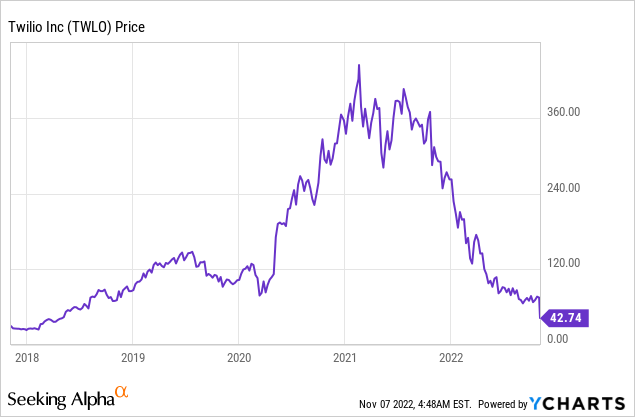

Twilio (NYSE:TWLO) is a leading communication as a service platform that has a range of elite customers which include eBay (EBAY), Shopify (SHOP), Airbnb (ABNB), IBM (IBM), and many more. The world is becoming more digitally connected across multiple platforms and this was a trend that was only accelerated by the pandemic. Therefore it is no surprise that the global unified communications as a service market was worth $38.74 billion in 2020 and is forecasted to grow at a compounded annual growth rate [CAGR] of 23.6% up until 2028. Twilio is forecasted to benefit from this growth trend and recently beat top-line growth estimates for the third quarter. So why did the stock price plummet by over 34% during the company’s investor day presentation? (which was quite ironic). Well, the answer is atrocious guidance and a downward trend in its growth rates which caused analysts to “vote with their feet”. However, if investors can look through the short-term guidance and take a 2 to 5-year time horizon, the stock looks to be undervalued intrinsically at these levels. Therefore in this post, I’m going to filter the signal from the noise by breaking down the company’s business model, financials, and valuation, let’s dive in.

Drew Angerer

Business Model Recap

Twilio’s flagship platform offers Communications as a service [CaaS] across Voice, Messaging, email etc. Basically Twilio is the app that businesses use to send bulk notification text messages to users. For example, when a company such as Netflix (NFLX) wants to send a text message to its 200 million subscribers, alerting them of a new series, it can do this easily and reliably via Twilio. Another example is the automated text messages you get from Airbnb to say your apartment has been booked, this is executed with Twilio as Airbnb is a customer.

For Communication Platform as a service, Twilio is ranked second on G2 by a number of reviews and ratings. Its competition looks to be a company called Plivo, which I must admit is less well known despite the reviews. The company even labels itself as a “Twilio Alternative” on its homepage. Although Plivo does have a range of leading customers from IBM to MercadoLibre (MELI) (The Amazon (AMZN) of Latin America), therefore should not be taken lightly as competition.

Twilio’s second platform is its cloud contact center platform called Twilio Flex. Traditional call centers require an office, many overheads, and have limited flexibility to adjust for changes. However, by using a cloud-based service such as Twilio Flex the platform can scale easily with the cloud. I personally believe a cloud contact center is a “no-brainer” for companies that operate with contact centers for outbound sales (cold calling) or customer service. Therefore its no surprise that the cloud contact center market is forecasted to grow at a rapid 22.7% compounded annual growth rate and be worth over $57.37 billion by 2027. Twilio Frontline is its third platform which is used by salespeople and customer service/success teams, in order to connect with customers.

Twilio’s fourth platform and newest is its customer data platform [CDP] which comprises of its $3.2 billion acquisition of Segment in 2020. The Big Data industry is forecasted to grow at an 11% compounded annual growth rate and be worth over $273 billion by 2026. In the age of big data, many companies collect data on its website visitors, prospects etc. However, often this data is “siloed” across different applications and services. A Customer Data Platform [CDP] helps to break down these silo’s and allow marketing leaders to derive insights, while better targeting advertisements. The days of mass “carpet bomb” advertising campaigns are over. Thanks to digital technology, advertising is becoming highly personalized as are our customer experiences. Just think about when you log in to Amazon, your page is personalized and highly relevant to recent purchases. The goal for businesses is to create a similar experience for users easily. Once the company “knows its users” well it can use a marketing automation tool such as Twilio Engage to send personalized engagement campaigns via email, text etc. This is great for Localization marketing, where you may wish to target users in specific geographies, with tailored translated and culture-friendly messages. Over 250,000 customers have built customer engagement with Twilio, over 9 million customers use the Segment platform and it was ranked #1 for 2021 market share in CDP by IDC.

Third Quarter Financials

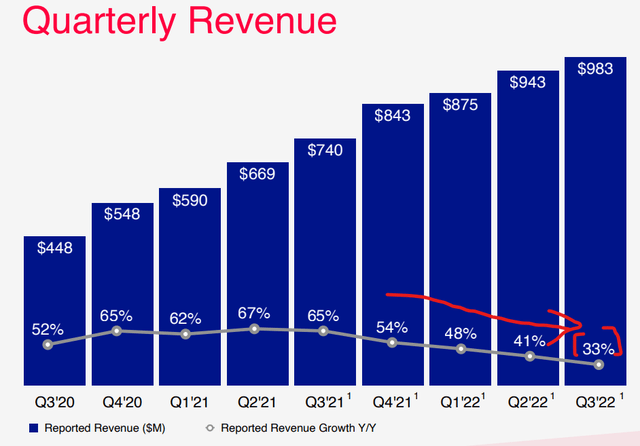

Twilio generated mixed financial results for the third quarter of 2022. Revenue was $983 million, which increased by 33% year over year and beat analyst expectations by $10.16 million. On an organic basis (not including acquisitions) revenue increased by 32% year over year. This is a solid growth rate overall but as you can see from the chart below the growth rate has been declining since 2021. For example, in Q3,21 its growth rate was 65%, this dropped to 54%, 48% and 41% in the quarters following. Therefore we have a clear downward trend which given the current economic climate is not a great sign.

Revenue Twilio (Q3 Earnings Report)

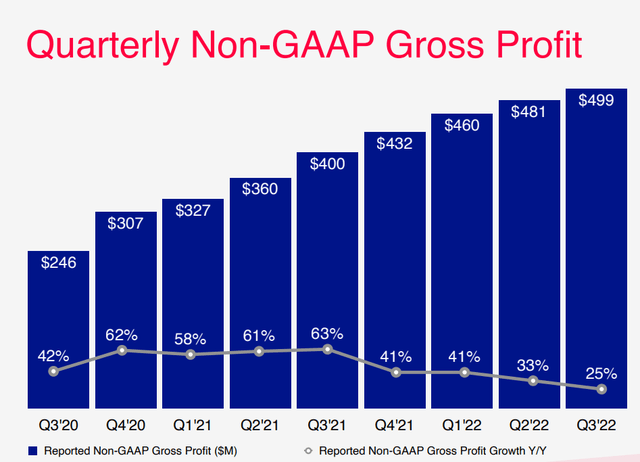

Twilio makes the majority of its revenue from its API-centric products in its communications portfolio. This includes those involved with messaging, email and voice. With messaging alone delivering 64% of total revenue. Its messaging platform continues to grow but does have a lower gross margin profile, which is most prevalent for its international messaging segment. Therefore it is no surprise that we have seen the growth rate in its Non-GAAP Gross Profit decline from 63% at Q3,21 to just 25% by Q3,22.

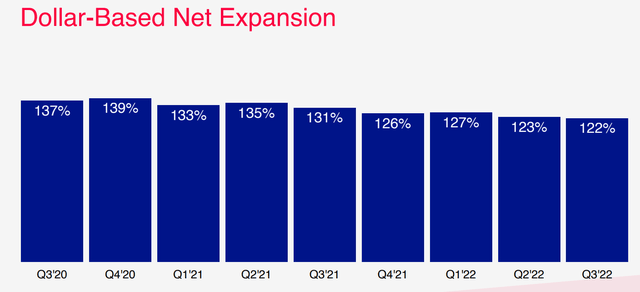

The good news is “Account Security” which includes Twilio verify the product is a “high growth” area according to management and has higher gross margins. Its Dollar Based Net Expansion rate was 122% in the third quarter of 2022. This was down from 131% in the third quarter of 2021 but is solid overall.

The business generated earnings per share of -$2.66, which was worse than the $1.26 in Q3,21 and missed analyst expectations by $0.66. However, the result is not so bad if we adjust for a $29 million noncash accrual related to a sabbatical program offered for long-time employees. With this adjustment, EPS was negative $0.27 which surprisingly beat analyst expectations by $0.08.

Twilio has a solid balance sheet with $4.2 billion in cash and short-term investments. In addition to long-term debt of $987 million, which is manageable.

Ghoulish Guidance

Management is guiding for $995 million to $1 billion of revenue for the fourth quarter of 2022. This would imply a total year-over-year growth rate of between 29% and 34%. Twilio has consistently delivered well above 30% revenue growth consistently but moving into the fourth quarter, at the low end of its guidance range of $955 million, its growth rate would equate to just 13%, which is pretty atrocious for a “growth” company.

Management highlighted that they are seeing “longer sales cycles” and delays in purchasing decisions relative to historic periods. Its areas of economic “softness” include cryptocurrency, e-commerce, consumer on demand, and social. Due to these factors management has decided to “pull” its 30% guidance.

Advanced valuation

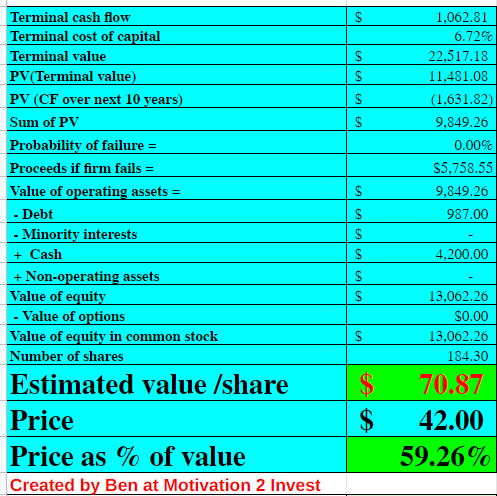

In order to value Twilio, I have plugged the latest financials into my advanced valuation model which uses the discounted cash flow method of valuation. I have forecasted just 13% revenue growth for “next year” which includes Q4,22 and is aligned with management guidance. After which I am forecasting its growth rate to recover to a 20% CAGR in years 2 to 5 given the secular trends mentioned prior.

Twilio stock valuation (created by author Ben at Motivation 2 Invest)

Management aims to focus more on profitability moving forward, and as the business scales operating leverage should begin to take hold, as is common for software companies. I am forecasting a 15% operating margin over the next 7 years, which is possible given the average operating margin for the software industry is 23%. Keep in mind, this also includes an adjustment for R&D expenses which has increased the baseline operating margin.

Twilio stock valuation (created by author Ben at Motivation 2 Invest)

Given these forecasts and financials, I get a fair value of $70 per share, the stock is trading at $42 per share at the time of writing and is ~41% undervalued.

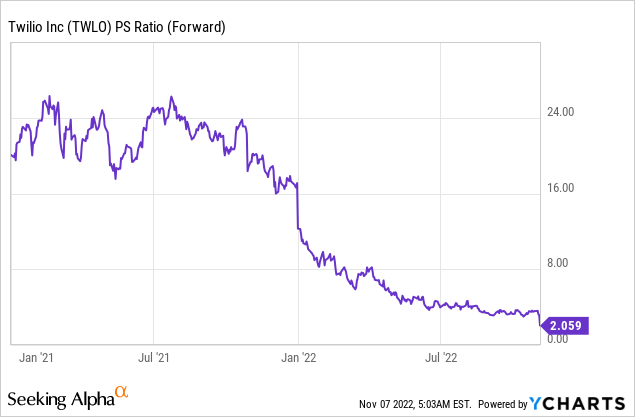

As an extra data point, Twilio trades at a price to sales ratio = 2.13 which is 87% cheaper than its 5 year average.

Risks

Recession/Longer Sales Cycles

The high inflation and rising interest rate environment have caused many analysts to forecast a recession. I personally believe it is not just the cold hard numbers that impact a recessionary environment but also human psychology. If company decision-makers are fearful of a recession (even if one would not have happened), they may delay spending on new software and this will lengthen the sales cycle. Ironically, by acting as if we may have a recession, a recession is often caused. Billionaire Investor George Soros would compare this to the “reflexivity” of the stock market. In that, the players impact the game and outcomes. As investors, we just have to be aware of the environment and the prevailing psychology when making investment decisions.

Final Thoughts

Twilio has grown from a single-product company to a multi-product, platform which is likely to benefit from the secular growth across big data and communications. The recently announced poor guidance looks to be mainly driven by macroeconomic factors and thus doesn’t seem independent to this business. The market looks to have overreacted somewhat and I think the stock is undervalued intrinsically at the time of writing.

Be the first to comment