Scott Olson/Getty Images News

Tyson Foods (NYSE:TSN) has not been unaffected by global supply chain issues and inflation which marked the economic environment in 2022. In this regard, Tyson Foods is down nearly 20% year-over-year, despite being considered a conservative and defensive consumer stock. Tyson Foods is one of largest poultry, pork, and beef processors in the United States and operates in over 140 countries. Based in Springdale, Arkansas, it currently owns 123 food processing plants and meat packaging facilities. The plants are mostly located across the Midwest and South, while it does not own breeding farms of the livestock, but cooperates with over 11,000 independent farms. Besides the U.S, Tyson also owns and operates internal production facilities in Australia, India, China, Malaysia, Mexico, South Korea, and the Netherlands.

Tyson Foods

The company offers four main protein products: beef, pork, chicken, and prepared foods which are sold through well-known brands, including its own label. By doing so, its products are being sold to major foodservice distributors including large grocery and fast-food chains. It sells everything from frozen products, to cooked and ready meals such as Pizzas, Tortillas, and Sandwiches. Some notable Tyson customers include McDonald’s (MCD) (being the major supplier of its popular Chicken Nuggets and Filet-O-Fish), Burger King (QSR), Wendy’s (WEN) Kroger (KR), and Walmart (WMT) being its largest customer. With over 139,000 employees, Tyson generates $47 billion in annual revenue, making it the 5th largest global food company by revenue.

Tyson Foods – Investor Presentation

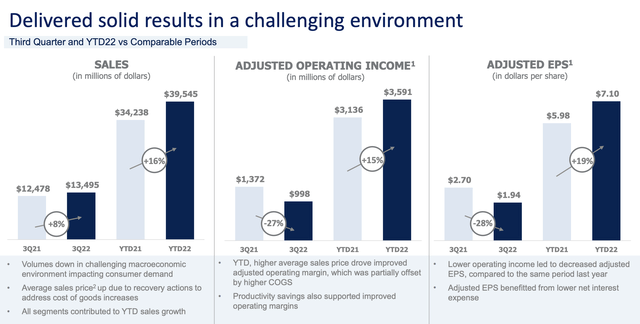

Despite operating in a relatively demand-stable industry, Tyson Foods has not been unaffected by global supply chain issues, labor shortages, and rising costs. Although it has been able to pass on higher production costs, overall operating cash flow suffered as a result of supply constraints and reduced demand for high-priced beef. Furthermore, Tyson stated it was unable to fulfill all its orders for prepared food products due to limitations on supplies and labor. Nevertheless, consumer demand for chicken and beef remained strong, as sales from the segment increased 20% year-over-year.

Overall, revenue ticked up 8% from the year-prior quarter, while operating income slightly decreased, coming in at $1.03 billion. Although the quarterly results were strong, decreased cash flows appeared to have worried investors. In this regard, operating free cash flow decreased to $1.89 billion from $2.56 billion in the first nine months of last year. The company targets to increase its cash flows again through cost savings of at least $400 million in 2022 by increasing productivity across key focus areas such as operational excellence, digital solutions, supply chain, and automation. Even as free cash flow slightly dipped, Tyson is still demonstrating excellent profitability despite facing supply chain issues and softer demand across its higher-margin products.

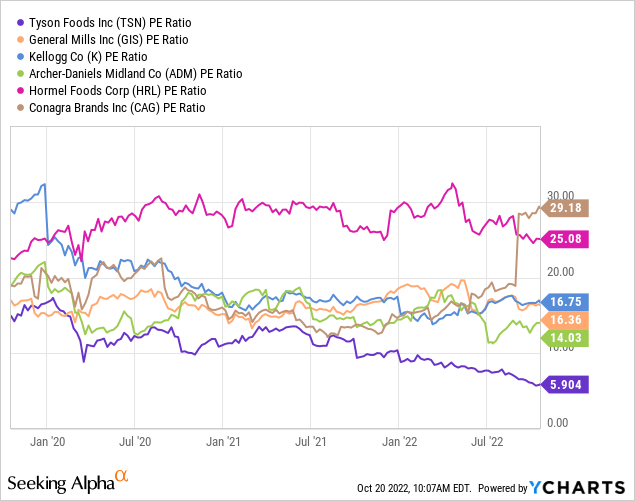

Attractive Valuation

The main reason for my bullish thesis is Tyson Foods’ low valuation, which has been significantly compressed over the last two years. For a company with monopoly-like status in the supply of chicken in the U.S, Tyson appears undervalued trading at just 5.9 times earnings. In comparison, the second largest chicken producer in the U.S, Pilgrim’s Pride (PPC) is trading at 17 times earnings, despite being much smaller with $14.7 billion in annual revenues. Also, compared to other companies in the food consumer industry, Tyson trades well below peers with similar margins and capital structures.

For instance, Archer-Daniels-Midland (ADM) surged over 100% over the last 5 years, as the stock did not see a similar multiple compression. In 2016-2018, the stock traded at multiples between 10 and 16 times earnings, similar to Tyson Foods; however, its valuation multiples remained stable. The same applies to peers in the food consumer industry such as Kellogg (K), Hormel Foods (HRL), and General Mills (GIS), which has been able to increase its operating cash flows. Nevertheless, Tyson Foods appears to be increasingly undervalued considering its past valuation and business strength. Even on a free cash flow basis, Tyson is trading at 16x free cash, lower than Hormel Foods which trades at 24 times free cash flow, for instance. Notably, Tyson Foods’ free cash flow is somewhat cyclical, so it is not as consistent as its peers. Therefore, if we consider Tyson’s three-year average free cash flow of $2 billion, it trades at just 10 times free cash flow.

If we look at large peers across the pond, large market leaders such as Nestle (OTCPK:NSRGY) are also trading more expensively, at 16 times earnings and 25 times free cash flow, despite operating in a similar industry with comparable margins.

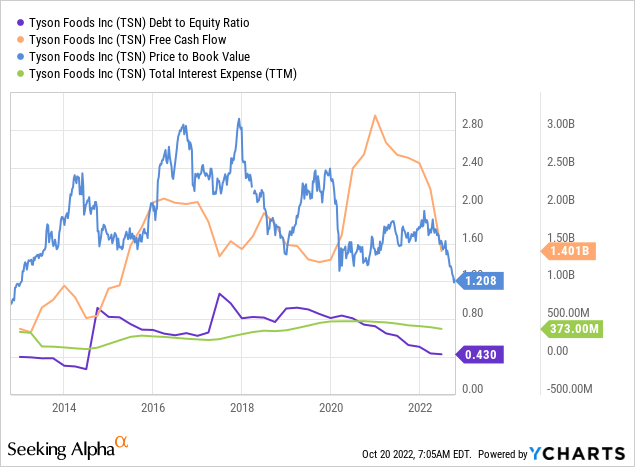

Favorable Capital Structure

While Tyson Foods can be considered a relatively capital-intensive business with low margins, its balance sheet is certainly healthy. As mentioned, Tyson generates average annual free cash flow of $2 billion and pays annual interest expenses of $373 million on its $8.2 billion in long-term debt. This means Tyson has a free cash flow to interest expense ratio of 0.19, which is lower than Pilgrim’s Pride and Kellogg. It’s also worth noting that Tyson is strictly focused on managing its liabilities, reducing debt by approximately $1 billion in the last quarter. As a result, its debt-to-equity ratio dropped to just 0.43, leaving plenty of room for acquisitions and stock buybacks to boost shareholder returns. At a price-to-book value of just 1.2x, the stock trades at 2013 levels and well below its average of 1.8x.

While Tyson Foods is certainly not invulnerable to economic fluctuations, food supply tends to be more stable in recessions compared to other industries like technology, financials, and real estate. Overall, meat and groceries tend to have a relatively low-income elasticity of demand. Nevertheless, a severe recession will likely impact Tyson’s thin profit margins, which could lead to short-term losses. However, as seen in both 2000 and 2008, the company recovered quickly as long-term demand for meat continues to grow.

The Future of Meat Production

In the past, Tyson has been repeatedly scrutinized for poor working conditions, including breaching local regulations and being accused of animal cruelty. Certainly, at the scale and reach of Tyson’s business, scandals are pretty much unavoidable. With meat consumption patterns changing and sustainability questions arising across the food supply sector, Tyson might be looking to the horizon for its next stage of growth. During a November 2019 earnings call, Tyson CEO Noel White stated that she believes about 90% of the increase in protein consumption will likely come from outside the U.S. In fact, China has long passed both North America and Europe in terms of total meat consumption, although the U.S still leads in terms of per capita consumption. However, with Asia’s and Africa’s populations quickly rising, including personal income levels, meat consumption is likely to see further growth until 2050.

Our World in Data

Although pork has for long made up the greatest share of consumed meat across the world, poultry has increasingly become popular and now accounts for roughly 33% of all consumed meat. Over the next 30 years, this trend is expected to continue, as developing and emerging markets continue to drive growth in poultry consumption. It is worth mentioning that this can be linked to religious factors, as around 2 billion people worldwide are Muslims, making it the second largest religion in the world. Nevertheless, other factors include a rise in income and overall consumption trends.

AG Web

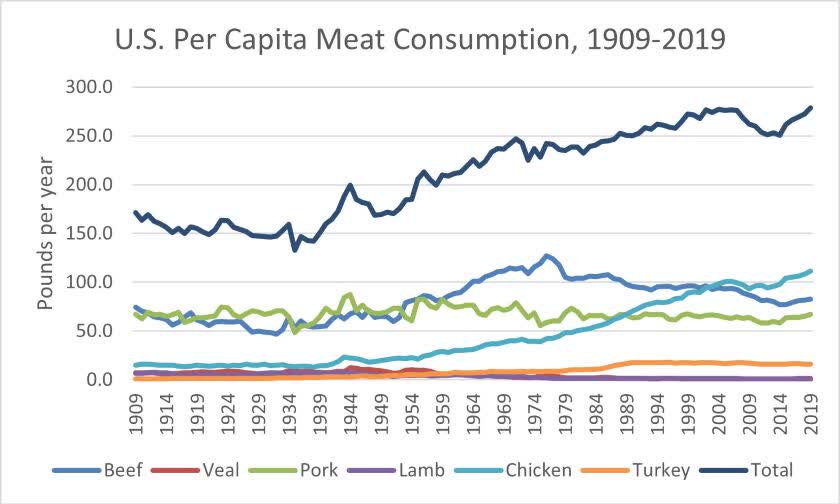

A similar trend can be observed in Tyson’s largest market, the U.S., where poultry consumption has gradually surpassed beef consumption. Total per capita meat consumption also continues to march higher, after seeing a multi-year downturn. While the U.S continues to be Tyson’s most important market, the company is certainly looking for growth opportunities abroad. After China lifted U.S. beef and pork import curbs, as a result of severe meat shortages, Tyson’s export revenues soared. However, in early August 2022, China suspended some meat imports from Tyson after China-US tensions have been re-escalating amid a series of U.S. moves against China. Trade tensions will likely continue to impact Tyson’s ability to effectively export to China, being by far its biggest opportunity. It is, therefore, likely that the company will concentrate on driving foreign growth through emerging market regions such as India, Indonesia and the Middle East.

Bloomberg

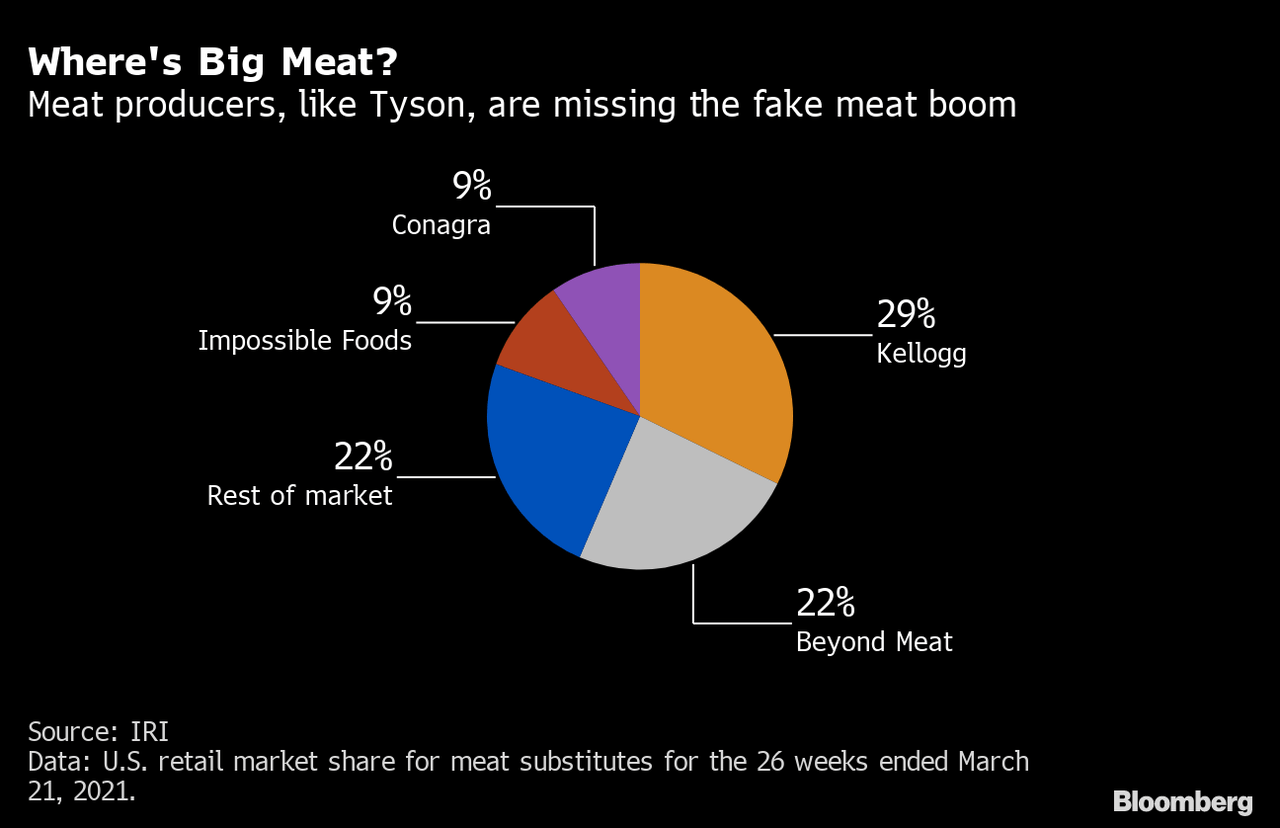

However, Tyson also has plenty of growth opportunities by introducing new products and innovating protein-based foods. According to a report by Bloomberg Intelligence, the global plant-based market could surpass $162 billion in 2030, up from just $29.4 billion in 2020. And by 2050, some estimates say that plant-based protein consumption could account for up to 50% of total meat consumption. However, Tyson has been slow when it comes to adopting the new trend, making up far less than 10% of the overall plant-based meat market.

In 2019, Tyson introduced its first meat burger, but the half-vegan, half-meat burger proved a tough sell and the company eventually discontinued it due to low demand. Now, Tyson aims to try again, rolling out its plant-based chicken nuggets and plant-based ground beef through its own Raised & Rooted brand. Christine McCracken, senior animal protein analyst at Rabobank acknowledged that large meat producers will face lots of trial and error and will not immediately get all products right. However, considering that the market is still in its early days and not yet a profitable niche for most meat companies, Tyson has time to get it right. Tyson’s largest R&D center, the Discovery Center, holds over 300 food scientists, sensory scientists, and chefs working to improve, create and test new products.

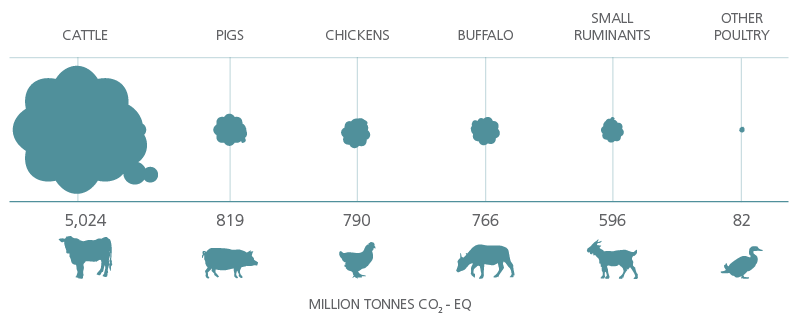

Food and Agriculture Organization of the United Nations

This will allow Tyson to discover and commercialize new food trends in order to adapt to changing consumer preferences. And certainly, the agriculture and food industry has room to improve, considering its contributions to global CO2 emissions. However, direct emissions aren’t the only segment with room for improvement. Around 30% of the earth’s land is used to raise farmed animals or grow crops to feed them. Reducing farmed land would restore ecological health and lead to sinking carbon levels in the atmosphere.

Besides organic growth and innovations, Tyson will likely continue to acquire in order to broaden its product portfolio and strengthen its competitive advantages. In 2014, Tyson acquired Hillshire Brands and AdvancePierre Foods to further push into the prepared foods market. It also snapped up the major maker of McDonald’s Chicken McNuggets and Filet-O-Fish supplier, Keystone Foods in 2018 for $2.16 billion. The deal further expands Tyson’s reach and presence around the world. It is likely that Tyson will continue to utilize its free cash flow to acquire new business and grow its market share.

The Bottom Line

While Tyson Foods may look like a rather uninteresting, low-growth, value stock, investors have seen their investment grow by an average of 16.8% annually over the past 10 years (excluding dividends), outpacing the S&P 500 which returned an average of 11.9% over the same time period. Is Tyson Foods able to show similar returns over the next 10 years and beat the broader market? Of course, the answer to the question lies in the distant future, but at the current valuation, it doesn’t seem unreasonable.

Be the first to comment