Drew Angerer

The biggest issue for Twilio (NYSE:TWLO) over the last couple of years were the high cost levels. The cloud communications leader has never had a problem with growing revenues and the latest news of a significant workforce reduction without a hit to revenues is a huge positive. My investment thesis is ultra bullish on the stock with an eye on whether Twilio can actually maintain revenue targets with the disruptions of cutting employees.

Talent Reduction

Over the last several years, Twilio has grown the revenue base dramatically while absorbing tons of additional costs via acquisitions. The company is still in major growth mode forecasting a 32% boost to revenues this year, but the company just announced the intention to trim the workforce by 11%.

As highlighted in previous research, nothing was wrong with the business causing the stock to fall to $80. The company has strong growth albeit at a lower growth rate with business normalizing after a period of COVID pull forwards.

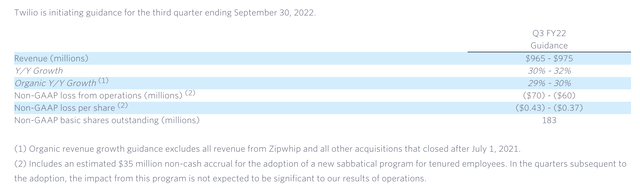

The major issue with the business is that all of this growth has come without the company actually generating profits. Twilio guided to Q3’22 losses from operations of at least $60 million with a $35 million charge for the new sabbatical program.

Source: Twilio Q2’22 earnings release

The cloud communications company has a strong platform attracting a growing customer base with 275,000 active accounts and a dollar-based net expansion rate of 123% for Q2. The integrated cloud communications suite offered by Twilio keeps growing and growing and attracting new customers along the way.

The issue is that the employee base and spending keeps growing and growing right along with revenues. Twilio ended June with an employee count of 8,510.

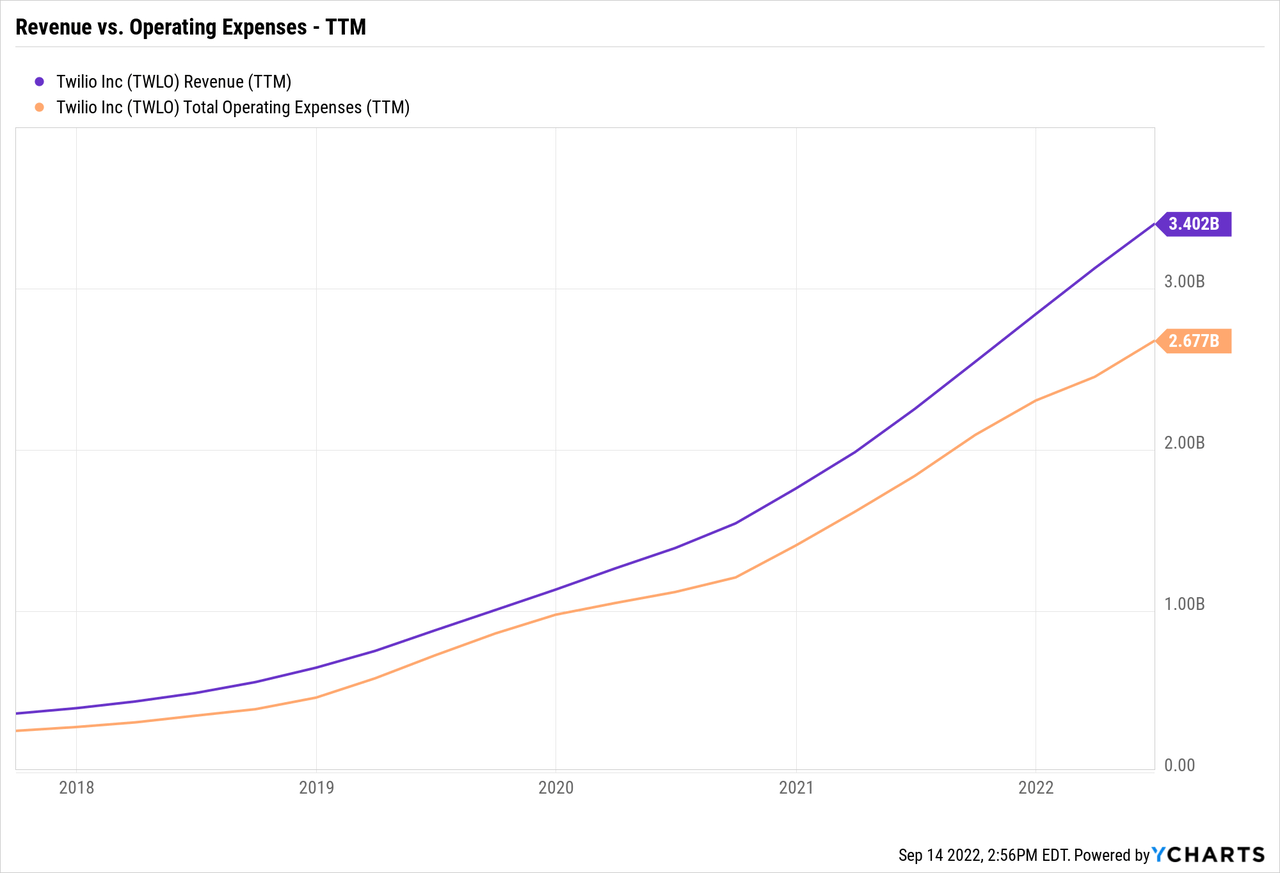

As the chart below shows, the never ending revenue growth (helped by acquisitions) was nearly matched with operating expense growth. Remember, Twilio only has 50% gross margins due the communications focus, not 80% margins like a software firm.

The company had the following Q2 non-GAAP numbers:

- Revenues – $943 million

- Gross Profits – $481 million

- R&D – $167 million

- S&M – $233 million

- G&A – $88 million

- Net operating loss – $7 million

Twilio spends ~18% on R&D expenses which appears logical. What isn’t logical is the company spending nearly 50% of gross profits on S&M. Twilio is spending on the sales department as if the business had high software margins.

While the company had promised being profitable by 2023, the news of an 11% workforce reduction without a hit to Q3 revenue targets is very bullish. The only catch is that this restructuring plan comes out with just a couple of weeks left in the quarter. A real business impact might not hit until Q4 starting in October.

The company expects to take charges of up to $90 million with a cash outlay of $55 to $70 million. The financial impact isn’t big or material to a company with $4.4 billion in cash on the balance sheet.

As mentioned above, Twilio had 8,510 employees as of the end of June suggesting the plan eliminates around 900 employees. Per CEO Jeff Lawson in an internal memo to staff:

A layoff is the last thing we want to do, but I believe it’s wise and necessary. Twilio has grown at an astonishing rate over the past couple years. It was too fast, and without enough focus on our most important company priorities. I take responsibility for those decisions, as well as the difficult decision to do this layoff.

A big part of this plan is streamlining operations from the major deals to acquire SendGrid, Segment and Zipwhip over the last several years. Duplicate employees in areas like accounting and human resources can be easily cut along with facilities consolidated. Not to mention, Twilio ramped up hiring and spending due to COVID pull forwards causing the company to over invest.

Worth More Profitable

The big question is where this takes the company profits wise. For the company to not have any disruption to the business, these employee cuts have to include a ton of people not actively engaged in revenue generation.

If Twilio was able to cut 11% of operating expenses, this deal would eliminate over $50 million in quarterly costs. Of course, a large portion of the above expenses are related to facilities, advertising and other costs not directly related to employee expenses, but a lot of times a company is able to eliminate some of these costs in the process of lowering the workforce.

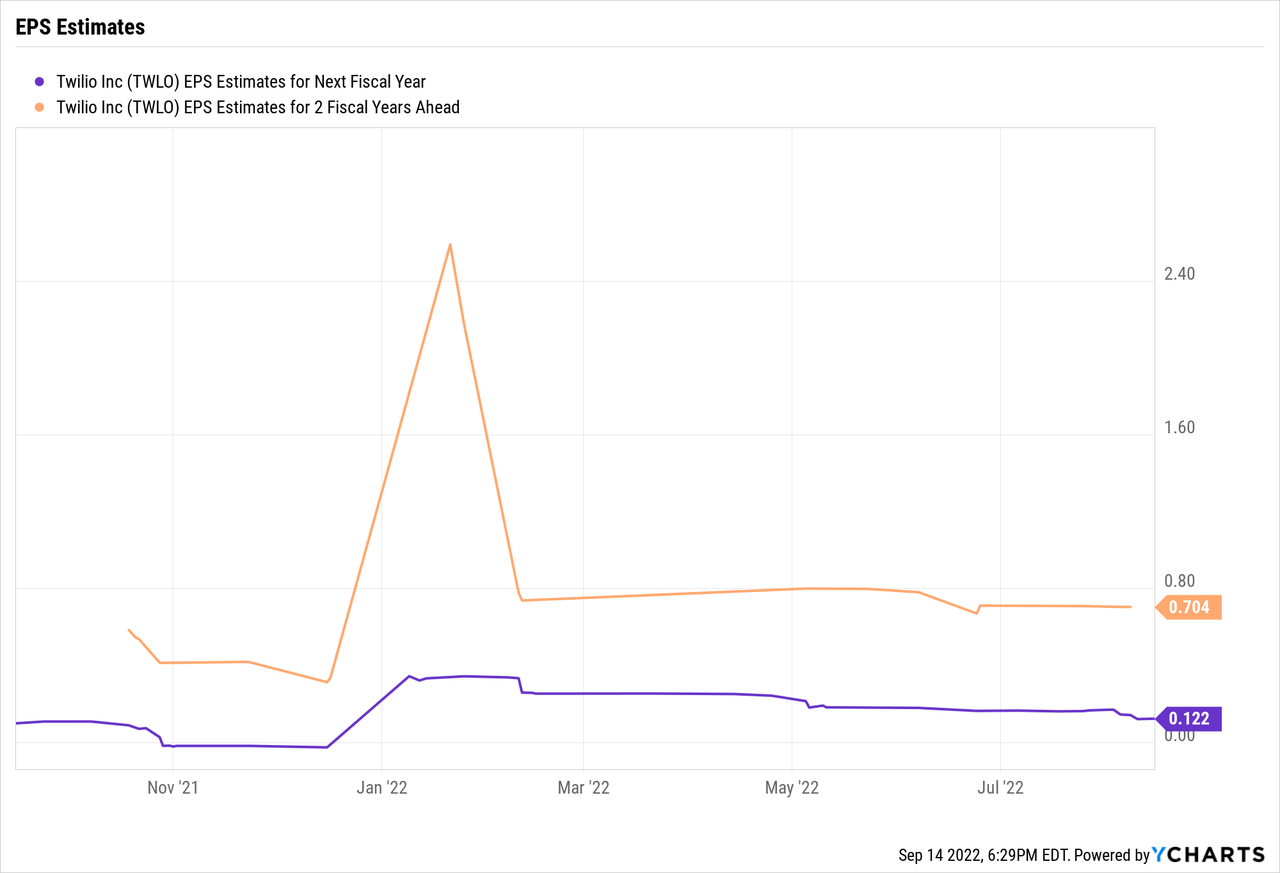

Analysts were forecasting a small profit in 2023 of $0.12 a share. A $100 million annual cut in operating expenses would provide a solid $0.55 boost to the EPS based on 183 million shares outstanding. The average employee cost savings would top $100K in order to save the $100 million annually.

Any stock is worth vastly more when every day the doors open the company generate profits and positive cash flows versus a scenario where the company reports losses and burns cash. On top of this, Twilio hands out a lot of stock options to employees. The company is only near breakeven now due to excluding stock based compensation. The share count will continue to rise whether Twilio is profitable or not.

The company quickly becomes very profitable on slashing operating expenses by at least $100 million annually. An equal boost to 2024 profits places Twilio on pace to earn $1.25 per share in that year.

The stock jumped to nearly $80 on the news of the layoff due to the positive signs of bigger profits ahead. Twilio will need to keep the nearly 30% sales growth rates intact for the stock to maintain a valuation of 64x updated 2024 EPS targets.

One of the major problems with a company becoming profitable is that the market switches to focusing on the profit level and quits justifying the valuation based on the future potential. If Twilio can cut operating expenses by the $50 million per quarter mark, the company could actually boost 2024 EPS by $1.10 to ~$1.80.

Takeaway

The key investor takeaway is that Twilio likely made some relatively easy job cuts after ramping up the employee base the last couple of years and integrating several large acquisitions. The company suddenly becomes very profitable after already heading in that direction in 2023 without major job cuts.

Twilio faces a bumpy road over the next year with this shift towards profits. Investors should use any weakness to buy the stock as the company trades at a fraction of the long term ability to turn $5 billion in 2023 sales into vastly larger profits.

Be the first to comment