PM Images

Investment Thesis

Though Twilio Inc (NYSE:TWLO) continues to report robust growth and guided an excellent 30% organic growth in FQ3’22, it is evident that Mr. Market is less convinced, as seen through the destruction of its stock prices thus far. However, we reckon that this only creates a very attractive entry point for investors who have been patient since the hyper-pandemic valuations, since the management intended to be profitable by FY2023 regardless of the impact on growth ahead.

That is an ambitious statement indeed, given the worsening macroeconomics. We naturally assume that TWLO is referring to non-GAAP profitability, since the company is still reporting massive Stock-Based Compensations of $748.33M in the last twelve months, compared to its GAAP net income of -$1.05B. However, updated data shows that the company actually has the lion’s share 53.58% of the global CPaaS market in FY2021, instead of our previous data of 38%. Combined with the company’s guidance of up to 30% growth rate ahead, we reckon TWLO will continue to aggressively grow its relevance ahead, as the world races in the digital transformation market.

Obviously, investors should also size their portfolio accordingly if they choose to add at these levels, in the event of further retracements. The recent flurry of Big Tech earnings this week had analysts hoping for a quick turnabout though we are less hopeful for now, since the September PPI/CPI remains surprisingly inflated with the US labor market remaining robust. Thereby, indicating the Feds’ tough job ahead through 2023, as 89.3% of analysts expect a 75 basis points hike in the Fed’s upcoming November and, likely, December meeting.

In the meantime, since we are nearing TWLO’s FQ3’22 earnings call on 03 November, conservative investors may want to wait a little longer. We do not expect to see massive volatility in the short term, since the stock has been overly beaten down to its previous July 2018 levels. Only catastrophic news would further test its current support level and potentially, plunge the stock to the $60s again. Though we reckon those levels would also provide bottom-fishing investors with a higher margin of safety for long-term investing and growth in these uncertain conditions.

TWLO Needs To Prove Itself Through The Impending Recession

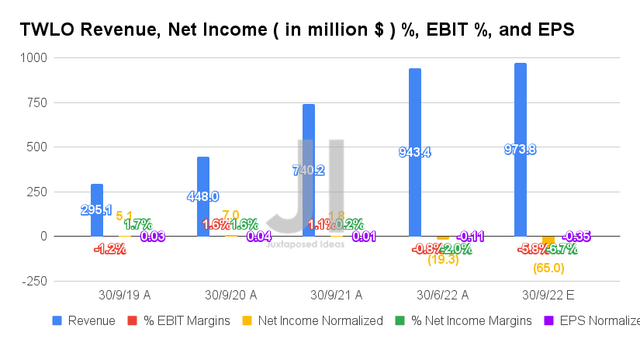

For its upcoming FQ3’22 earnings call, TWLO is expected to report revenues of $973.8M and EBIT margins of -5.8%, indicating an increase of 3.22% though a decline of -5 percentage points QoQ, respectively. Otherwise, an excellent YoY growth of 31.55% though a moderation of -6.9 percentage points YoY, respectively.

The rising inflationary costs and elevated operating expenses have definitely impacted TWLO’s margins and profitability for the next quarter. The company is expected to report net incomes of -$65M and net income margins of -6.7%, representing a decline of 336.78% and -4 percentage points QoQ, respectively. Otherwise, a further YoY fall of -97.23% and -6.9 percentage points YoY, respectively. However, these are temporary headwinds, since TWLO has embarked on aggressive job cuts through Q4’22 with remote work strategy, further boosting its operational efficiency despite the hefty $90M one-time charges.

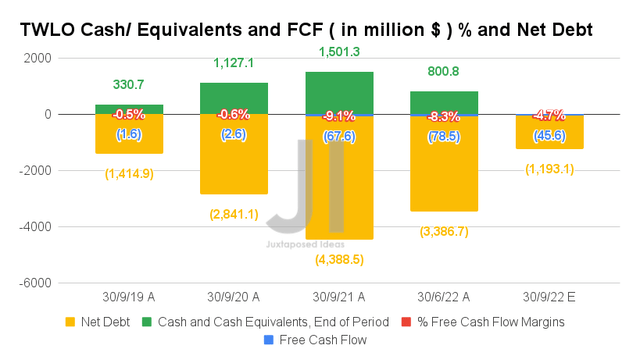

Thereby, also temporarily affecting TWLO’s Free Cash Flow (FCF) generation in FQ3’22 to -$45.6M and FCF margins of -4.7%. However, we are encouraged by these numbers, since they represent notable improvements QoQ and YoY. Furthermore, analysts are also expecting the company to report an improved net debt situation of -$1.19B for the next quarter, compared to -$3.38B in FQ2’22 and -$4.38B in FQ3’21. As a result, we may potentially see decent liquidity ahead as TWLO carefully navigates through its first recession since its incorporation in 2008.

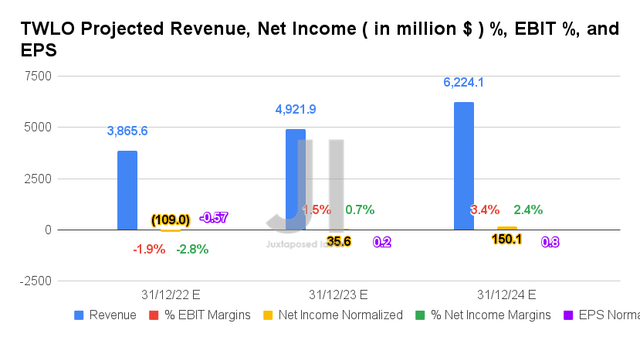

Over the next three years, TWLO is expected to report revenue growth at a CAGR of 29.8%. Though it represents a notable deceleration in top-line expansion from pre-pandemic levels of 59.9% and pandemic levels of 50.4%, we are encouraged by its projected net income profitability from FY2023 onwards. Impressive, despite the Fed’s aggressive hikes ahead and, consequently, the worsening macroeconomics.

It is also important to highlight that consensus estimates remain quietly confident about TWLO’s forward execution, since there are minimal downgrades of -2.2% on its topline growth, with bottom lines remaining intact for now. Furthermore, we expect FY2021 and FY2022 numbers to be exceptions to its previous performance, since the company may report improved EPS numbers of $0.2 in FY2023 and $0.8 in FY2024. Naturally, potentially triggering its stock recovery by H2’23 as the Fed’s pivot.

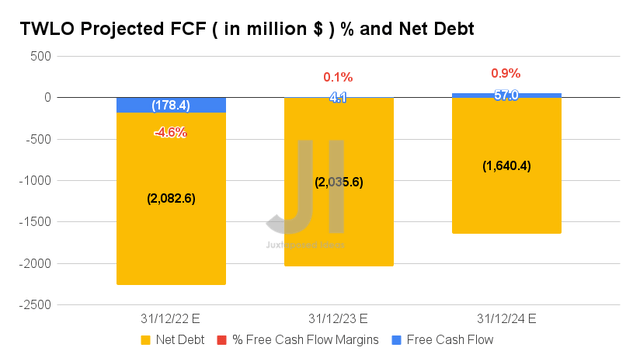

Thereby, also boosting TWLO’s FCF generation, with analysts further expecting improvements in liquidity on the balance sheet ahead, as its net debts continue to moderate through FY2024. Of course, this is assuming a similar acquisition strategy that the company has embarked on thus far, with minimal reliance on capital raises and share dilution. However, since the recessionary fears have also reduced the availability of equity funding in the market, we expect to see TWLO’s expansion to potentially lean more toward the latter. Investors take note.

In the meantime, we encourage you to read our previous article on TWLO, which would help you better understand its position and market opportunities.

- Twilio Is Racing Forward With Frantic Land Grab Strategies

So, Is TWLO Stock A Buy, Sell, or Hold?

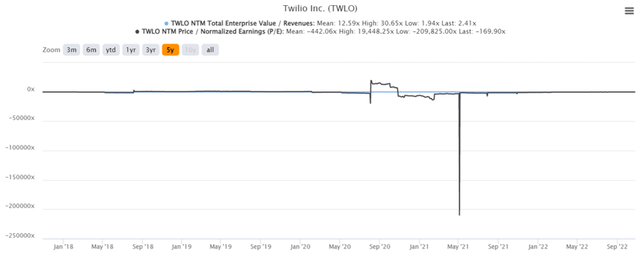

TWLO 5Y EV/Revenue and P/E Valuations

TWLO is currently trading at an EV/NTM Revenue of 2.41x and NTM P/E of -169.90x, lower than its 5Y EV/Revenue mean of 12.59x though massively improved from its 5Y P/E mean of -442.06x. The stock is also trading at $74.28, down -79.58% from its 52 weeks high of $363.80, though at a premium of 19.61% from its 52 weeks low of $62.10. Nonetheless, consensus estimates remain bullish about TWLO’s prospects, given their price target of $129.10 and a 73.80% upside from current prices.

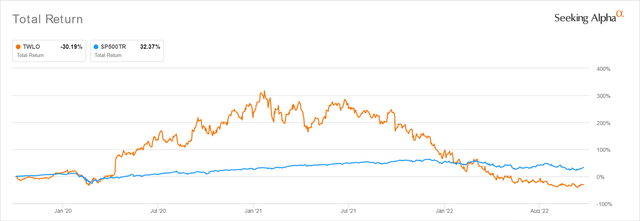

TWLO 3Y Stock Price

It is apparent that TWLO has continued to underperform thus far, trading sideways after the continuous plunge since July 2021. With the peak levels of FUD in the market, we can surmise that Mr. Market is probably punishing speculative tech stocks with minimal profitability to speak of, on top of its previously over-inflated valuations.

It is a given that the TWLO stock would be drastically corrected, since it used to boast peak EV/Revenue valuations of 30.65x and P/E of 19,448.25x or -209,825.00x. Even then, the stock is still trading at a slight premium compared to other software companies, such as Salesforce (CRM) at NTM P/E of 30.61x and Oracle (ORCL) at 14.61x, significantly worsened by its minimal profitability ahead.

Nonetheless, assuming that this forms a sustainable bottom for TWLO, we may safely assume that most of the pessimism is already baked in, with minimal to moderate downsides from current levels. Therefore, we continue to rate the stock as a Buy, preferably in the mid $60s.

Be the first to comment