cagkansayin/iStock via Getty Images

After the bell on Thursday, we received third quarter results from customer engagement platform Twilio (NYSE:TWLO). Shares of the company soared in 2020 thanks to revenue growth that accelerated during the pandemic. However, the past year or two has not been pretty, as the name has fallen along with a number of other unprofitable technology names. The company’s Q3 report was terrible to say the least, sending shares to a new multi-year low.

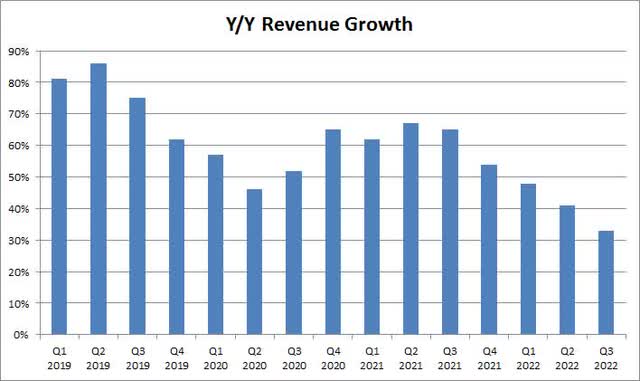

For Q3, the headline numbers came in quite decent, although one must remember that weak guidance a couple of months back caused expectations to decline a bit. Revenues came in at $983 million, beating street estimates by just over $10 million. This was 33% growth over the prior year period, although that number was the lowest seen in many years. Part of the growth percentage decline was due to higher base numbers, but as a point of reference, last year’s revenue growth percentage was double what we saw in Q3 2022 as the chart below shows.

Twilio Revenue Growth (Company Earnings Reports)

On the bottom line, the adjusted EPS loss of $0.27 beat the street by 8 cents, but also swung downward from a one cent profit in Q3 2021. This beat was not a surprise, however, as the company hasn’t missed this estimate over the past five years. Twilio is a big money loser, however, with the company reporting a nearly $287 million operating loss after taking out restructuring expenses and asset impairments. That’s up more than $54 million over the prior year period. A lot of these expenses are stock-based, but the company has also been cash flow negative this year, about $175 million more than the first nine months of last year. Twilio is also diluting investors a bit over time, as the diluted share count was up about 3.65% over the past year.

There are a couple of key numbers I’d like to focus on that are showing quite a bit of weakness currently. The first is the Dollar-based net expansion rate, which measures the company’s ability to maintain and grow its relationships with existing active customer accounts and to increase their use of the platform. This number was at 122% in Q3, which still implies decent potential future revenue growth, but that’s down 9 percentage points over the past year and in early 2019 the figure was at 142%.

Another item is deferred revenue and customer deposits on the balance sheet, which is also a sign of future business. For the third straight quarter, this number declined on a sequential basis, this time to $135.6 million from over $140 million at the end of the last fiscal year. In growth terms, this figure showed a less than 11.8% year over year increase, as compared to a nearly 258% increase a year earlier. Without a sequential jump in Q4, the year over year change could go negative when we get the next quarter’s results.

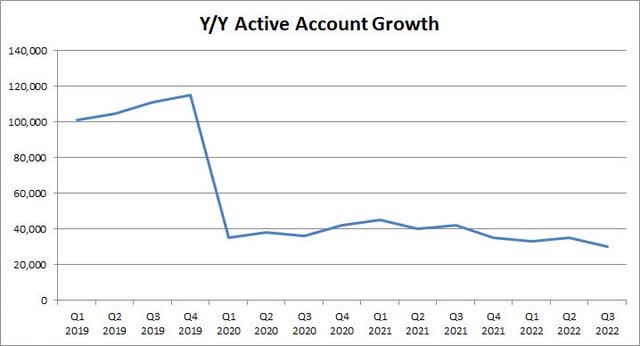

The final item I’m a bit worried about is active account growth. Twilio is still adding new accounts, finishing the quarter at more than 280,000 as compared to less than 54,000 in Q1 2018. However, like we saw with revenue growth, the percentage increase has come down over time, and it could even be in the single digits in the next couple of quarters if things don’t improve. Perhaps even worse though is the year over year numerical increase, which in Q3 hit a new multi-year low of just 30,000. As the chart below shows, that’s well off the peak, and the trend is not looking good.

Twilio Y/Y Active Account Growth (Company Earnings Reports)

With these key numbers all showing some problems at the moment, investors might not be surprised to hear that Q4 revenue guidance came in weak. However, it was the size of the miss here that was the main problem. Twilio management guided to fourth quarter revenues of $995 million to $1.005 billion, whereas the street was looking for $1.07 billion. When guidance missed at the Q2 report, the midpoint of the guidance range was a little more than $9 million below the street, whereas here is a $70 million difference. Twilio is guiding to revenue growth in the high teens, percentage wise, while the street was looking for more than 27% growth.

Twilio shares peaked at more than $435 in early 2021, at a time when analysts thought the name could be worth more than $500 a share. Going into Thursday’s report, the average target was down to $120, and we’re likely to see a number of valuation cuts on the weak Q4 guidance. Twilio shares were down more than 16% in the after-hours session, losing $55 a share to set a new multi-year low.

In the end, Twilio announced a terrible set of results on Thursday, sending the stock to a point where it is nearly 90% off its all-time high. While Q3 figures beat after last quarter’s weak guidance, key metrics are weakening at alarming rates. Management’s forecast for the current forecast was very bad, showing that revenue growth is falling much faster than expected. If this proves to be more than a short term issue, and management wasn’t just guiding conservatively in this uncertain economic situation, it wouldn’t surprise me to see more new lows in the coming months.

Be the first to comment