Evgenii Kovalev

It is amazing how complete is the delusion that beauty is goodness.”― Leo Tolstoy

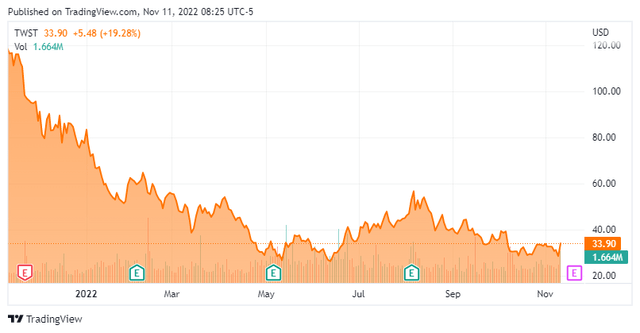

We put our first research article on Twist Bioscience Corporation (NASDAQ:TWST) in May of this year. The company has been somewhat in the news in recent months and the stock jumped nearly 20% in trading on Thursday, coinciding with the largest daily rally in the markets since 2020. Therefore, it seems a good time to peek back on this unique play in the biology space. An updated analysis follows below.

Company Overview:

Twist Bioscience Corporation is headquartered in South San Francisco. The stock currently trades near $34.00 a share and sports an approximate market capitalization of $1.8 billion. The company manufactures and sells synthetic DNA-based products off its DNA synthesis platform that enables the manufacturing of synthetic DNA by writing DNA on a silicon chip. Among the products Twist offers are synthetic genes, tools for sample preparation, antibody libraries for drug discovery and development, and DNA as a digital data storage medium. These products have many uses in the industrial, agriculture, and medical fields.

Second Quarter Results:

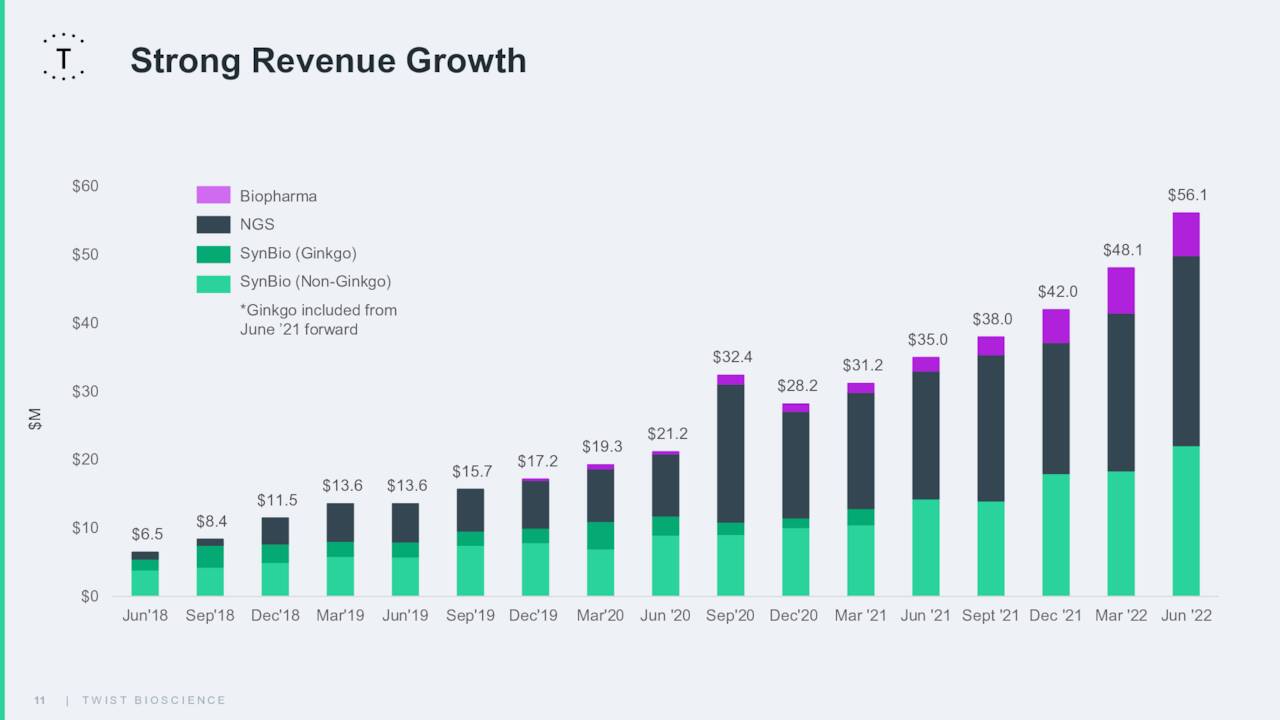

On August 5th, the company disclosed second quarter results. The company lost $1.08 a share on a GAAP basis. Despite the deep loss, that was nearly a quarter a share above the consensus. Revenues rose 60% on year-over-year basis to $60.1 million, approximately $4 million above expectations.

August Company Presentation

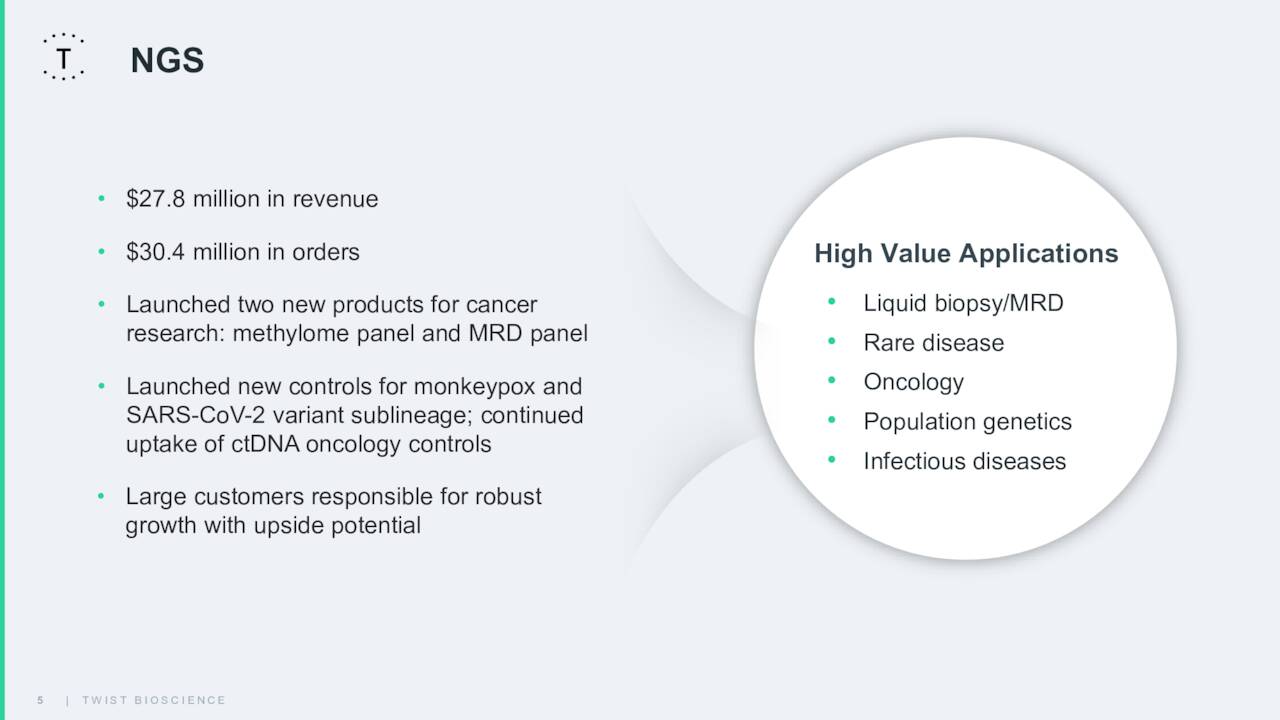

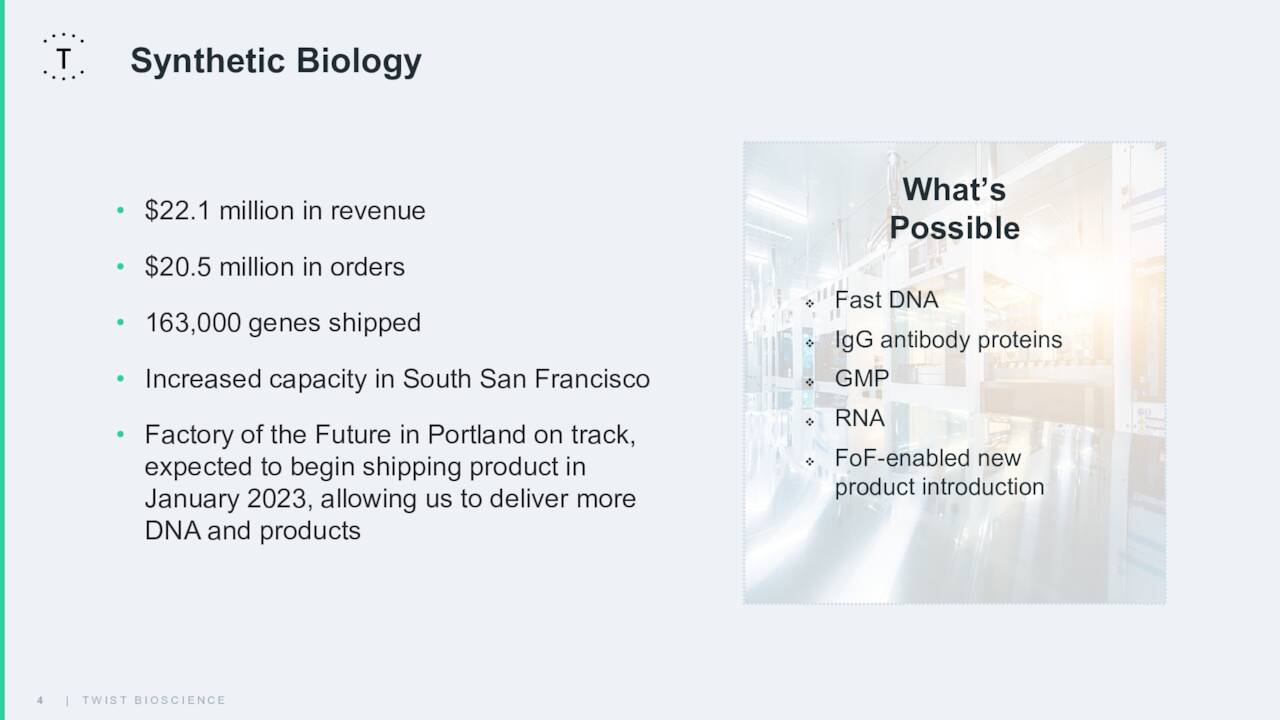

The company launched several new products during the quarter including its MRD Rapid 500 Panel that enables customers to implement fully customizable panels for $50 per sample. Revenue for Twist comes from three primary sources/industries. Here is how they broke down in the second quarter.

Next-Generation Sequencing or NGS:

August Company Presentation

Synthetic Biology:

August Company Presentation

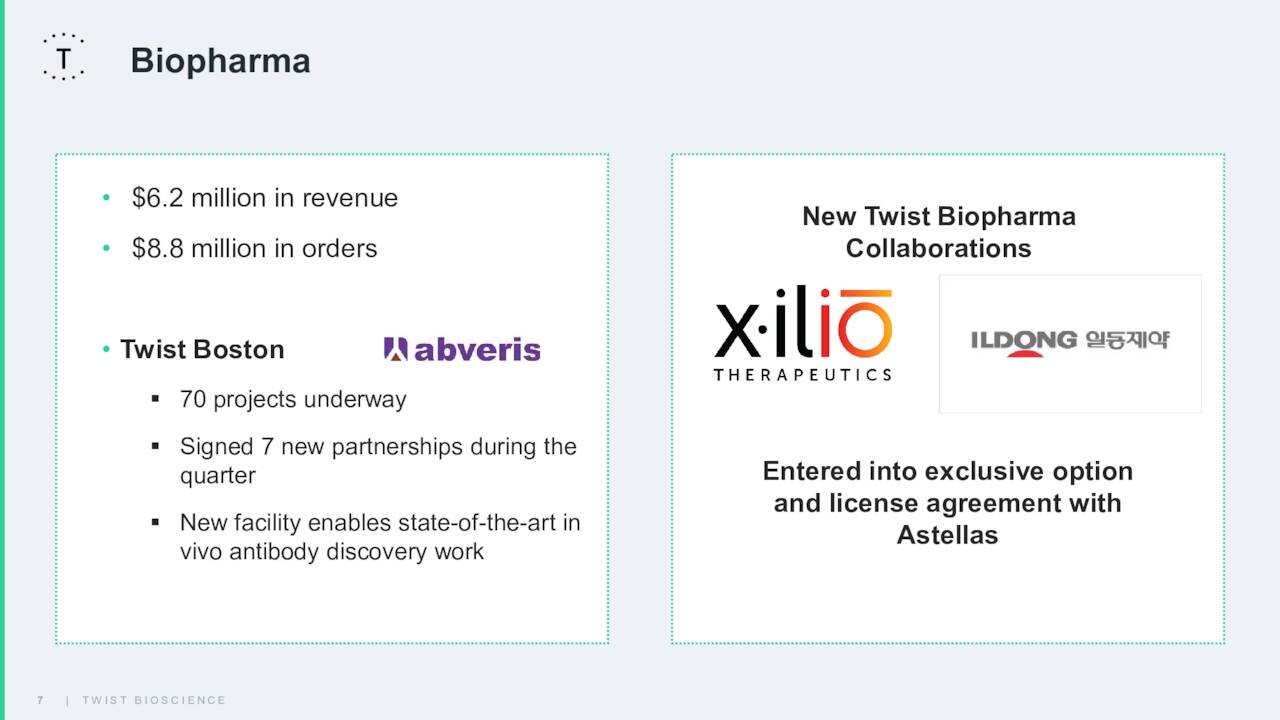

Biopharma:

August Company Presentation

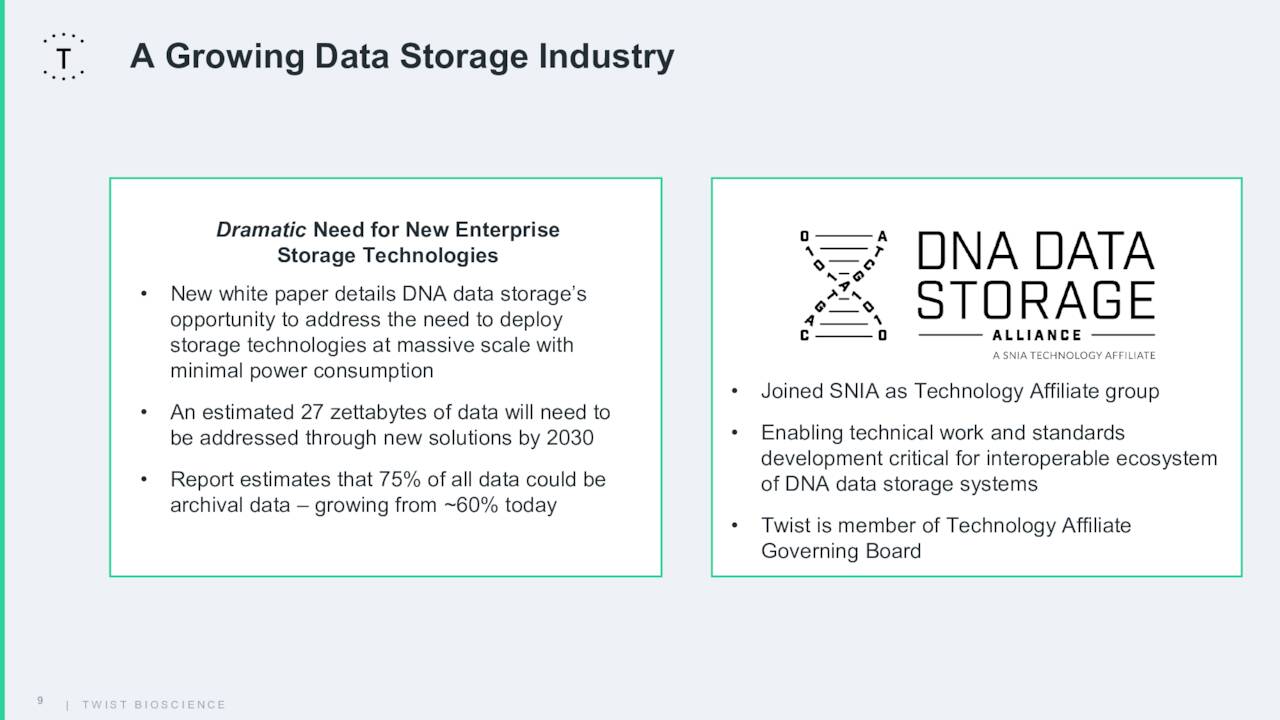

In addition, DNA can be used to encode and store digital data and the company continues to build its data storage capabilities. The company is investing approximately $40 million of its projected $125 million R&D expenses in 2022 on this effort. In the second quarter, Twist participated in panels and presentations at key data storage and industry conferences including Fujifilm’s 12th Annual Global IT Executive Summit, the 2022 MRS Spring Meeting and Exhibit, and the Flash Memory Summit. Management believes DNA Data Storage could eventually be a $2 billion annual market for the firm.

August Company Presentation

Management bumped up its FY2022 sales guidance to approximately $203 million, an increase from its previous guidance of $191 million to $199 million. Leadership expects a full year net loss of roughly $250 million for this fiscal year.

Recent Developments:

In late October, the company promoted its chief commercial officer to be its new president and chief operating officer. Last week, the company announced it will partner with Illumina (ILMN) to expand customer access to the Illumina Exome 2.0 Plus panel to promote disease research. Finally, Twist disclosed in mid-September that it will work with Enzolytics (OTCPK:ENZC) on the discovery of monoclonal antibodies against several viruses.

Analyst Commentary & Balance Sheet:

Since second quarter numbers posted, the analyst community has been mixed on Twist’s prospects. Goldman Sachs reissued its Sell rating and $35 price target, while last month SVB Securities maintained its Hold rating and $46 price target on TWST. Both Barclays ($45 price target) and Robert W. Baird ($56 price target) reiterated Buy ratings on the equity.

Approximately 11% of the outstanding float in TWST is currently held short. There has been frequent but generally smallish selling by numerous insiders here in 2022. In the third quarter, they sold just over $1 million worth of equity in aggregate. The company ended the second quarter with just over $525 million worth of cash and marketable securities on its balance sheet after posting a net loss for the quarter of $60.5 million. The company posted a net loss of $60.7 million during the first quarter of this year.

Verdict:

The current analyst firm consensus is that the company will lose approximately $4.50 a share in FY2022 even as revenues rise over 50% to just north of $200 million. They project similar losses in FY2023 even as sales exceed $250 million.

Twist Bioscience is delivering solid revenue growth. Unfortunately, the company continues to bleed cash on a substantial basis and is likely to do so continually at least through FY2023. The company does have over a half a billion dollars of cash on its balance sheet. DNA Data Storage has intriguing long term possibilities. The company is also building 110,000 square foot facility that should be complete in 2023 and should drive economies of scale and open up the fast gene market.

However, until management at Twist Biosciences shows significant strides lowering its quarterly cash burn rate and is much closer to getting to break even status; I will be avoiding the shares. We should get a new set of data points to analyze, it should be noted, as third quarter results will be out shortly.

The greater the gap between self perception and reality, the more aggression is unleashed on those who point out the discrepancy.”― Stefan Molyneux

Be the first to comment