance Sheet

The company has more than $1.8 billion in cash at 31 January 2022 and has no debt on its balance sheet, which shows a strong balance sheet for UiPath, more so in an uncertain market environment.

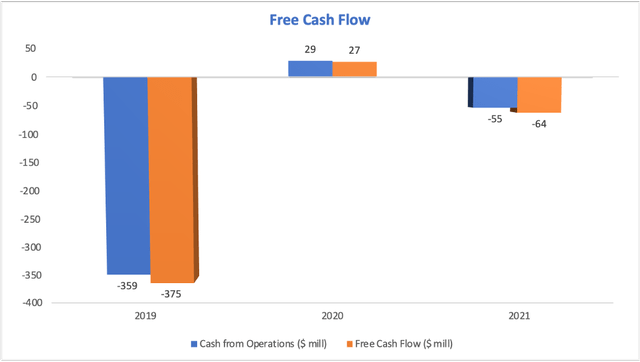

Free Cash Flow (Cash from operations – Capital expenditures)

FCF is a crucial metric for any software company. However, given the company’s growth profile, UiPath has achieved free cash flow sporadically, only during 2020:

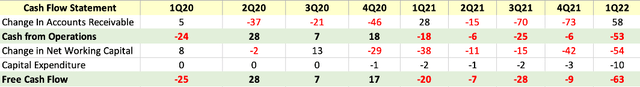

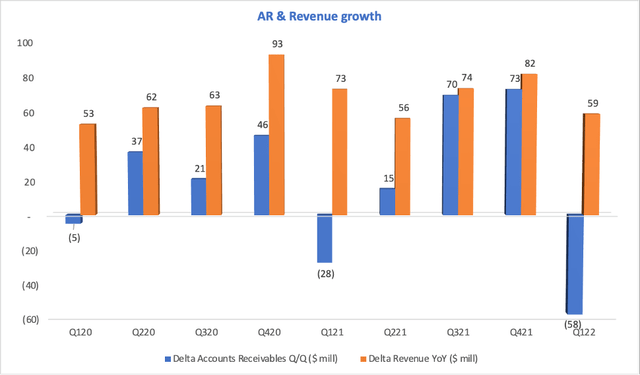

Analyzing further on a quarter level, UiPath didn’t achieve operating free cash flow during the last year mostly because of its change in the Net working capital, particularly in the Accounts Receivables balance. (negative amounts show an increase in the (AR) balance):

As we can observe, UiPath has been adversely impacted by the Accounts Receivables balance growth, especially since it affects the company’s Free Cash Flow and represents most of the revenue growth from H2 2021:

2022 started on the right foot for UiPath, which reduced its Accounts receivables balance in Q1. Even so, the change in net working capital has been negative because of a $65 million expense with compensation and employee benefits. I will be watching closely the Accounts Receivables to make sure that UiPath doesn’t showcase consistent difficulties in collecting sales from its customers.

In terms of guidance for 2022, UiPath raised its full year revenue estimate to come between $1.085 and $1.09 billion from $1.075 to $1.085 billion. This implies a 22% revenue growth for 2023, decreasing substantially from 47% in 2022. This is clearly an effect of the slowdown in demand as a result of the macroeconomic environment, as well as UiPath’s exposure to Russia and I believe that the next quarters will shed some light on the strength of the economy and the demand for UiPath’s services.

Valuation and technical

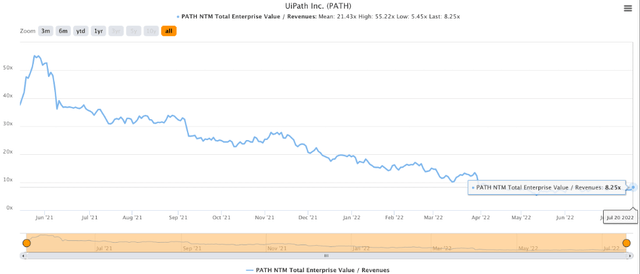

During the last couple of months, most of the software companies had their multiples compressing severely. UiPath’s Enterprise Value / Revenues multiples has come down from a gigantic 55X following its IPO to around 8.2X.

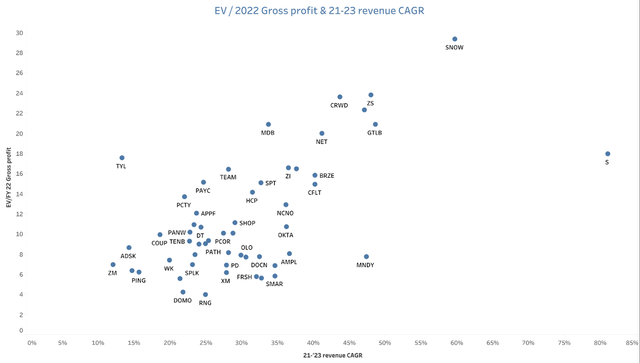

To give some more color to the company’s valuation let’s look at how it compares to some of other fast growing software businesses. I prefer using a metric that takes gross profit so that we consider the operational leverage that some of the companies were able to obtain, as well as Enterprise value instead of market cap since it takes debt and cash into account:

When considering 2021-2023 revenue (CAGR) and Enterprise value / 2022 Gross profit, UiPath has a 25% revenue CAGR with 9X EV/2022 Gross profit, which shows that the company is nicely valued for its growth prospects, even when considering the current headwinds that UiPath might experience.

Technical Analysis

There’s no doubt that the trend is bearish for UiPath’s stock with a YTD return around -57%.

Before buying any shares, I would need to see a long period of consolidation and a breakout of that consolidation. The stock is so beaten up right now that any buying would mean trying to catch a falling knife. While the stock is a major discount, there is still no evidence of how low it can go so I believe that patience will create the best opportunities.

Final Thoughts

I do like what UiPath has done so far. I believe it’s incredible how much of the RPA market has UiPath gained and how well it competes with Microsoft. Some of their metrics like the Net retention rate and ARR growth are impressive, but the market environment won’t allow the company to sustain the fast growth. I believe that looking at the future, UiPath stock is not yet a buy considering lower than expected market demand and the headwinds that the company will experience in the near term, but I will keep the company high on my watchlist as the execution has been phenomenal so far.

Be the first to comment