designer491/iStock via Getty Image

U.S. Global Investors, Inc. (NASDAQ:GROW) is undervalued based on a sum-of-the-parts method where the company’s investment management services segment alone suggests a value of $6.66 per share in a takeover situation. GROW also has no debt and a growing $26.765m cash and cash equivalents position on their balance sheet which represents 40% of the current market cap. Management has indicated they are looking for ways to unlock what they call deep value of the stock. A recently rejected takeover from Echo Lake Capital and Deer Haven Capital at $5.30, a premium of 18% to current prices, demonstrates M&A interest.

Given management actively seeking ways to unlock value, a recent offer, valuation of the investment management services segment, increase to share buyback authorization and volume, and the strong balance sheet I believe that there is a margin of safety represented at the current price of GROW. While there are risks related to a recession and broader market downturn that would proportionally impact GROW, I argue that given the strength of the balance sheet and quality of earnings in their investment management services segment there is value in the name at current levels.

Company Overview

U.S. Global Investors is an investment management firm specializing in actively managed equity and bond strategies. They have a longstanding history of expertise in gold and precious metals, natural resources, airlines, and emerging markets which they in recent years leverage to create specialized exchange-traded funds (ETFs). The company manages eight mutual funds and three exchange-traded funds which as of their last quarterly filing total assets under management (AUM) were $4.1b, with an average AUM over the last nine months of $4.0b. The company also operates by allocating capital towards investments they believe will yield a return.

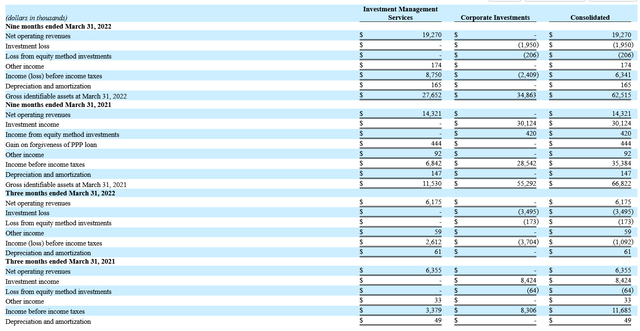

GROW reports on two lines of business: Investment Management Services, which includes all of its funds, and Corporate Investments, where it predominantly is invested in cryptocurrency-related investments. Their most recent quarterly filing breaks down the gross identifiable assets as $27.652m and $34.863m respectively which is 44% and 56% breakdown. Around 80% of their revenue is generated from the investment management services segment, in other words from 44% of their assets. This chunk of the business we will explore in more detail later as we believe its value is around $6.66 per share alone. But let’s look briefly at their corporate investments.

The corporate investment gross assets total $27.652m with $17.5m of this related to an investment in crypto-miner HIVE Blockchain Technologies (HIVE). The HIVE interest represents ~28% of the gross assets of the company overall and it has caused interest in GROW as a crypto-related trading vehicle at times. The HIVE interests are warrants valued at $4.8 million and convertible debentures valued at $12.7 million. The bond has yielded $1.7m in income in the last nine months. I note the above details as they are material to the company yet my thesis assumes no value for these. In my opinion, the debenture is likely to remain whole and the warrants provide upside optionality as a benefit.

Frank Holmes is the CEO and controlling shareholder of GROW. There are two classes of common stock with only one class that are voting shares. Holmes owns over 99% of the voting shares, which means he alone determines the fate of the company, and he’s maintained this interest since 1989. He became chief investment officer in 1999. Additionally, Holmes is currently the executive chairman and acting CEO at HIVE. I believe there is some risk that Holmes is in a position where doing right by both shareholders of GROW and HIVE might not be possible.

Echo Lake Capital and Deer Haven Capital Offering and Response

U.S. Global Investors recently received an offer letter on June 27th from Echo Lake Capital and Deer Haven Capital to purchase the company for $5.30 per share which represents about a ~21% premium to current prices. They argue that “GROW suffers from a lack of sell-side analyst coverage, limited trading volume, and limited demand from institutional investors” as a public micro-cap company and is offering shareholders an “attractive value for their investments and provide stockholders certainty of value for their shares.” Their letter concludes that the proposal was already rebuffed by a board director at GROW.

Within days, on July 1st, GROW released an update confirming receipt of the proposal and they had this to say:

While the Company would normally not view a proposal of this nature as warranting a reply, the fact that it was publicized requires that the Company provide a timely public response. The Company does not believe the Proposal provides the Company’s shareholders with appropriate value for their securities and therefore is not interested in pursuing the Proposal based on the terms submitted.

The update was not simply a response to the takeover proposal as it outlined the company’s continued share buyback program which is currently set at $5m annually. In June they purchased 13,255 shares at an average purchase price of $4.45 per share. Over the last nine months ended March 31, 2022, the company repurchased 43,591 shares at an average of $5.35 per share. And in the nine months ended March 31st, 2021, the company repurchased 35,996 shares at an average of $5.25 per share.

The share repurchases in June are of note in that they may represent a ramping up of actually utilizing the $5m reserved for buybacks, which could help support the share price. The company explains that they use an algorithm to repurchase shares, so we have a sense that the company considered itself to be undervalued in June at a price of $4.45 per share. Therefore, if prices remain low it’s likely that repurchases will continue. The last thing of note from their updated letter is their emphasis on their growing cash position as they expect a possible recession upcoming. I think this is prudent and given they have no debt I think it enables the company to weather whatever may come, and perhaps even benefit.

The Investment Management Services Business Valuation

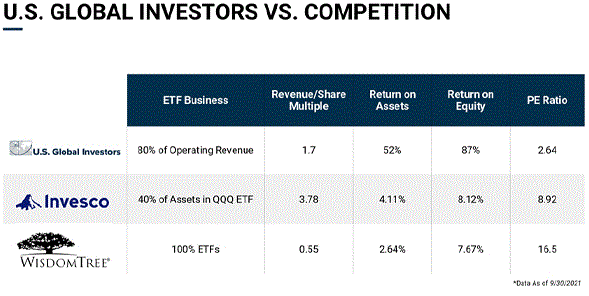

Earlier this year, the company included the below graphic, which emphasizes their ETF business.

Company’s January 8-K Filing

The focus is on the ETF portion of their business not only because 80% of their operating revenue is generated from it, but also because the ETF business is highly profitable overall. Charren Investment Research provides a great explanation of why ETFs can be so profitable, using GROW as an example in this article. More specifically, the author looks at one of GROW’s ETFs, JETS (JETS), which was launched in 2015 as a way to track the broader global airline industry. Since launch, the fund, being first of its kind, has attracted billions mainly as it has been used as a very efficient way to bet on or against the entire airline sector. JETS was the beginning of GROW’s ETF business as they pivoted away from the more traditional active mutual fund management style.

And since the success of JETS they have attempted to mimic that by launching two other specialty-focused ETFs: U.S. Global GO GOLD and Precious Metal Miners ETF (GOAU) in 2017 and U.S. Global Sea to Sky Cargo ETF (SEA) in 2022. Neither at this point has had the same standard setting success of JETS, but I think the approach makes sense and they are building in areas of their historical expertise. Regardless, the margins still remain high on ETFs and we can estimate the earnings potential pretty directly.

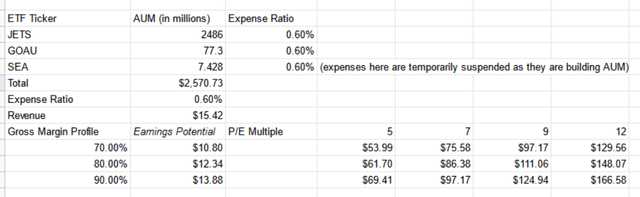

We’ll start with looking at the total AUM of these ETFs, which can be found in the chart below. If we multiply the AUM by the expense ratio for the ETF we can calculate the revenue they generate. Then finally we can multiply that revenue by a margin to calculate earnings potential overall. The variable here is around margin assumptions. The article linked to above by Charren Investment Research noted that “the completely passive nature of ETFs means there are very low fixed costs for business operations. Our diligence with industry participants suggests margins as high as 90%.” This is around the same margins that SA author Safety in Value estimated for GROWs ETF business back in August 2020.

Author’s calculations using US Global Investor website data

Using this range we can see that gross profit potential for the 3 ETFs alone is between $10.80m and $13.99m a year. If we take a conservative estimate that the ETF business generates $10m in earnings this year then the company with its $65.4m market capitalization is trading at a P/E of 6.54 for this segment of the business alone. This assumes no value to the mutual fund aspect of the business, which has generated an average of $3.190m in advisory fees per year over the last three years. Nor does it ascribe any value to the $26.765m in cash and cash equivalents that GROW has on their balance sheet, which is ~40% of the current market capitalization.

I believe that the ETF business is likely a great candidate to be tucked into another investment fund. Bain & Company released a report in February highlighting that they believe the asset management industry is attractive for M&A given the importance of scale and profitability. They released a report a year prior to that saying broadly the same thing. This has been a trend in the industry for some time now. The reason for this is that a similar or larger-sized company that already manages ETFs incurs very low costs in managing additional ETFs, and sometimes can even decrease those costs more. With companies looking to increase returns, JETS could be immediately accretive to the right buyer. For those interested to read deeper about consolidation in ETFs specifically I found this article highlighting heightened M&A back in 2020 to be instructive.

The question then is what kind of earnings multiple should we apply to the business? According to this article in 2019 regarding asset management, M&A deals were being done between 10 and 14 times EBITDA. I’d argue that the ETF business at the least could sell for a 10x multiple which would peg valuation at $100m. This represents a ~53% premium to the current market cap of $65.4m.

Risks

A major risk to this thesis is a significant decline in AUM for the ETF business, JETS in particular. JETS is focused on airline operators and builders so the directionality of that sector will be significant in terms of performance for GROW. Given the uniqueness of the JETS ETF product, I think it’s unlikely we’d see a massive AUM change quarter-to-quarter that isn’t market-related. I believe the risk of significant decline in AUM is manageable given GROW provides NAV details for JETS every day.

But let’s look at a hypothetical decline of JETS AUM by 50%. Starting with $2.486b, halving the AUM would bring it to $1.243b. With the expense ratio of 0.60%, revenue would be $7.458m. If we assume an 80% EBITDA margin, the company would still earn around $5.966m. At that level, if we assume a 10x multiple valuation of the ETF business would be $59.66m, which is about a 9% decline from the current share price. So if JETS lost around 50% of its AUM then it could still be worth around current prices.

Another risk I see is that Frank Holmes is ultimately going to make the decision about what happens. I’m comfortable with this in the near term as Holmes has been highlighting undervaluation in the company for a while and is actively seeking ways to unlock value. The increased share repurchase authorization and volume are promising actions in terms of capital allocation. I believe that the recently rejected offer will bring some additional attention to the name as well.

Conclusion

U.S. Global Investors received an offer for $5.30 per share, which I believe undervalued the company, currently trading for $4.36. Based on a conservative valuation of just the ETF portion of the company they trade for a 53% discount to the value of that business alone. I believe that the strength of the ETF business, the 40% of market cap cash pile, share repurchases, and active consolidation interest in the sector create a margin of safety in this name while management explores ways to unlock value.

While I would not buy and hold this position long term, I believe it is a “buy and monitor” situation that will likely play out over the next year or two, with many signposts along the way to gauge whether one believes Frank Holmes is truly unlocking shareholder value or not.

Be the first to comment