Chesky_W

A Quick Take On U Power Limited

U Power Limited (UCAR) has filed to raise $25 million in an IPO of its ordinary shares, according to an F-1 registration statement.

The firm provides electric vehicle battery-swapping technologies and is developing compatible EV products.

I’ll provide a final opinion when we learn more about the IPO.

U Power Overview

Shanghai, China-based U Power Limited was founded to broker automobiles originally but has since transitioned to developing battery-swapping technologies and stations and related electric vehicles located in China.

Management is headed by Founder, Chairman and CEO, Mr. Jia Li, who has been with the firm since inception in 2013 and was previously the Vice President at SAIC-GMAC Automotive Finance Co., and Vice President of Siemens Ltd., China.

The company’s primary offerings include the design, manufacture and operation of battery swapping stations for electric vehicles as well as the development of commercial-use EVs that use its battery swapping system.

As of June 30, 2022, U Power has booked fair market value investment of $54.2 million from investors including U Trend Limited, Upincar Limited, U Create Limited and Everpine Delta Fund.

U Power – Customer Acquisition

U Power operates a single battery swapping station in Quanzhou City, Fujian Province and has begun manufacturing its UOTTA battery swapping stations.

The company has entered into cooperation agreements with Chinese automobile manufacturers to jointly develop electric trucks using its battery-swapping technology.

Sales and Marketing expenses as a percentage of total revenue have dropped as revenues have increased, as the figures below indicate:

|

Sales and Marketing |

Expenses vs. Revenue |

|

Period |

Percentage |

|

Six Mos. Ended June 30, 2022 |

20.2% |

|

2021 |

60.7% |

|

2020 |

205.4% |

(Source – SEC)

The Sales and Marketing efficiency multiple, defined as how many dollars of additional new revenue are generated by each dollar of Sales and Marketing spend, rose to 4.3x in the most recent reporting period, as shown in the table below:

|

Sales and Marketing |

Efficiency Rate |

|

Period |

Multiple |

|

Six Mos. Ended June 30, 2022 |

4.3 |

|

2021 |

1.4 |

(Source – SEC)

U Power’s Market & Competition

According to a 2022 market research report by Grand View Research, the global battery-swapping charging infrastructure market was an estimated $166.5 million in 2021 and is forecast to reach $872 million by 2030.

This represents a forecast CAGR of 20.2% from 2022 to 2030.

The main drivers for this expected growth are a desire for reduced charging times, lower upfront EV purchase costs, and helpful government subsidies.

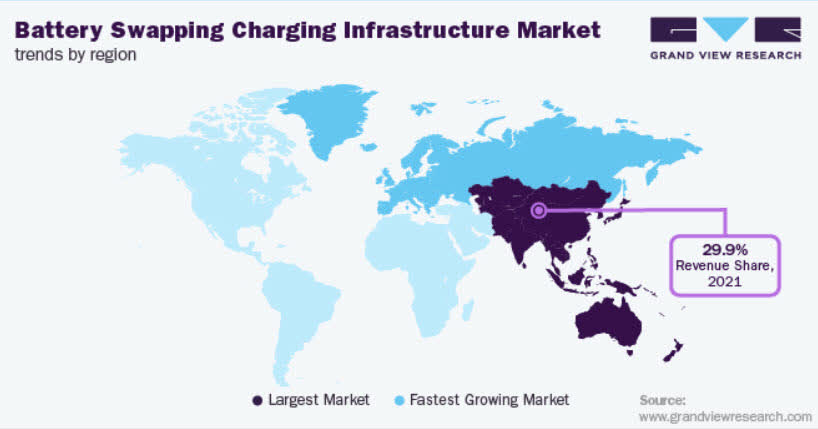

Also, below is a chart showing that the Asia-Pacific region was the largest market in 2021, with 29.9% in total market revenue share:

Battery Swapping Charging Market (Grand View Research)

Major competitive or other industry participants include:

-

NIO

-

Gogoro

-

Leo Motors

-

Tesla

-

SUN Mobility Private Ltd.

-

BYD Co. Ltd.

-

BattSwap

-

Kwang Yang Motor Co. Ltd. (KYMCO)

-

Panasonic Corp.

-

Lithion Power Pvt. Ltd.

U Power Limited’s Financial Performance

The company’s recent financial results can be summarized as follows:

-

Growing topline revenue from a tiny base

-

Flattening gross profit and dropping gross margin

-

Lowered operating losses

-

Reduced cash used in operations

Below are relevant financial results derived from the firm’s registration statement:

|

Total Revenue |

||

|

Period |

Total Revenue |

% Variance vs. Prior |

|

Six Mos. Ended June 30, 2022 |

$638,000 |

646.8% |

|

2021 |

$1,257,000 |

501.0% |

|

2020 |

$209,143 |

|

|

Gross Profit (Loss) |

||

|

Period |

Gross Profit (Loss) |

% Variance vs. Prior |

|

Six Mos. Ended June 30, 2022 |

$228,000 |

304.1% |

|

2021 |

$451,000 |

115.6% |

|

2020 |

$209,143 |

|

|

Gross Margin |

||

|

Period |

Gross Margin |

|

|

Six Mos. Ended June 30, 2022 |

35.74% |

|

|

2021 |

35.88% |

|

|

2020 |

100.00% |

|

|

Operating Profit (Loss) |

||

|

Period |

Operating Profit (Loss) |

Operating Margin |

|

Six Mos. Ended June 30, 2022 |

$(2,041,000) |

-319.9% |

|

2021 |

$(7,053,000) |

-561.1% |

|

2020 |

$(2,287,429) |

-1093.7% |

|

Net Income (Loss) |

||

|

Period |

Net Income (Loss) |

Net Margin |

|

Six Mos. Ended June 30, 2022 |

$(1,938,000) |

-303.8% |

|

2021 |

$(7,697,000) |

-1206.4% |

|

2020 |

$(932,857) |

-146.2% |

|

Cash Flow From Operations |

||

|

Period |

Cash Flow From Operations |

|

|

Six Mos. Ended June 30, 2022 |

$(1,812,000) |

|

|

2021 |

$(12,904,000) |

|

|

2020 |

$(3,198,857) |

|

(Source – SEC)

As of June 30, 2022, U Power had $1.8 million in cash and $9.8 million in total liabilities.

Free cash flow during the twelve months ended June 30, 2022 was negative ($12.5 million).

U Power Limited’s IPO Details

U Power intends to raise $25 million in gross proceeds from an IPO of its ordinary shares, although the final figure may differ.

No existing shareholders have indicated an interest in purchasing shares at the IPO price.

Management says it will use the net proceeds from the IPO as follows:

approximately 40% for developing and marketing of UOTTA-powered EVs;

approximately 30% for manufacturing and developing UOTTA-powered battery-swapping stations;

approximately 20% for developing and upgrading UOTTA technologies; and

approximately 10% for working capital.

(Source – SEC)

Management’s presentation of the company roadshow is not available.

Regarding outstanding legal proceedings, management said the company is not subject to any legal proceedings that would have a material adverse effect on its financial condition or operations.

The sole listed bookrunner of the IPO is AMTD.

Commentary About U Power’s IPO

UCAR is seeking U.S. public capital market investment to further its battery-swapping system and EV manufacturing plans.

The company’s financials have generated increasing topline revenue from a tiny base, flat gross profit and dropping gross margin, reduced operating losses and lowered cash used in operations.

Free cash flow for the twelve months ended June 30, 2022 was negative ($12.5 million).

Sales and Marketing expenses as a percentage of total revenue have dropped as revenue has increased from a tiny base; its Sales and Marketing efficiency multiple was 4.3x in the most recent reporting period.

The firm currently plans to pay no dividends and to retain any future earnings to reinvest back into the company’s growth initiatives.

UCAR has spent heavily on capital expenditures despite negative operating cash flow, and if the firm obtains IPO investment, I expect its CapEx to increase markedly.

The market opportunity for battery-swapping technologies is expected to grow rapidly in the coming years but remain a niche offering.

Like other firms with Chinese operations seeking to tap U.S. markets, the firm operates within a WFOE structure or Wholly Foreign Owned Entity. U.S. investors would only have an interest in an offshore firm with interests in operating subsidiaries, some of which may be located in the PRC. Additionally, restrictions on the transfer of funds between subsidiaries within China may exist.

The recent Chinese government crackdown on IPO company candidates combined with added reporting and disclosure requirements from the U.S. has put a serious damper on Chinese or related IPOs, resulting in generally poor post-IPO performance.

Also, a potentially significant risk to the company’s outlook is the uncertain future status of Chinese company stocks in relation to the U.S. HFCA Act, which requires delisting if the firm’s auditors do not make their working papers available for audit by the PCAOB.

Prospective investors would be well advised to consider the potential implications of specific laws regarding earnings repatriation and changing or unpredictable Chinese regulatory rulings that may affect such companies and U.S. stock listings.

Additionally, post-IPO communications from the management of smaller Chinese companies that have become public in the U.S. has been spotty and perfunctory, indicating a lack of interest in shareholder communication, only providing the bare minimum required by the SEC and a generally inadequate approach to keeping shareholders up-to-date about management’s priorities.

AMTD is the sole underwriter, and IPOs led by the firm over the last 12-month period have generated an average return of negative (12.7%) since their IPO. This is a lower-tier performance for all major underwriters during the period.

Risks to the company’s outlook as a public company include the continued buildout of traditional charging stations as competitive technologies that are more familiar to current EV vehicle owners.

The firm is trying to change what has become somewhat ingrained driver behavior, so that will be a tall order to do.

I’ll provide an update when we learn more IPO details from management.

Expected IPO Pricing Date: To be announced.

Be the first to comment