Matthew Horwood/Getty Images News

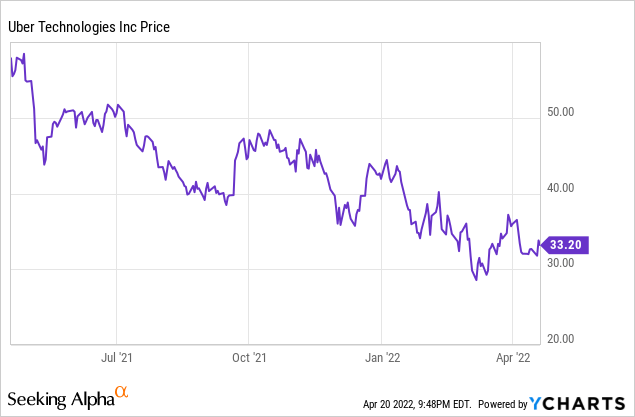

If you’re looking for high-quality, long-term growth stocks to bank on during the current tech pullback, look no further than Uber (NYSE:UBER). The global rideshare giant has seen its business recover (and then some) post pandemic, even though the stock price is still underwater.

By now, most of us and our immediate connections have taken a ride in an Uber. However we may feel about it, the world is slowly moving to a non-ownership model. With interest rates skyrocketing and inflation roaring, it makes more and more sense to subscribe and pay for one-time services rather than own big, chunky assets like cars. Uber’s growing prevalence is demonstrated by its huge growth in rideshare and particularly in delivery, which skyrocketed alongside the pandemic.

Yet for all of Uber’s strengths and its near-certain place as one of the most critical apps of the next few decades, Uber’s stock is still suffering from a multi-quarter correction. Uber started sinking even before other tech stocks did, and right now the stock is sitting 40% below where it was at twelve months ago. Year to date alone, bolstered by elevated skepticism over growth stocks, Uber has lost nearly 25%.

The Uber bullish thesis revisited

Now is the perfect time, in my view, to revisit the bullish thesis for Uber and review exactly why this company will continue to dominate consumer services within our lifetimes. I remain long on Uber and am holding onto it steadfastly within my portfolio.

To me, here are the key reasons I’m staying invested in Uber:

- Huge $13.8 trillion TAM. Mobility and Delivery each carry $5 trillion market opportunities, and nascent Uber Freight is another massive $3.8 trillion market that is heavily underserved and ripe for tech disruption.

- Formidable market leadership. In most of the markets that Uber operates in, the company has a leading market share, and usually by a substantial margin. The company has selectively exited markets where it lost share to a local incumbent (Grab in Singapore is a good example), so it can focus on turf where it has the advantage.

- The sharing economy is gradually taking precedence over ownership. In 2021, a semiconductor shortage has dramatically increased the price of cars, both used and new. Even before this price shock and pre-pandemic, many consumers were already questioning the wisdom of car ownership over rideshare. Owning a car comes with maintenance costs, insurance costs, and in urban areas, often hefty parking costs. Gradually, I expect car ownership to decline and for rideshare to become the preeminent form of transportation.

- “Other bets” are numerous. Uber Freight is the best example of a new initiative to drive growth, but grocery and package delivery are others as well. Uber’s focus on anything involving mobility gives it a massive greenfield market to operate in.

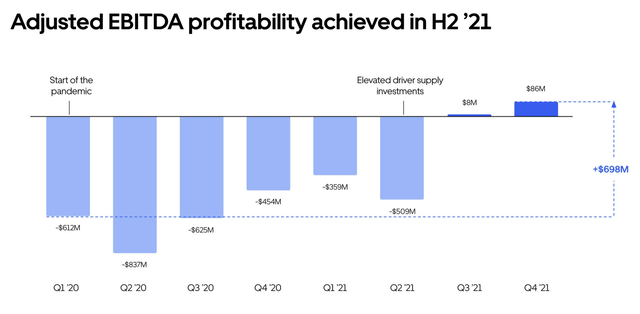

- Profitability is sinking back in. In Q4, thanks to a massive y/y recovery in rideshare volumes, Uber returned to adjusted EBITDA profitability.

Here’s a more detailed look at the last point here. Even pre-pandemic, Uber’s profitability was challenged by the fact that Delivery was still in a nascent state and burning huge holes of cash. Now at its much more elevated volumes, Uber has been able to drive slightly profitable segment earnings (on an adjusted EBITDA basis) for Delivery, while Rideshare has also continued to pump out positive adjusted EBITDA. The result is an Uber that is more profitable than ever before:

Uber profitability (Uber 2022 investor presentation)

Given how laser-focused investors are on bottom-line results and safety this year, Uber’s much-improved adjusted EBITDA picture should give the stock a clearer path to recovery than growth stocks driving much larger losses.

Overall, I continue to view Uber’s stock slump as an excellent buying opportunity. I’ll continue to emphasize that patience is going to be necessary here, as it will take time for the Uber thesis to play out. But I can’t imagine a future in which Uber doesn’t continue to expand its business (both organically and through combinations with other players as the rideshare industry consolidates) and eventually commands the vaunted trillion-dollar valuations that all tech companies aspire to.

Let’s now review some of the more recent trends and announcements which further embolden the bullish call for Uber:

Uber One introduces subscription revenue while wringing more spend out of core customers

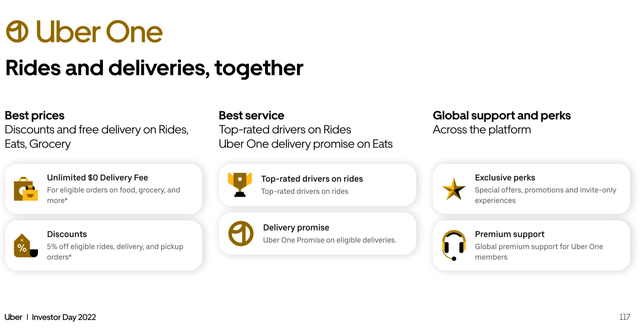

In November, Uber launched a new subscription offering called Uber One. Now, Uber One is not quite yet the full-on subscription offering that Uber fans have always clamored for (a monthly subscription cost for unlimited rides), but it does help dip Uber’s toes into the subscription/recurring revenue game (also a big plus to investors and Wall Street, once the mood on growth stocks lightens up).

Uber One benefits (Uber 2022 investor presentation)

For those who are unaware of Uber One, the key benefits offered, as shown in the chart above, include free Uber Eats and grocery delivery fees as well as 5% all other rides. For a price of just $9.99/month or $99/year, these benefits make a lot of financial sense to those who spend upward of $150-200 on Uber per month. And while this may sound like a hefty amount, note that it’s not entirely uncommon for people to rely on Uber for part of their daily commute.

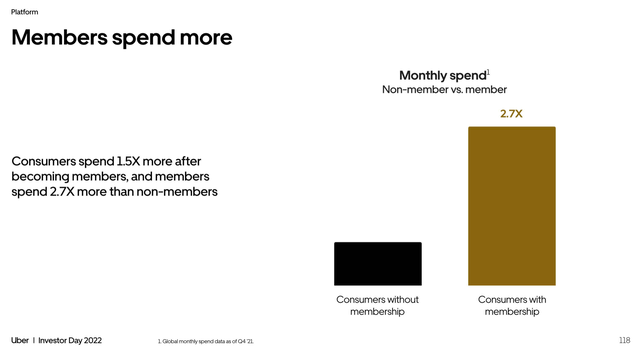

Aside from the subscription revenue itself, however, Uber One has proven effective at driving more spend within the subscriber base. The company has found that users spend 1.5x more on Uber after joining Uber One, while members also spend 2.7x more than non-Members. The Uber One offering, in other words, helps to expand Uber’s wallet share within its customer base alongside earning a subscription fee. Cross-selling is key to Uber’s strategy, and links from one app to another (rideshare to Uber Eats) is how Uber drives spend within its base. By offering discounts across services, Uber One continues to underscore that strategy.

Uber One user impacts (Uber 2022 investor presentation)

The company also noted that churn is lessened among members (it’s the same as the gym membership phenomenon – you’re more likely to use something if you know you’re shelling out for it); Uber One subscribers have 20% better retention than non-members.

Tremendous bookings performance, with lots of room to go

Aside from Uber One, the company has managed to drive continued strength in bookings and revenue post-pandemic. Take a look at the trends below:

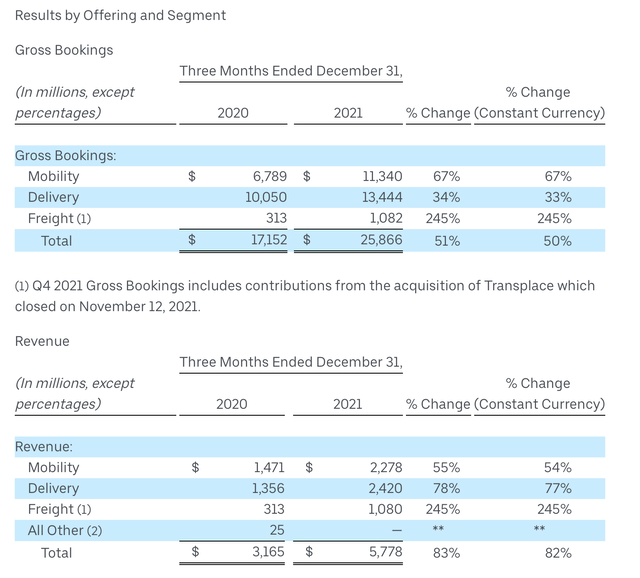

Uber bookings and revenue by segment (Uber Q4 investor presentation)

Total bookings are up 50% y/y to $25.9 billion, while revenue in the quarter is up 82% y/y to $5.79 billion, heftily beating Wall Street’s expectations of $5.36 billion (+69% y/y) for the quarter.

The first key highlight to point out is how impressive it is that Delivery bookings continue to elevate, even after reaching unprecedented heights during the pandemic era. The return to schools and offices has apparently not dented takeout demand, which has seemingly become a new fixture of modern life. Even after a tough comp in the December quarter of 2020, delivery bookings and revenue are still up 33% y/y and 77% y/y, respectively (you can thank the tacking on of additional/heightened fees on delivery for the large gap between bookings and revenue growth, which consumers seemingly haven’t minded paying).

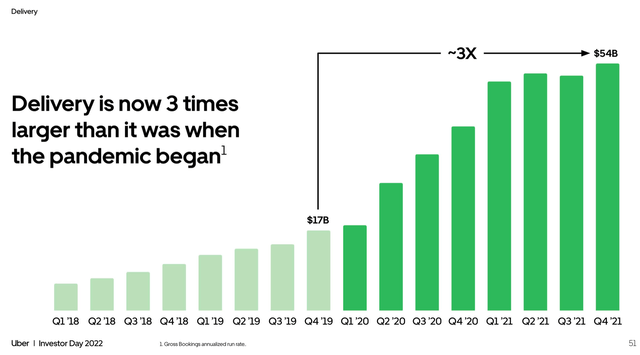

Uber Delivery bookings (Uber Q4 investor presentation)

The chart above showcases the speed at which the Delivery business scaled since the pandemic, which is also helpful in illustrating how a previously loss-bearing business has suddenly become a profitable contributor to Uber’s adjusted EBITDA.

The company has noted continued rebounds in mobility/rideshare as well. The company has called out the winter Omicron surge as only a temporary deterrent to demand, while driver supply has continued to improve. Here’s some further helpful commentary from CEO Dara Khosrowshahi’s prepared remarks on the most recent earnings call:

We’re beginning to see several major economies in Europe relaxing COVID restrictions, including the U.K., the Netherlands, Denmark and Norway, with more countries expected to take similar actions soon. In the last two weeks, the Mobility recovery has rapidly resumed with both trips and gross bookings recovering and Mobility gross bookings last week up 25% month-on-month.

I’ll quickly touch on driver supply, which continues to improve. We made steady progress through product innovation, more targeted marketing and on-the-ground operational refinements to onboard more drivers and couriers faster. Nearly 325,000 people started to work on Uber in the quarter, bringing our total global active earner base to 4.4 million people, the largest it’s been since the second quarter of 2020.

One important call-out is that while the Omicron wave acted as a temporary deterrent to demand, supply has been much more stable. As a result, surge and wait times have improved to their lowest level in the year. Recent internal research has shown that Uber is by far the preferred choice amongst drivers, and we’re confident that our marketplace will be more, not less balanced going forward.

Turning now to Delivery, which exceeded our expectations and performed better than we typically in January, likely in part to Omicron. This relative overperformance has moderated just as the Mobility trends have improved. Overall trends continue to be very healthy, and there’s no question now that Delivery’s here stay, both in food and other verticals.”

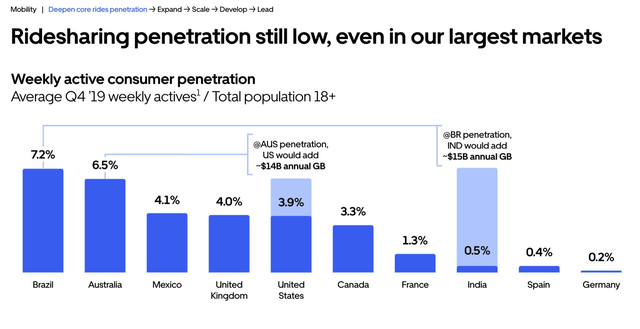

Yet there is still room for expansion in rideshare. The chart below shows low single-digit penetration in most major markets, helping to justify Uber’s ~$14 trillion TAM:

Rideshare untapped growth potential (Uber Q4 investor presentation)

The company has also highlighted certain focus markets overseas like Spain, Germany, and Korea, where the company has targets in sight to double bookings by 2024 relative to current scale.

Key takeaways

Uber remains a long-term, potential multi-bagger growth stock to invest in. This is a company that continues to build out its product flywheel, rolling out a number of complementary services and tying them together through offerings like Uber One, while aggressively chasing a massive multi-trillion dollar global market. Don’t miss the chance to buy this stock on sale.

Be the first to comment