Scott Olson

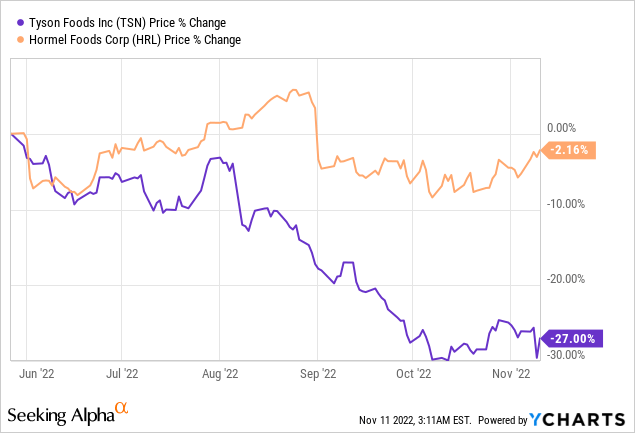

It has been a very disappointing year for Tyson Foods (NYSE:TSN) as the company is struggling with the rising cost of raw materials due to its low price premium products.

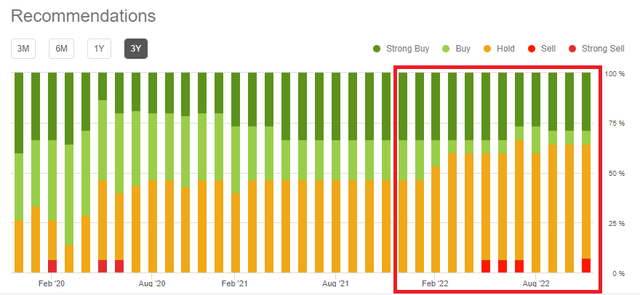

The sentiment on Wall Street has also been largely trailing the share price trend as analysts turned increasingly bearish on the stock.

Seeking Alpha

This is hardly a surprise as TSN lower value added products are more vulnerable to cost-push inflationary pressures that we have seen for the most part of 2022. I noted this risk back in May of this year:

(…) as inflation pressures are rising, companies that are enjoying the highest price premiums are usually best-positioned to sustain their high returns on capital.

Source: Seeking Alpha

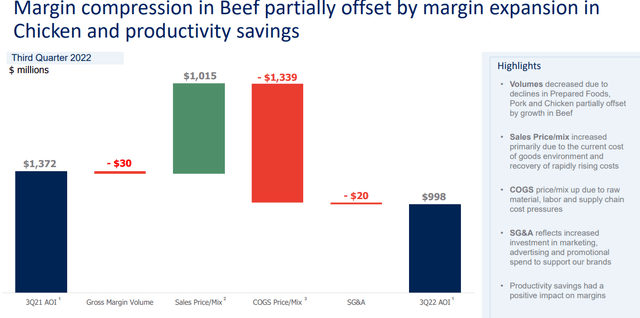

As expected, the last quarterly reported margins were almost entirely driven by higher raw material and labor costs, including supply chain disruptions.

Tyson Foods Investor Presentation

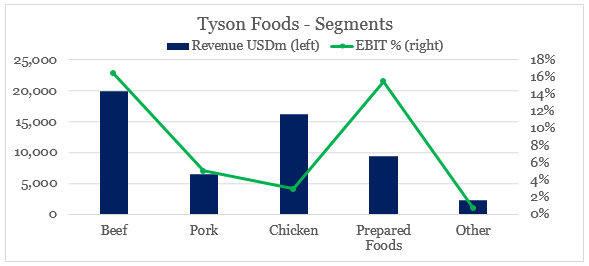

On a segmented basis, the company relies heavily on its beef business unit, which is both the largest in terms of revenue and by far the most profitable segment of the company.

prepared by the author, using data from SEC Filings

Tyson Foods, however, does not own the facilities to raise the cattle and relies heavily on imports and the market prices of live cattle.

The primary raw materials used in our beef operations are live cattle. We do not have facilities of our own to raise cattle but employ cattle buyers located throughout cattle producing areas

Source: Tyson Foods 10-K SEC Filing

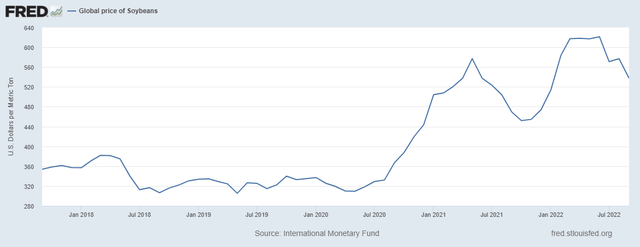

In addition to live cattle prices, TSN margins are also heavily exposed to the price of corn and soybean, which are used as the main raw material in the chicken segment.

The primary raw materials used in our domestic chicken operations are corn and soybean meal used as feed and live chickens raised primarily by independent contract farmers

Source: Tyson Foods 10-K SEC Filing

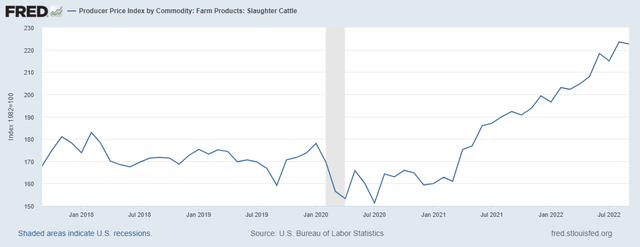

Having said all that, it is not hard to see why TSN share price has been under pressure so far this year. First and foremost, cattle prices continued to go up for a second year in a row.

FRED

Although prices for soybeans and corn have cooled-off somehow, they remain near all-time highs.

FRED

FRED

With a significant share of price increases already in place this dynamic of rising costs of raw materials will continue to weigh on Tyson Foods share price at least in the short-term. Although there is some elasticity to the company’s higher margin products, too aggressive pricing will likely lead to consumers switching to substitutes.

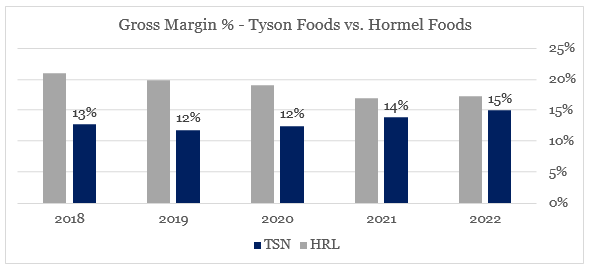

Although this puts TSN between a rock and a hard place for its upcoming results today, we should also recognize the company’s efforts in recent years which lead to significant operational efficiencies and with that the company has nearly closed the margin gap with its major peer – Hormel Foods (HRL).

prepared by the author, using data from SEC Filings

With that in mind, Long-term beef margins are expected to decline within the range of 5% to 7%.

Our operating margin of 10.2% was lower than the same quarter last year but remains a strong performance. We expect to see Beef margins return closer to an expected long-term 5% to 7% average.

Source: TSN Q3 2022 Earnings Transcript

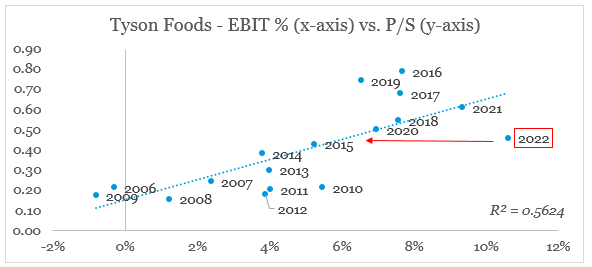

Even if this proves to be the case, however, Tyson foods Price-to-Sales multiple is already reflecting these lower margin expectations.

prepared by the author, using data from SEC Filings and Seeking Alpha

Conclusion

The upcoming quarter for TSN will likely be haunted by deteriorating margins and a tough macroeconomic environment. The company’s limited headroom for more price increases will prove challenging for both margins and volumes in the quarters ahead. Having said that, however, any major price action to the downside will create an attractive buying opportunity given the conservative pricing of TSN shares and the company’s improved operational efficiency in recent years.

Be the first to comment